UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material under §240.14a-12 | |

Comerica Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

Comerica Incorporated

Proxy Statement and Notice of

2016 Annual Meeting of Shareholders

Comerica Incorporated

Comerica Bank Tower

1717 Main Street

Dallas, Texas 75201

March 16, 2016

Dear Shareholder,

It is our pleasure to invite you to attend the 2016 Annual Meeting of Shareholders of Comerica Incorporated at 9:30 a.m., Central Time, on Tuesday, April 26, 2016 at Comerica Bank Tower, 1717 Main Street, 4th Floor, Dallas, Texas 75201. Registration will begin at 8:30 a.m., Central Time. A map showing the location of the Annual Meeting is on the back cover of the accompanying proxy statement.

This year, we are continuing to provide proxy materials to our shareholders primarily through the Internet. We are pleased to use this process, which allows our shareholders to receive proxy materials in an expedited manner, while significantly lowering the costs of our annual proxy campaign. On or about March 16, 2016, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement, our annual report and additional soliciting materials online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail (with the exception of the proxy card, which will be separately mailed on or around March 28, 2016 to shareholders of record that have not yet voted) unless you specifically request them. The Notice of Internet Availability of Proxy Materials instructs you on how to electronically access and review all of the important information contained in this proxy statement and the annual report, and it provides you with information on voting. The proxy materials available online include our 2016 proxy statement, our 2015 annual report, which summarizes Comerica’s major developments during 2015 and includes the 2015 consolidated financial statements, and additional soliciting materials.

Whether or not you plan to attend the Annual Meeting, please submit your proxy promptly so that your shares will be voted as you desire.

Sincerely,

Ralph W. Babb, Jr.

Chairman and Chief Executive Officer

PROXY STATEMENT

| 1 | ||||

| 8 | ||||

| 10 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

|

Director Independence and Transactions of Directors with Comerica |

25 | |||

| 27 | ||||

| 27 | ||||

| 30 | ||||

| 31 | ||||

| 33 | ||||

| 34 | ||||

| 37 | ||||

| 41 | ||||

| 42 | ||||

| 70 | ||||

| 71 | ||||

| 73 | ||||

| 75 | ||||

| 77 | ||||

| 78 | ||||

| 81 | ||||

|

Potential Payments upon Termination or Change of Control at Fiscal Year-End 2015 |

82 | |||

|

Securities Authorized for Issuance under Equity Compensation Plans |

90 | |||

| 92 | ||||

| 93 | ||||

| 95 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 97 | ||||

|

Appendix I —Comerica Incorporated 2016 Management Incentive Plan |

I-1 | |||

|

Annex A — Reconciliation of Non-GAAP and GAAP Financial Measures |

A-1 | |||

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Shareholders

| Time and Date | 9:30 a.m., Central Time, April 26, 2016 | |

| Place | Comerica Bank Tower, 1717 Main Street, 4th Floor, Dallas, Texas 75201 | |

| Record Date | February 26, 2016 | |

| Mailing Date | On or around March 16, 2016 | |

| Voting | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | |

Voting Matters

|

Board Vote Recommendation |

Page Reference |

|||||

|

Election of directors |

FOR EACH DIRECTOR NOMINEE | 16 | ||||

| Ratification of Ernst & Young LLP as independent registered public accounting firm for 2016 | FOR | 30 | ||||

| Approval of the Comerica Incorporated 2016 Management Incentive Plan including for purposes of Section 162(m) of the Internal Revenue Code | FOR | 37 | ||||

| Advisory approval of the Company’s executive compensation | FOR | 41 | ||||

Voting Your Shares

If you are a shareholder of record as of February 26, 2016, you will be able to vote in four ways: in person, by proxy card, by telephone, or by the Internet as follows:

| • |

BY TELEPHONE: 1-866-883-3382 |

| • |

VIA THE INTERNET: http://www.proxydocs.com/cma |

| • |

BY MAIL: complete, sign, date and return your proxy card in the envelope provided |

| • |

IN PERSON: attend our Annual Meeting on April 26, 2016 and vote by ballot |

See “How can I vote?” on page 11 for more information on voting at the Annual Meeting.

1

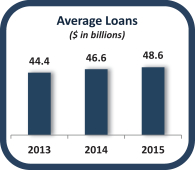

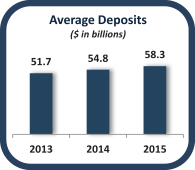

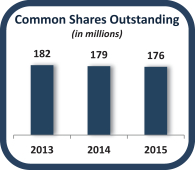

2015 Financial and Operating Performance

In 2015, the challenging environment for financial institutions continued due to persistently low interest rates, combined with a host of increasing regulatory and technology demands. Furthermore, Comerica continued to face headwinds created by the energy cycle.

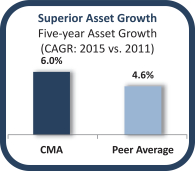

Despite these short-term challenges, we delivered another successful year of results, highlighted by strong balance sheet growth in 2015. Some of our significant accomplishments of 2015 included:1

| • |

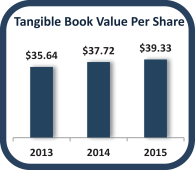

Increased tangible common equity per share by 4% to $39.33. |

| • |

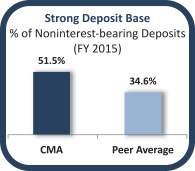

Achieved record average deposits of $58.3 billion, with a $3.5 billion, or 6%, increase over 2014. |

| • |

Returned $389 million, or 75% of net income, to shareholders through dividends and repurchasing 5.1 million shares and 500,000 warrants through our equity repurchase program. |

| • |

Increased average total loans by $2 billion, or 4%, to $48.6 billion. |

| • |

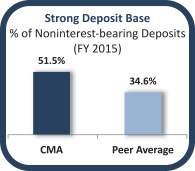

Grew average noninterest-bearing deposits by $3.1 billion, or 12%. |

| • |

Credit quality remained strong with only $100 million in net charge-offs, or 0.21% of average loans. |

| • |

Net interest income of $1.7 billion increased by $34 million, or 2%, primarily due to solid loan growth. |

| • |

Experienced positive total shareholder return (“TSR”), which includes share price appreciation and dividends paid on our common stock, for the three-year period ended December 31, 2015, of 45%. |

| 1 | Balances as of December 31, 2015, as compared to December 31, 2014. Activity and performance for the year ended December 31, 2015, as compared to the year ended December 31, 2014. |

2013 - 2015 Performance Snapshot

|

|

|

|

|

With respect to the tangible common equity per share and the tangible common equity ratio, see Annex A for a reconciliation of generally accepted accounting principles (“GAAP”) and non-GAAP measures presented.

2

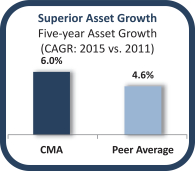

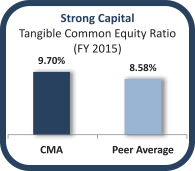

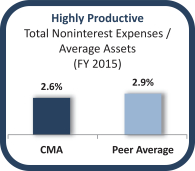

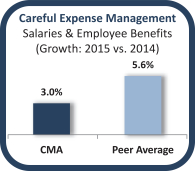

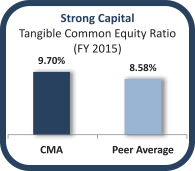

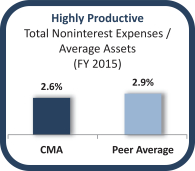

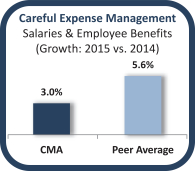

2015 Relative Performance Snapshot

|

|

|

|

|

Source: SNL Financial

For purposes of these charts, peer average is the average of the relevant metric for Comerica’s peer group. The peer group is listed in the “Peer Group” section of this proxy statement on page 55.

