| YEAR ENDED DECEMBER 31 | 2017 | 2016 | % Change |

|---|---|---|---|

| Financial Performance | |||

| Net interest income | $2,061 | $1,797 | 15% |

| Net interest margin | 3.12% | 2.71% | % |

| Provision for credit losses | 74 | 248 | (70) |

| Net charge-off ratio | 0.19% | 0.32% | % |

| Noninterest income | 1,107 | 1,051 | 5 |

| Noninterest expense | 1,860 | 1,930 | (4) |

| Provision for income tax | 491 | 193 | 154 |

| Net income available to common shareholders | 738 | 473 | 56 |

| Diluted net income per share | 4.14 | 2.68 | 54 |

| Book value per share | 46.07 | 44.47 | 4 |

| Selected Ratios | |||

| Return on average common shareholders’ equity | 9.34% | 6.22% | 50 |

| Return on average assets | 1.04 | 0.67 | 55 |

| Common equity Tier 1 capital ratio (12/31/17) | 11.68 | 11.09 | 4 |

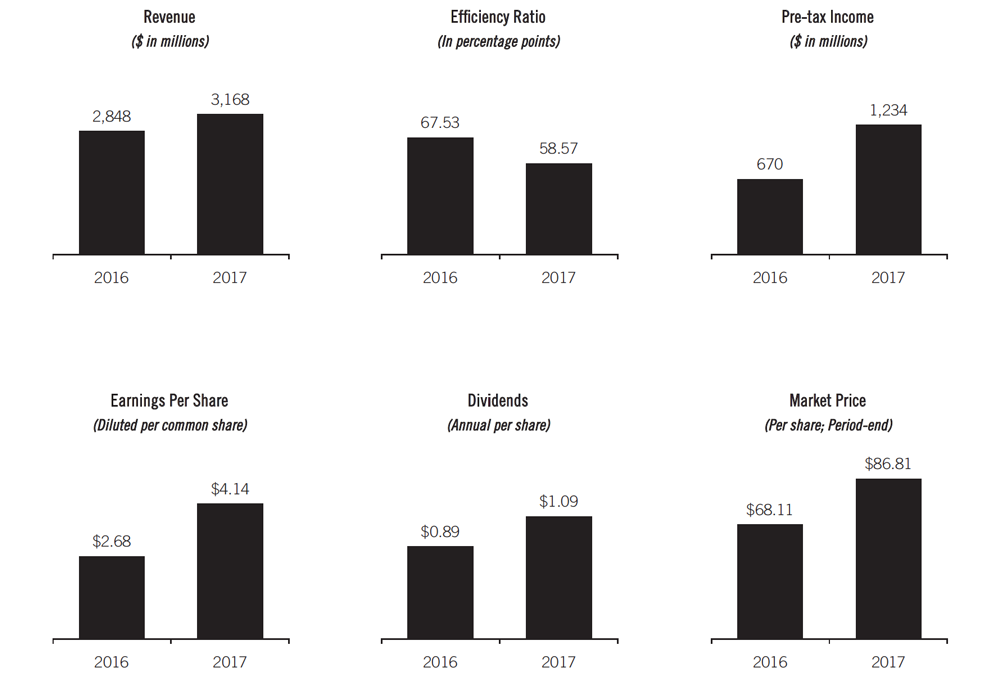

We began 2017 with clear strategic objectives, and we delivered solid outcomes, including record revenue, an 84 percent increase in pre-tax income and significant increases in our returns. In diligent fashion, our team made substantial progress on our goals of further enhancing financial performance, technology, products, corporate responsibility, diversity and community involvement. Our stock’s performance continued to positively reflect the advancements we have made.

We continued to successfully implement our action-oriented improvement plan—GEAR Up—which was launched in mid-2016 to drive efficiencies and revenue. It’s working. A 5 percent increase in fee income and a 4 percent decrease in expenses in 2017 demonstrate that we are reaping substantial and sustainable benefits from this enterprise-wide initiative. With enhanced training, improved customer analytics and increased marketing capacity, we are starting to see growth in our revenue base from developing deeper customer relationships. On the expense side, we obtained significant savings from several of our larger initiatives, most notably from the retirement program redesign and banking center consolidations. Through GEAR Up, we realized $30 million in revenue benefits and reached $150 million in expense savings through 2017. Our goal is to drive additional annual pre-tax income of $305 million by the end of 2019, relative to when the initiative began. Benefits we expect to realize in 2018 include the migration of a significant number of our applications to the secure cloud. Also, we expect to complete the automation and streamlining of our end-to-end credit process.

As we continue to grow our business and position Comerica for the future, we’ve been encouraged by external factors, such as higher interest rates, tax reform and the potential for regulatory relief. Our balance sheet remains well positioned to benefit from rate increases, with over 90 percent of our loans tied to floating rates and about half of our deposits noninterest-bearing at year-end 2017. The Federal Reserve increased interest rates four times since December 2016, resulting in more than a $200 million increase in our net interest income, as we prudently managed loan and deposit pricing. The Fed signaled in December that it could raise rates three more times in 2018.

While it is still too early to determine the full impact, it appears that the tax reform act Congress passed in December will be great for Comerica and our customers, as well as help drive U.S. economic growth. We distributed some of the benefit of lower taxes to our hardworking team by raising our minimum wage to $15 per hour and paid approximately 4,500 non-officer colleagues (more than half of our workforce) a one-time bonus of $1,000. We value our team and strive to provide competitive compensation packages that attract and retain the best talent.

On the regulatory front, we have recently witnessed some positive developments as well, including a white paper issued by the Treasury and a bipartisan compromise on regulatory relief bills for financial institutions. The changes outlined could allow us to actively manage capital and liquidity on a real-time basis. They also have the potential to lower related expenses, for example by reducing the amount of data management required and simplifying regulatory compliance processes. As one of the smallest banks subject to CCAR and LCR and with a relatively simple business model, we are subject to a disproportionate burden. We are closely monitoring the developments and hope to see additional action in 2018. The ultimate benefit will depend on what changes are made, as well as how they are interpreted and implemented.

We remain committed to being a trusted advisor to our customers as we’ve been preparing for a new age in banking. Our technology transformation strategy, TechVision2020, is one of our top priorities. We have been investing and will continue to invest in technology to enhance the customer experience, increase efficiency through simplification and take risk management to the next level. While the list of projects is long, here are a few examples. We rolled out improved information reporting and mobility tools for our commercial customers. We also deployed new platforms for consumer loans and mortgages. We’re upgrading our customer contact centers to leverage biometric authentication, natural language processing and robotics. We are employing tools, such as robust data analytics, to match our customers’ banking habits with products and services to meet their needs. In risk management, we will be utilizing state-of-the-art behavioral monitoring to reduce fraud.

Additionally, we are installing a new customer relationship management platform across the bank. We believe TechVision2020 provides us the blueprint to strengthen our core technology infrastructure as we continue our transformation.

Comerica demonstrated its resiliency in 2017 as we dealt with some unique challenges. For instance, we weathered several major natural disasters. In addition to the California wildfires, Hurricanes Harvey and Irma temporarily disrupted business at some of our locations, affecting our customers and colleagues. But thanks to the preparedness of our team, we were able to unite, recover and assist those in need. Furthermore, in support of our communities, we proudly partnered with the American Red Cross plus other organizations to donate more than $100,000 to assist in the hurricane-related disaster recovery efforts.

Revenue grew 11 percent in 2017, an all-time record. This included a 15 percent increase in net interest income, which benefited from higher interest rates as we prudently managed loan and deposit pricing. In addition, successful execution of our GEAR Up initiative helped increase fee income and lowered expenses. Credit quality remained strong with a net charge-off ratio of 19 basis points, well below our historical norm, even as we continued to navigate the energy cycle. Our tax provision included a $107 million charge to adjust deferred taxes resulting from the enactment of the Tax Cuts and Jobs Act. Altogether, we generated net income of $743 million, an increase of 56 percent over 2016, and drove significant increases in our returns as well as an efficiency ratio of 58 percent.

