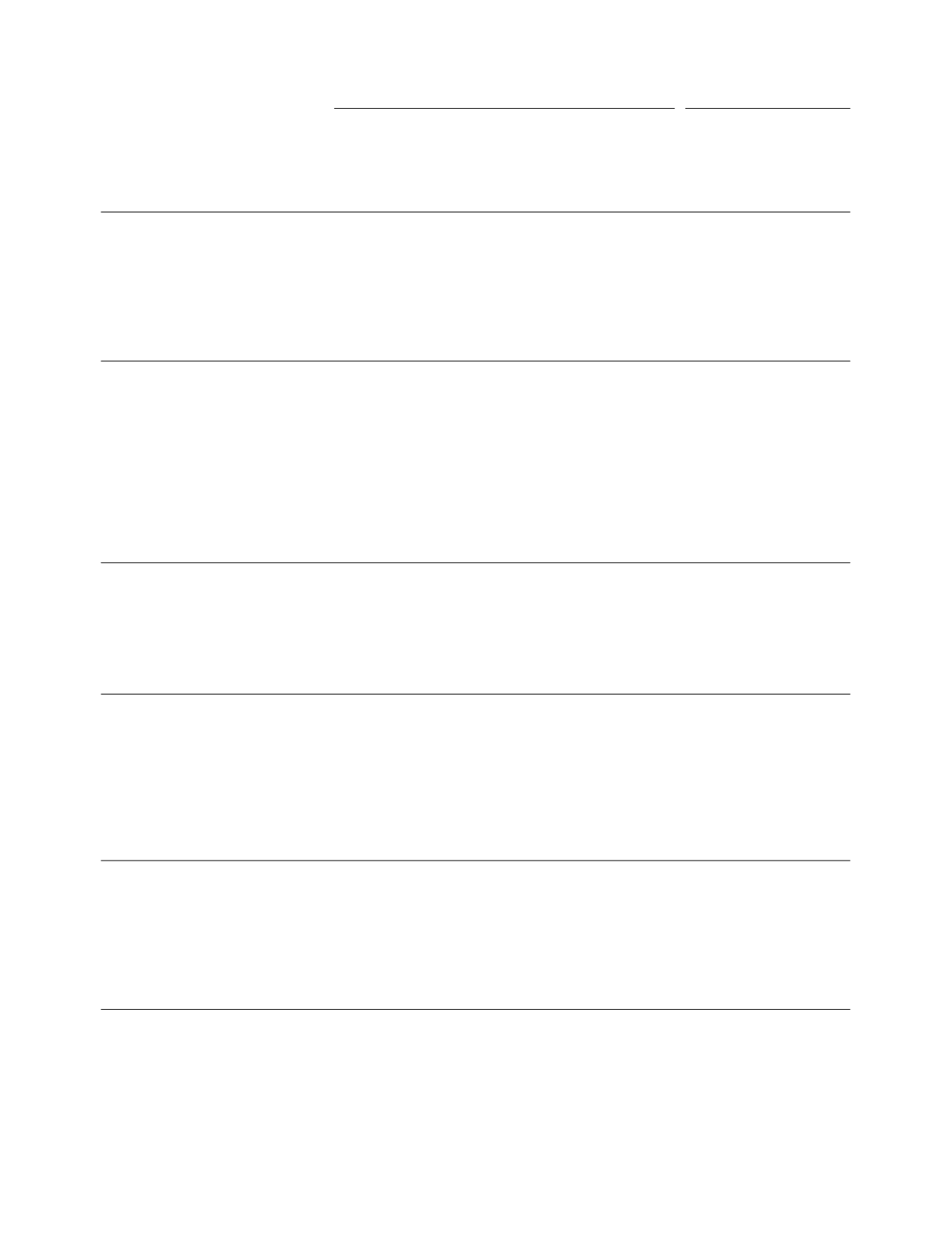

Outstanding EquityAwards At December 31, 2014

OptionAwards

StockAwards

Name

Grant

Date

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

(1)

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

Option

Exercise

Price ($)

Option

Expiration

Date

Number of

Shares or

Units of

Stock that

Have Not

Vested

(2)

Market

Value of

Shares or

Units of

Stock that

Have Not

Vested

(3)

($)

Stanley T. Crooke. . . .

