Comerica Incorporated

Proxy Statement and Notice of

2014 Annual Meeting of Shareholders

Comerica Incorporated

Comerica Bank Tower

1717 Main Street

Dallas, Texas 75201

March 11, 2014

Dear Shareholder,

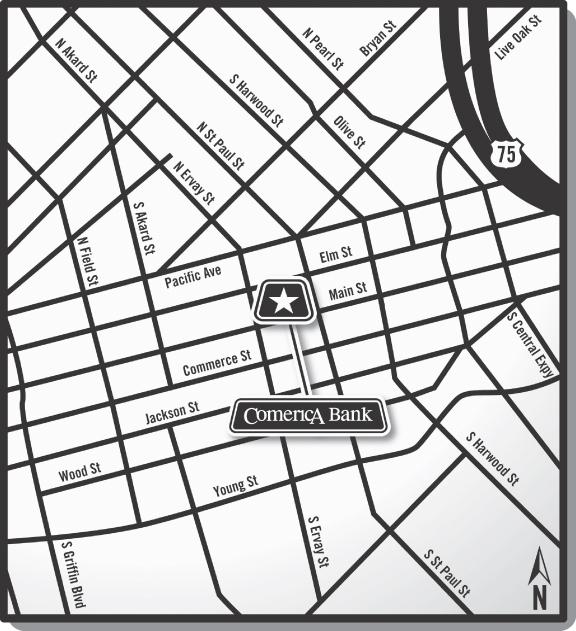

It is our pleasure to invite you to attend the 2014 Annual Meeting of Shareholders of Comerica Incorporated at 9:30 a.m., Central Time, on Tuesday, April 22, 2014 at Comerica Bank Tower, 1717 Main Street, 4th Floor, Dallas, Texas 75201. Registration will begin at 8:30 a.m., Central Time. A map showing the location of the Annual Meeting is on the back cover of the accompanying proxy statement.

This year, we are continuing to provide proxy materials to our shareholders primarily through the Internet. We are pleased to use this process, which allows our shareholders to receive proxy materials in an expedited manner, while significantly lowering the costs of our annual proxy campaign. On or about March 11, 2014, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement, our annual report and additional soliciting materials online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail (with the exception of the proxy card, which will be separately mailed on or around March 21, 2014 to shareholders of record that have not yet voted) unless you specifically request them. The Notice of Internet Availability of Proxy Materials instructs you on how to electronically access and review all of the important information contained in this proxy statement and the annual report, and it provides you with information on voting. The proxy materials available online include our 2014 proxy statement, our 2013 annual report, which summarizes Comerica’s major developments during 2013 and includes the 2013 consolidated financial statements, and additional soliciting materials.

Whether or not you plan to attend the Annual Meeting, please submit your proxy promptly so that your shares will be voted as you desire.

Sincerely,

Ralph W. Babb, Jr.

Chairman and Chief Executive Officer

PROXY STATEMENT

| 1 | ||||

| 4 | ||||

| 6 | ||||

| 11 | ||||

| 13 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| Director Independence and Transactions of Directors with Comerica |

19 | |||

| 21 | ||||

| 21 | ||||

| Proposal II Submitted for your Vote — Ratification of the Appointment of Independent Auditors |

24 | |||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 31 | ||||

| 32 | ||||

| 62 | ||||

| 63 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 72 | ||||

| Potential Payments upon Termination or Change of Control at Fiscal Year-End 2013 |

74 | |||

| 80 | ||||

| 81 | ||||

| 83 | ||||

| 83 | ||||

| 83 | ||||

| 84 | ||||

| Annex A — Reconciliation of Non-GAAP and GAAP Financial Measures |

A-1 | |||

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Shareholders

| Time and Date | 9:30 a.m., Central Time, April 22, 2014 | |

| Place | Comerica Bank Tower, 1717 Main Street, 4th Floor, Dallas, Texas 75201 | |

| Record Date | February 21, 2014 | |

| Mailing Date | On or around March 11, 2014 | |

| Voting | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | |

Voting Matters

| Board Vote Recommendation |

Page Reference | ||||||

| Election of directors |

FOR EACH DIRECTOR NOMINEE | 11 | |||||

| Ratification of Ernst & Young LLP as independent auditors for 2014 | FOR | 24 | |||||

| Advisory approval of the Company’s executive compensation

|

FOR | 31 | |||||

1

Board Nominees

The following table provides summary information about each director nominee. Each director nominee will be elected for a one-year term. Directors are elected by a majority of votes cast.

| Director | Committee Memberships |

Other Public Company Boards | ||||||||||||||||||

| Name | Age | since | Occupation | Independent | AC | GCNC | ERC | QLCC | ||||||||||||

|

| ||||||||||||||||||||

|

|

||||||||||||||||||||

| Ralph W. Babb, Jr. |

65 | 2001 | Chairman, President & CEO, Comerica Incorporated and Comerica Bank |

Texas Instruments Inc. | ||||||||||||||||

| Roger A. Cregg |

57 | 2006 | President & CEO, AV Homes, Inc. |

X | F | X | X | AV Homes, Inc. | ||||||||||||

| T. Kevin DeNicola |

59 | 2006 | Former CFO, KIOR, Inc. | X | C, F | X | C | Axiall Corporation | ||||||||||||

| Jacqueline P. Kane |

61 | 2008 | SVP, Human Resources and Corporate Affairs, The Clorox Company |

X | X | |||||||||||||||

| Richard G. Lindner |

59 | 2008 | Retired; Former SEVP & CFO, AT&T, Inc. | IFD | C | X | ||||||||||||||

| Alfred A. Piergallini |

67 | 1991 | Consultant, Desert Trail Consulting |

X | X | Central Garden & Pet Company | ||||||||||||||

| Robert S. Taubman |

60 | 2000 | Chairman, President & CEO, Taubman Centers, Inc. and The Taubman Company |

X | X | Sotheby’s Holdings, Inc., Taubman Centers, Inc. | ||||||||||||||

| Reginald M. Turner, Jr. |

54 | 2005 | Attorney, Clark Hill PLC | X | X | C | X | |||||||||||||

| Nina G. Vaca |

42 | 2008 | Chairman & CEO, Pinnacle Technical Resources, Inc. and Vaca Industries Inc. |

X | X | X | X | Kohl’s Corporation | ||||||||||||

AC — Audit Committee; C — Chair; ERC — Enterprise Risk Committee; F — Financial expert; GCNC — Governance, Compensation and Nominating Committee; IFD — Independent Facilitating Director; QLCC — Qualified Legal Compliance Committee

Attendance

All director nominees and all incumbent directors attended at least seventy-five percent (75%) of the aggregate number of meetings held by the Board and all the committees of the Board on which the respective directors served.