Excluding cyclical declines in Energy and Mortgage Banker, average loans increased $670 million. Loans grew in most other businesses, led by National Dealer Services as well as Corporate and Private Banking. Average noninterest-bearing deposits grew 4 percent; however, this was more than offset by a decline in interest-bearing deposits. The decrease was primarily due to customers using their excess liquidity for working capital needs and acquisitions, our deliberate approach to relationship pricing, as well as strategic actions we took in light of Liquidity Coverage Ratio requirements.

Our capital position remains strong. The first and most important use of capital is to invest in profitable growth. Since we are generating more capital than we can deploy, 3returning excess capital to our shareholders is a priority. We repurchased approximately 7.3 million shares in 2017 under our equity repurchase program. With increases in July and October, our board of directors raised our quarterly dividend a total of 30 percent. Through the share buyback and dividends, we returned $724 million to our shareholders, a 58 percent increase over 2016.

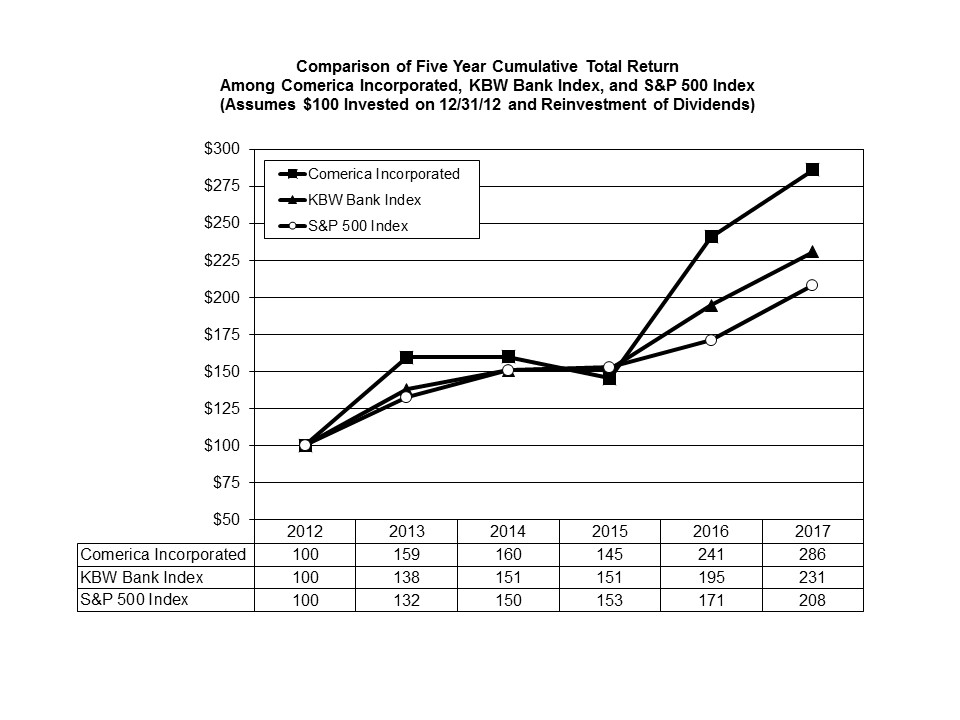

We believe our stock’s market value, which increased 27 percent in 2017, reflects our solid financial performance, which included the benefit of deliberate balance sheet positioning and delivering on GEAR Up targets, as well as investors’ acknowledgement of the value of our relationship banking model. For the second consecutive year, Comerica’s stock outperformed all our peers, as well as the KBW Bank Index and the S&P500 Index.

We recognize that customer loyalty begins with building connections. Being a trusted advisor means we are committed to forming enduring relationships, rather than short-term gains. With long-tenured employees who have deep expertise in the businesses they serve, we deliver high-quality financial services. For example, the average Middle Market banker has been with Comerica for 11 years, and the average tenure of their managers is 22 years. Our relationship-based strategy, combined with our attractive geographic footprint, helps drive our success.

We have a unique geographic footprint that is well situated with a strong presence in the major metropolitan areas of Texas, California and Michigan, providing us with a balanced market presence. We also have locations in Arizona and Florida, with certain businesses operating in several other states, as well as Canada and Mexico. A single, integrated platform across our markets provides significant synergies that are highly efficient, yet cost effective. While our markets are not contiguous, they are complementary. Our footprint provides diversity to our portfolio, reduces risk, and provides important counterbalances for us as economic conditions change.

Our headquarters is located in Dallas, Texas, and we have over 120 banking centers in the Dallas, Houston, Austin and San Antonio areas. Over the past two years, our Texas growth has been affected by the energy cycle. Strategically, we have reduced the size of our energy portfolio by $1.2 billion since year-end 2015 and have successfully managed credit losses.

We believe this will be less of a headwind going forward, and the Texas economy is expected to grow faster than the national average in 2018.

We are a market leader in Michigan, where we have been operating for 169 years. With over 190 banking centers, we maintain a strong deposit base. Over 50 percent of our loans in Michigan are to middle market companies. After several years of contraction, loans have begun to increase, and we expect this to continue as the Michigan economy grows and diversifies. We are very excited about the renaissance underway in Detroit. We look forward to participating in its continued revitalization through our financial support of new developments along the Woodward Corridor and in Corktown, in addition to our continued support of many of Detroit’s sports teams.

California, the largest economy in the United States, is where we have more than 95 banking centers positioned in the major metropolitan areas of San Francisco, San Jose, Los Angeles and San Diego. California accounts for 37 percent of our total loans and contributed most to our loan growth in 2017, led by Private Banking, National Dealer Services and general Middle Market. Economic activity in California was slightly above the national average for 2017 and is expected to continue to outperform in 2018.

We are aligned by three business segments—the Business Bank, the Retail Bank and Wealth Management. Each segment made significant strides in 2017.

By providing comprehensive financial solutions, the Business Bank experienced broad-based growth across our various business lines. Putting aside cyclical declines in Energy and Mortgage Banker, we achieved solid loan growth in National Dealer Services, U.S. Banking, Technology and Life Sciences (driven by Equity Fund Services), as well as Environmental Services. In addition, fee income increased 5 percent, which benefitted from enhanced treasury management solutions, including enabling our customers to more efficiently manage their business through reporting and mobile capabilities.

We continue to implement enhancements to our sales and service model for our Middle Market businesses, delivering tools and sharing best practices with the goal of driving faster, more efficient growth. Early results were demonstrated by the record number of new Middle Market banking relationships we won in California, which drove their strong loan and deposit growth. Our relationship model and high standards for customer service distinguish us from competitors. For instance, for the third time in the last four years, our Captive Insurance group was named the “U.S. Captive Collateral Service Provider” of the year by Captive Review Magazine. Comerica also was a recipient of the national Greenwich Excellence Award for Middle Market Banking in 2017 for overall customer satisfaction.

Our Retail Bank is a vital part of our deposit gathering and revenue growth strategy. It is imperative that we have the products, services and locations to meet our customers’ needs. Our success is demonstrated by the more than $400 million increase in average Retail Bank deposits in 2017 along with our team’s efforts to drive customer engagement. To maximize the mobile banking experience, Retail Bank delivered on innovation with a major upgrade across mobile devices. We integrated and expanded our real-time alerts and implemented new features for our customers such as the ability to log-in using Touch ID for iPhones, view check images and perform transaction searches. We also launched an Android tablet application. Through these initiatives, we achieved our goal of providing our customers with more convenient features to manage their finances anytime and anywhere. In this ever-evolving age of technology, part of our ongoing service commitment is to provide customers with more secure, authenticated ways to make transactions. In 2017, our Retail Bank team converted to a state-of-the-art debit card platform and completed a brand conversion, efficiently reissuing more than 500,000 new chip-embedded debit cards to better protect our customers’ information during usage, such as point of sale transactions.

We have a variety of tools and information to help small businesses reach their goals, whatever they may be. These customers found our commercial and merchant card offering increased their efficiency. As a result, Small Business card fees increased more than 20 percent in 2017, primarily related to new and expanded merchant card business.