With respect to the tangible common equity per share and the tangible common equity ratio, see Annex A for a reconciliation of generally accepted accounting principles (“GAAP”) and non-GAAP measures presented.

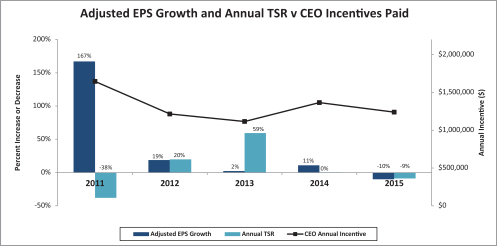

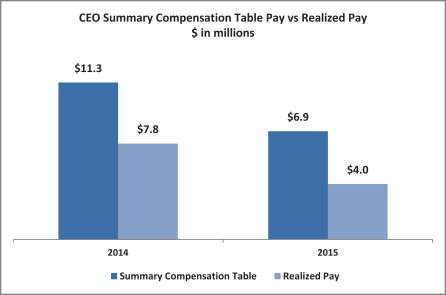

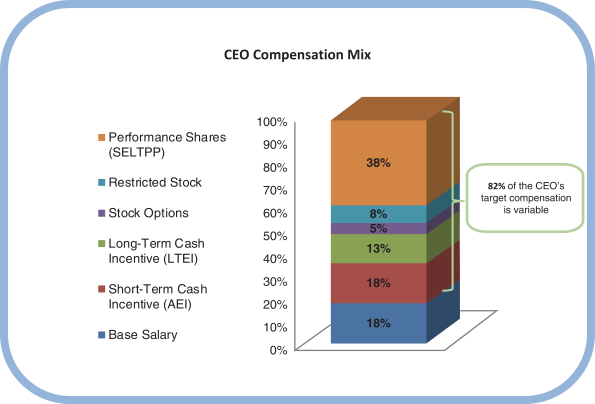

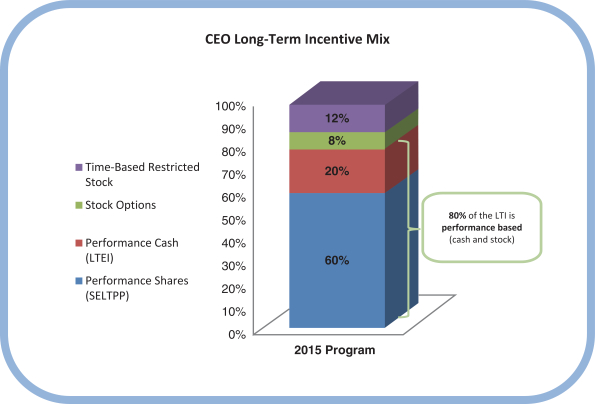

2015 Compensation Highlights

We use our executive compensation programs to align the interests of executive officers with the interests of our shareholders. Our programs are designed to attract, retain and motivate leadership to sustain our competitive advantage in the financial sector, and to provide a framework that encourages outstanding financial results and shareholder returns over the long-term.

Our compensation philosophy and objectives directly influence our pay practices. Key compensation highlights for 2015 include the following:

| • |

Maintained the modifications made to the compensation programs in 2014 for 2015, which included: |

| ¡ |

A three-year performance share program where payouts are contingent on the achievement of specific prospective financial goals and would be reduced in the case of bottom quartile relative total shareholder return (TSR) performance |

| ¡ |

A short-term incentive program that measures absolute (actual) performance as opposed to relative (compared to our peers) performance |

3

| ¡ |

A forfeiture provision applicable to all awards granted in 2014 or later that allows for the cancelation of unvested equity awards in the event of an adverse risk outcome |

| • |

In connection with Mr. Farmer’s promotion, revised stock ownership guidelines to provide an ownership level for the President of four times base salary (compared to three times base salary for Vice Chair) |

| • |

Eliminated 2015 annual merit increases for key senior officers in light of the challenging operating environment |

| What We Do Have: | What We Don’t Have: | |

|

• Clawback policy in addition to Sarbanes-Oxley requirements |

• Employment agreements* | |

|

• Prohibition on pledging or hedging shares by employees or directors |

• Excise tax gross-up payments for change of control agreements entered into after 2008, and Comerica will not include this provision in future agreements. | |

|

• Negative discretion which the Committee can utilize in determining incentive funding |

• Modified single trigger severance for change of control agreements entered into after 2008, and Comerica will not include this provision in future agreements. | |

|

• An annual non-binding say on pay vote |

• Repricing or replacing of underwater stock options or SARs without shareholder approval | |

|

• Stock ownership guidelines for both senior executives and the Board of Directors. The CEO is expected to own 6X his salary, the President 4X his salary and the other NEOs 3X their salary; directors have a 5,000 share holding expectation |

• Perquisites, which were eliminated for executive officers in 2010 | |

|

• Independent compensation consultant who works solely for the Committee and performs no other work for Comerica |

||

|

• Independent compensation committee comprised of entirely independent directors |

| * | Mr. Babb is party to a preexisting Supplemental Pension and Retiree Medical Agreement dated May 29, 1998. Details can be found on page 66. |

4

Board Nominees

The following table provides summary information about each director nominee. Each director nominee will be elected for a one-year term. Directors are elected by a majority of votes cast.

| Director | Committee Memberships |

Other Public Company Boards | ||||||||||||||||||

| Name | Age | since | Occupation | Independent | AC | GCNC | ERC | QLCC | ||||||||||||

|

| ||||||||||||||||||||

|

Ralph W. Babb, Jr. |

67 | 2001 |

Chairman & CEO, Comerica Incorporated and Comerica Bank |

Texas Instruments Inc. | ||||||||||||||||

|

Roger A. Cregg |

59 | 2006 |

President & CEO, AV Homes, Inc. |

X | F | X | X | AV Homes, Inc. | ||||||||||||

|

T. Kevin DeNicola |

61 | 2006 | Former CFO, KIOR, Inc. | X | C, F | X | C | Axiall Corporation | ||||||||||||

|

Jacqueline P. Kane |

63 | 2008 |

Retired; Former EVP, Human Resources and Corporate Affairs, The Clorox Company |

X | X | |||||||||||||||

|

Richard G. Lindner |

61 | 2008 | Retired; Former SEVP & CFO, AT&T, Inc. | IFD | C | X | ||||||||||||||

|

Alfred A. Piergallini |

69 | 1991 |

Consultant, Desert Trail Consulting |

X | X | Central Garden & Pet Company | ||||||||||||||

|

Robert S. Taubman |

62 | 2000 |

Chairman, President & CEO, Taubman Centers, Inc. and The Taubman Company |

X | X | Sotheby’s Holdings, Inc., Taubman Centers, Inc. | ||||||||||||||

|

Reginald M. Turner, Jr. |

56 | 2005 | Attorney, Clark Hill PLC | X | X | C | X | Masco Corporation | ||||||||||||

|

Nina G. Vaca |

44 | 2008 |

Chairman & CEO, Pinnacle Technical Resources, Inc. and Vaca Industries Inc. |

X | X | X | X | Cinemark Holdings, Inc., Kohl’s Corporation | ||||||||||||

AC — Audit Committee; C — Chair; ERC — Enterprise Risk Committee; F — Financial expert; GCNC — Governance, Compensation and Nominating Committee; IFD — Independent Facilitating Director; QLCC — Qualified Legal Compliance Committee

Governance Highlights

Our management team and the Board are focused on serving the long-term interests of Comerica’s shareholders. The Board’s primary responsibility is the oversight of the Company’s management team, and the Board has a number of measures in place to improve Board composition, efficiency and effectiveness.