Corporate Governance Highlights

Comerica is very committed to sound corporate governance practices. We believe that strong corporate governance is important, and that integrity and trustworthiness are the cornerstones upon which successful companies are built. In light of this belief, over the past several years, we have implemented multiple enhancements in the corporate governance of Comerica. Specifically, we have:

| • | appointed an independent Facilitating Director who participates in the process of preparing meeting agendas and schedules and presides over executive sessions of the Board of Directors; |

| • | adopted a majority vote standard for director elections; |

| • | eliminated supermajority voting requirements in our governing documents; |

| • | declassified our Board of Directors to allow for the annual election of all directors; and |

| • | prohibited transactions by employees and directors that are designed to hedge or offset any decrease in the market value of Comerica’s equity securities. |

2

Auditors

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of Ernst & Young LLP as our independent auditors for 2014. Set forth below is summary information with respect to Ernst & Young’s fees for services provided in 2013 and 2012.

| 2013 | 2012 | |||||||

| Audit Fees |

$ | 1,846,915 | $ | 1,907,708 | ||||

| Audit-Related Fees |

272,900 | 269,900 | ||||||

| Tax Fees |

66,933 | 225,045 | ||||||

| All Other Fees |

218,181 | 1,995 | ||||||

|

|

|

|

|

|||||

| $ | 2,404,929 | $ | 2,404,648 | |||||

|

|

|

|

|

|||||

2013 Compensation Highlights

| • | Granted performance restricted stock units to our named executive officers and key leaders in 2013, which allows for the cancelation of a portion of the award if certain capital thresholds are not maintained over the three-year measurement period. |

| • | Reduced the weighting of stock options to 10% of equity awards to further discourage inappropriate risk taking and better align with regulatory expectations. |

| • | Instituted a holding period as part of our stock ownership guidelines which requires individuals not meeting the guidelines within the specified time frame to hold 50% of all net shares from stock option transactions and restricted stock vestings. |

| • | Engaged a new independent compensation consultant for the Governance, Compensation and Nominating Committee – Frederic W. Cook & Co., Inc., which superseded Aon Hewitt in June 2013. |

| • | In response to shareholder and regulatory feedback, approved further compensation changes that will be applicable for 2014, as described on pages 52-57. |

3

COMERICA INCORPORATED

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

APRIL 22, 2014

| Date: | April 22, 2014 | |

| Time: | 9:30 a.m., Central Time | |

| Place: | Comerica Bank Tower 1717 Main Street, 4th Floor Dallas, Texas 75201 | |

We invite you to attend the Comerica Incorporated Annual Meeting of Shareholders for the following purposes:

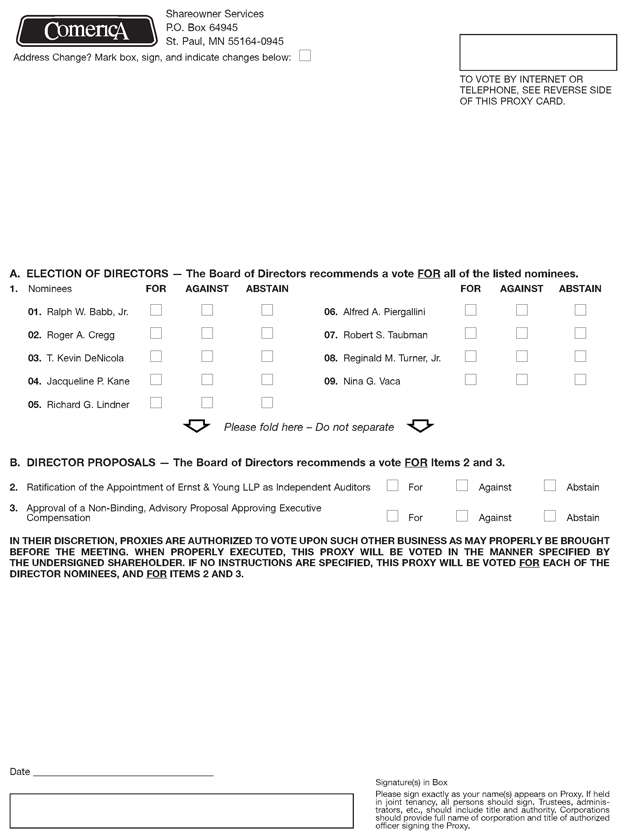

| 1. | To elect nine directors nominated by the Board of Directors for one-year terms expiring in 2015 or upon the election and qualification of their successors; |

| 2. | To ratify the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2014; |

| 3. | To approve a non-binding, advisory proposal approving executive compensation; and |

| 4. | To transact any other business that is properly submitted before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

The record date for the Annual Meeting is February 21, 2014 (the “Record Date”). Only shareholders of record at the close of business on the Record Date can vote at the Annual Meeting. Action may be taken at the Annual Meeting on any of the foregoing proposals on the date specified above or any date or dates to which the Annual Meeting may be adjourned or postponed.

Under rules adopted by the Securities and Exchange Commission, we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of the proxy statement and annual report. Shareholders of record have been mailed a Notice of Internet Availability of Proxy Materials on or around March 11, 2014, which provides them with instructions on how to vote and how to electronically access the proxy materials on the Internet. It also provides them with instructions on how to request paper copies of these materials, should they so desire. In addition, on or around March 21, 2014, Comerica will mail a proxy card to its shareholders of record that have not yet voted, along with a second copy of the Notice of Internet Availability of Proxy Materials. Shareholders of record who previously enrolled in a program to receive electronic versions of the proxy materials will receive an email notice with details on how to access those materials and how to vote.

Comerica will have a list of shareholders who can vote at the Annual Meeting available for inspection by shareholders at the Annual Meeting and, for 10 days prior to the Annual Meeting, during regular business hours at the offices of the Comerica Corporate Legal Department, Comerica Bank Tower, 1717 Main Street, Dallas, Texas 75201.

If you plan to attend the Annual Meeting but are not a shareholder of record because you hold your shares in street name, please bring evidence of your beneficial ownership of your shares with you to the Annual Meeting. See the “Questions and Answers” section of the proxy statement for a discussion of the difference between a shareholder of record and a street name holder.

4

Whether or not you plan to attend the Annual Meeting and whether you own a few or many shares of stock, the Board of Directors urges you to vote promptly. Registered holders may vote through the Internet, by telephone or, once you receive a printed proxy card in the mail, by completing, dating, signing and returning the proxy card so that your shares may be represented at the Annual Meeting. “Street name” holders must vote their shares in the manner prescribed by their brokerage firm, bank or other nominee. You will find instructions for voting in the “Questions and Answers” section of the proxy statement.

| By Order of the Board of Directors, |

|

|

| Jon W. Bilstrom Executive Vice President — Governance, Regulatory Relations and Legal Affairs, and Corporate Secretary |

March 11, 2014

5

Comerica Incorporated

Comerica Bank Tower

1717 Main Street

Dallas, Texas 75201

What is a proxy?

A proxy is your authorization for someone else to vote for you in the way that you want to vote. When you complete and submit a proxy card or use the automated telephone voting system or the Internet voting system, you are submitting a proxy. The Board of Directors of Comerica Incorporated (“Comerica” or the “Company”) is soliciting this proxy. All references in this proxy statement to “you” will mean you, the shareholder, and to “yours” will mean the shareholder’s or shareholders’, as appropriate.

What is a proxy statement?

A proxy statement is a document the United States Securities and Exchange Commission (“SEC”) requires to explain the matters on which you are asked to vote on by proxy and to disclose certain related information. This proxy statement was first made available to the shareholders on or about March 11, 2014.

Why am I receiving my proxy materials electronically instead of receiving paper copies through the mail?

Under rules adopted by the SEC, we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of the proxy statement and annual report. In addition to reducing the amount of paper used in producing these materials, this method lowers the costs associated with mailing the proxy materials to shareholders.

On or about March 11, 2014, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement and our annual report online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail (with the exception of the proxy card, which will be separately mailed on or around March 21, 2014 to shareholders of record that have not yet voted). The Notice of Internet Availability of Proxy Materials instructs you on how to electronically access and review all of the important information contained in this proxy statement and the annual report, and it provides you with information on voting.

If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a paper copy of our proxy materials, follow the instructions contained in the Notice of Internet Availability of Proxy Materials about how you may request to receive your materials in printed form on a one-time or ongoing basis.

Who can vote?

Only record holders of Comerica’s common stock at the close of business on February 21, 2014, the Record Date, can vote at the Annual Meeting. Each shareholder of record has one vote, for each share of common stock owned, on each matter presented for a vote at the Annual Meeting.

6

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, then the brokerage firm, bank or other nominee is considered to be the shareholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the brokerage firm, bank or other nominee how to vote their shares. See “How can I vote?” below.

How can I vote?

