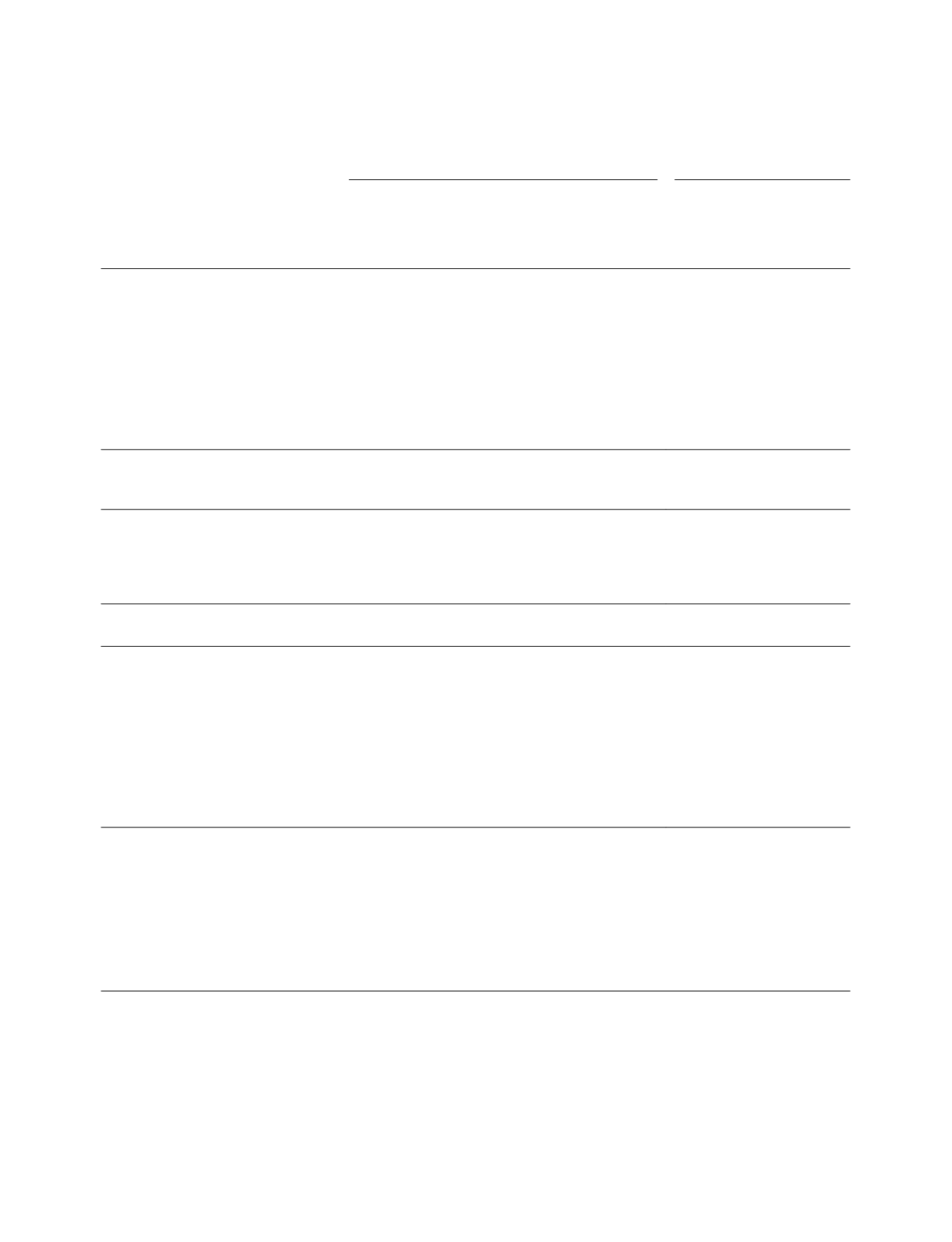

Outstanding EquityAwards at Fiscal Year-End – Directors

The following table shows for the fiscal year ended December 31, 2014, certain information regarding

outstanding awards at fiscal year-end of all our non-employee Directors:

Outstanding EquityAwards At December 31, 2014

OptionAwards

StockAwards

Name

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

(1)

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or

Units of Stock

that Have Not

Vested

(2) (3)

Market Value

of Shares or

Units of Stock

that Have Not

Vested

(4)

($)

Spencer R. Berthelsen. . . . . . . . . . . . .

10,000

0

$ 3.95 6/30/15

4,697

$ 289,993

12,500

0

$ 5.93 7/2/16

12,500

0

$ 9.77 7/1/17

15,000

0

$13.88 6/30/18

15,000

0

$16.32 6/30/19

15,000

0

$ 9.22 6/30/20

11,250

3,750

$ 9.30 6/30/21

5,626

5,624

$12.94 7/1/22

2,813

8,437

$28.47 6/30/23

0

16,000

$35.53 6/30/24

Breaux B. Castleman . . . . . . . . . . . . .

5,625

16,875

$26.66 6/24/23

6,885

$ 425,080

2,813

8,437

$28.47 6/30/23

0

16,000

$35.53 6/30/24

Joseph Klein . . . . . . . . . . . . . . . . . . .

3,750

0

$ 9.22 6/30/20

4,697

$ 289,993

3,750

$ 9.30 6/30/21

2,813

5,624

$12.94 7/1/22

2,813

8,437

$28.47 6/30/23

0

16,000

$35.53 6/30/24

Joseph Loscalzo . . . . . . . . . . . . . . . . .

0

22,500

$49.09 2/2/24

6,417

$ 396,186

0

16,000

$35.53 6/30/24

Frederick T. Muto . . . . . . . . . . . . . . .

10,000

0

$ 3.95 6/30/15

4,697

$ 289,993

12,500

0

$ 5.93 7/2/16

12,500

0

$ 9.77 7/1/17

15,000

0

$13.88 6/30/18

15,000

0

$16.32 6/30/19

15,000

0

$ 9.22 6/30/20

11,250

3,750

$ 9.30 6/30/21

5,626

5,624

$12.94 7/1/22

2,813

8,437

$28.47 6/30/23

0

16,000

$35.53 6/30/24

Joseph H. Wender . . . . . . . . . . . . . . .

10,000

0

$ 3.95 6/30/15

4,697

$ 289,993

12,500

0

$ 5.93 7/2/16

12,500

0

$ 9.77 7/1/17

15,000

0

$13.88 6/30/18

15,000

0

$ 9.22 6/30/20

11,250

3,750

$ 9.30 6/30/21

5,626

5,624

$12.94 7/1/22

2,813

8,437

$28.47 6/30/23

0

16,000

$35.53 6/30/24

(1) The options were granted out of our Directors’ Plan and have a term of ten years and vest at the rate of 25%per year over four years.

(2) The RSUs were granted out of our Directors’ Plan and vest at the rate of 25%per year over four years.

(3) All of our non-employee Directors are subject to our Stock Holding and Ownership Guidelines for RSU Shares, which requires each

non-employee Director to accumulate and maintain shares of Common Stock issued pursuant to RSUs until he has accumulated shares

of Common Stock equal to four times such non-employee Director’s base annual cash retainer for service as a Director (but not for

service on a Board committee), or until his termination of service.

(4) Market value of stock awards was determined by multiplying the number of unvested shares by $61.74, which was the closing market

price of our common stock on the Nasdaq Select Market on December 31, 2014, the last trading day of fiscal 2014.

118