Wealth Management> enables us to bring private banking, investment management and fiduciary services to our Business Bank and Retail Bank clients. In 2017, the Wealth Management team delivered a strong performance by growing average loans over 4 percent and fee income by 5 percent, including a 4 percent increase in fiduciary income. We launched our Wealth Productivity initiative, which incorporates a relationship management tool to enable our colleagues to better serve our clients, and ultimately, drive increased market share. We also continued to enhance our investment management platform by adding new advisors. Finally, our Professional Trust Alliance remains diligent in building business. Currently, we have agreements with 17 alliance partners. This business has become a significant contributor to our fee income and assets under management continue to grow at a strong pace.

We recognize that maintaining customer confidence is a key component to our relationship banking strategy. As cyber threats evolve, we continue to invest in protecting our customers. In 2017, we increased customer communications, recruited and trained highly-skilled colleagues, and enhanced our security detection capabilities. We take a proactive approach to cybersecurity, making sure we understand the threats and vulnerabilities that exist in the world, and that the necessary safeguards are in place to help protect against potential risks. Our robust, in-depth defense strategy also focuses on responsiveness and recovery capabilities. We have technical experts who are constantly reassessing our processes and best practices, while monitoring systems around the clock and adjusting as necessary.

Our board of directors provides Comerica with strong guidance and direction. Along with executive management, our board regularly reviews, and ensures that we adhere to, our long-term corporate strategy. Much of that strategy, and the necessary tactics to achieve it, stems from knowing who we are: a non-complex, regional, commercially-focused bank. We are dedicated to serving our communities by meeting their basic financial needs, with an emphasis on our core capabilities of taking deposits and making loans.

Our long-term value is generated not by sheer scale, but rather through a sustainable competitive advantage with a customer base we understand, and a conservative approach to risk, capital management and operations. We strive to build enduring relationships that drive superior credit quality, a stable funding base and consistent returns that meet our shareholders’ expectations. Collectively, our 10 independent directors bring a wealth of skills, experiences, diversity and knowledge that allow them to effectively address the interests of Comerica’s four core constituencies: our shareholders, our customers, our colleagues and the communities we serve each day.

In 2017, our board appointed a new independent director, Barbara R. Smith, chairman, president and chief executive officer of Texas-based Commercial Metals Company. She brings to our board many key skills, including relevant business management experience and knowledge of our geographic markets, as well as significant financial expertise garnered through the chief financial officer roles she previously held.

At the end of 2017, long-time board member Alfred A. Piergallini retired. He was appointed to the Comerica board in 1991. His experience and insights were invaluable, particularly as we navigated complex regulations and the changing landscape of the financial services industry. We are thankful for the contributions that Al made to Comerica over 26 years.

Comerica is only as strong as the communities we serve, and that is why we invest in them, helping ensure they remain vibrant. Annual events, financial education programs, corporate giving and our drive for sustainability were just some of the ways Comerica continued to shine in the community in 2017. Our Corporate Responsibility report, which can be found on Comerica.com, provides a comprehensive review of our active environmental, social and governance program. Here are a few highlights.

Our most visible community event – Shred Day – held in Dallas/Fort Worth, Houston, Phoenix and Detroit, experienced a banner year with a record 862,087 pounds of paper recycled. The DFW event shattered its previous record, collecting more than 548,000 pounds. In the process, we raised awareness of the Comerica brand, helped reduce fraud and identity theft, preserved the environment by freeing up space in local landfills and helped fight hunger in our communities with a connected food drive.

Empowering youth and adults to become good financial stewards remains a key component in Comerica’s commitment to our communities. In 2017, we touched the lives of thousands of students through our Money $ense, Gift of Knowledge, Empower Series and youth savings programs. Also, these educational opportunities created dialogue with our communities to showcase Comerica as a trusted advisor.

Comerica, along with our colleagues, continued to serve as pillars in the community, distributing $7.9 million in contributions to nonprofit organizations and logging nearly 68,000 volunteer hours.

Our commitment to fostering a diverse work environment garnered national recognition in 2017. For the fourth consecutive year, we earned a perfect rating on the Human Rights Campaign’s Corporate Equality Index, resulting in designation as a Best Place to Work for LGBTQ Equality. For the fifth consecutive year, Comerica was named to LATINO Magazine’s “LATINO 100” list – an honor bestowed on companies providing opportunities for Latinos. And for the third consecutive year, Comerica was ranked No. 2 on DiversityInc’s 2017 Top Regional Companies for diversity.

We are dedicated to protecting and preserving the environment. Significant strides were made in achieving our 2020 Environmental Sustainability Goals to reduce emissions, water consumption, waste generation and paper usage. Topping the list of accomplishments for 2017 was the achievement of our 2020 greenhouse gas (GHG) reduction goal three years ahead of schedule with a reduction of 22.4 percent relative to our 20 percent target. This was one component which helped us achieve an A- rating by CDP (Carbon Disclosure Project) for our climate change management strategy and emission reduction efforts. The honor places Comerica among the top 16 percent of responders within the U.S. financial services industry. The year also marked our first mapping to demonstrate how Comerica’s actions reflect the United Nations’ 17 Sustainable Development Goals. We also supported our customers’ sustainability efforts through over $830 million in environmentally beneficial loans and commitments in 13 different green loan categories.

We are focused on continuing to enhance shareholder value by delivering solid results and positioning Comerica well for the future. Significant progress was made in 2017. Our relationship banking strategy and prudent management of loan and deposit pricing helped drive record revenue as interest rates increased. It’s been energizing to see the results we’ve achieved with our GEAR Up initiative, and that speaks to the perseverance and dedication of our 8,000 colleagues. Over the years, we’ve witnessed the ebbs and flows of the banking industry in response to the varying economic cycles. Today, we are experiencing an upswing and we believe Comerica is well situated to benefit from lower tax rates, further interest rate increases and favorable changes in regulation. We operate with a “go forward” approach and remain committed to being responsible stewards of our shareholders’ capital by growing relationships, continued implementation of our GEAR Up initiative and returning excess capital to our investors.

Comerica’s success story is not only told through our promise to “raise expectations of what a bank can be,” but also through our core values of diversity, collaboration, agility, excellence, customer-centricity, integrity and involvement. These are not merely words, but values we practice daily. Thank you for your support in 2017.

