“We delivered solid results in 2013, despite an extremely challenging operating environment, while maintaining our uncompromising commitment to invest in the long-term growth of our business.”

Last year was uniquely challenging for the industry and for PMI. The exceptionally weak global macroeconomic environment had a significant impact on industry volume in a number of key markets.

Within this context, we withstood the pressures well and delivered a solid financial performance. This is testament to the strength of our business fundamentals – which include our strong pricing power, driven by our industry-leading brand portfolio – and our ability to overcome challenges with discipline and determination.

Our overall performance last year was adversely impacted by specific challenges in Japan and the Philippines.

In Japan, we endured sustained competitive activities throughout the year that eroded our market share. We fully intend to address the situation through a planned pipeline of strong portfolio initiatives and increased marketing investment and expect that our share should stabilize during 2014.

In the Philippines, we faced truly exceptional circumstances following an excise tax increase of unprecedented magnitude in January 2013. We believe that, by the end of last year, our main local competitor was still producing approximately double the volume that it was declaring for excise tax purposes, thereby subsidizing an artificially low price for its portfolio that, in turn, caused significant down-trading from our key brands, Marlboro and Fortune. While recent developments are encouraging, the situation is likely to remain uncertain for much of 2014. Our focus going forward will be on recovering our volume base and re-establishing a platform for long-term growth.

Our market share performance elsewhere was strong in 2013, with 23 of our top 30 income markets registering stable or growing share, the highest number of markets to do so since we became a public company in 2008. Our share performance was also strong, on an aggregate basis, with gains in three of our four Regions, namely the EU, EEMA and LA&C, up by 0.5, 0.2 and 1.1 percentage points, respectively. Excluding China and the Philippines, our market share in the Asia Region was down by 0.4 points, and our total international share was essentially flat.

Within the context of our overall share performance, Marlboro was resilient, particularly given the sizable total industry declines in a large number of its strongholds and down-trading across a wide range of markets. Most encouragingly, the brand continued to gain share in the EU Region, where it grew by 0.4 percentage points versus 2012, while also achieving growth in both the EEMA and LA&C Regions, up by 0.1 point and 0.4 points, respectively. Furthermore, excluding China and the Philippines, Marlboro grew by 0.1 share point in the Asia Region as well. In addition to the deployment of several innovative line extensions last year, some of which are featured later in this Report, we are ready to introduce the Marlboro Architecture 2.0. This new initiative will allow the core brand variants to firmly occupy more modern and smoother-tasting territories with new packaging and cigarette construction as well as an array of digital marketing platforms. We plan to initiate the worldwide rollout of the Marlboro Architecture 2.0 as of the second half of 2014.

Other major brands also fared well last year. Of particular note was the excellent performance of above premium Parliament, which grew volume by 2.9% versus 2012, and below premium L&M, which grew volume by 1.4% over the same period. Both brands benefited from the deployment of packaging upgrades and the launch of several innovative products, including the industry’s first-ever Recessed Filter capsule product, Parliament Hybrid, in Korea.

To support our brand portfolio, we continued to deploy a wide range of innovative adult consumer and trade engagement tools adapted to modern mobile channels. Last year, 37 markets had active pilot commercial programs in place, many of which contributed to significant increases in market share and strong organizational engagement. By the end of 2014, more than 45 markets – representing close to 90% of our operating companies income (OCI) – are expected to have fully deployed similar programs, which we believe should further accelerate the growth momentum of our brand portfolio.

Cigarette volume of 880.2 billion units in 2013 declined by 5.1% versus the previous year, driven almost exclusively by total market declines, notably in the EU Region, the Philippines, Russia and Turkey, partly offset by market share gains in the EU, EEMA and LA&C Regions. Excluding the impact of the Philippines, cigarette volume declined by 2.7% versus 2012.

Reported net revenues, excluding excise taxes, of $31.2 billion, reflecting constant currency growth of 1.9% versus 2012, fell short of our mid- to long-term annual growth target of 4% to 6%. This shortfall was due to the most severe volume/ mix impact in our history resulting from total market declines, which eroded a large part of our currency-neutral $2.1 billion positive price variance for the year – the highest price variance we have ever achieved.

Adjusted OCI reached $14.1 billion, up by 3.4% on a constant currency basis versus 2012, but below our growth target of 6% to 8%. Pricing was the key contributor to our OCI growth versus the previous year, while the adverse volume/mix and higher manufacturing costs weighed on our performance.

We surpassed our cost savings target of $300 million in 2013. Manufacturing and procurement-related savings helped offset increases in tobacco leaf and clove costs. In February this year, we announced a new annual productivity target of a further $300 million.

Adjusted diluted earnings per share (EPS) reached $5.40, up by 3.4% versus 2012 and by 10.0% on a constant currency basis, within our mid- to long-term growth target of 10% to 12%. Currency negatively impacted adjusted diluted EPS growth by $0.34 per share, representing a significant headwind

Free cash flow of $8.9 billion was up by $570 million versus 2012, mainly driven by improvements in working capital. Excluding the impact of unfavorable currency, our free cash flow grew by $990 million or 11.8% versus 2012.