As such, the Board is committed to good corporate governance, demonstrated through the following:

| • |

Annual election of directors |

| • |

Majority voting for directors |

| • |

Annual self-evaluation by the Board and its committees |

| • |

Regularly scheduled executive sessions of non-management directors |

| • |

Eight out of nine directors are independent |

| • |

Independent Audit Committee, Enterprise Risk Committee, Governance, Compensation and Nominating Committee and Qualified Legal Compliance Committee |

Role of the Independent Facilitating Director

Every year, the independent directors elect a Facilitating Director to lead executive sessions of the Board. The Board believes that such executive sessions, in which the non-management directors meet without management, are important to the effectiveness of the Board’s oversight of the Company and its management team.

5

The duties of the Facilitating Director include, but are not limited to, the following:

| • |

presiding at all other meetings of the Board at which the Chairman is not present; |

| • |

serving as liaison between the Chairman and the independent directors; |

| • |

approving information sent to the Board; |

| • |

approving meeting agendas and schedules for the Board; |

| • |

having the authority to call meetings of the independent directors; and |

| • |

if requested by major shareholders, ensuring that he is available for consultation and direct communication. |

The role of the Facilitating Director serves as a bridge between management and the independent Board members.

6

Director Qualifications and Experience

Upon thorough review, the Board is nominating the following candidates: Ralph W. Babb, Jr., Roger A. Cregg, T. Kevin DeNicola, Jacqueline P. Kane, Richard G. Lindner, Alfred A. Piergallini, Robert S. Taubman, Reginald M. Turner, Jr., and Nina G. Vaca.

In identifying potential candidates for nomination as directors, the Governance, Compensation and Nominating Committee considers the specific qualities and skills of potential directors.

Each of the directors has gained substantial experience through his or her Comerica Board tenure, which has involved significant exposure to the complex regulations and changing landscape of the financial services industry. The following table highlights a number of our directors’ specific skills, experiences and areas of knowledge that allow the Board to effectively serve and represent the interests of Comerica’s four core constituencies: its shareholders, its customers, the communities it serves and its employees.

|

Summary of Director Qualifications and Experience |

Babb | Cregg | DeNicola | Kane | Lindner | Piergallini | Taubman | Turner | Vaca | |||||||||

|

Accounting |

ü | ü | ü | ü | ||||||||||||||

|

Corporate Governance |

ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||

|

Financial / Capital Allocation |

ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||

|

Legal and Regulatory |

ü | ü | ||||||||||||||||

|

Leadership of Financial Institutions |

ü | ü | ü | |||||||||||||||

| Regional Expertise in Relevant Geographic Markets | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||

|

Human Resources |

ü | ü | ||||||||||||||||

|

Management |

ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||

|

Marketing |

ü | |||||||||||||||||

|

Other Public Company Board Service |

ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||

|

Real Estate |

ü | ü | ||||||||||||||||

|

Risk Management / Cyber Security |

ü | ü | ü | ü | ü | ü | ||||||||||||

|

Technology Services |

ü | ü | ||||||||||||||||

Attendance

All director nominees and all incumbent directors attended at least seventy-five percent (75%) of the aggregate number of meetings held by the Board and all the committees of the Board on which the respective directors served.

7

COMERICA INCORPORATED

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

APRIL 26, 2016

| Date: | April 26, 2016 | |

| Time: | 9:30 a.m., Central Time | |

| Place: |

Comerica Bank Tower 1717 Main Street, 4th Floor Dallas, Texas 75201 | |

We invite you to attend the Comerica Incorporated Annual Meeting of Shareholders for the following purposes:

| 1. | To elect nine directors nominated by the Board of Directors for one-year terms expiring in 2017 or upon the election and qualification of their successors; |

| 2. | To ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | To approve the Comerica Incorporated 2016 Management Incentive Plan including for purposes of Section 162(m) of the Internal Revenue Code; |

| 4. | To approve a non-binding, advisory proposal approving executive compensation; and |

| 5. | To transact any other business that is properly submitted before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

The record date for the Annual Meeting is February 26, 2016 (the “Record Date”). Only shareholders of record at the close of business on the Record Date can vote at the Annual Meeting. Action may be taken at the Annual Meeting on any of the foregoing proposals on the date specified above or any date or dates to which the Annual Meeting may be adjourned or postponed.

Under rules adopted by the Securities and Exchange Commission, we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of the proxy statement and annual report. Shareholders of record have been mailed a Notice of Internet Availability of Proxy Materials on or around March 16, 2016, which provides them with instructions on how to vote and how to electronically access the proxy materials on the Internet. It also provides them with instructions on how to request paper copies of these materials, should they so desire. In addition, on or around March 28, 2016, Comerica will mail a proxy card to its shareholders of record that have not yet voted, along with a second copy of the Notice of Internet Availability of Proxy Materials. Shareholders of record who previously enrolled in a program to receive electronic versions of the proxy materials will receive an email notice with details on how to access those materials and how to vote.

Comerica will have a list of shareholders who can vote at the Annual Meeting available for inspection by shareholders at the Annual Meeting and, for 10 days prior to the Annual Meeting, during regular business hours at the offices of the Comerica Corporate Legal Department, Comerica Bank Tower, 1717 Main Street, Dallas, Texas 75201.

If you plan to attend the Annual Meeting but are not a shareholder of record because you hold your shares in street name, please bring evidence of your beneficial ownership of your shares with you to the Annual Meeting.

8

See the “Questions and Answers” section of the proxy statement for a discussion of the difference between a shareholder of record and a street name holder.

Whether or not you plan to attend the Annual Meeting and whether you own a few or many shares of stock, the Board of Directors urges you to vote promptly. Registered holders may vote through the Internet, by telephone or, once you receive a printed proxy card in the mail, by completing, dating, signing and returning the proxy card so that your shares may be represented at the Annual Meeting. “Street name” holders must vote their shares in the manner prescribed by their brokerage firm, bank or other nominee. You will find instructions for voting in the “Questions and Answers” section of the proxy statement.

|

By Order of the Board of Directors, |

|

|

|

John D. Buchanan Executive Vice President — Governance, Regulatory Relations and Legal Affairs, and Corporate Secretary |

March 16, 2016

9

Comerica Incorporated

Comerica Bank Tower

1717 Main Street

Dallas, Texas 75201

What is a proxy?

A proxy is your authorization for someone else to vote for you in the way that you want to vote. When you complete and submit a proxy card or use the automated telephone voting system or the Internet voting system, you are submitting a proxy. The Board of Directors of Comerica Incorporated (“Comerica,” the “Company” or “we”) is soliciting this proxy. All references in this proxy statement to “you” will mean you, the shareholder, and to “yours” will mean the shareholder’s or shareholders’, as appropriate.

What is a proxy statement?

A proxy statement is a document the United States Securities and Exchange Commission (“SEC”) requires to explain the matters on which you are asked to vote on by proxy and to disclose certain related information. This proxy statement was first made available to the shareholders on or about March 16, 2016.

Why am I receiving my proxy materials electronically instead of receiving paper copies through the mail?

Under rules adopted by the SEC, we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of the proxy statement and annual report. In addition to reducing the amount of paper used in producing these materials, this method lowers the costs associated with mailing the proxy materials to shareholders.

On or about March 16, 2016, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access this proxy statement and our annual report online. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail (with the exception of the proxy card, which will be separately mailed on or around March 28, 2016 to shareholders of record that have not yet voted). The Notice of Internet Availability of Proxy Materials instructs you on how to electronically access and review all of the important information contained in this proxy statement and the annual report, and it provides you with information on voting.