Sincerely,

(1) Audit Committee

(2) Governance, Compensation and Nominating Committee

(3) Qualified Legal Compliance Committee

(4) Enterprise Risk Committee

|

Delaware |

38-1998421 | |

|

(State

or Other Jurisdiction of Incorporation) |

(IRS

Employer Identification

Number) | |

|

Large

accelerated filer ý |

Accelerated

filer o

| |

|

Non-accelerated

filer o

(Do

not check if a smaller reporting company) |

Smaller

reporting company o | |

|

Emerging

growth company o | ||

|

F-1 | |

|

S-1 | |

|

• |

People: Including the

competence, integrity and succession planning of

customers. |

|

• |

Purpose: The legal, logical

and productive purposes of the credit

facility. |

|

• |

Payment: Including the

source, timing and probability of

payment. |

|

• |

Protection: Including

obtaining alternative sources of repayment, securing the loan, as

appropriate, with collateral and/or third-party guarantees and ensuring

appropriate legal documentation is

obtained. |

|

• |

Perspective: The

risk/reward relationship and pricing elements (cost of funds; servicing

costs; time value of money; credit risk). |

|

• |

The borrower's business

model. |

|

• |

Periodic review of

financial statements including financial statements audited by an

independent certified public accountant when

appropriate. |

|

• |

The pro-forma financial

condition including financial

projections. |

|

• |

The borrower's sources and

uses of funds. |

|

• |

The borrower's debt service

capacity. |

|

• |

The guarantor's financial

strength. |

|

• |

A comprehensive review of

the quality and value of collateral, including independent third-party

appraisals of machinery and equipment and commercial real estate, as

appropriate, to determine the advance

rates. |

|

• |

Physical inspection of

collateral and audits of receivables, as

appropriate. |

|

• |

General

political, economic or industry conditions, either domestically or

internationally, may be less favorable than

expected. |

|

• |

Governmental

monetary and fiscal policies may adversely affect the financial services

industry, and therefore impact Comerica's financial condition and results

of operations. |

|

• |

Proposed

revenue enhancements and efficiency improvements may not be

achieved. |

|

• |

Operational

difficulties, failure of technology infrastructure or information security

incidents could adversely affect Comerica's business and

operations. |

|

• |

Comerica

relies on other companies to provide certain key components of its

delivery systems, and certain failures could materially adversely affect

operations. |

|

• |

Comerica

must maintain adequate sources of funding and liquidity to meet regulatory

expectations, support its operations and fund outstanding

liabilities. |

|

• |

Compliance

with more stringent capital and liquidity requirements may adversely

affect Comerica. |

|

• |

Declines

in the businesses or industries of Comerica's customers could cause

increased credit losses or decreased loan balances, which could adversely

affect Comerica. |

|

• |

Unfavorable

developments concerning credit quality could adversely affect Comerica's

financial results. |

|

• |

Changes

in the financial markets, including fluctuations in interest rates and

their impact on deposit pricing, could adversely affect Comerica's net

interest income and balance sheet. |

|

• |

Interest

rates on Comerica's outstanding financial instruments might be subject to

change based on regulatory developments, which could adversely affect its

revenue, expenses, and the value of those financial

instruments. |

|

• |

Reduction

in our credit ratings could adversely affect Comerica and/or the holders

of its securities. |

|

• |

Damage

to Comerica’s reputation could damage its

businesses. |

|

• |

Comerica

may not be able to utilize technology to efficiently and effectively

develop, market, and deliver new products and services to its customers.

|

|

• |

Competitive

product and pricing pressures within Comerica's markets may

change. |

|

• |

The

soundness of other financial institutions could adversely affect

Comerica. |

|

• |

The

introduction, implementation, withdrawal, success and timing of business

initiatives and strategies may be less successful or may be different than

anticipated, which could adversely affect Comerica's

business. |

|

• |

Changes

in customer behavior may adversely impact Comerica's business, financial

condition and results of operations. |

|

• |

Management's

ability to maintain and expand customer relationships may differ from

expectations. |

|

• |

Methods

of reducing risk exposures might not be

effective. |

|

• |

Catastrophic

events, including, but not limited to, hurricanes, tornadoes, earthquakes,

fires, droughts and floods, may adversely affect the general economy,

financial and capital markets, specific industries, and

Comerica. |

|

• |

The

impacts of recent tax reform are not yet fully known, and these and other

tax regulations could be subject to potential legislative, administrative

or judicial changes or interpretations. |

|

• |

Any

future strategic acquisitions or divestitures may present certain risks to

Comerica's business and operations. |

|

• |

Management's

ability to retain key officers and employees may

change. |

|

• |

Legal

and regulatory proceedings and related matters with respect to the

financial services industry, including those directly involving Comerica

and its subsidiaries, could adversely affect Comerica or the financial

services industry in general. |

|

• |

Terrorist

activities or other hostilities may adversely affect the general economy,

financial and capital markets, specific industries, and

Comerica. |

|

• |

Changes

in accounting standards could materially impact Comerica's financial

statements. |

|

• |

Comerica's

accounting policies and processes are critical to the reporting of

financial condition and results of operations. They require management to

make estimates about matters that are uncertain.

|

|

• |

Comerica's

stock price can be volatile. |

|

• |

Actual

or anticipated variations in quarterly results of

operations. |

|

• |

Recommendations

or projections by securities analysts. |

|

• |

Operating

and stock price performance of other companies that investors deem

comparable to us. |

|

• |

News

reports relating to trends, concerns and other issues in the financial

services industry. |

|

• |

Perceptions

in the marketplace regarding us and/or our

competitors. |

|

• |

New

technology used, or services offered, by

competitors. |

|

• |

Significant

acquisitions or business combinations, strategic partnerships, joint

ventures or capital commitments by or involving Comerica or its

competitors. |

|

• |

Changes

in dividends and capital returns. |

|

• |

Changes

in government regulations. |

|

• |

Cyclical

fluctuations. |

|

• |

Geopolitical

conditions such as acts or threats of terrorism or military

conflicts. |

|

• |

Activity

by short sellers and changing government restrictions on such

activity. |

|

Quarter |

High |

Low |

Dividends Per

Share |

Dividend Yield* | |||||||||||

|

2017 |

|||||||||||||||

|

Fourth |

$ |

88.22 |

|

$ |

74.16 |

|

$ |

0.30 |

|

1.5 |

% | ||||

|

Third |

76.76 |

|

64.04 |

|

0.30 |

|

1.7 |

| |||||||

|

Second |

75.30 |

|

64.75 |

|

0.26 |

|

1.5 |

| |||||||

|

First |

75.00 |

|

64.27 |

|

0.23 |

|

1.3 |

| |||||||

|

2016 |

|||||||||||||||

|

Fourth |

$ |

70.44 |

|

$ |

46.75 |

|

$ |

0.23 |

|

1.6 |

% | ||||

|

Third |

47.81 |

|

38.39 |

|

0.23 |

|

2.1 |

| |||||||

|

Second |

47.55 |

|

36.27 |

|

0.22 |

|

2.1 |

| |||||||

|

First |

41.74 |

|

30.48 |

|

0.21 |

|

2.3 |

| |||||||

|

*

Dividend yield is calculated by annualizing the quarterly dividend per

share and dividing by an average of the high and low price in the

quarter. | |||||||||||||||

|

(shares

in thousands) |

Total Number of Shares

and

Warrants Purchased

as Part

of Publicly

Announced

Repurchase

Plans

or Programs (a) |

Remaining

Repurchase

Authorization

(b) |

Total Number

of

Shares

Purchased

(c) |

Average

Price

Paid Per

Share | ||||||||

|

Total

first quarter 2017 |

1,498 |

|

11,756 |

|

1,694 |

|

$ |

69.75 |

| |||

|

Total

second quarter 2017 |

2,011 |

|

9,634 |

|

2,015 |

|

69.09 |

| ||||

|

Total

third quarter 2017 |

1,955 |

|

12,395 |

|

(d) |

1,956 |

|

71.11 |

| |||

|

October

2017 |

797 |

|

11,589 |

|

799 |

|

77.36 |

| ||||

|

November

2017 |

753 |

|

10,836 |

|

753 |

|

79.17 |

| ||||

|

December

2017 |

314 |

|

10,387 |

|

314 |

|

85.05 |

| ||||

|

Total

fourth quarter 2017 |

1,864 |

|

10,387 |

|

1,866 |

|

79.38 |

| ||||

|

Total

2017 |

7,328 |

|

10,387 |

|

7,531 |

|

$ |

72.31 |

| |||

|

(a) |

Comerica

made no repurchases of warrants under the repurchase program during the

year ended December 31,

2017.

Upon exercise of a warrant, the number of shares with a value equal to the

aggregate exercise price is withheld from an exercising warrant holder as

payment (known as a "net exercise provision"). During the year ended

December 31,

2017,

Comerica withheld the equivalent of approximately 1,209,000 shares

to cover an aggregate of $35.6

million

in exercise price and issued approximately 1,771,000 shares

to the exercising warrant holders. Shares withheld in connection with the

net exercise provision are not included in the total number of shares or

warrants purchased in the above table. |

|

(b) |

Maximum

number of shares and warrants that may yet be purchased under the publicly

announced plans or programs. |

|

(c) |

Includes

approximately 203,000 shares

(including 2,000 shares

in the quarter ended December 31,

2017)

purchased pursuant to deferred compensation plans and shares purchased

from employees to pay for taxes related to restricted stock vesting under

the terms of an employee share-based compensation plan during the year

ended December 31,

2017.