If you are a shareholder of record as of the Record Date (as opposed to a street name holder), you will be able to vote in four ways: in person, by proxy card, by telephone, or by the Internet. On or about March 11, 2014, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials and how to submit their proxy via the Internet. In addition, on or about March 21, 2014, we will mail a printed version of the proxy card, along with a second copy of the Notice of Internet Availability of Proxy Materials, to such shareholders of record, if they have not yet voted. Generally, shareholders of record will need information on the Notice of Internet Availability of Proxy Materials or the proxy card to vote. If you previously enrolled in a program to receive electronic versions of Comerica’s annual report and proxy statement instead of receiving printed versions, you will receive an email notice that will provide you with the information you will need to access the proxy materials and vote.

To vote in person, you will need to attend the Annual Meeting to cast your vote. To vote by proxy card, complete, sign, date and return the proxy card in the return envelope provided with your proxy card. To vote by using the automated telephone voting system or the Internet voting system, the instructions for shareholders of record are as follows:

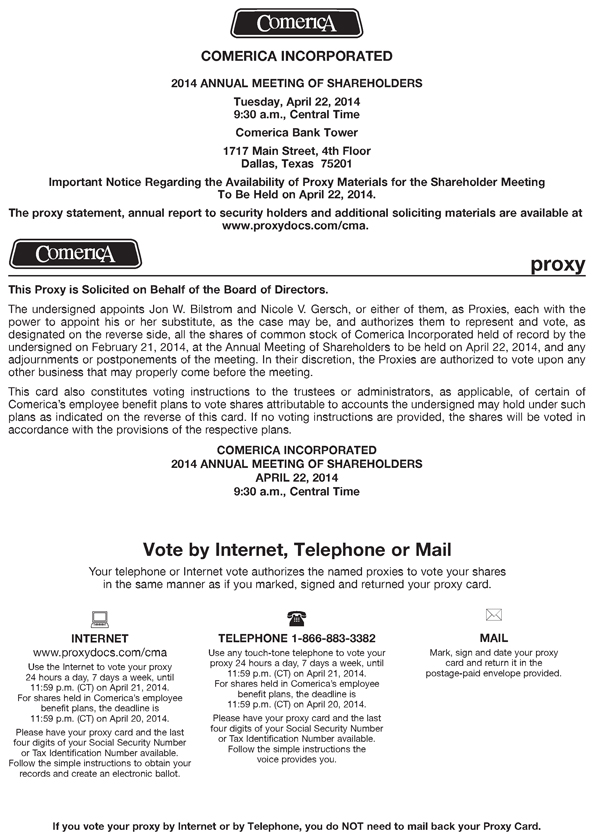

TO VOTE BY TELEPHONE: 1-866-883-3382

| • | Use any touch-tone telephone to vote your proxy. |

| • | Have your proxy card or Notice of Internet Availability of Proxy Materials and the last four digits of your Social Security Number or Tax Identification Number available when you call. |

| • | Follow the simple instructions the system provides you. |

| • | You may dial this toll free number at your convenience, 24 hours a day, 7 days a week. The deadline for telephone voting is 11:59 p.m. (Central Time), April 21, 2014. For shares held in Comerica’s employee benefit plans, the deadline is 11:59 p.m. (Central Time), April 20, 2014. |

(OR)

TO VOTE BY THE INTERNET: http://www.proxydocs.com/cma

| • | Use the Internet to vote your proxy. |

| • | Have your proxy card or Notice of Internet Availability of Proxy Materials and the last four digits of your Social Security Number or Tax Identification Number available when you access the website. |

| • | Follow the simple instructions to obtain your records and create an electronic ballot. |

7

| • | You may log on to this Internet site at your convenience, 24 hours a day, 7 days a week. The deadline for Internet voting is 11:59 p.m. (Central Time), April 21, 2014. For shares held in Comerica’s employee benefit plans, the deadline is 11:59 p.m. (Central Time), April 20, 2014. |

If you submit a proxy to Comerica before the Annual Meeting, whether by proxy card, by telephone or by Internet, the persons named as proxies will vote your shares as you direct. If no instructions are specified, the proxy will be voted for the nine directors nominated by the Board of Directors; for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2014; and for the non-binding, advisory proposal to approve executive compensation. No other matters are currently scheduled to be acted upon at the Annual Meeting.

You may revoke a proxy at any time before the proxy is exercised by:

| (1) | delivering written notice of revocation to the Corporate Secretary of Comerica at the Corporate Legal Department, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201; |

| (2) | submitting another properly completed proxy card that is later dated; |

| (3) | voting by telephone at a subsequent time; |

| (4) | voting by the Internet at a subsequent time; or |

| (5) | voting in person at the Annual Meeting. |

If you hold your shares in “street name,” you must vote your shares in the manner prescribed by your brokerage firm, bank or other nominee. Your brokerage firm, bank or other nominee should have enclosed or otherwise provided a voting instruction card for you to use in directing the brokerage firm, bank or other nominee how to vote your shares. If you hold your shares in street name and you want to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker and present it at the Annual Meeting.

What is a quorum?

There were 182,089,217 shares of Comerica’s common stock issued and outstanding on the Record Date. A majority of the issued and outstanding shares, 91,044,609 shares, present or represented by proxy at the meeting, constitutes a quorum. A quorum must exist to conduct business at the Annual Meeting.

What vote is required?

Directors: If a quorum exists, the nominees for director receiving a majority of the votes cast (i.e., the number of shares voted “for” a director nominee exceeds the number of votes cast “against” that nominee) will be elected as directors. Votes cast will include only votes cast with respect to shares present in person or represented by proxy at the meeting and entitled to vote and will exclude abstentions. Therefore, shares not present at the meeting, broker non-votes (described below) and shares voting “abstain” have no effect on the election of directors. If the number of nominees exceeds the number of directors to be elected, the directors shall be elected by the vote of a plurality of the shares represented in person or by proxy at the meeting.

Other Proposals: If a quorum exists, the proposals: (i) to ratify the appointment of Ernst & Young LLP as independent auditors and (ii) to approve a non-binding, advisory proposal to approve executive compensation must receive the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal in question. Therefore, abstentions will have the same effect as voting against the applicable proposal. Broker non-votes will not be counted as eligible to vote on the applicable proposal and, therefore, will have no effect on the outcome of the voting on that proposal.

8

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote under the rules of the stock exchange or other organization of which it is a member. In this situation, a “broker non-vote” occurs.

An independent third party, Wells Fargo, N.A., will act as the inspector of the Annual Meeting and the tabulator of votes.

Who pays for the costs of the Annual Meeting?

Comerica pays the cost of preparing and printing the proxy statement and soliciting proxies. Comerica will solicit proxies primarily by mail, but may also solicit proxies personally and by telephone, the Internet, facsimile or other means. Comerica will use the services of Georgeson Inc., a proxy solicitation firm, at a cost of $10,000 plus out-of-pocket expenses and fees for any special services. Officers and regular employees of Comerica and its subsidiaries may also solicit proxies, but they will not receive additional compensation for soliciting proxies. Comerica also will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their out-of-pocket expenses for forwarding solicitation materials to beneficial owners of Comerica’s common stock.

When are shareholder proposals for the 2015 Annual Meeting due?

To be considered for inclusion in next year’s proxy statement, all shareholder proposals must comply with applicable laws and regulations, including SEC Rule 14a-8, as well as Comerica’s bylaws, and must be submitted in writing to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, and received by November 11, 2014.

Under Comerica’s bylaws, shareholders of Comerica must provide advance notice to Comerica if they wish to propose items of business at an Annual Meeting of Comerica’s shareholders. For the 2015 Annual Meeting of Shareholders, notice must be received by Comerica’s Corporate Secretary no later than the close of business on January 22, 2015 and no earlier than the close of business on December 23, 2014. If, however, Comerica moves the Annual Meeting of Shareholders to a date that is more than 30 days before or more than 60 days after the date which is the one-year anniversary of this year’s Annual Meeting date (i.e., April 22, 2015), Comerica’s Corporate Secretary must receive your notice no earlier than the close of business on the 120th day prior to the new Annual Meeting date and no later than the close of business on the later of the 90th day prior to the new Annual Meeting date or the 10th day following the day on which Comerica first made a public announcement of the new Annual Meeting date.