If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a paper copy of our proxy materials, follow the instructions contained in the Notice of Internet Availability of Proxy Materials about how you may request to receive your materials in printed form on a one-time or ongoing basis.

Who can vote?

Only record holders of Comerica common stock at the close of business on February 26, 2016, the Record Date, can vote at the Annual Meeting. Each shareholder of record has one vote, for each share of common stock owned, on each matter presented for a vote at the Annual Meeting.

10

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, then the brokerage firm, bank or other nominee is considered to be the shareholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the brokerage firm, bank or other nominee how to vote their shares. See “How can I vote?” below.

How can I vote?

If you are a shareholder of record as of the Record Date (as opposed to a street name holder), you will be able to vote in four ways: in person, by proxy card, by telephone, or by the Internet. On or about March 16, 2016, we mailed to our shareholders of record (other than those who previously requested electronic delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials and how to submit their proxy via the Internet. In addition, on or about March 28, 2016, we will mail a printed version of the proxy card, along with a second copy of the Notice of Internet Availability of Proxy Materials, to such shareholders of record, if they have not yet voted. Generally, shareholders of record will need information on the Notice of Internet Availability of Proxy Materials or the proxy card to vote. If you previously enrolled in a program to receive electronic versions of Comerica’s annual report and proxy statement instead of receiving printed versions, you will receive an email notice that will provide you with the information you will need to access the proxy materials and vote.

To vote in person, you will need to attend the Annual Meeting to cast your vote. To vote by proxy card, complete, sign, date and return the proxy card in the return envelope provided with your proxy card. To vote by using the automated telephone voting system or the Internet voting system, the instructions for shareholders of record are as follows:

TO VOTE BY TELEPHONE: 1-866-883-3382

| • |

Use any touch-tone telephone to vote your proxy. |

| • |

Have your proxy card or Notice of Internet Availability of Proxy Materials and the last four digits of your Social Security Number or Tax Identification Number available when you call. |

| • |

Follow the simple instructions the system provides you. |

| • |

You may dial this toll free number at your convenience, 24 hours a day, 7 days a week. The deadline for telephone voting is 11:59 p.m. (Central Time), April 25, 2016. For shares held in Comerica’s employee benefit plans, the deadline is 11:59 p.m. (Central Time), April 24, 2016. |

(OR)

TO VOTE BY THE INTERNET: http://www.proxydocs.com/cma

| • |

Use the Internet to vote your proxy. |

| • |

Have your proxy card or Notice of Internet Availability of Proxy Materials and the last four digits of your Social Security Number or Tax Identification Number available when you access the website. |

| • |

Follow the simple instructions to obtain your records and create an electronic ballot. |

11

| • |

You may log on to this Internet site at your convenience, 24 hours a day, 7 days a week. The deadline for Internet voting is 11:59 p.m. (Central Time), April 25, 2016. For shares held in Comerica’s employee benefit plans, the deadline is 11:59 p.m. (Central Time), April 24, 2016. |

If you submit a proxy to Comerica before the Annual Meeting, whether by proxy card, by telephone or by Internet, the persons named as proxies will vote your shares as you direct. If no instructions are specified, the proxy will be voted for the nine directors nominated by the Board of Directors; for the ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending December 31, 2016; for the approval of the Comerica Incorporated 2016 Management Incentive Plan including for purposes of Section 162(m) of the Internal Revenue Code; and for the non-binding, advisory proposal to approve executive compensation. No other matters are currently scheduled to be acted upon at the Annual Meeting.

You may revoke a proxy at any time before the proxy is exercised by:

| (1) | delivering written notice of revocation to the Corporate Secretary of Comerica at the Corporate Legal Department, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201; |

| (2) | submitting another properly completed proxy card that is later dated; |

| (3) | voting by telephone at a subsequent time; |

| (4) | voting by the Internet at a subsequent time; or |

| (5) | voting in person at the Annual Meeting. |

If you hold your shares in “street name,” you must vote your shares in the manner prescribed by your brokerage firm, bank or other nominee. Your brokerage firm, bank or other nominee should have enclosed or otherwise provided a voting instruction card for you to use in directing the brokerage firm, bank or other nominee how to vote your shares. If you hold your shares in street name and you want to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker and present it at the Annual Meeting.

What is a quorum?

There were 174,877,020 shares of Comerica common stock issued and outstanding on the Record Date. A majority of the issued and outstanding shares, 87,438,511 shares, present or represented by proxy at the meeting, constitutes a quorum. A quorum must exist to conduct business at the Annual Meeting.

What vote is required?

Directors: If a quorum exists, the nominees for director receiving a majority of the votes cast (i.e., the number of shares voted “for” a director nominee exceeds the number of votes cast “against” that nominee) will be elected as directors. Votes cast will include only votes cast with respect to shares present in person or represented by proxy at the meeting and entitled to vote and will exclude abstentions. Therefore, shares not present at the meeting, broker non-votes (described below) and shares voting “abstain” have no effect on the election of directors. If the number of nominees exceeds the number of directors to be elected, the directors shall be elected by the vote of a plurality of the shares represented in person or by proxy at the meeting.

Other Proposals: If a quorum exists, the proposals: (i) to ratify the appointment of Ernst & Young LLP as independent registered public accounting firm; (ii) to approve the Comerica Incorporated 2016 Management Incentive Plan including for purposes of Section 162(m) of the Internal Revenue Code; and (iii) to approve a non-binding, advisory proposal to approve executive compensation must receive the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal in question. Therefore, abstentions will have the same effect as voting against the applicable proposal.

12

Broker non-votes will not be counted as eligible to vote on the applicable proposal and, therefore, will have no effect on the outcome of the voting on that proposal.

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote under the rules of the stock exchange or other organization of which it is a member. In this situation, a “broker non-vote” occurs.

An independent third party, Wells Fargo Bank, N.A., will act as the inspector of the Annual Meeting and the tabulator of votes.

Who pays for the costs of the Annual Meeting?

Comerica pays the cost of preparing and printing the proxy statement and soliciting proxies. Comerica will solicit proxies primarily by mail, but may also solicit proxies personally and by telephone, the Internet, facsimile or other means. Comerica will use the services of Georgeson LLC, a proxy solicitation firm, at a cost of $10,000 plus out-of-pocket expenses and fees for any special services. Officers and regular employees of Comerica and its subsidiaries may also solicit proxies, but they will not receive additional compensation for soliciting proxies. Comerica also will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their out-of-pocket expenses for forwarding solicitation materials to beneficial owners of Comerica common stock.

When are shareholder proposals for the 2017 Annual Meeting due?

To be considered for inclusion in next year’s proxy statement, shareholder proposals must comply with applicable laws and regulations, including SEC Rule 14a-8, as well as Comerica’s bylaws, and must be submitted in writing to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, and received by November 16, 2016.

Comerica’s bylaws also establish an advance notice procedure with regard to shareholder proposals that are not submitted for inclusion in the proxy statement, but that a shareholder instead wishes to present directly at an Annual Meeting of Comerica’s shareholders. For the 2017 Annual Meeting of Shareholders, notice must be received by Comerica’s Corporate Secretary no later than the close of business on January 26, 2017 and no earlier than the close of business on December 27, 2016. If, however, Comerica moves the Annual Meeting of Shareholders to a date that is more than 30 days before or more than 60 days after the date which is the one-year anniversary of this year’s Annual Meeting date (i.e., April 26, 2017), Comerica’s Corporate Secretary must receive your notice no earlier than the close of business on the 120th day prior to the new Annual Meeting date and no later than the close of business on the later of the 90th day prior to the new Annual Meeting date or the 10th day following the day on which Comerica first made a public announcement of the new Annual Meeting date.