These transactions are not considered part of Comerica's repurchase

program. |

|

(d) |

Includes

July 25,

2017

equity repurchase authorization for up to an additional 5

million

shares. |

|

1. |

Financial

Statements: The financial statements that are filed as part of this report

are included in the Financial Section on pages F-40 through

F-107. | |

|

2. |

All

of the schedules for which provision is made in the applicable accounting

regulations of the SEC are either not required under the related

instruction, the required information is contained elsewhere in the

Form 10-K, or the schedules are inapplicable and therefore have been

omitted. | |

|

3. |

Exhibits:

| |

|

3.1 |

||

|

3.2 |

||

|

3.3 |

||

|

4 |

[Reference

is made to Exhibits 3.1, 3.2 and 3.3 in respect of instruments

defining the rights of security holders. In accordance with

Regulation S-K Item No. 601(b)(4)(iii), the Registrant is not

filing copies of instruments defining the rights of holders of long-term

debt because none of those instruments authorizes debt in excess of 10% of

the total assets of the registrant and its subsidiaries on a consolidated

basis. The Registrant hereby agrees to furnish a copy of any such

instrument to the SEC upon request.] | |

|

4.1 |

||

|

4.2 |

||

|

4.3 |

||

|

4.3A |

||

|

4.4 |

||

|

9 |

(not

applicable) | |

|

10.1† |

||

|

10.1A† |

||

|

10.1B† |

||

|

10.1C† |

||

|

10.1D† |

||

|

10.1E† |

||

|

10.1F† |

||

|

10.1G† |

||

|

10.1H† |

||

|

10.1I† |

||

|

10.1J† |

||

|

10.1K† |

||

|

10.1L† |

||

|

10.1M† |

||

|

10.1N† |

||

|

10.1O† |

||

|

10.1P† |

||

|

10.1Q† |

||

|

10.1R† |

||

|

10.1S† |

||

|

10.1T† |

||

|

10.1U† |

||

|

10.1V† |

||

|

10.1W† |

||

|

10.1X† |

||

|

10.1Y† |

||

|

10.2† |

||

|

10.2A† |

||

|

10.3† |

||

|

10.4† |

||

|

10.5† |

||

|

10.6† |

||

|

10.7† |

||

|

10.8† |

||

|

10.9† |

||

|

10.10† |

||

|

10.11† |

||

|

10.12† |

||

|

10.13† |

||

|

10.14† |

||

|

10.14A† |

||

|

10.14B† |

||

|

10.14C† |

||

|

10.14D† |

||

|

10.14E† |

||

|

10.15† |

||

|

10.15A† |

||

|

10.16† |

||

|

10.17† |

||

|

10.18† |

||

|

10.19A† |

||

|

10.19B† |

||

|

10.19C† |

||

|

10.19D† |

||

|

10.20† |

||

|

10.20A† |

||

|

10.21† |

||

|

10.21A† |

||

|

10.22† |

||

|

10.23† |

||

|

10.23A† |

||

|

11 |

Statement

regarding Computation of Net Income Per Common Share (incorporated by

reference from Note 15 on page F-84 of this Annual Report on

Form 10-K). | |

|

12 |

(not

applicable) | |

|

13 |

(not

applicable) | |

|

14 |

(not

applicable) | |

|

16 |

(not

applicable) | |

|

18 |

(not

applicable) | |

|

21 |

||

|

22 |

(not

applicable) | |

|

23.1 |

||

|

24 |

(not

applicable) | |

|

31.1 |

||

|

31.2 |

||

|

32 |

||

|

33 |

(not

applicable) | |

|

34 |

(not

applicable) | |

|

35 |

(not

applicable) | |

|

95 |

(not

applicable) | |

|

99 |

(not

applicable) | |

|

100 |

(not

applicable) | |

|

101 |

Financial

statements from Annual Report on Form 10-K of the Registrant for the

year ended December 31, 2017, formatted in Extensible Business

Reporting Language: (i) the Consolidated Balance Sheets,

(ii) the Consolidated Statements of Income, (iii) the

Consolidated Statements of Changes in Shareholders' Equity, (iv) the

Consolidated Statements of Cash Flows and (v) the Notes to

Consolidated Financial Statements. | |

|

† |

Management

contract or compensatory plan or arrangement. | |

|

|

File

No. for all filings under Exchange Act, unless otherwise noted:

