10

Backlog

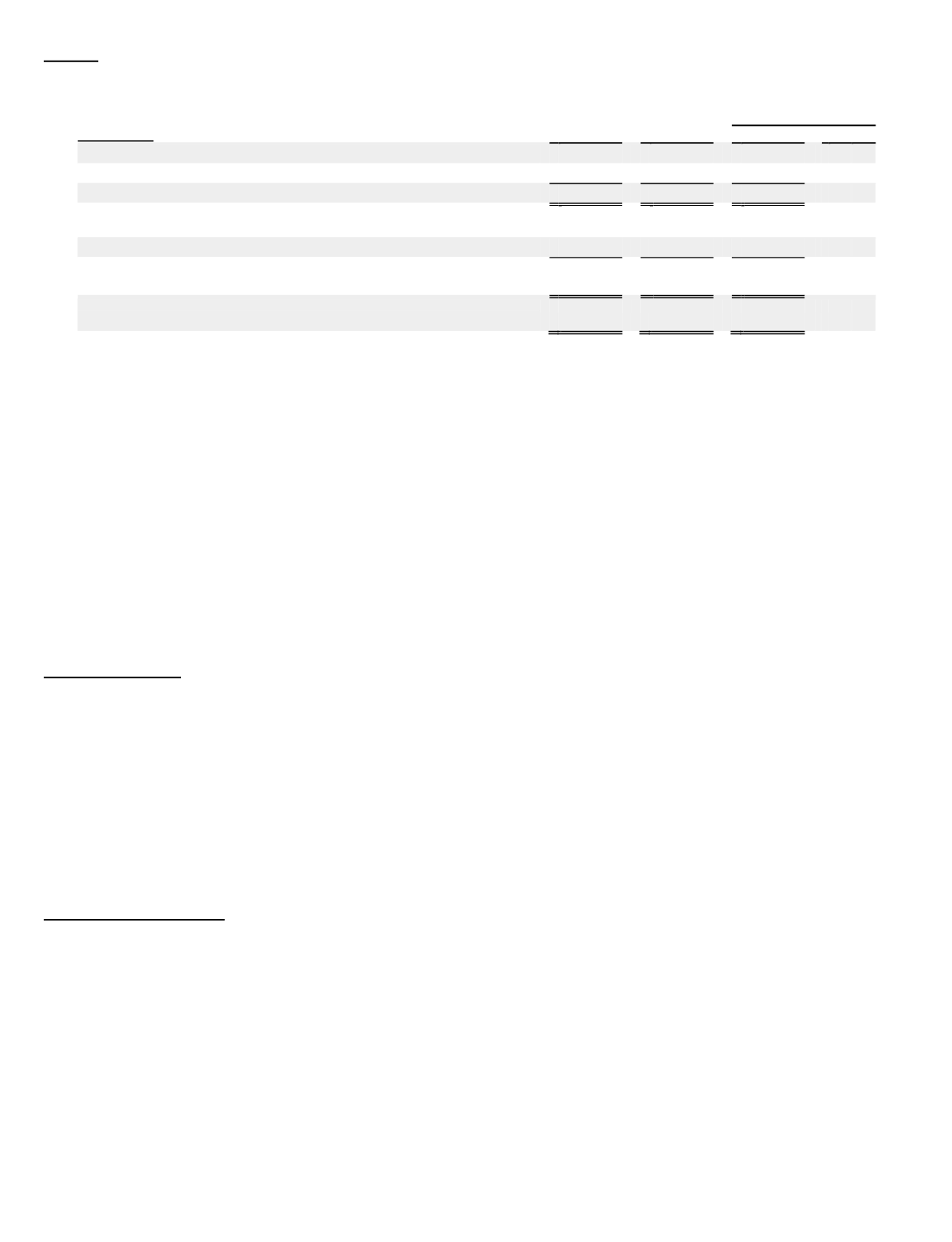

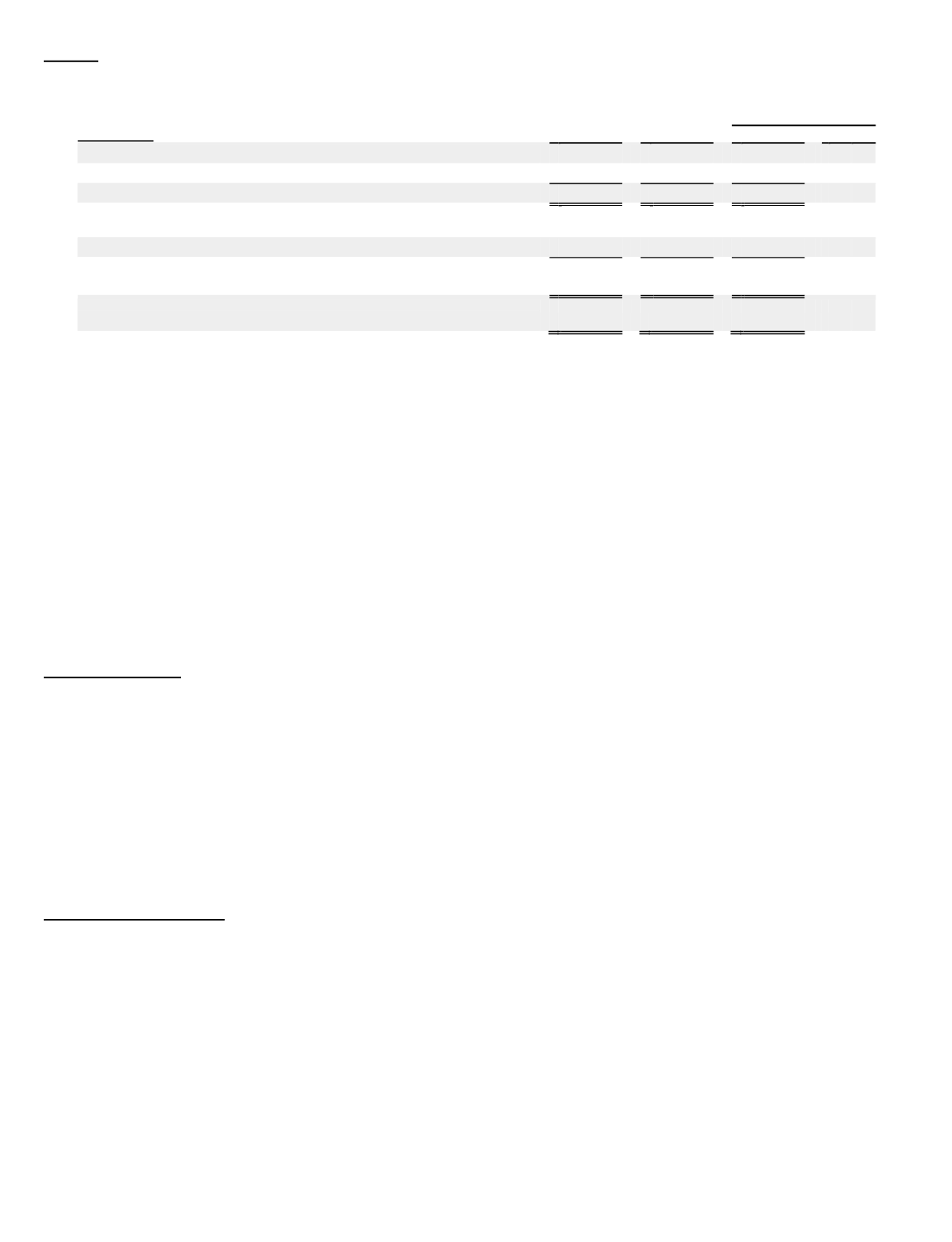

We had unfilled orders, or funded contract and total backlog at December 31, as follows:

2013 vs. 2012

($ in millions)

2013

2012

$

%

Commercial Segment funded contract backlog ...................................... $

223.7 $

215.5 $

8.2 4%

Government Segment funded contract backlog......................................

64.4

93.1

(28.7) (31%)

Total funded contract backlog....................................................... $

288.1 $

308.6 $

(20.5) (7%)

Commercial Segment un-funded customer options................................ $

223.7 $

215.5 $

8.2 4%

Government Segment un-funded customer options................................

788.9

872.4

(83.5) (10%)

Total backlog of orders and commitments, including customer

options...................................................................................... $ 1,012.6 $ 1,087.9 $

(75.3) (7%)

Expected to be realized within next 12 months ...................................... $

158.7 $

218.3 $

(59.6) (27%)

Funded contract backlog represents contracts for which fiscal year funding has been appropriated by our customers (mainly

federal agencies), and for hosted services (mainly for wireless carriers). Backlog is computed by multiplying the most recent month’s

contract or subscription revenue by the months remaining under the existing long-term agreements, which is considered to be the best

available information for anticipating revenue under those agreements. Total backlog, as is typically measured by government

contractors, includes orders covering optional periods of service and/or deliverables, but for which budgetary funding may not yet

have been approved, and could expire unused. At December 31, 2013 our total backlog had $683 million of unfunded orders related to

the Worldwide Satellite Systems contract vehicle which will expire on March 31, 2014, so most will likely expire unused.

Our backlog at any given time may be affected by a number of factors, including the availability of funding, contracts being

renewed, or new contracts being signed before existing contracts are completed and the other factors described in the Company’s Risk

Factors as filed with the Securities and Exchange Commission from time to time. The timing and amounts of government contract

funding may be adversely affected by federal budget policy decision like handling of sequestration and continuing resolutions, and can

lead to delays in procurement of our products and services due to lack of funding. Some of our backlog could be canceled for causes