1/4/2010 109,163

— $ 11.27

1/3/2017

—

—

1/3/2011 119,552

2,544

$ 10.29

1/2/2018

—

—

1/3/2012

78,169

29,034

$ 7.25

1/2/2019

—

—

1/30/2013

63,815

69,365

$ 14.69 1/29/2020

—

—

1/2/2014

— 187,500

$ 39.87

1/1/2021

—

—

1/15/2012

—

—

—

— 5,954 $ 367,600

1/30/2013

—

—

—

— 16,642 $1,027,477

1/15/2014

—

—

—

— 31,250 $1,929,375

Elizabeth L. Hougen. .

1/2/2009

12,657

— $ 14.47

1/1/2016

—

—

1/4/2010

20,000

— $ 11.27

1/3/2017

—

—

1/3/2011

21,541

459

$ 10.29

1/2/2018

—

—

1/3/2012

14,218

5,282

$ 7.25

1/2/2019

—

—

1/2/2013

7,522

8,178

$ 10.82

1/1/2020

—

—

1/2/2013

3,593

3,907

$ 10.82

1/1/2020

—

—

1/2/2014

— 45,000

$ 39.87

1/1/2021

—

—

1/15/2012

—

—

—

— 1,082 $ 66,803

1/15/2013

—

—

—

— 937 $ 57,850

1/15/2013

—

—

—

— 1,961 $ 121,072

1/15/2014

—

—

—

— 1,082 $ 66,803

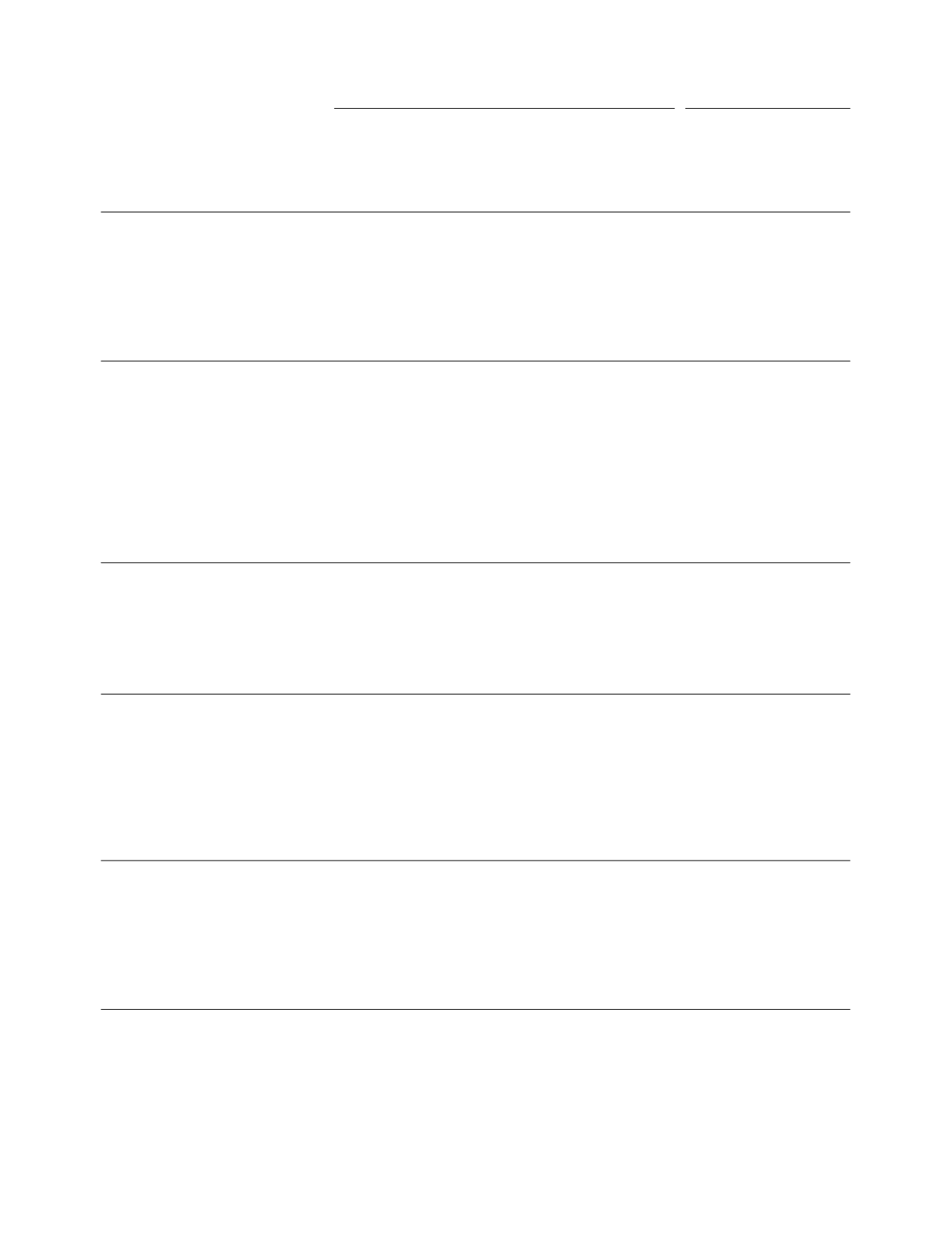

B. Lynne Parshall. . . .

1/3/2011

6,074

1,519

$ 10.29

1/2/2018

—

—

1/3/2012

5,146

16,724

$ 7.25

1/2/2019

—

—

1/30/2013

27,332

32,438

$ 14.69 1/29/2020

—

—

1/2/2014

0

82,500

$ 39.87

1/2/2021

—

—

1/15/2012

—

—

—

— 3,430 $ 211,768

1/30/2013

—

—

—

— 7,785 $ 480,646

1/30/2014

—

—

—

— 13,750 $ 848,925

Brett P. Monia . . . . . .

1/3/2011

7,129

471

$ 10.29