1-10706. | |

|

(dollar

amounts in millions, except per share data) |

|||||||||||||||||||

|

Years

Ended December 31 |

2017 |

2016 |

2015 |

2014 |

2013 | ||||||||||||||

|

EARNINGS

SUMMARY |

|||||||||||||||||||

|

Net

interest income |

$ |

2,061 |

|

$ |

1,797 |

|

$ |

1,689 |

|

$ |

1,655 |

|

$ |

1,672 |

| ||||

|

Provision

for credit losses |

74 |

|

248 |

|

147 |

|

27 |

|

46 |

| |||||||||

|

Noninterest

income |

1,107 |

|

1,051 |

|

1,035 |

|

(a) |

857 |

|

874 |

| ||||||||

|

Noninterest

expenses |

1,860 |

|

(b) |

1,930 |

|

(b) |

1,827 |

|

(a) |

1,615 |

|

1,714 |

| ||||||

|

Provision

for income taxes |

491 |

|

(c) |

193 |

|

229 |

|

277 |

|

245 |

| ||||||||

|

Net

income |

743 |

|

477 |

|

521 |

|

593 |

|

541 |

| |||||||||

|

Net

income attributable to common shares |

738 |

|

473 |

|

515 |

|

586 |

|

533 |

| |||||||||

|

PER

SHARE OF COMMON STOCK |

|||||||||||||||||||

|

Diluted

earnings per common share |

$ |

4.14 |

|

$ |

2.68 |

|

$ |

2.84 |

|

$ |

3.16 |

|

$ |

2.85 |

| ||||

|

Cash

dividends declared |

1.09 |

|

0.89 |

|

0.83 |

|

0.79 |

|

0.68 |

| |||||||||

|

Common

shareholders’ equity |

46.07 |

|

44.47 |

|

43.03 |

|

41.35 |

|

39.22 |

| |||||||||

|

Tangible

common equity (d) |

42.34 |

|

40.79 |

|

39.33 |

|

37.72 |

|

35.64 |

| |||||||||

|

Market

value |

86.81 |

|

68.11 |

|

41.83 |

|

46.84 |

|

47.54 |

| |||||||||

|

Average

diluted shares (in millions) |

178 |

|

177 |

|

181 |

|

185 |

|

187 |

| |||||||||

|

YEAR-END

BALANCES |

|||||||||||||||||||

|

Total

assets |

$ |

71,567 |

|

$ |

72,978 |

|

$ |

71,877 |

|

$ |

69,186 |

|

$ |

65,224 |

| ||||

|

Total

earning assets |

65,880 |

|

67,518 |

|

66,687 |

|

63,788 |

|

60,200 |

| |||||||||

|

Total

loans |

49,173 |

|

49,088 |

|

49,084 |

|

48,593 |

|

45,470 |

| |||||||||

|

Total

deposits |

57,903 |

|

58,985 |

|

59,853 |

|

57,486 |

|

53,292 |

| |||||||||

|

Total

medium- and long-term debt |

4,622 |

|

5,160 |

|

3,058 |

|

2,675 |

|

3,543 |

| |||||||||

|

Total

common shareholders’ equity |

7,963 |

|

7,796 |

|

7,560 |

|

7,402 |

|

7,150 |

| |||||||||

|

AVERAGE

BALANCES |

|||||||||||||||||||

|

Total

assets |

$ |

71,452 |

|

$ |

71,743 |

|

$ |

70,247 |

|

$ |

66,336 |

|

$ |

63,933 |

| ||||

|

Total

earning assets |

66,300 |

|

66,545 |

|

65,129 |

|

61,560 |

|

59,091 |

| |||||||||

|

Total

loans |

48,558 |

|

48,996 |

|

48,628 |

|

46,588 |

|

44,412 |

| |||||||||

|

Total

deposits |

57,258 |

|

57,741 |

|

58,326 |

|

54,784 |

|

51,711 |

| |||||||||

|

Total

medium- and long-term debt |

4,969 |

|

4,917 |

|

2,905 |

|

2,963 |

|

3,972 |

| |||||||||

|

Total

common shareholders’ equity |

7,952 |

|

7,674 |

|

7,534 |

|

7,373 |

|

6,965 |

| |||||||||

|

CREDIT

QUALITY |

|||||||||||||||||||

|

Total

allowance for credit losses |

$ |

754 |

|

$ |

771 |

|

$ |

679 |

|

$ |

635 |

|

$ |

634 |

| ||||

|

Total

nonperforming loans |

410 |

|

590 |

|

379 |

|

290 |

|

374 |

| |||||||||

|

Foreclosed

property |

5 |

|

17 |

|

12 |

|

10 |

|

9 |

| |||||||||

|

Total

nonperforming assets |

415 |

|

607 |

|

391 |

|

300 |

|

383 |

| |||||||||

|

Net

credit-related charge-offs |

92 |

|

157 |

|

101 |

|

25 |

|

73 |

| |||||||||

|

Net credit-related

charge-offs as a percentage of average total loans |

0.19 |

% |

0.32 |

% |

0.21 |

% |

0.05 |

% |

0.16 |

% | |||||||||

|

Allowance for loan losses as

a percentage of total period-end loans |

1.45 |

|

1.49 |

|

1.29 |

|

1.22 |

|

1.32 |

| |||||||||

|

Allowance for loan losses as

a percentage of total nonperforming loans |

173 |

|

124 |

|

167 |

|

205 |

|

160 |

| |||||||||

|

RATIOS |

|||||||||||||||||||

|

Net

interest margin (fully taxable equivalent) |

3.12 |

% |

2.71 |

% |

2.60 |

% |

2.70 |

% |

2.84 |

% | |||||||||

|

Return

on average assets |

1.04 |

|

0.67 |

|

0.74 |

|

0.89 |

|

0.85 |

| |||||||||

|

Return

on average common shareholders’ equity |

9.34 |

|

6.22 |

|

6.91 |

|

8.05 |

|

7.76 |

| |||||||||

|

Dividend

payout ratio |

25.77 |

|

32.48 |

|

28.33 |

|

24.09 |

|

23.29 |

| |||||||||

|

Average common shareholders’

equity as a percentage of average assets |

11.13 |

|

10.70 |

|

10.73 |

|

11.11 |

|

10.90 |

| |||||||||

|

Common equity tier 1 capital

as a percentage of risk-weighted assets (e) |

11.68 |

|

11.09 |

|

10.54 |

|

n/a |

|

n/a |

| |||||||||

|

Tier

1 capital as a percentage of risk-weighted assets (e) |

11.68 |

|

11.09 |

|

10.54 |

|

10.50 |

|

10.64 |

| |||||||||

|

Common

equity ratio |

11.13 |

|

10.68 |

|

10.52 |

|

10.70 |

|

10.97 |

| |||||||||

|

Tangible

common equity as a percentage of tangible assets (d) |

10.32 |

|

9.89 |

|

9.70 |

|

9.85 |

|

10.07 |

| |||||||||

|

(a) |

Effective

January 1, 2015, contractual changes to a card program resulted in a

change to the accounting presentation of the related revenues and

expenses. The effect of this change was an increase of $177 million in

2015 to both noninterest income and noninterest expenses. Amounts prior to

2015 reflect revenues from this card program net of related noninterest

expenses. |

|

(b) |

Noninterest

expenses included restructuring charges of $45

million

and $93

million

in 2017 and 2016, respectively. |

|

(c) |

The

provision for income taxes for 2017 was impacted by a $107 million charge

to adjust deferred taxes as a result of the enactment of the Tax Cuts and

Jobs Act. |

|

(d) |

See

Supplemental Financial Data section for reconcilements of non-GAAP

financial measures. |

|

(e) |

Ratios

calculated based on the risk-based capital requirements in effect at the

time. The U.S. implementation of the Basel III regulatory capital

framework became effective on January 1, 2015, with transitional

provisions. |

|

• |

Net income was $743 million in 2017, an increase of

$266

million, or

56

percent,

compared to $477 million in 2016. Net income per diluted

common share was $4.14 in 2017, compared to $2.68

in 2016.

Net income in 2017

included a $107 million charge to adjust deferred

tax assets (60

cents per

share) resulting from the 2017 enactment of the Tax Cuts and Jobs

Act. |

|

• |

Average loans were

$48.6

billion in

2017,

a decrease of $438 million, or 1

percent,

compared to 2016.

Excluding cyclical declines of $696 million

in Energy and

$412 million in Mortgage Banker Finance, average loans increased $670

million, or 1 percent, with growth in most other businesses, led by

National Dealer Services. |

|

• |

Average deposits decreased

$483

million, or

1

percent, to

$57.3

billion in

2017

compared to 2016.

The decrease in average deposits reflected a decrease of $1.7 billion, or 6

percent, in

average interest-bearing deposits, partially offset by an increase of

$1.3

billion, or

4

percent, in

average noninterest-bearing deposits. The decrease in interest-bearing

deposits was primarily due to customers using their excess liquidity for

working capital needs and acquisitions, a deliberate approach to

relationship pricing, as well as strategic actions taken in early

2017

in light of the new Liquidity Coverage Ratio (LCR) rules. Average total

deposits reflected decreases in Corporate Banking and Technology and Life

Sciences, partially offset by increases in Commercial Real Estate and

Retail Bank. |

|

• |

Net interest income was

$2.1

billion in

2017,

an increase

of $264

million, or

15

percent,

compared to 2016.

The increase

primarily reflected the benefit from higher short-term rates and prudently

managing loan and deposit pricing. |

|

• |

The provision for credit

losses was $74

million in

2017,

a decrease of $174 million compared to 2016,

primarily due to improvement in the credit quality in the Energy and

energy-related portfolio. Net credit-related charge-offs were $92 million, or 0.19

percent of

average loans in 2017, a decrease of

$65

million

compared to $157 million, or 0.32

percent of

average loans, in 2016. The decrease primarily

reflected lower Energy and energy-related

charge-offs. |

|

• |

Noninterest income

increased $56

million, or

5

percent, to

$1.1

billion in

2017

in part due to the impact of Growth in Efficiency and Revenue (GEAR Up)

initiatives. Increases in card fees, service charges on deposit accounts

and fiduciary income, as well as smaller increases in several other

categories of noninterest income were partially offset by decreases in

letter of credit fees and commercial lending

fees. |

|

• |

Noninterest expenses

decreased $70

million, or

4

percent, to

$1.9

billion in

2017

primarily due to decreases in salaries and benefits expense, largely

driven by the GEAR Up initiative, and restructuring charges, partially

offset by an increase in outside processing fees primarily tied to

revenue-generating activities. |

|

• |

The provision for income

taxes increased $298

million in

2017.

The increase primarily reflected an increase in pretax income and the

$107

million charge

to adjust deferred taxes resulting from the Tax Cuts and Jobs Act,

partially offset by a $35

million tax

benefit from employee stock transactions in 2017 due to new accounting

guidance for stock compensation effective January 1,

2017. |

|

• |

The quarterly dividend was

increased 13 percent to 26

cents per

share in April 2017 and further increased 15 percent to 30 cents

per share in July 2017. |

|

• |

The Corporation repurchased

approximately 7.3 million shares of common stock

during 2017

under the equity repurchase program. Together with dividends of

$1.09

per share, $724 million was returned to

shareholders in 2017, an increase of

$266

million, or

58

percent,

compared to 2016. |

|

• |

Expense reductions are

expected to total $200 million by year-end 2018 and increase to $215

million by year-end 2019, reflecting incremental savings of $50 million in

2018 and an additional $15 million in 2019. This is to be achieved through

rationalizing and modernizing technology, including optimizing

infrastructure platforms, process optimization and migrating certain

applications to cloud-based systems, as well as consolidating office and

operations space. The Corporation is in the process of implementing the

end-to-end credit design program to streamline the credit process and

increase relationship managers' capacity to service clients.