Comerica’s bylaws contain additional requirements for shareholder proposals. A copy of Comerica’s bylaws can be obtained by making a written request to the Corporate Secretary.

How can shareholders nominate persons for election as directors at the 2015 Annual Meeting?

All shareholder nominations of persons for election as directors at the 2015 Annual Meeting of Shareholders must comply with applicable laws and regulations, as well as Comerica’s bylaws, and must be submitted in writing to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201.

Under Comerica’s bylaws, shareholders of Comerica must provide advance notice to Comerica’s Corporate Secretary if they wish to nominate persons for election as directors at an Annual Meeting of Comerica’s Shareholders. For the 2015 Annual Meeting of Shareholders, written notice must be received by Comerica’s Corporate Secretary no later than the close of business on January 22, 2015 and no earlier than the close of business on December 23, 2014.

If, however, Comerica moves the Annual Meeting of Shareholders to a date that is more than 30 days before or more than 60 days after the date that is the one-year anniversary of this year’s Annual Meeting date (i.e., April 22, 2015), or if a special meeting of shareholders is called for the purpose of electing directors, Comerica’s

9

Corporate Secretary must receive your notice no earlier than the close of business on the 120th day prior to the meeting date and no later than the close of business on the later of the 90th day prior to the meeting date or the 10th day following the day on which Comerica first made a public announcement of the meeting date (and, in the case of a special meeting, of the nominees proposed by the Board of Directors to be elected at such meeting).

If Comerica increases the number of directors to be elected to the Board at the Annual Meeting and there is no public announcement naming all of the nominees for director or specifying the size of the increased Board at least 100 days prior to the first anniversary of the immediately preceding year’s Annual Meeting, then Comerica will consider your notice timely (but only with respect to nominees for any new positions created by such increase) if Comerica’s Corporate Secretary receives your notice no later than the close of business on the 10th day following the day on which Comerica first makes the public announcement of the increase in the number of directors.

In addition, Article III, Section 12 of the bylaws requires a nominee for election or re-election as a director of Comerica to complete and deliver to the Corporate Secretary (in accordance with the time periods described above, in the case of director nominations by shareholders) a written questionnaire prepared by Comerica with respect to the background and qualification of the person and, if applicable, the background of any other person or entity on whose behalf the nomination is being made.

A nominee also must make certain representations and agree that he or she (A) will abide by the requirements of Article III, Section 13 of the bylaws (concerning, among other things, the required tendering of a resignation by a director who does not receive a majority of votes cast in an uncontested election), (B) is not and will not become a party to (1) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how, if elected as a director of Comerica, he or she will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to Comerica or (2) any Voting Commitment that could limit or interfere with his or her ability to comply, if elected as a director of Comerica, with his or her fiduciary duties under applicable law, (C) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than Comerica with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed, and (D) in his or her individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, would be in compliance, if elected as a director of Comerica, and would comply with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of Comerica.

You may receive a copy of Comerica’s bylaws specifying the advance notice and additional requirements for shareholder nominations by making a written request to the Corporate Secretary.

A copy of Comerica’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as filed with the Securities and Exchange Commission, may be obtained without charge upon written request to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on April 22, 2014.

The proxy statement, annual report to security holders and additional soliciting materials are available at www.proxydocs.com/cma.

10

PROPOSAL I SUBMITTED FOR YOUR VOTE

ELECTION OF DIRECTORS

The Board of Directors recommends that you vote “FOR”

the candidates for director.

Election of Directors. Comerica’s Board of Directors currently has nine members, and directors are elected annually for terms of one year. Based on the recommendation of the Governance, Compensation and Nominating Committee, the Board has nominated all of Comerica’s current directors to serve another term or until their successors are elected and qualified. The current directors are the only nominees, and each of them has been previously elected by the shareholders. Each of the nominees has consented to his or her nomination and has agreed to serve as a director of Comerica, if elected. Proxies cannot be voted for a greater number of people than the number of nominees named.

If any director is unable to stand for re-election, Comerica may vote the shares to elect any substitute nominees recommended by the Governance, Compensation and Nominating Committee. If the Governance, Compensation and Nominating Committee does not recommend any substitute nominees, the number of directors to be elected at the Annual Meeting may be reduced by the number of nominees who are unable to serve.

In identifying potential candidates for nomination as directors, the Governance, Compensation and Nominating Committee considers the specific qualities and skills of potential directors. Criteria for assessing nominees include a potential nominee’s ability to represent the interests of Comerica’s four core constituencies: its shareholders, its customers, the communities it serves and its employees. Minimum qualifications for a director nominee are experience in those areas that the Board determines are necessary and appropriate to meet the needs of Comerica, including leadership positions in public companies, small or middle market businesses, or not-for-profit, professional or educational organizations.

For those proposed director nominees who meet the minimum qualifications, the Governance, Compensation and Nominating Committee then assesses the proposed nominee’s specific qualifications, evaluates his or her independence, and considers other factors, including skills, geographic location, considerations of diversity, standards of integrity, memberships on other boards (with a special focus on director interlocks), and ability and willingness to commit to serving on the Board for an extended period of time and to dedicate adequate time and attention to the affairs of Comerica as necessary to properly discharge his or her duties. Considerations of diversity can include seeking nominees with a broad diversity of experience, professions, skills, geographic representation and/or backgrounds. The Governance, Compensation and Nominating Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

In addition, Article III, Section 12 of the bylaws requires a nominee for election or re-election as a director of Comerica to complete and deliver to the Corporate Secretary a written questionnaire prepared by Comerica with respect to the background and qualification of the person and, if applicable, the background of any other person or entity on whose behalf the nomination is being made. All of the director nominees completed the required questionnaire.

A nominee also must make certain representations and agree that he or she (A) will abide by the requirements of Article III, Section 13 of the bylaws (concerning, among other things, the required tendering of a resignation by a director who does not receive a majority of votes cast in an uncontested election), (B) is not and will not become a party to (1) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how, if elected as a director of Comerica, he or she will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to Comerica or (2) any Voting Commitment that could limit or interfere with his or her ability to comply, if elected as a director of Comerica, with his or her fiduciary duties under applicable law, (C) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than Comerica with respect to any direct or

11

indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed, and (D) in his or her individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, would be in compliance, if elected as a director of Comerica, and would comply with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of Comerica. All of the director nominees made the foregoing representations and agreements.

The Governance, Compensation and Nominating Committee does not have a separate policy for consideration of any director candidates recommended by shareholders. Instead, the Governance, Compensation and Nominating Committee considers any candidate meeting the requirements for nomination by a shareholder set forth in Comerica’s bylaws (as well as applicable laws and regulations) in the same manner as any other director candidate. The Governance, Compensation and Nominating Committee believes that requiring shareholder recommendations for director candidates to comply with the requirements for nominations in accordance with Comerica’s bylaws ensures that the Governance, Compensation and Nominating Committee receives at least the minimum information necessary for it to begin an appropriate evaluation of any such director nominee.

The Governance, Compensation and Nominating Committee also periodically uses a third-party search firm for the purpose and function of identifying potential director nominees.

Further information regarding the Board and these nominees begins directly below.

COMERICA’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE CANDIDATES FOR DIRECTOR.

12

The following section provides information as of March 11, 2014 about each nominee for election as a director.