We successfully completed a number of capital market transactions in 2013. We issued an aggregate of $7.3 billion in bonds at favorable interest rates and, in so doing, prolonged the average time to maturity of our total long-term debt to 10.8 years while simultaneously reducing the weighted average coupon of our total bond portfolio to 3.8%.

Our total shareholder return (TSR) in 2013 in U.S. Dollar terms was 8.5%, trailing that of the S&P 500 (32.4%), our Compensation Survey Group (27.6%), the FTSE 100 (20.9%) and our Tobacco Peers (17.5%). Strong currency headwinds, recent volume declines and our moderate EPS outlook for 2014 weighed on our share price.

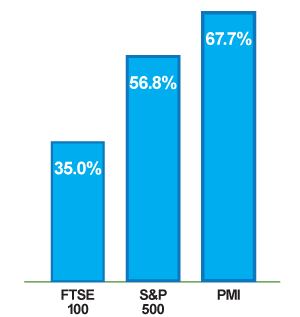

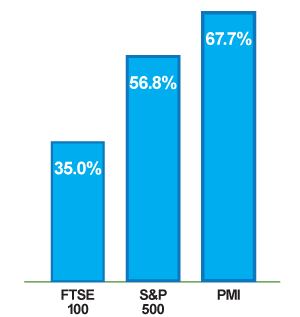

On a three-year basis beginning January 1, 2011, our TSR in U.S. Dollar terms of 67.7% was below that of our Tobacco Peers (71.6%), which includes the major American tobacco companies with U.S. Dollar earnings that were not comparably affected by currency exchange rates, but outperformed that of our Compensation Survey Group (63.6%), the S&P 500 (56.8%) and the FTSE 100 (35.0%).

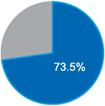

Our strong free cash flow enabled us to continue to reward shareholders generously, as demonstrated by our dividend increase last year of 10.6%, to an annualized rate of $3.76 per share, and $6.0 billion in total share repurchases. Since the spin-off in March 2008, we have increased the dividend rate by 104.3% and have spent $33.9 billion through the end of 2013 to repurchase 556.2 million shares – representing 26.4% of our initial shares outstanding – at an average price of $60.86 per share.

Business Development

In 2013 we finalized certain important business development initiatives that we expect will enhance our long-term competitiveness and growth prospects.

These included: the purchase of the remaining 20% interest in our affiliate in Mexico; the purchase of a 49% interest in Arab Investors-TA, which will bring our economic interest in Société des Tabacs Algéro-Emiratie (STAEM) in Algeria to approximately 25%; the acquisition of a 20% interest in Megapolis, our distributor in Russia; and the restructuring of our business in Egypt. These transactions are accretive to our earnings and will yield attractive returns. In addition, we finalized a strategic framework with our former parent, Altria Group, Inc., related to the commercialization of certain reduced-risk products, subject to FDA authorization, and e-cigarettes.

2011-2013 Total Shareholder Return - US$

Six Consecutive Dividend Increases Since the Spin-Off

The Fiscal, Regulatory and Illicit Trade Environment

Our record-high pricing variance in 2013 reflects not only the strength of our brand portfolio but also the broadly rational excise tax environment that prevails internationally. Overall, we did not face any disruptive excise tax increase around the world – with the obvious exception of the Philippines. Importantly, an increasing number of governments have now implemented multi-year excise tax plans that increase predictability. We also continued to see improved and more effective tax structures through high specific-to-total tax ratios, as well as higher levels of minimum excise tax yields. Despite this good progress, certain key markets still maintain high ad-valorem regimes and thus remain a priority for change.

The European Union Tobacco Products Directive (TPD) was the subject of a highly politicized debate throughout 2013. While it was encouraging to eventually see the elimination or moderation of certain irrational TPD provisions, such as the ban on slimmer-diameter cigarettes, the Directive regretfully still contains oversized health warnings without any apparent concern for property rights that the EU Charter protects and several provisions that fail to meet the standards of sound evidence-based policy. Once the TPD comes into force – expected during the second quarter of 2014 – Member States will have up to 24 months to transpose its text into national legislation.

Beyond the TPD, 2013 was a year of intensifying regulatory pressure across the globe. Nevertheless, numerous legislative initiatives advocating plain packaging, display bans and/or ingredients restrictions were averted, rejected or made subject to an injunction, demonstrating our continued ability as a company and/or industry to prevail in the face of extreme measures that ignore scientific evidence or rely on dubious facts. We have demonstrated our readiness to resort to legal action when political dialogue fails.

Growth in the illicit trade of cigarettes continues unabated despite some progress in certain markets. Challenging economic conditions in the EU Region, coupled with the impact of large excise tax increases in markets, such as the Philippines, Russia and Turkey, are exacerbating this phenomenon. We remain committed to combating this threat through our well-staffed and centralized organizational structure, our agreement with Interpol and the industry’s recent progress in enhancing controls surrounding the supply of critical raw materials, especially acetate tow, which could have the most significant impact on reducing illicit production in the short-term.