|

|

• |

Revenue enhancements are

expected to total $70 million by year-end 2018 and increase to $90 million

by year-end 2019, reflecting incremental revenue of $40 million in 2018

and an additional $20 million in 2019, achieved through product

enhancements, enhanced sales tools and training and improved customer

analytics to drive opportunities. |

|

• |

Pre-tax restructuring

charges of $185 million to $195 million in total are expected to be

incurred from inception through 2018. Cumulative pre-tax restructuring

charges of $138 million have been incurred through

December 31,

2017. For

additional information regarding restructuring charges, refer to Note

22 to the consolidated

financial statements. |

|

• |

Average loans higher in

line with Gross Domestic Product, reflecting increases in most lines of

business while remaining stable in Energy and Corporate

Banking. |

|

• |

Net interest income higher,

reflecting full-year benefits from the 2017 rate increases and loan

growth. |

|

◦ |

Full-year benefit from 2017

rate increases expected to be $110 million to $125 million, assuming a 20

percent to 40 percent deposit beta for the December rate

increase. |

|

◦ |

Elevated interest

recoveries of $28 million in 2017 not expected to repeat in

2018. |

|

• |

Provision for credit losses

of 15 basis points to 25 basis points and net charge-offs to remain low,

with continued solid performance of the overall

portfolio. |

|

• |

Excluding deferred

compensation asset returns of $8 million in 2017, noninterest income

higher by 4 percent1, benefiting from the

continued execution of GEAR Up opportunities helping to drive growth in

treasury management income, card fees, brokerage fees and fiduciary

income. |

|

• |

Excluding restructuring

charges, noninterest expenses higher by 1 percent1, reflecting an additional

$50 million benefit from the GEAR Up initiative.

|

|

◦ |

Restructuring charges of

$47 million to $57 million. |

|

◦ |

Additionally, headwinds

include higher technology expenditures and typical inflationary pressures,

as well as outside processing expenses to increase in line with growing

revenue1. |

|

• |

Income tax expense to

approximate 23 percent of pre-tax income reflecting the passage of the Tax

Cuts and Jobs Acts and assuming no tax impact from employee stock

transactions. |

|

(dollar

amounts in millions) |

||||||||||||||||||||||||||

|

Years

Ended December 31 |

2017 |

2016 |

2015 | |||||||||||||||||||||||

|

Average

Balance |

Interest |

Average

Rate

(a) |

Average

Balance |

Interest |

Average

Rate

(a) |

Average

Balance |

Interest |

Average

Rate

(a) | ||||||||||||||||||

|

Commercial

loans |

$ |

30,415 |

|

$ |

1,162 |

|

3.83 |

% |

$ |

31,062 |

|

$ |

1,008 |

|

3.26 |

% |

$ |

31,501 |

|

$ |

962 |

|

3.07 |

% | ||

|

Real

estate construction loans |

2,958 |

|

124 |

|

4.18 |

|

2,508 |

|

91 |

|

3.63 |

|

1,884 |

|

66 |

|

3.48 |

| ||||||||

|

Commercial

mortgage loans |

9,005 |

|

358 |

|

3.97 |

|

8,981 |

|

314 |

|

3.49 |

|

8,697 |

|

296 |

|

3.41 |

| ||||||||

|

Lease

financing |

509 |

|

13 |

|

2.64 |

|

684 |

|

18 |

|

2.65 |

|

783 |

|

25 |

|

3.17 |

| ||||||||

|

International

loans |

1,157 |

|

47 |

|

4.07 |

|

1,367 |

|

50 |

|

3.63 |

|

1,441 |

|

51 |

|

3.58 |

| ||||||||

|

Residential

mortgage loans |

1,989 |

|

74 |

|

3.70 |

|

1,894 |

|

71 |

|

3.76 |

|

1,878 |

|

71 |

|

3.77 |

| ||||||||

|

Consumer

loans |

2,525 |

|

94 |

|

3.70 |

|

2,500 |

|

83 |

|

3.32 |

|

2,444 |

|

80 |

|

3.26 |

| ||||||||

|

Total

loans (b) |

48,558 |

|

1,872 |

|

3.86 |

|

48,996 |

|

1,635 |

|

3.34 |

|

48,628 |

|

1,551 |

|

3.20 |

| ||||||||

|

Mortgage-backed

securities |

9,330 |

|

202 |

|

2.17 |

|

9,356 |

|

203 |

|

2.19 |

|

9,113 |

|

202 |

|

2.24 |

| ||||||||

|

Other

investment securities |

2,877 |

|

48 |

|

1.67 |

|

2,992 |

|

44 |

|

1.51 |

|

1,124 |

|

14 |

|

1.25 |

| ||||||||

|

Total

investment securities (c) |

12,207 |

|

250 |

|

2.05 |

|

12,348 |

|

247 |

|

2.02 |

|

10,237 |

|

216 |

|

2.13 |

| ||||||||

|

Interest-bearing

deposits with banks |

5,443 |

|

60 |

|

1.09 |

|

5,099 |

|

26 |

|

0.51 |

|

6,158 |

|

16 |

|

0.26 |

| ||||||||

|

Other

short-term investments |

92 |

|

— |

|

0.64 |

|

102 |

|

1 |

|

0.61 |

|

106 |

|

1 |

|

0.81 |

| ||||||||

|

Total

earning assets |

66,300 |

|

2,182 |

|

3.30 |

|

66,545 |

|

1,909 |

|

2.88 |

|

65,129 |

|

1,784 |

|

2.75 |

| ||||||||

|

Cash

and due from banks |

1,209 |

|

1,146 |

|

1,059 |

|

||||||||||||||||||||

|

Allowance

for loan losses |

(728 |

) |

(730 |

) |

(621 |

) |

||||||||||||||||||||

|

Accrued

income and other assets |

4,671 |

|

4,782 |

|

4,680 |

|

||||||||||||||||||||

|

Total

assets |

$ |

71,452 |

|

$ |

71,743 |

|

$ |

70,247 |

|

|||||||||||||||||

|

Money

market and interest-bearing checking deposits |

$ |

21,585 |

|

33 |

|

0.15 |

|

$ |

22,744 |

|

27 |

|

0.11 |

|

$ |

24,073 |

|

26 |

|

0.11 |

| |||||

|

Savings

deposits |

2,133 |

|

— |

|

0.02 |

|

2,013 |

|

— |

|

0.02 |

|

1,841 |

|

— |

|

0.02 |

| ||||||||

|

Customer

certificates of deposit |

2,471 |

|

9 |

|

0.36 |

|

3,200 |

|

13 |

|

0.40 |

|

4,209 |

|

16 |

|

0.37 |

| ||||||||

|

Foreign

office time deposits (d) |

56 |

|

— |

|

0.64 |

|

33 |

|

— |

|

0.35 |

|

116 |

|

1 |

|

1.02 |

| ||||||||

|

Total

interest-bearing deposits |

26,245 |

|

42 |

|

0.16 |

|

27,990 |

|

40 |

|

0.14 |

|

30,239 |

|

43 |

|

0.14 |

| ||||||||

|

Short-term

borrowings |

277 |

|

3 |

|

1.14 |

|

138 |

|

— |

|

0.45 |

|

93 |

|

— |

|

0.05 |

| ||||||||

|

Medium-

and long-term debt (e) |

4,969 |

|

76 |

|

1.51 |

|

4,917 |

|

72 |

|

1.45 |

|

2,905 |

|

52 |

|

1.80 |

| ||||||||

|

Total

interest-bearing sources |

31,491 |

|

121 |

|

0.38 |

|

33,045 |

|

112 |

|

0.34 |

|

33,237 |

|

95 |

|

0.29 |

| ||||||||

|

Noninterest-bearing

deposits |

31,013 |

|

29,751 |

|

28,087 |

|

||||||||||||||||||||

|

Accrued

expenses and other liabilities |

996 |

|

1,273 |

|

1,389 |

|

||||||||||||||||||||

|

Total

shareholders’ equity |

7,952 |

|

7,674 |

|

7,534 |

|

||||||||||||||||||||

|

Total

liabilities and shareholders’ equity |

$ |

71,452 |

|

$ |

71,743 |

|

$ |

70,247 |

|

|||||||||||||||||

|

Net

interest income/rate spread |

$ |

2,061 |

|

2.92 |

|

$ |

1,797 |

|

2.54 |

|

$ |

1,689 |

|

2.46 |

| |||||||||||

|

Impact

of net noninterest-bearing sources of funds |

|

0.20 |

|

0.17 |

|

0.14 |

| |||||||||||||||||||

|

Net interest margin (as a

percentage of average earning assets) (c) |

|

|

3.12 |

% |

|

|

2.71 |

% |

|

|

2.60 |

% | ||||||||||||||

|

(a) |

Average

rate is calculated on a fully taxable equivalent (FTE) basis using a

federal tax rate of 35%. The FTE adjustment to net interest income

included in the rate calculations totaled $4 million in each of the three

years presented. |

|

(b) |

Nonaccrual

loans are included in average balances reported and in the calculation of

average rates. |

|

(c) |

Includes

investment securities available-for-sale and investment securities

held-to-maturity. Average rate is based on average historical cost.