The information provided includes the age of each nominee or incumbent director; the nominee’s or incumbent director’s principal occupation, employment and business experience during the past five years, including employment with Comerica and Comerica Bank, a wholly-owned subsidiary of Comerica; other public company or registered investment company directorships during the past five years; and the year in which the nominee or incumbent director became a director of Comerica.

|

Ralph W. Babb, Jr. | Director since 2001(1) | ||||

| Mr. Babb, 65, has been President and Chief Executive Officer (since January 2002), Chairman (since October 2002), Chief Financial Officer (June 1995 to April 2002) and Vice Chairman (March 1999 to January 2002) of Comerica Incorporated and Comerica Bank. He has been a director of Texas Instruments Inc. since March 2010.

As our Chairman, President and Chief Executive Officer and our former Chief Financial Officer, Mr. Babb has extensive knowledge of all aspects of our business which, combined with his drive for excellence and his strong leadership skills, position him well to continue to serve as our Chairman, President and Chief Executive Officer.

| ||||||

|

Roger A. Cregg | Director since 2006 | ||||

| Mr. Cregg, 57, has been President, Chief Executive Officer and a director of AV Homes, Inc., a developer and homebuilder in Florida and Arizona, since December 2012. From August 2011 through November 2012, he served as senior vice president of finance and chief financial officer of The ServiceMaster Company, a residential and commercial service company. He served as Executive Vice President of PulteGroup, Inc. (formerly known as Pulte Homes, Inc.), a national homebuilding company, from May 2003 to May 2011 and Chief Financial Officer of PulteGroup, Inc. from January 1998 to May 2011. He served as Senior Vice President of PulteGroup, Inc. from January 1998 to May 2003. He was a director of the Federal Reserve Bank of Chicago, Detroit Branch, from January 2004 to December 2009 and served as Chair from January to December 2006.

As the current Chief Executive Officer of a public company and the former Chief Financial Officer of public companies, Mr. Cregg has demonstrated leadership capability and extensive knowledge of complex financial and operational issues. | ||||||

13

|

T. Kevin DeNicola | Director since 2006 | ||||

| Mr. DeNicola, 59, served as Chief Financial Officer of KIOR, Inc., a biofuels company, from November 2009 to January 2011. He was Senior Vice President and Chief Financial Officer of KBR, Inc., a global engineering, construction and services company, from June 2008 until October 2009. From June 2002 to January 2008, he was Senior Vice President and Chief Financial Officer of Lyondell Chemical Company, a global manufacturer of basic chemicals. Mr. DeNicola also served as Senior Vice President and Chief Financial Officer of Equistar Chemicals, LP and Millenium Chemicals Inc., both subsidiaries of Lyondell Chemical Company, from June 2002 to January 2008. In January 2009, Lyondell Chemical Company and certain of its subsidiaries, including Equistar Chemicals, LP and Millenium Chemicals Inc., filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code. Lyondell emerged from bankruptcy in April 2010. Mr. DeNicola has been a volunteer adjunct professor at Rice University, a higher learning institution, from March 2008 to the present. He also has been a director of Axiall Corporation (formerly Georgia Gulf Corporation) since September 2009.

Mr. DeNicola is an experienced financial leader with the skills necessary to lead our Audit Committee. His service as Chief Financial Officer of several public companies makes him a valuable asset, both on our Board of Directors and as the Chairman of our Audit Committee. Mr. DeNicola’s positions have provided him with a wealth of knowledge in dealing with financial and accounting matters. The depth and breadth of his exposure to complex financial issues make him a skilled advisor.

| ||||||

|

Jacqueline P. Kane | Director since 2008 | ||||

| Ms. Kane, 61, has been Senior Vice President, Human Resources and Corporate Affairs, of The Clorox Company, a manufacturer and marketer of consumer products, since January 2005. She was Senior Vice President, Human Resources from June 2004 to December 2004, and Vice President, Human Resources from March 2004 to May 2004 for The Clorox Company. From March 2003 to January 2004, she was Vice President, Human Resources and Executive Leadership for The Hewlett-Packard Company, a technology company.

As a senior executive with experience in human resources, including compensation matters, as well as experience in several of our key geographic markets, Ms. Kane has a unique and insightful perspective to offer the Board. As a member of our Governance, Compensation and Nominating Committee, she is able to use her experience and perspectives to offer best practices advice.

| ||||||

|

Richard G. Lindner | Director since 2008 | ||||

| Mr. Lindner, 59, is retired. He served as Senior Executive Vice President and Chief Financial Officer of AT&T, Inc. (formerly SBC Communications, Inc.), a telecommunications company, from May 2004 to June 2011. From October 2000 to May 2004, he was the Chief Financial Officer of Cingular Wireless LLC (now AT&T Mobility LLC), a wireless telecommunications company. From October 2002 to March 2007, he served as a director of Sabre Holdings.

As the former Chief Financial Officer of AT&T, Inc., Mr. Lindner has demonstrated leadership capability and extensive knowledge of complex financial and operational issues facing large organizations. In addition, Mr. Lindner is able to draw upon, among other things, his knowledge of several of our key geographic markets that he has gained through experience in the telecommunications industry. | ||||||

14

|

Alfred A. Piergallini | Director since 1991 | ||||

| Mr. Piergallini, 67, has been a consultant with Desert Trail Consulting, a marketing consulting organization, since January 2001. He was Chairman of Wisconsin Cheese Group, Inc., a manufacturer and marketer of ethnic and specialty cheeses, from January 2006 until December 2010. He also was President and Chief Executive Officer of Wisconsin Cheese Group, Inc. from January 2006 to June 2007. He was Chairman, President and Chief Executive Officer of Novartis Consumer Health Worldwide, a health care and infant nutrition company, from December 1999 to December 2001. He was Vice Chairman, President and Chief Executive Officer of Gerber Products Company, a manufacturer and developer of infant and toddler nutrition and wellness products, until February 1999. He has been a director of Central Garden & Pet Company since January 2004.

As a senior executive with experience in general management, marketing, sales and branding, as well as experience in several of our key markets, Mr. Piergallini contributes valuable insight to the Board.

| ||||||

|

Robert S. Taubman | Director since 2000(2) | ||||

| Mr. Taubman, 60, has been Chairman of Taubman Centers, Inc., a real estate investment trust that owns, develops and operates regional shopping centers nationally, since December 2001 and has been President and Chief Executive Officer of Taubman Centers, Inc., since August 1992. He has been Chairman of The Taubman Company, a shopping center management company engaged in leasing, management and construction supervision, since December 2001 and has been President and Chief Executive Officer of The Taubman Company since September 1990. He has been a director of Sotheby’s Holdings, Inc. since 2000 and Taubman Centers, Inc. since 1992.

As an executive involved in real estate development and operations and with his experience as a member of the board of directors of two public companies, Mr. Taubman has demonstrated leadership capability and brings key experience of the real estate markets. He also brings insight through experience in many of Comerica’s geographic markets.

| ||||||

|

Reginald M. Turner, Jr. | Director since 2005 | ||||

| Mr. Turner, 54, has been an attorney with Clark Hill PLC, a law firm, since April 2000.

As a lawyer, Mr. Turner has a unique legal perspective to offer the Board. He also has extensive involvement and experience in community affairs.

| ||||||

|

|

Nina G. Vaca(3) | Director since 2008 | ||||

| Ms. Vaca, 42, has been Chairman and Chief Executive Officer of Pinnacle Technical Resources, Inc., a staffing, vendor management and information technology services firm, since October 1996. She also has been Chairman and Chief Executive Officer of Vaca Industries Inc., a management company, since April 1999. She has been a director of Kohl’s Corporation since March 2010.

