55

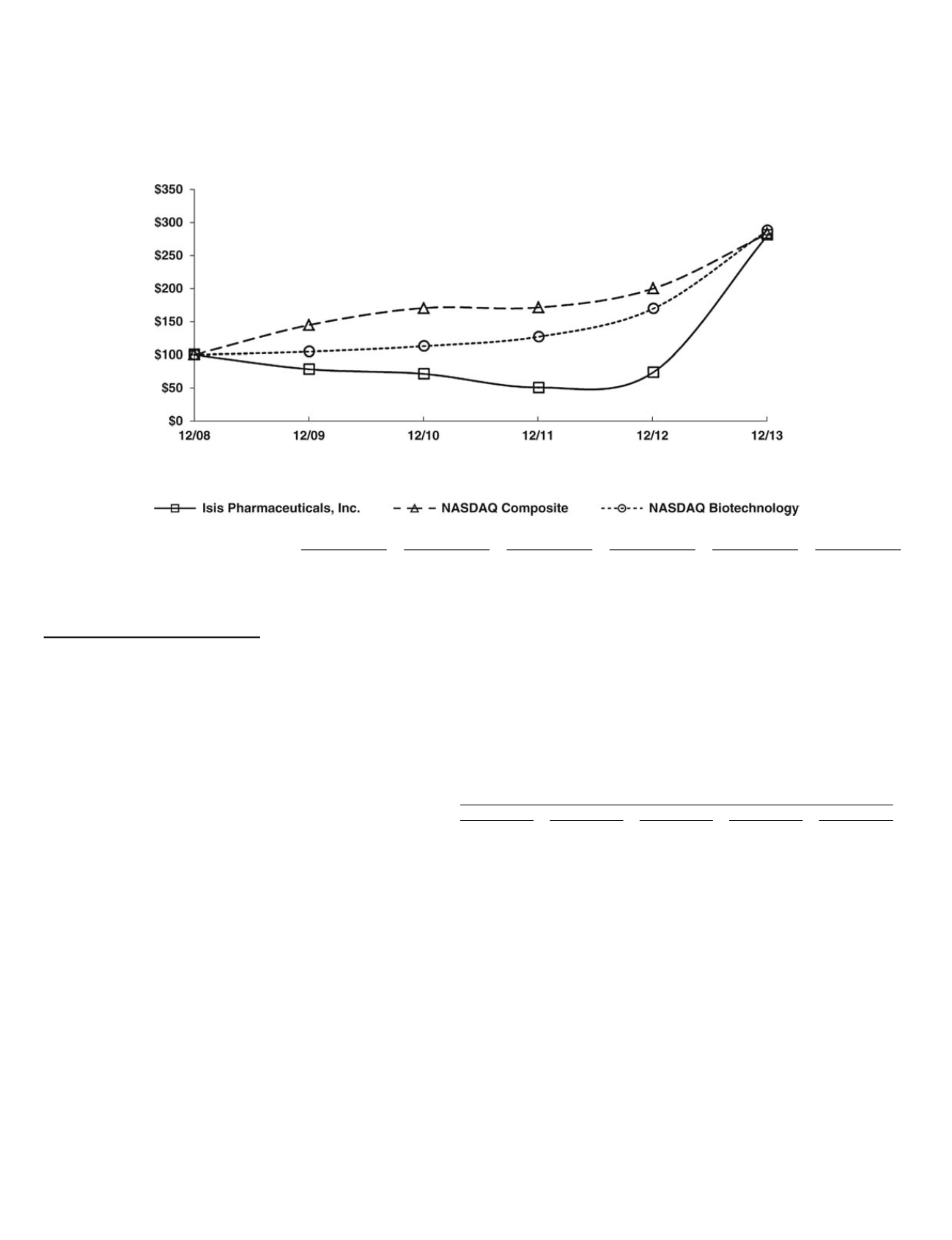

PerformanceGraph (1)

COMPARISONOF5YEARCUMULATIVETOTALRETURN

Among Isis Pharmaceuticals, Inc., theNASDAQComposite Index,

and theNASDAQBiotechnology Index

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Isis Pharmaceuticals, Inc. .............. $

100 $

78.35 $

71.37 $

50.85 $

73.62 $ 280.96

NASDAQComposite Index ......... $

100 $ 144.88 $ 170.58 $ 171.30 $

199.99 $ 283.39

NASDAQBiotechnology Index ... $

100 $ 104.67 $ 112.89 $ 127.04 $

169.50 $ 288.38

(1) This section is not “solicitingmaterial,” is not deemed “filed”with theSEC, is not subject to the liabilities of Section18of the

ExchangeAct and is not tobe incorporatedby reference in any of our filings under theSecuritiesAct or theExchangeAct, whether

made before or after the date hereof and irrespective of anygeneral incorporation language in any such filing.

Item6. SelectedFinancialData

Set forthbelow are our selected consolidated financial data (in thousands, except per share amounts):

YearsEndedDecember 31,

2013

2012

2011

2010

2009

ConsolidatedStatement ofOperationsData:

Revenue ............................................................................... $ 147,285 $ 102,049 $ 99,086 $ 108,473 $ 121,600

Research, development andpatent expenses ....................... $ 184,033 $ 158,458 $ 157,397 $ 145,160 $ 134,623

Net loss from continuingoperations attributable to Isis

Pharmaceuticals, Inc. common stockholders ................... $ (60,644) $ (65,478) $ (84,801) $ (61,251) $ (30,562)

Net income (loss) attributable to Isis Pharmaceuticals,

Inc. common stockholders ............................................... $ (60,644) $ (65,478) $ (84,801) $ (61,251) $ 155,066

Basic anddilutednet loss per share from continuing

operations attributable to Isis Pharmaceuticals, Inc.

common stockholders ...................................................... $ (0.55) $ (0.65) $ (0.85) $

(0.62) $ (0.31)

Basic anddilutednet income (loss) per share attributable

to Isis Pharmaceuticals, Inc. common stockholders ........ $ (0.55) $ (0.65) $ (0.85) $

(0.62) $ 1.58

Shares used in computingbasic anddilutednet income

(loss) per share .................................................................

110,502

100,576

99,656

99,143

98,109