Carrying value was $28

million

below average historical cost in 2017 and

exceeded average historical cost by $143

million

and $100

million

in 2016 and

2015,

respectively. |

|

(d) |

Includes

substantially all deposits by foreign depositors; deposits are primarily

in excess of $100,000. |

|

(e) |

Medium-

and long-term debt average balances included $77

million,

$162

million

and $160

million

in 2017,

2016 and

2015,

respectively, for the gain attributed to the risk hedged with interest

rate swaps. Interest expense on medium-and long-term debt was reduced by

$32

million,

$60

million

and $70

million

in 2017,

2016 and

2015,

respectively, for the net gains on these fair value hedge

relationships. |

|

(in

millions) |

|||||||||||||||||||||||||

|

Years

Ended December 31 |

2017/2016 |

2016/2015 | |||||||||||||||||||||||

|

Increase

(Decrease)

Due to Rate |

Increase

(Decrease)

Due to

Volume (a) |

Net

Increase

(Decrease) |

Increase

(Decrease)

Due to Rate |

Increase

(Decrease)

Due to

Volume (a) |

Net

Increase

(Decrease) | ||||||||||||||||||||

|

Interest

Income: |

|||||||||||||||||||||||||

|

Commercial

loans |

$ |

179 |

|

$ |

(25 |

) |

$ |

154 |

|

$ |

60 |

|

$ |

(14 |

) |

$ |

46 |

|

|||||||

|

Real

estate construction loans |

14 |

|

19 |

|

33 |

|

2 |

|

23 |

|

25 |

|

|||||||||||||

|

Commercial

mortgage loans |

43 |

|

1 |

|

44 |

|

8 |

|

10 |

|

18 |

|

|||||||||||||

|

Lease

financing |

— |

|

(5 |

) |

(5 |

) |

(4 |

) |

(3 |

) |

(7 |

) |

|||||||||||||

|

International

loans |

6 |

|

(9 |

) |

(3 |

) |

1 |

|

(2 |

) |

(1 |

) |

|||||||||||||

|

Residential

mortgage loans |

(1 |

) |

4 |

|

3 |

|

— |

|

— |

|

— |

|

|||||||||||||

|

Consumer

loans |

10 |

|

1 |

|

11 |

|

1 |

|

2 |

|

3 |

|

|||||||||||||

|

Total

loans |

251 |

|

(14 |

) |

237 |

|

68 |

|

16 |

|

84 |

|

|||||||||||||

|

Mortgage-backed

securities |

(1 |

) |

— |

|

(1 |

) |

(4 |

) |

5 |

|

1 |

|

|||||||||||||

|

Other

investment securities |

5 |

|

(1 |

) |

4 |

|

3 |

|

27 |

|

30 |

|

|||||||||||||

|

Total

investment securities (b) |

4 |

|

(1 |

) |

3 |

|

(1 |

) |

32 |

|

31 |

|

|||||||||||||

|

Interest-bearing

deposits with banks |

30 |

|

4 |

|

34 |

|

15 |

|

(5 |

) |

10 |

|

|||||||||||||

|

Other

short-term investments |

— |

|

(1 |

) |

(1 |

) |

— |

|

— |

|

— |

|

|||||||||||||

|

Total

interest income |

285 |

|

(12 |

) |

273 |

|

82 |

|

43 |

|

125 |

|

|||||||||||||

|

Interest

Expense: |

|||||||||||||||||||||||||

|

Money

market and interest-bearing checking deposits |

8 |

|

(2 |

) |

6 |

|

2 |

|

(1 |

) |

1 |

|

|||||||||||||

|

Customer

certificates of deposit |

(1 |

) |

(3 |

) |

(4 |

) |

1 |

|

(4 |

) |

(3 |

) |

|||||||||||||

|

Foreign

office time deposits |

— |

|

— |

|

— |

|

(1 |

) |

— |

|

(1 |

) |

|||||||||||||

|

Total

interest-bearing deposits |

7 |

|

(5 |

) |

2 |

|

2 |

|

(5 |

) |

(3 |

) |

|||||||||||||

|

Short-term

borrowings |

1 |

|

2 |

|

3 |

|

— |

|

— |

|

— |

|

|||||||||||||

|

Medium-

and long-term debt |

23 |

|

(19 |

) |

4 |

|

9 |

|

11 |

|

20 |

|

|||||||||||||

|

Total

interest expense |

31 |

|

(22 |

) |

9 |

|

11 |

|

6 |

|

17 |

|

|||||||||||||

|

Net

interest income |

$ |

254 |

|

$ |

10 |

|

$ |

264 |

|

$ |

71 |

|

$ |

37 |

|

$ |

108 |

|

|||||||

|

(a) |

Rate/volume

variances are allocated to variances due to

volume. |

|

(b) |

Includes

investment securities available-for-sale and investment securities

held-to-maturity. |

|

(in

millions) |

||||||||||||

|

Years

Ended December 31 |

2017 |

2016 |

2015 | |||||||||

|

Card

fees |

$ |

333 |

|

$ |

303 |

|

$ |

276 |

|

|||

|

Service

charges on deposit accounts |

227 |

|

219 |

|

223 |

|

||||||

|

Fiduciary

income |

198 |

|

190 |

|

187 |

|

||||||

|

Commercial

lending fees |

85 |

|

89 |

|

99 |

|

||||||

|

Letter

of credit fees |

45 |

|

50 |

|

53 |

|

||||||

|

Bank-owned

life insurance |

43 |

|

42 |

|

40 |

|

||||||

|

Foreign

exchange income |

45 |

|

42 |

|

40 |

|

||||||

|

Brokerage

fees |

23 |

|

19 |

|

17 |

|

||||||

|

Net

securities losses |

(3 |

) |

(5 |

) |

(2 |

) |

||||||

|

Other

noninterest income (a) |

111 |

|

102 |

|

102 |

|

||||||

|

Total

noninterest income |

$ |

1,107 |

|

$ |

1,051 |

|

$ |

1,035 |

|

|||

|

(a) |

The

table below provides further details on certain categories included in

other noninterest income. |

|

(in

millions) |

|||||||||||||

|

Years

Ended December 31 |

2017 |

2016 |

2015 | ||||||||||

|

Customer

derivative income |

$ |

26 |

|

$ |

27 |

|

$ |

18 |

|

||||

|

Insurance

commissions |

8 |

|

10 |

|

10 |

|

|||||||

|

Investment

banking fees |

9 |

|

7 |

|

12 |

|

|||||||

|

Income

from principal investing and warrants |

6 |

|

7 |

|

6 |

|

|||||||

|

Securities

trading income |

8 |

|

6 |

|

9 |

|

|||||||

|

Deferred

compensation asset returns (a) |

8 |

|

3 |

|

— |

|

|||||||

|

Risk

management hedge ineffectiveness

|

1 |

|

(2 |

) |

1 |

|

|||||||

|

All

other noninterest income |

45 |

|

44 |

|

46 |

|

|||||||

|

Other

noninterest income |

$ |

111 |

|

$ |

102 |

|

$ |

102 |

|

||||

|

(a) |

Compensation

deferred by the Corporation's officers and directors is invested based on

investment selections of the officers and directors. Income earned on

these assets is reported in noninterest income and the offsetting change

in liability is reported in salaries and benefits

expense. |

|

(in

millions) |

||||||||||||

|

Years

Ended December 31 |

2017 |

2016 |

2015 | |||||||||

|

Salaries

and benefits expense |

$ |

912 |

|

$ |

961 |

|

$ |

1,009 |

|

|||

|

Outside

processing fee expense |

366 |

|

336 |

|

318 |

|

||||||

|

Net

occupancy expense |

154 |

|

157 |

|

159 |

|

||||||

|

Equipment

expense |

45 |

|

53 |

|

53 |

|

||||||

|

Restructuring

charges |

45 |

|

93 |

|

— |

|

||||||

|