As a chief executive officer with experience in staffing, vendor management and information technology, as well as successful entrepreneurial endeavors, Ms. Vaca offers a unique and insightful perspective to the Board. | ||||||

15

Footnotes:

| (1) | Mr. Babb became a director of Comerica Bank in 2000. |

| (2) | Mr. Taubman became a director of Manufacturer’s Bank, N.A. or its predecessors in 1987. He became a director of Comerica Bank in 1992 when it merged with Manufacturer’s Bank, N.A. He resigned as a director of Comerica Bank in 2000, when he became a director of Comerica. |

| (3) | Professional name of Ximena G. Humrichouse. |

COMMITTEES AND MEETINGS OF DIRECTORS

The Board had several committees in 2013, as set forth in the following chart and described below. The names of the directors serving on the committees and the committee chairs are also set forth in the chart. The current terms of the various committee members expire in April 2014.

| AUDIT |

ENTERPRISE RISK | GOVERNANCE, COMPENSATION AND NOMINATING |

QUALIFIED LEGAL COMPLIANCE |

SPECIAL PREFERRED STOCK |

CAPITAL | |||||||||

| Cregg, Roger A. |

DeNicola, T. Kevin | Cregg, Roger A. | Cregg, Roger A. | Babb, Ralph W., Jr. | Babb, Ralph W., Jr. | |||||||||

| DeNicola, T. Kevin |

Lindner, Richard G. | Kane, Jacqueline P. | DeNicola, T. Kevin | |||||||||||

| Turner, Reginald M., Jr. |

Taubman, Robert S. | Lindner, Richard G. | Turner, Reginald M., Jr. | |||||||||||

| Vaca, Nina G. |

Turner, Reginald M., Jr. | Piergallini, Alfred A. | Vaca, Nina G. | |||||||||||

| Vaca, Nina G. | ||||||||||||||

Footnotes:

| (1) | Chair names are in italics. |

Audit Committee. As provided in its Board-adopted written charter, this committee consists solely of members who are outside directors and who meet the independence and experience requirements of applicable rules of the New York Stock Exchange and the SEC with respect to audit committee members. This committee is responsible, among other things, for providing assistance to the Board by overseeing: (i) the integrity of Comerica’s financial statements; (ii) Comerica’s compliance with legal and regulatory requirements; (iii) the independent auditors’ qualifications and independence; and (iv) the performance of Comerica’s internal audit function and independent auditors, including with respect to both bank and non-bank subsidiaries; and by preparing the “Audit Committee Report” found in this proxy statement. None of the members of the Audit Committee serves on the audit committees of more than three public companies. The Board of Directors has determined that all of the members of the Audit Committee are independent within the meaning of those independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section in this proxy statement). Although the SEC requires only one financial expert serve on the Audit Committee, the Board of Directors has determined that Comerica has two audit committee financial experts serving on the Audit Committee. These directors are Roger A. Cregg and T. Kevin DeNicola. A current copy of the charter of the Audit Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Audit Committee met 13 times in 2013.

Governance, Compensation and Nominating Committee. This committee, among other things, establishes Comerica’s executive compensation policies and programs, administers Comerica’s 401(k), stock, incentive, pension and deferral plans, monitors compliance with laws and regulations applicable to the documentation and administration of Comerica’s employee benefit plans, monitors the effectiveness of the Board and oversees corporate governance issues. Among its various other duties, this committee reviews and recommends to the full Board candidates to become Board members, develops and administers performance criteria for members of the Board, and oversees matters relating to the size of the Board, its committee structure and assignments, and the conduct and frequency of Board meetings. The Board of Directors has determined that all of the members of the Governance, Compensation and Nominating Committee are independent, pursuant to independence requirements established from time to time by the Board and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of

16

the proxy statement). A current copy of the charter of the Governance, Compensation and Nominating Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Governance, Compensation and Nominating Committee also oversees the discussion, review and evaluation of our compensation plans as described below. The Governance, Compensation and Nominating Committee met eight times in 2013.

Enterprise Risk Committee. This committee oversees policies, procedures and practices relating to enterprise-wide risk and compliance with bank regulatory obligations. The Board of Directors has determined that all of the members of the Enterprise Risk Committee are independent, pursuant to independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of the proxy statement). A current copy of the charter of the Enterprise Risk Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Enterprise Risk Committee met four times in 2013.

Qualified Legal Compliance Committee. This committee assists the Board in promoting the best interests of Comerica by reviewing evidence of potential material violations of securities law or breaches of fiduciary duties or similar violations by Comerica or any officer, director, employee, or agent thereof, providing recommendations to address any such violations, and monitoring Comerica’s remedial efforts with respect to any such violations. The Board of Directors has determined that all of the members of the Qualified Legal Compliance Committee are independent, pursuant to independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of the proxy statement). A current copy of the charter of the Qualified Legal Compliance Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Qualified Legal Compliance Committee did not meet in 2013.

Special Preferred Stock Committee. This committee is a temporary committee of the Board of Directors that is authorized to carry out the Board’s authority with respect to the issuance of securities. It did not meet in 2013.

Capital Committee. This committee is a temporary committee of the Board of Directors that was authorized to carry out the Board’s authority with respect to the Company’s March 2010 common stock offering and the October 2010 redemption of trust preferred securities. It did not meet in 2013.

Board and Committee Meetings. There were six regular meetings of the Board, two special meetings of the Board and 25 meetings of the various committees and subcommittees of the Board, including actions by unanimous written consents, during 2013. All director nominees and all incumbent directors attended at least seventy-five percent (75%) of the aggregate number of meetings held by the Board and all the committees of the Board on which the respective directors served.

Comerica expects all of its directors to attend the Annual Meeting except in cases of illness, emergency or other reasonable grounds for non-attendance. Eight of the nine Board members on the date of the 2013 Annual Meeting attended that meeting.

NON-MANAGEMENT DIRECTORS AND COMMUNICATION WITH THE BOARD

The non-management directors meet at regularly scheduled executive sessions without management. Richard G. Lindner is the Facilitating Director at such sessions. Interested parties may communicate directly with Mr. Lindner or with the non-management directors as a group by sending written correspondence, delivered via United States mail or courier service, to: Secretary of the Board, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, Attn: Non-Management Directors. Alternatively, shareholders may send communications to the full Board by sending written correspondence, delivered via United States mail or courier service, to: Secretary of the Board, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, Attn: Full Board of Directors. The Board of Directors’ current practice is that the Secretary will relay all communications received to the Facilitating Director, in the case of communications to non-management directors, and to the Chairman of the Board, in the case of communications to the full Board.

17

Our Chief Executive Officer also serves as the Chairman of the Board. The Board has chosen this structure because it believes the Chief Executive Officer serves as a bridge between management and the Board, ensuring that both groups act with a common purpose. Separating the roles would risk creating the perception of having two chiefs, which could lead to fractured leadership and a weakened ability to develop and implement strategy. Mr. Babb has provided strong leadership to the Board and management, instilling a clear focus on the Company’s strategy and business plans. Although the Board believes that it is more effective to have one person serve as the Company’s Chairman and Chief Executive, it also believes that it is simultaneously important to have a robust governance structure to ensure a strong and independent Board. All directors, with the exception of the Chairman, are independent as defined under New York Stock Exchange rules, and the Audit Committee, the Enterprise Risk Committee, the Governance, Compensation and Nominating Committee and the Qualified Legal Compliance Committee are comprised entirely of independent directors. The Board also has an independent Facilitating Director (Mr. Lindner) who leads the non-management directors in regularly scheduled executive sessions. As Facilitating Director, Mr. Lindner’s duties include, but are not limited to, the following:

| • | presiding at all other meetings of the Board at which the Chairman is not present; |

| • | serving as liaison between the Chairman and the independent directors; |

| • | approving information sent to the Board; |

| • | approving meeting agendas and schedules for the Board; |

| • | having the authority to call meetings of the independent directors; and |

| • | if requested by major shareholders, ensuring that he is available for consultation and direct communication. |

The Facilitating Director position is elected annually by the non-management directors. The Board believes that the Facilitating Director further strengthens the Board’s independence and autonomous oversight of our business as well as Board communication and effectiveness.