Comerica’s bylaws contain additional requirements for shareholder proposals. A copy of Comerica’s bylaws can be obtained by making a written request to the Corporate Secretary.

How can shareholders nominate persons for election as directors at the 2017 Annual Meeting?

All shareholder nominations of persons for election as directors at the 2017 Annual Meeting of Shareholders must comply with applicable laws and regulations, as well as Comerica’s bylaws, and must be submitted in writing to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201.

Under Comerica’s bylaws, shareholders of Comerica must provide advance notice to Comerica’s Corporate Secretary if they wish to nominate persons for election as directors at an Annual Meeting of Comerica’s Shareholders. For the 2017 Annual Meeting of Shareholders, written notice must be received by Comerica’s

13

Corporate Secretary no later than the close of business on January 26, 2017 and no earlier than the close of business on December 27, 2016.

If, however, Comerica moves the Annual Meeting of Shareholders to a date that is more than 30 days before or more than 60 days after the date that is the one-year anniversary of this year’s Annual Meeting date (i.e., April 26, 2017), or if a special meeting of shareholders is called for the purpose of electing directors, Comerica’s Corporate Secretary must receive your notice no earlier than the close of business on the 120th day prior to the meeting date and no later than the close of business on the later of the 90th day prior to the meeting date or the 10th day following the day on which Comerica first made a public announcement of the meeting date (and, in the case of a special meeting, of the nominees proposed by the Board of Directors to be elected at such meeting).

If Comerica increases the number of directors to be elected to the Board at the Annual Meeting and there is no public announcement naming all of the nominees for director or specifying the size of the increased Board at least 100 days prior to the first anniversary of the immediately preceding year’s Annual Meeting, then Comerica will consider your notice timely (but only with respect to nominees for any new positions created by such increase) if Comerica’s Corporate Secretary receives your notice no later than the close of business on the 10th day following the day on which Comerica first makes the public announcement of the increase in the number of directors.

In addition, Article III, Section 12 of the bylaws requires a nominee for election or re-election as a director of Comerica to complete and deliver to the Corporate Secretary (in accordance with the time periods described above, in the case of director nominations by shareholders) a written questionnaire prepared by Comerica with respect to the background and qualification of the person and, if applicable, the background of any other person or entity on whose behalf the nomination is being made.

A nominee also must make certain representations and agree that he or she (A) will abide by the requirements of Article III, Section 13 of the bylaws (concerning, among other things, the required tendering of a resignation by a director who does not receive a majority of votes cast in an uncontested election), (B) is not and will not become a party to (1) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how, if elected as a director of Comerica, he or she will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to Comerica or (2) any Voting Commitment that could limit or interfere with his or her ability to comply, if elected as a director of Comerica, with his or her fiduciary duties under applicable law, (C) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than Comerica with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed, and (D) in his or her individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, would be in compliance, if elected as a director of Comerica, and would comply with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of Comerica.

You may receive a copy of Comerica’s bylaws specifying the advance notice and additional requirements for shareholder nominations by making a written request to the Corporate Secretary.

Does Comerica have a Code of Ethics?

Yes, Comerica has a Code of Business Conduct and Ethics for Employees, which applies to employees and agents of Comerica and its subsidiaries and affiliates, as well as a Code of Business Conduct and Ethics for Members of the Board of Directors. Comerica also has a Senior Financial Officer Code of Ethics that applies to the Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and Treasurer. The Code of Business Conduct and Ethics for Employees, the Code of Business Conduct and Ethics for Members of the Board of Directors and the Senior Financial Officer Code of Ethics are available on Comerica’s website at www.comerica.com. Copies of such codes can also be obtained in print by making a written request to the Corporate Secretary.

14

A copy of Comerica’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the Securities and Exchange Commission, may be obtained without charge upon written request to the Corporate Secretary, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on April 26, 2016.

The proxy statement, annual report to security holders and additional soliciting materials are available at www.proxydocs.com/cma.

15

PROPOSAL I SUBMITTED FOR YOUR VOTE

ELECTION OF DIRECTORS

The Board of Directors recommends that you vote “FOR”

the candidates for director.

Election of Directors. Comerica’s Board of Directors currently has nine members, and directors are elected annually for terms of one year. Based on the recommendation of the Governance, Compensation and Nominating Committee, the Board has nominated all of Comerica’s current directors to serve another term or until their successors are elected and qualified.

The Board has chosen to nominate Comerica’s current directors based on their unique expertise, experiences, perspectives and leadership skills.

Our nominees include individuals who:

| • |

Are experienced in leading complex, highly-regulated companies (including banks and other financial services entities) |

| • |

Have served in a variety of leadership roles on boards and management teams of U.S. public companies |

| • |

Have extensive experience in the geographic areas in which we operate |

| • |

Understand Comerica’s business and unique position in the banking industry |

The current directors are the only nominees, and each of them has been previously elected by the shareholders. Each of the nominees has consented to his or her nomination and has agreed to serve as a director of Comerica, if elected. Proxies cannot be voted for a greater number of people than the number of nominees named.

If any director is unable to stand for re-election, Comerica may vote the shares to elect any substitute nominees recommended by the Governance, Compensation and Nominating Committee, and it is intended that such shares represented by proxy, if given and unless otherwise specified therein, will be voted FOR the remaining nominees and substitute nominee or nominees so designated. If any such substitute nominees are so designated, Comerica would expect to provide supplemental proxy materials that, as applicable, identify the substitute nominees, disclose that such nominees have consented to being named in Comerica’s proxy materials and to serve if elected, and include biographical and other information about such nominees to the extent required by the rules of the SEC. If the Governance, Compensation and Nominating Committee does not recommend any substitute nominees, the number of directors to be elected at the Annual Meeting may be reduced by the number of nominees who are unable to serve.

Further information regarding the Board and the nominees begins directly below.

COMERICA’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR CANDIDATES LISTED BELOW.

16

The following section provides information as of March 16, 2016 about each nominee for election as a director.

The information provided includes the age of each nominee or incumbent director; the nominee’s or incumbent director’s principal occupation, employment and business experience during the past five years, including employment with Comerica and Comerica Bank, a wholly-owned subsidiary of Comerica, as well as other professional experience; other public company or registered investment company directorships during the past five years; and the year in which the nominee or incumbent director became a director of Comerica.

|

Ralph W. Babb, Jr. | Director since 2001(1) | ||||

|

Mr. Babb, 67, has been Chief Executive Officer (since January 2002), Chairman (since October 2002), President (January 2002 to April 2015), Chief Financial Officer (June 1995 to April 2002) and Vice Chairman (March 1999 to January 2002) of Comerica Incorporated and Comerica Bank. Before joining Comerica, Mr. Babb served as the vice chairman for Mercantile Bancorporation Inc. after years of service with Peat Marwick Mitchell & Co. Additionally, Mr. Babb has been a director of Texas Instruments Inc. since March 2010. He has been a member of the Federal Reserve Board’s Federal Advisory Council since 2013.

Mr. Babb brings to the Board:

• In-depth knowledge of the Company’s business resulting from his years of service with the Company in various capacities

• Extensive industry experience as a result of several decades in the banking industry and his professional involvement with the Federal Reserve Board

• Leadership experience as the Company’s current Chairman and Chief Executive Officer and our former President and Chief Financial Officer, including:

¡ The successful integration of Sterling Bancshares, Inc. in 2011, which enabled Comerica to significantly boost its Texas presence with a solid deposit base and well-located banking center network.