such as late delivery, poor performance and other factors. Accordingly, a comparison of backlog from period to period is not

necessarily meaningful and may not be indicative of eventual actual revenue.

Sales and Marketing

We sell our products and services through our direct sales force and through indirect channels. Our direct sales and marketing

force consists of approximately 75 professionals in the U.S., Europe, Latin America, Africa and Asia as of December 31, 2013. We

also leverage our relationships with larger companies to market our commercial systems. These indirect sales relationships include

AT&T, Huawei, and Alcatel-Lucent.

We are pre-qualified as an approved vendor for some government contracts, and some of our products and services are available

to government customers via the General Services Administration’s Information Technology Schedule 70, GTACS, CS2, and the

Space and the Naval Warfare Foreign Military Sales contract vehicles. We collaborate in sales efforts under various arrangements

with integrators. Our marketing efforts also include advertising, public relations, speaking engagements and attending and sponsoring

industry conferences.

Research and Development

Our success depends on a number of factors, which include, among other items, our ability to identify and respond to emerging

technological trends in our target markets, to develop and maintain competitive products, to enhance our existing products by adding

features and functionality that differentiate the products from those of our competitors, and to bring products to market on a timely

basis and at competitive prices. As of December 31, 2013, our overall staff included more than 780 professionals with technical

expertise in wireless network, client software development and satellite-based communication technology. Since 1996, we have made

substantial investments in wireless technology research and development, most of which has been devoted to the development of

carrier and enterprise network software products and services. We are primarily focusing our current research and development

investments in cellular location-based and electronic map technology, including 9-1-1 call routing and dispatch solutions, and highly

reliable tactical communication solutions.

We support existing telecommunications standards and promote new standards in order to expand the market for wireless data.

We actively participate in wireless standards-setting organizations including the Open Mobile Alliance, and our CEO is a member of