Comerica has historically had and continues to pursue a strong risk management culture. We recognize that nearly every action taken as a financial institution requires some degree of risk. Our objective is not to eliminate risk but to give consideration to ensure we take the appropriate risks. Risk management is one of the interlinking pillars of Comerica’s corporate strategy which reinforces its critical role within our organization. In choosing when and how to take risks, we evaluate our capacity for risk and seek to protect our brand and reputation, our financial flexibility, the value of our assets and the strategic potential of our Company. Each year, our Board approves a statement of our Company’s risk appetite, which is used internally to help our Board and management understand our Company’s tolerance for risk in each of the major risk categories and allow for the adaption of those tolerances to align with a changing economic environment.

Governance and oversight of risk management activities are shared by management and our Board as follows:

| • | Enterprise Risk Committee. The Enterprise Risk Committee, as discussed on page 17, oversees policies, procedures and practices relating to risk for to the entire organization including compliance with bank regulatory obligations, and is charged with the responsibility for establishing governance over the risk management process, providing oversight in managing Comerica’s aggregate risk position and reporting on the comprehensive portfolio of risks and the potential impact these risks can have on Comerica’s risk profile and resulting capital level. To help discharge its duties, the Enterprise Risk Committee has established the Enterprise-Wide Risk Management Committee. |

| • | Enterprise-Wide Risk Management Committee. This group is principally comprised of senior officers representing the different risk areas and business units. Members of the Enterprise-Wide Risk Management Committee are appointed by the Chairman and Chief Executive Officer of Comerica. It meets at least quarterly and submits a comprehensive risk report to the Enterprise Risk Committee each quarter providing its view of Comerica’s risk position. |

18

| • | Audit Committee. In addition to providing oversight of our financial statements and compliance with legal and regulatory requirements, the Audit Committee plays a key role in risk management through the validation and oversight of our internal controls, policies and procedures to ensure their effectiveness. |

| • | Governance, Compensation and Nominating Committee. The Governance, Compensation and Nominating Committee provides information on the risks associated with the Company’s compensation programs. A more detailed discussion of the Governance, Compensation and Nominating Committee’s evaluation of risk and compensation programs can be found on pages 60-62. |

Each of the Enterprise Risk Committee, the Audit Committee and the Governance, Compensation and Nominating Committee reports regularly to the full Board. The Board believes that the combination of the joint Chief Executive Officer and Chairman positions, the independent Facilitating Director and the roles of the Board and its Committees and management committees provide the appropriate leadership to help ensure effective risk oversight.

In addition, in February 2014, Comerica named Executive Vice President Michael H. Michalak as its Chief Risk Officer. In that role, he reports directly to Comerica’s Chief Executive Officer and to the Enterprise Risk Committee. As Chief Risk Officer, he is responsible for overseeing risk on an enterprise-wide basis. This includes ongoing compliance with policies and procedures relating to risk management governance, risk management procedures, and risk control infrastructure, and monitoring compliance with such policies and procedures, among other responsibilities.

TRANSACTIONS OF DIRECTORS WITH COMERICA

Independence and Transactions of Directors

The Board of Directors has determined that all non-management directors, currently constituting 88.9% of the full Board of Directors of Comerica, are independent within the meaning of the listing standards of the New York Stock Exchange. To assist in making these determinations of independence, Comerica adopted categorical standards found in its Corporate Governance Guidelines, a current copy of which is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary.

In addition to the categorical standards, the Board of Directors, in making its determinations of independence, reviewed certain relationships that multiple Board members, or members of their immediate family, may have with the same charitable or civic organization, as well as certain other types of relationships that directors, members of their immediate family or affiliated entities, may have with each other or Comerica, and determined that such relationships are not material. These relationships with Comerica include, among other things, lending relationships, other banking relationships (such as depository, transfer, registrar, indenture trustee, trusts and estates, private banking, investment management, custodial, securities brokerage, cash management and similar services) and other commercial or charitable relationships between Comerica and its subsidiaries, on the one hand, and a director or an entity with which the director (or any of the director’s immediate family members, as defined in the categorical standards) is affiliated by reason of being a director, trustee, officer or person holding a comparable position or a significant shareholder thereof, on the other. They also include situations in which Comerica, or one or more affiliates, serves in a fiduciary capacity for a client needing legal services. The Board additionally reviewed certain relationships involving directors or their companies and Comerica’s independent auditor.

In connection with making its director independence determinations, the Board specifically considered the following relationships and transactions:

Loans, extensions of credits and related commitments to Mr. Piergallini, Mr. Taubman, Mr. Turner and Ms. Vaca and/or their respective immediate family members, affiliated entities and/or charities with which they are affiliated have been made by Comerica Bank in the ordinary course of business, on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with other

19

persons not related to or affiliated with Comerica or its subsidiaries, and the transactions did not involve more than the normal risk of collectability or present other unfavorable features. Such relationships are not material pursuant to the Board’s categorical standards of independence.

During 2013, Mr. Turner’s wife was employed by an entity that has an ordinary course, non-preferential business relationship with Comerica. She was not an officer or a director of her employer, and she neither received compensation from her employer as a direct result of such business relationship with Comerica, nor was she directly involved in the negotiations of transactions with Comerica. The aggregate amount of such expenditures by Comerica was less than 1% of Comerica’s consolidated gross revenues. Such relationship is immaterial under the Board’s categorical standards of independence.

Certain directors, their respective immediate family members and/or affiliated entities have banking relationships (other than extensions of credit) with Comerica in the ordinary course of business, on terms and conditions not more favorable than those afforded by Comerica to other similarly situated customers. Such relationships are deemed immaterial.

Certain directors serve as director or trustee of charitable or civic organizations to which Comerica and/or the Comerica Charitable Foundation make charitable contributions or other payments in the ordinary course of business. The Board determined that such relationships are not material pursuant to its categorical standards of independence.

In certain instances, Comerica, acting in a fiduciary capacity, selects, on behalf of its client, a law firm to represent the client. If applicable, the firm with a related pre-existing relationship with the client is typically selected by Comerica (e.g., the firm that drafted a will in which Comerica is named fiduciary of the associated estate). From time to time, this has resulted in the engagement, by the client, of the firm in which Mr. Turner is a member. Mr. Turner is not directly involved in providing these legal services, and any associated fees are paid to the firm from the client’s funds, not from funds belonging to Comerica. The Board determined that such relationships are not material.

Mr. Turner is not personally involved in any litigation in which Comerica is directly or indirectly adverse. However, on occasion, his firm represents clients in legal matters indirectly or potentially directly adverse to Comerica, such as loans and other commercial transactions (in which his firm represents a borrower), trust administration matters (where Clark Hill might represent a trust or beneficiary and/or act as co-trustee for a trust for which Comerica serves as trustee) and bankruptcy litigation (in which his firm represents creditors other than Comerica), and thus receives fees from such parties it represents, but not from Comerica. The Board determined that such relationships are not material.

Mr. Cregg, Mr. DeNicola, Ms. Kane and Ms. Vaca are, or were during 2013, executive officers and/or directors of companies that use Comerica’s independent auditor for certain financial services, including audit and audit-related services as well as non-audit-related services. The Board considered the use of the same independent auditor by Comerica and companies that either employ Comerica’s directors or have Comerica’s directors serving on their board. The Board determined that such relationships are not material.

Ms. Kane is an executive officer of a company whose compensation committee also uses Comerica’s independent compensation consultant as its independent compensation consultant. The Board considered the use of the same independent compensation consultant by Comerica and the compensation committee of Ms. Kane’s employer. The Board determined that such relationship is not material.