Research & Development and Environment, Health & Safety

We made very substantial progress on the exciting reduced-risk product front (RRP) – the term we use to refer to products that have the potential to reduce individual risk and population harm. We announced, in January this year, our plans to construct our first reduced-risk products manufacturing facility in Italy and have selected the electronic device supplier for our Platform 1 “heat-not-burn” product. We initiated the eight planned clinical trials of our Platform 1 in 2013 which we expect to complete this year. In parallel, we greatly advanced our preparation for the commercialization of RRPs in terms of our marketing programs and business model, including our supply and after-sales chain. Consequently, we have announced our decision to accelerate the launch of our Platform 1 product with pilot city tests in 2014 and a national launch in 2015. Our Platform 2 product is in the pre-clinical testing phase and early stages of industrial scale-up, while our Platform 3 product is still in the product development phase and early stages of pre-clinical assessment. We intend to enter the e-cigarette category in the second half of 2014 with current generation technology, but with an improved taste. We are also developing other potential platforms and are working on developing the next generation of e-cigarette technology.

On the RRP regulatory front, we have shared our approach and studies with the U.S. Food & Drug Administration’s Center for Tobacco Products. In parallel, we have begun to engage with regulators in several other markets. The TPD, although disappointing for its failure to provide a comprehensive regulatory framework for RRPs in the EU, does not raise any insurmountable hurdles to their commercialization.

Our Agricultural Labor Practices program rollout is on track. By the end of 2013, all of our more than 3,700 field technicians had received additional training, and 98% of our approximately 500,000 farmers had already been enrolled in the program in more than 30 countries. The U.S. Department of Labor acknowledged PMI’s continued efforts to address child labor and migrant workers’ issues and removed Kazakhstani tobacco from their List of Goods Produced by Child Labor or Forced Labor.

On the environmental front, the Carbon Disclosure Project awarded us a score of 97%, up by six points versus 2012, and recognized PMI as one of only five Global 500 Consumer Staples companies to be a carbon disclosure leader. We aim to continue our leading performance and have set clear targets to further improve our environmental sustainability.

Also of note was the significant improvement in lost-time injuries in our factories to a record-low rate that represented a 60% reduction over the previous year, reflecting our unfailing focus on workplace safety.

The Organization

Last year marked the third edition of our biennial employee opinion survey since the spin-off. Key findings from the survey included spectacular progress in overall employee engagement and managerial effectiveness, well above global norms; tangible evidence that the numerous organizational initiatives we have put in place over the past few years are bearing fruit; and a clear demonstration that short-term adversities forge our employees’ determination and unfailing belief in the company’s bright future. The survey also allowed us to identify certain areas for further improvement which we are addressing. Last year, we continued to strengthen the depth and breadth of our already impressive talent pool, and to improve our organizational effectiveness, collaborative spirit and long-term focus.

Importantly, diversity and, in particular, gender balance improvement at all levels, continue to be a key focus area for the organization.

As of 2014, we are adopting a modified salary grade structure that better addresses PMI’s current organizational needs. We have also reduced our target variable compensation levels, while increasing the relative mix of equity versus cash for senior management, to better reflect current market practices and to increase even further the focus of management on longer-term performance.

We are blessed with an exceptional Board of Directors and derive great benefit from its tremendous experience. The Chief Executive Officer (CEO) transition was planned and executed seamlessly, and the separation of the Chairman and CEO roles operates with utmost efficiency. The relationship between the Board and management continues to be governed by total transparency and a very positive atmosphere.

Last year ended on the profoundly sad note of Graham Mackay’s passing. Graham had served as a member of our Board of Directors since our transition to a public company in March 2008. As the Executive Chairman of one of the largest brewers in the world, he brought invaluable business, strategic, marketing and regulatory insights to PMI’s Board. He will be sorely missed.

Finally, Mathis Cabiallavetta and J. Dudley Fishburn will retire from the Board of Directors at the Annual Meeting in May this year. Mathis and Dudley also served on the Board since our spin-off, and we have benefited tremendously from their dedicated service and invaluable advice. They leave with our most heartfelt gratitude.

The Year Ahead

We delivered solid results in 2013, despite an extremely challenging operating environment, while maintaining our uncompromising commitment to invest in the long-term growth of our business. The challenges of last year will likely persist well into 2014, but we have sharpened our ability to confront adversity and are focused on what needs to be done. We are blessed with some of the best resources in the industry, from our world-class portfolio of leading brands to a depth and breadth of employee talent that is second-to-none. We will continue to meet our challenges head-on in 2014 and, through judicious additional investment into the business, reinvigorate our growth prospects for 2015 and beyond, all with the objective of maintaining our steadfast commitment to generously reward our shareholders.

André Calantzopoulos, Chief Executive Officer

Louis C. Camilleri, Chairman of the Board

March 7, 2014

30%*

30%*