1/2/2018

—

—

1/1/2012

5,468

2,032

$ 7.21 12/31/2018

—

—

1/3/2012

3,849

5,144

$ 7.25

1/2/2019

—

—

1/30/2013

16,291

17,709

$ 14.69 1/29/2020

—

—

1/2/2014

0

45,000

$ 39.87

1/1/2021

—

—

1/15/2012

—

—

—

— 1,054 $ 65,074

1/15/2012

—

—

—

— 416 $ 25,684

1/30/2013

—

—

—

— 4,245 $ 262,086

1/15/2014

—

—

—

— 7,500 $ 463,050

Richard S. Geary . . . .

1/4/2010

80

— $ 11.27

1/3/2017

—

—

1/3/2011

7,729

697

$ 10.29

1/2/2018

—

—

1/3/2012

6,470

7,565

$ 7.25

1/2/2019

—

—

1/30/2013

7,771

17,469

$ 14.69 1/29/2020

—

—

1/2/2014

0

45,000

$ 39.87

1/1/2021

—

—

1/15/2012

—

—

—

— 1,551 $ 95,759

1/30/2013

—

—

—

— 4,192 $ 258,814

1/15/2014

—

—

—

— 7,500 $ 463,050

(1) The options have a term of seven years and vest at the rate of 25% for the first year and then at the rate of 2.08%per month for 36

months thereafter during the optionee’s employment.

(2) The RSUs were granted out of our 2011 Equity Incentive Plan. The RSUs vest at the rate of 25%per year over four years.

(3) Market value of stock awards was determined by multiplying the number of unvested shares by $61.74, which was the closing market

price of our common stock on the Nasdaq Global Select Market on December 31, 2014, the last trading day of fiscal 2014.

114