¡ An overall enhancement of Comerica’s risk governance structure, with a focus on mitigating risk across the Company, including credit, market, liquidity, operational, compliance and cybersecurity.

| ||||||

|

Roger A. Cregg | Director since 2006 | ||||

|

Mr. Cregg, 59, has been President, Chief Executive Officer and a director of AV Homes, Inc., a developer and homebuilder in Florida, Arizona and North Carolina, since December 2012. From August 2011 through November 2012, he served as senior vice president of finance and chief financial officer of The ServiceMaster Company, a residential and commercial service company. He served as Executive Vice President of PulteGroup, Inc. (formerly known as Pulte Homes, Inc.), a national homebuilding company, from May 2003 to May 2011 and Chief Financial Officer of PulteGroup, Inc. from January 1998 to May 2011. He served as Senior Vice President of PulteGroup, Inc. from January 1998 to May 2003. He was a director of the Federal Reserve Bank of Chicago, Detroit Branch, from January 2004 to December 2009 and served as Chair from January to December 2006.

As the current Chief Executive Officer of a public company and the former Chief Financial Officer of public companies, Mr. Cregg has demonstrated leadership capability and extensive knowledge of complex financial and operational issues. | ||||||

17

|

T. Kevin DeNicola | Director since 2006 | ||||

|

Mr. DeNicola, 61, served as Chief Financial Officer of KIOR, Inc., a biofuels company, from November 2009 to January 2011. He was Senior Vice President and Chief Financial Officer of KBR, Inc., a global engineering, construction and services company, from June 2008 until October 2009. From June 2002 to January 2008, he was Senior Vice President and Chief Financial Officer of Lyondell Chemical Company, a global manufacturer of basic chemicals. Mr. DeNicola also served as Senior Vice President and Chief Financial Officer of Equistar Chemicals, LP and Millennium Chemicals Inc., both subsidiaries of Lyondell Chemical Company, from June 2002 to January 2008. In January 2009, Lyondell Chemical Company and certain of its subsidiaries, including Equistar Chemicals, LP and Millennium Chemicals Inc., filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code. Lyondell emerged from bankruptcy in April 2010. Mr. DeNicola has been a volunteer adjunct professor at Rice University, a higher learning institution, from March 2008 to the present. He also has been a director of Axiall Corporation (formerly Georgia Gulf Corporation) since September 2009.

Mr. DeNicola is an experienced financial leader with the skills necessary to lead our Audit Committee. His service as Chief Financial Officer of public companies makes him a valuable asset, both on our Board of Directors and as the Chairman of our Audit Committee. Mr. DeNicola’s positions have provided him with a wealth of knowledge in dealing with financial and accounting matters. He is also a licensed CPA. The depth and breadth of his exposure to complex financial issues make him a skilled advisor.

| ||||||

|

Jacqueline P. Kane | Director since 2008 | ||||

|

Ms. Kane, 63, is retired. She served as Executive Vice President, Human Resources and Corporate Affairs, from February 2015 to January 2016, Senior Vice President, Human Resources and Corporate Affairs, from December 2004 to February 2015, Senior Vice President, Human Resources from June 2004 to December 2004, and Vice President, Human Resources from March 2004 to May 2004 for The Clorox Company, a manufacturer and marketer of consumer products. From March 2003 to January 2004, she was Vice President, Human Resources and Executive Leadership for The Hewlett-Packard Company, a technology company. Prior to her role at The Hewlett-Packard Company, Ms. Kane spent 22 years in human resources in the financial services industry.

As a former senior executive with experience in human resources, including compensation matters, as well as experience in several of our key geographic markets, Ms. Kane has a unique and insightful perspective to offer the Board. As a member of our Governance, Compensation and Nominating Committee, she is able to use her experience and perspectives to offer best practices advice.

| ||||||

|

Richard G. Lindner | Director since 2008 | ||||

|

Mr. Lindner, 61, is retired. He served as Senior Executive Vice President and Chief Financial Officer of AT&T, Inc. (formerly SBC Communications, Inc.), a telecommunications company, from May 2004 to June 2011. From October 2000 to May 2004, he was the Chief Financial Officer of Cingular Wireless LLC (now AT&T Mobility LLC), a wireless telecommunications company. From October 2002 to March 2007, he served as a director of Sabre Holdings.

As the former Chief Financial Officer of AT&T, Inc., Mr. Lindner has demonstrated leadership capability and extensive knowledge of complex financial and operational issues facing large organizations. In addition, Mr. Lindner is able to draw upon, among other things, his knowledge of several of our key geographic markets that he has gained through experience in the telecommunications industry. | ||||||

18

|

Alfred A. Piergallini | Director since 1991 | ||||

|

Mr. Piergallini, 69, has been a consultant with Desert Trail Consulting, a marketing consulting organization, since January 2001. He was Chairman of Wisconsin Cheese Group, Inc., a manufacturer and marketer of ethnic and specialty cheeses, from January 2006 until December 2010. He also was President and Chief Executive Officer of Wisconsin Cheese Group, Inc. from January 2006 to June 2007. He was Chairman, President and Chief Executive Officer of Novartis Consumer Health Worldwide, a health care and infant nutrition company, from December 1999 to December 2001. He was Vice Chairman, President and Chief Executive Officer of Gerber Products Company, a manufacturer and developer of infant and toddler nutrition and wellness products, until February 1999. He has been a director of Central Garden & Pet Company since January 2004.

As a senior executive with experience in general management, marketing, sales and branding, as well as experience in several of our key markets, Mr. Piergallini contributes valuable insight to the Board.

| ||||||

|

Robert S. Taubman | Director since 2000(2) | ||||

|

Mr. Taubman, 62, has been Chairman of Taubman Centers, Inc., a real estate investment trust that owns, develops and operates regional shopping centers nationally, since December 2001 and has been President and Chief Executive Officer of Taubman Centers, Inc., since August 1992. He has been Chairman of The Taubman Company, a shopping center management company engaged in leasing, management and construction supervision, since December 2001 and has been President and Chief Executive Officer of The Taubman Company since September 1990. He has been a director of Sotheby’s Holdings, Inc. since 2000 and Taubman Centers, Inc. since 1992.

As an executive involved in real estate development and operations, Mr. Taubman has demonstrated leadership capability and brings key experience in the real estate sector. He also brings insight through experience in many of Comerica’s geographic markets.

| ||||||

|

Reginald M. Turner, Jr. | Director since 2005 | ||||

|

Mr. Turner, 56, has been an attorney with Clark Hill PLC, a law firm, since April 2000. He has been a director of Masco Corporation since March 1, 2015. Mr. Turner is active in public service and with civic and charitable organizations, serving in leadership positions with the Detroit Public Safety Foundation, the Detroit Institute of Arts, the Community Foundation for Southeast Michigan and the Hudson-Webber Foundation.

As a lawyer, Mr. Turner has a unique legal and risk management perspective to offer the Board. He also has extensive involvement and experience in community affairs.

| ||||||

19

|

Nina G. Vaca(3) | Director since 2008 | ||||

|

Ms. Vaca, 44, has been Chairman and Chief Executive Officer of Pinnacle Technical Resources, Inc., a staffing, vendor management and information technology services firm, since October 1996. She also has been Chairman and Chief Executive Officer of Vaca Industries Inc., a management company, since April 1999. She has been a director of Kohl’s Corporation since March 2010 and a director of Cinemark Holdings, Inc. since November 2014. In 2014, the Obama Administration appointed Ms. Vaca as a Presidential Ambassador for Global Entrepreneurship. Ms. Vaca is also Chairman Emeritus of the United States Hispanic Chamber of Commerce, and serves as Chairman of the United States Hispanic Chamber of Commerce Foundation.