On the bases described above, the Board of Directors has affirmatively determined that the following current directors meet the categorical standards of independence, where applicable, and have no material relationship with Comerica (either directly or as a partner, shareholder or officer of an organization that has a relationship with Comerica) other than as a director: Roger A. Cregg, T. Kevin DeNicola, Jacqueline P. Kane, Richard G. Lindner, Alfred A. Piergallini, Robert S. Taubman, Reginald M. Turner, Jr. and Nina G. Vaca. The Board of Directors further determined that Ralph W. Babb, Jr. is not independent because he is an employee of Comerica.

20

Review of Transactions with Related Persons

Comerica has adopted a Regulation O Policy and Procedure document to implement the requirements of Regulation O of the Federal Reserve Board, which restricts the extension of credit to directors and executive officers and their family members, as well as 10% or greater shareholders, and the related interests of any of the foregoing. Under the policy and procedure, extensions of credit that exceed regulatory thresholds must be approved by the board of the appropriate subsidiary bank.

Comerica also has other procedures and policies for reviewing transactions between Comerica and its directors and executive officers, their immediate family members and entities with which they have a position or relationship. These other procedures are intended to determine whether any such transaction impairs the independence of a director or presents a conflict of interest on the part of a director or executive officer.

Annually, each director and executive officer is required to complete a director, director nominee and executive officer questionnaire, and each non-management director is required to complete an independence certification. Both of these documents elicit information about related person transactions. The Governance, Compensation and Nominating Committee and the Board of Directors annually review the transactions and relationships disclosed in the questionnaire and certification, prior to the Board of Directors making a formal determination regarding the directors’ independence. To assist them in their review, the Governance, Compensation and Nominating Committee and the Board of Directors use the categorical standards found in Comerica’s Corporate Governance Guidelines, as discussed above.

In order to monitor transactions that occur between the annual review, the independence certification also obligates the directors to immediately notify Comerica’s Head of Legal Affairs in writing if they discover that any statement in the certification was untrue or incomplete when made, or if any statement in the certification becomes untrue or incomplete at any time in the future. Likewise, under the Code of Business Conduct and Ethics for Members of the Board of Directors, any situation that involves, or may involve, a conflict of interest with Comerica, should be promptly disclosed to the Chairman of the Board, who will consult with the Chair of the Governance, Compensation and Nominating Committee.

Executive officers are bound by the Code of Business Conduct and Ethics for Employees and, in the case of the Chief Executive Officer and senior financial officers, by the Senior Financial Officer Code of Ethics.

The Regulation O Policy and Procedure, questionnaire, certification, Corporate Governance Guidelines, Code of Business Conduct and Ethics for Members of the Board of Directors, Code of Business Conduct and Ethics for Employees and Senior Financial Officer Code of Ethics are all in writing.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2013, Mr. Cregg, Ms. Kane, Mr. Lindner and Mr. Piergallini served as members of the Governance, Compensation and Nominating Committee. No such individual is, or was during 2013, an officer or employee of Comerica or any of its subsidiaries, nor was any such member formerly an officer of Comerica or any of its subsidiaries.

The Governance, Compensation and Nominating Committee determines the form and amount of non-employee director compensation and makes a recommendation to the Board of Directors for final approval. In determining director compensation, the Governance, Compensation and Nominating Committee considers the recommendations of Mr. Babb, as well as information provided by the compensation consultant retained by the Governance, Compensation and Nominating Committee to provide market analyses and consulting services on director compensation matters. See “Role of the Independent Compensation Consultant” on page 45 for more information about the compensation consultants used by the Governance, Compensation and Nominating Committee.

21

The table below illustrates the compensation structure for non-employee directors in 2013. Employee directors receive no compensation for their Board service. In addition to the compensation described below, each director is reimbursed for reasonable out-of-pocket expenses incurred for travel and attendance related to meetings of the Board of Directors or its committees.

| Elements of 2013 Compensation | Amount | |||

| Annual Retainer (cash) |

$ | 45,000 | ||

| Annual Committee Chair and Vice Chair Retainer (cash)(1) |

$ | 15,000 | ||

| Annual Facilitating Director Retainer (cash) |

$ | 15,000 | ||

| Board or Committee Meeting Fees — per meeting (cash) |

$ | 1,500 | ||

| Board Sponsored Training Seminar Fees — per seminar (cash) |

$ | 1,500 | ||

| Briefing Fees — per briefing session (cash) |

$ | 1,500 | ||

| Restricted Stock Unit Award(2) |

$ | 65,000 | ||

Footnotes:

| (1) | The annual retainer for the chair and, if applicable, vice chair of each committee with the exception of the chair and vice chair of the Audit Committee was increased from $10,000 to $15,000, effective July 23, 2013. No change was made to the annual retainer for the chair and vice chair of the Audit Committee. |

| (2) | Comerica has an Incentive Plan for Non-Employee Directors, under which a total of 500,000 shares of common stock of Comerica can be issued as stock options, stock appreciation rights, restricted stock, restricted stock units and other equity-based awards. On July 23, 2013, each non-employee director received a grant of 1,516 restricted stock units with a fair market value of $65,000 based on the closing stock price the date of grant. |

Deferred Compensation Plans. Comerica allows non-employee directors to defer some or all of their annual retainer(s), as well as meeting or training fees, under two deferred compensation plans. Under the first plan, deferred compensation earns a return based on the return of Comerica common stock during the deferral period. Deferred compensation under this plan is settled in Comerica’s common stock. Under the second plan, deferred compensation earns a return based on investment funds elected by the director. Deferred compensation under this plan is settled in cash.

Equity Incentive Plans. Comerica has an Incentive Plan for Non-Employee Directors, under which a total of 500,000 shares of common stock of Comerica can be issued as stock options, stock appreciation rights, restricted stock, restricted stock units and other equity-based awards.

|

Comerica typically grants restricted stock units to non-employee directors annually. These restricted stock units vest one year after the grant date, if the director remains in service during the vesting period. Non-employee directors are required to hold all restricted stock units until one year after the director is no longer on the Board, at which point restricted stock units are settled in common stock.

|

Comerica has not granted stock options to non-employee directors since 2004. Comerica formerly utilized a stock option plan for non-employee directors under which a total of 375,000 shares of common stock could be issued as options. On the date of each Annual Meeting of Shareholders, Comerica granted each non-employee director an option to purchase shares of common stock of Comerica. The exercise price of each option is the fair market value of each share of common stock on the date the option was granted.

Retirement Plans for Directors. Until May 15, 1998, Comerica and Comerica Bank, its wholly owned subsidiary, each had a retirement plan for non-employee directors who served at least five years on the Board. The plans terminated on May 15, 1998, and benefit accrual under the plans froze on the same date. Any non-employee director of either Comerica or Comerica Bank as of May 15, 1998 who served at least five years on the Board, whether before or after that date, has vested benefits under the plan(s). Any director who became a non-employee director of either Comerica or Comerica Bank on or after May 15, 1998, is not eligible to participate in the plans. However, non-employee directors who became members of the Board of Comerica in the year 2000, but who were directors of Comerica Bank prior to May 15, 1998, are covered by the Comerica Bank retirement plan.

22

Under the plans, Comerica or Comerica Bank, as appropriate, accrued one month of retirement income credit for each month of service as of May 15, 1998, up to a maximum of 120 months, on behalf of each eligible director. Benefits under the plans become payable when the director reaches age 65 or retires from the Board, whichever occurs later. Payments may commence prior to the director’s 65th birthday if he or she retires from the Board due to illness or disability. There is no survivor benefit. If a director passes away before all, or any, payments have been made, his or her beneficiary does not receive any payment. The maximum benefit payable is $20,000 per year for 10 years.

The following table provides information on the compensation of Comerica’s directors who served at any point during the fiscal year ended December 31, 2013.

2013 Director Compensation Table

| Name(1) |

Fees Earned or Paid in Cash(2) ($) |