As a chief executive officer with experience in staffing, vendor management and information technology, as well as successful entrepreneurial endeavors, Ms. Vaca offers a unique and insightful perspective to the Board. | ||||||

Footnotes:

| (1) |

Mr. Babb became a director of Comerica Bank in 2000. |

| (2) |

Mr. Taubman became a director of Manufacturer’s Bank, N.A. or its predecessors in 1987. He became a director of Comerica Bank in 1992 when it merged with Manufacturer’s Bank, N.A. He resigned as a director of Comerica Bank in 2000, when he became a director of Comerica. |

| (3) |

Professional name of Ximena G. Humrichouse. |

BOARD AND COMMITTEE GOVERNANCE

Annual Elections. Comerica’s directors are elected each year by the shareholders at the Annual Meeting, to hold office until the next Annual Meeting and until their successors are elected and qualified.

Majority Voting Standard. In an election of directors where the number of nominees does not exceed the number of directors to be elected, each director must receive the vote of the majority of the votes cast with respect to that director. If a director does not receive the vote of the majority of the votes cast and no successor has been elected at such meeting, the director will promptly tender his or her resignation to the Board.

Annual Self-Evaluation. The Board conducts an annual self-evaluation to determine whether it and its committees are functioning effectively. The Governance, Compensation and Nominating Committee reviews the self-evaluation process. A report is made to the Board on the assessment of the performance of the Board and its committees.

Overboarding Limit. To ensure that our directors have sufficient time to devote to Comerica and its shareholders, our directors may not serve on more than three public company boards in addition to the Comerica Board, and members of Comerica’s Audit Committee may not serve on more than two other public company audit committees.

Nominee Selection Process. In identifying potential candidates for nomination as directors, the Governance, Compensation and Nominating Committee considers the specific qualities and skills of potential directors. Criteria for assessing nominees include a potential nominee’s ability to represent the interests of Comerica’s four core constituencies: its shareholders, its customers, the communities it serves and its employees. Minimum qualifications for a director nominee are experience in those areas that the Board determines are necessary and appropriate to meet the needs of Comerica, including leadership positions in public companies, small or middle market businesses, or not-for-profit, professional/regulatory or educational organizations.

For those proposed director nominees who meet the minimum qualifications, the Governance, Compensation and Nominating Committee then assesses the proposed nominee’s specific qualifications, evaluates his or her independence, and considers other factors, including skills, geographic location, considerations of diversity,

20

standards of integrity, memberships on other boards (with a special focus on director interlocks), and ability and willingness to commit to serving on the Board for an extended period of time and to dedicate adequate time and attention to the affairs of Comerica as necessary to properly discharge his or her duties. Considerations of diversity can include seeking nominees with a broad diversity of experience, professions, skills, geographic representation and/or backgrounds. The Governance, Compensation and Nominating Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

In addition, Article III, Section 12 of the bylaws requires a nominee for election or re-election as a director of Comerica to complete and deliver to the Corporate Secretary a written questionnaire prepared by Comerica with respect to the background and qualification of the person and, if applicable, the background of any other person or entity on whose behalf the nomination is being made. All of the director nominees completed the required questionnaire.

A nominee also must make certain representations and agree that he or she (A) will abide by the requirements of Article III, Section 13 of the bylaws (concerning, among other things, the required tendering of a resignation by a director who does not receive a majority of votes cast in an uncontested election), (B) is not and will not become a party to (1) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how, if elected as a director of Comerica, he or she will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to Comerica or (2) any Voting Commitment that could limit or interfere with his or her ability to comply, if elected as a director of Comerica, with his or her fiduciary duties under applicable law, (C) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than Comerica with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed, and (D) in his or her individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, would be in compliance, if elected as a director of Comerica, and would comply with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of Comerica. All of the director nominees made the foregoing representations and agreements.

The Governance, Compensation and Nominating Committee does not have a separate policy for consideration of any director candidates recommended by shareholders. Instead, the Governance, Compensation and Nominating Committee considers any candidate meeting the requirements for nomination by a shareholder set forth in Comerica’s bylaws (as well as applicable laws and regulations) in the same manner as any other director candidate. The Governance, Compensation and Nominating Committee believes that requiring shareholder recommendations for director candidates to comply with the requirements for nominations in accordance with Comerica’s bylaws ensures that the Governance, Compensation and Nominating Committee receives at least the minimum information necessary for it to begin an appropriate evaluation of any such director nominee.

The Governance, Compensation and Nominating Committee also periodically uses a third-party search firm for the purpose and function of identifying potential director nominees.

COMMITTEES AND MEETINGS OF DIRECTORS

The Board had several committees in 2015, as set forth in the following chart and described below. The names of the directors serving on the committees and the committee chairs, where applicable, are also set forth in the chart. The current terms of the various standing committee members expire in April 2016.

21

|

AUDIT |

ENTERPRISE RISK | GOVERNANCE, COMPENSATION AND NOMINATING |

QUALIFIED LEGAL COMPLIANCE | |||

|

Cregg, Roger A. |

DeNicola, T. Kevin | Cregg, Roger A. | Cregg, Roger A. | |||

|

DeNicola, T. Kevin |

Lindner, Richard G. | Kane, Jacqueline P. | DeNicola, T. Kevin | |||

|

Turner, Reginald M., Jr. |

Taubman, Robert S. | Lindner, Richard G. | Turner, Reginald M., Jr. | |||

|

Vaca, Nina G. |

Turner, Reginald M., Jr. | Piergallini, Alfred A. | Vaca, Nina G. | |||

| Vaca, Nina G. |

Audit Committee. As provided in its Board-adopted written charter, this committee consists solely of members who are outside directors and who meet the independence and experience requirements of applicable rules of the New York Stock Exchange and the SEC with respect to audit committee members. This committee is responsible, among other things, for providing assistance to the Board by overseeing: (i) the integrity of Comerica’s financial statements; (ii) Comerica’s compliance with legal and regulatory requirements; (iii) the independent registered public accounting firm’s qualifications and independence; and (iv) the performance of Comerica’s internal audit function and independent registered public accounting firm, including with respect to both bank and non-bank subsidiaries; and by preparing the “Audit Committee Report” found in this proxy statement. None of the members of the Audit Committee serves on the audit committees of more than three public companies. The Board of Directors has determined that all of the members of the Audit Committee are independent pursuant to the independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section in this proxy statement). Although the SEC requires only one financial expert serve on the Audit Committee, the Board of Directors has determined that Comerica has two audit committee financial experts serving on the Audit Committee. These directors are Roger A. Cregg and T. Kevin DeNicola. A current copy of the charter of the Audit Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Audit Committee met 12 times in 2015.

Enterprise Risk Committee. This committee oversees policies, procedures and practices relating to enterprise-wide risk and compliance with bank regulatory obligations. The Board of Directors has determined that all of the members of the Enterprise Risk Committee are independent, pursuant to independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of the proxy statement). A current copy of the charter of the Enterprise Risk Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Enterprise Risk Committee met four times in 2015.

Governance, Compensation and Nominating Committee. This committee, among other things, establishes Comerica’s executive compensation policies and programs, administers Comerica’s 401(k), stock, incentive, pension and deferral plans, monitors compliance with laws and regulations applicable to the documentation and administration of Comerica’s employee benefit plans, monitors the effectiveness of the Board, oversees corporate governance issues and periodically reviews succession plans for key officers of Comerica and reports to the Board on succession planning. Among its various other duties, this committee reviews and recommends to the full Board candidates to become Board members, develops and administers performance criteria for members of the Board, and oversees matters relating to the size of the Board, its committee structure and assignments, and the conduct and frequency of Board meetings. The Board of Directors has determined that all of the members of the Governance, Compensation and Nominating Committee are independent, pursuant to independence requirements established from time to time by the Board and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of the proxy statement). A current copy of the charter of the Governance, Compensation and Nominating Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in

22

print by making a written request to the Corporate Secretary. The Governance, Compensation and Nominating Committee also oversees the discussion, review and evaluation of our compensation plans as described below. The Governance, Compensation and Nominating Committee met seven times in 2015.

Qualified Legal Compliance Committee. This committee assists the Board in promoting the best interests of Comerica by reviewing evidence of potential material violations of securities law or breaches of fiduciary duties or similar violations by Comerica or any officer, director, employee, or agent thereof, providing recommendations to address any such violations, and monitoring Comerica’s remedial efforts with respect to any such violations. The Board of Directors has determined that all of the members of the Qualified Legal Compliance Committee are independent, pursuant to independence requirements established from time to time by the Board and the SEC and the listing standards of the New York Stock Exchange (see the “Director Independence and Transactions of Directors with Comerica” section of the proxy statement). A current copy of the charter of the Qualified Legal Compliance Committee is available to security holders on Comerica’s website at www.comerica.com or may be obtained in print by making a written request to the Corporate Secretary. The Qualified Legal Compliance Committee did not meet in 2015.

Other Committees. The Special Preferred Stock Committee, the Capital Committee and the Capital Plan Committee are temporary committees of the Board of Directors that did not meet in 2015.

Board and Committee Meetings. There were six regular meetings of the Board, two special meetings of the Board and 33 meetings of the various committees and subcommittees of the Board, including actions by unanimous written consents, during 2015. All director nominees and all incumbent directors attended at least seventy-five percent (75%) of the aggregate number of meetings held by the Board and all the committees of the Board on which the respective directors served.

Comerica expects all of its directors to attend the Annual Meeting except in cases of illness, emergency or other reasonable grounds for non-attendance. All of the nine Board members attended the 2015 Annual Meeting.

NON-MANAGEMENT DIRECTORS AND COMMUNICATION WITH THE BOARD

The non-management directors meet at regularly scheduled executive sessions without management. Every year, the non-management directors elect a Facilitating Director, for a one-year term, to lead such sessions. Currently, Richard G. Lindner is the Facilitating Director at such sessions. Interested parties may communicate directly with Mr. Lindner or with the non-management directors as a group by sending written correspondence, delivered via United States mail or courier service, to: Secretary of the Board, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, Attn: Non-Management Directors. Alternatively, shareholders may send communications to the full Board by sending written correspondence, delivered via United States mail or courier service, to: Secretary of the Board, Comerica Incorporated, Comerica Bank Tower, 1717 Main Street, MC 6404, Dallas, Texas 75201, Attn: Full Board of Directors. The Board of Directors’ current practice is that the Secretary will relay all communications received to the Facilitating Director, in the case of communications to non-management directors, and to the Chairman of the Board, in the case of communications to the full Board.

Our Chief Executive Officer also serves as the Chairman of the Board. The Board has chosen this structure because it believes the Chief Executive Officer serves as a bridge between management and the Board, ensuring that both groups act with a common purpose. Separating the roles would risk creating the perception of having two chiefs, which could lead to fractured leadership and a weakened ability to develop and implement strategy. Mr. Babb has provided strong leadership to the Board and management, instilling a clear focus on the Company’s strategy and business plans. Although the Board believes that it is more effective to have one person serve as the Company’s Chairman and Chief Executive, it also believes that it is simultaneously important to have a robust governance structure to ensure a strong and independent Board. All directors, with the exception of the Chairman, are independent as defined under New York Stock Exchange rules, and the Audit Committee, the Enterprise Risk Committee, the Governance, Compensation and Nominating Committee and

23

the Qualified Legal Compliance Committee are comprised entirely of independent directors. The Board also has an independent Facilitating Director (Mr. Lindner) who leads the non-management directors in regularly scheduled executive sessions. As Facilitating Director, Mr. Lindner’s duties include, but are not limited to, the following:

| • |

presiding at all other meetings of the Board at which the Chairman is not present; |

| • |

serving as liaison between the Chairman and the independent directors; |

| • |

approving information sent to the Board; |

| • |

approving meeting agendas and schedules for the Board; |

| • |

having the authority to call meetings of the independent directors; and |

| • |

if requested by major shareholders, ensuring that he is available for consultation and direct communication. |

The Facilitating Director position is elected annually by the non-management directors. The Board believes that the Facilitating Director further strengthens the Board’s independence and autonomous oversight of our business as well as Board communication and effectiveness. The executive sessions over which he presides allow non-management directors to discuss issues facing the Company, including matters concerning management, without any members of management present. The role of the Facilitating Director provides the necessary leadership for such discussions and serves as a bridge between the independent directors and the Company’s management team.

Comerica has historically had and continues to pursue a strong risk management culture. We recognize that nearly every action taken as a financial institution requires some degree of risk. Our objective is not to eliminate risk but to give consideration to ensure we take the appropriate risks. Risk management is one of the interlinking pillars of Comerica’s corporate strategy which reinforces its critical role within our organization. In choosing when and how to take risks, we evaluate our capacity for risk and seek to protect our brand and reputation, our financial flexibility, the value of our assets and the strategic potential of our Company. Each year, our Board approves a statement of our Company’s risk appetite, which is used internally to help our Board and management understand our Company’s tolerance for risk in each of the major risk categories and allow for the adaption of those tolerances to align with a changing economic environment.

Governance and oversight of risk management activities are shared by management and our Board as follows:

| • |

Enterprise Risk Committee. The Enterprise Risk Committee, as discussed on page 22, oversees policies, procedures and practices relating to risk for to the entire organization including compliance with bank regulatory obligations, and is charged with the responsibility for establishing governance over the risk management process, providing oversight in managing Comerica’s aggregate risk position and reporting on the comprehensive portfolio of risks and the potential impact these risks can have on Comerica’s risk profile and resulting capital level. To help discharge its duties, the Enterprise Risk Committee has established the Enterprise-Wide Risk Management Committee. |

| • |

Enterprise-Wide Risk Management Committee. This group is principally comprised of senior officers representing the different risk areas and business units. Members of the Enterprise-Wide Risk Management Committee are appointed by the Chairman and Chief Executive Officer of Comerica. It meets at least quarterly and submits a comprehensive risk report to the Enterprise Risk Committee each quarter providing its view of Comerica’s risk position. |

| • |

Chief Risk Officer. In 2014, Comerica named Michael H. Michalak as its Chief Risk Officer. In that role, he reports directly to Comerica’s Chief Executive Officer and to the Enterprise Risk Committee. As Chief Risk Officer, he is responsible for overseeing risk on an enterprise-wide basis. This includes ongoing compliance with policies and procedures relating to risk management governance, risk management procedures, and risk control infrastructure, and monitoring compliance with such policies and procedures, among other responsibilities. |

24

| • |

Audit Committee. In addition to providing oversight of our financial statements and compliance with legal and regulatory requirements, the Audit Committee plays a key role in risk management through the validation and oversight of our internal controls, policies and procedures to ensure their effectiveness. |

| • |

Governance, Compensation and Nominating Committee. The Governance, Compensation and Nominating Committee provides information on the risks associated with the Company’s compensation programs. A more detailed discussion of the Governance, Compensation and Nominating Committee’s evaluation of risk and compensation programs can be found on pages 68-70. |

Each of the Enterprise Risk Committee, the Audit Committee and the Governance, Compensation and Nominating Committee reports regularly to the full Board. The Board believes that Comerica has the appropriate leadership to help ensure effective risk oversight. This risk leadership includes our Chief Risk Officer, our Chairman and Chief Executive Officer, our independent Facilitating Director, the Board, various committees of the Board, and various management committees.

TRANSACTIONS OF DIRECTORS WITH COMERICA

Independence and Transactions of Directors