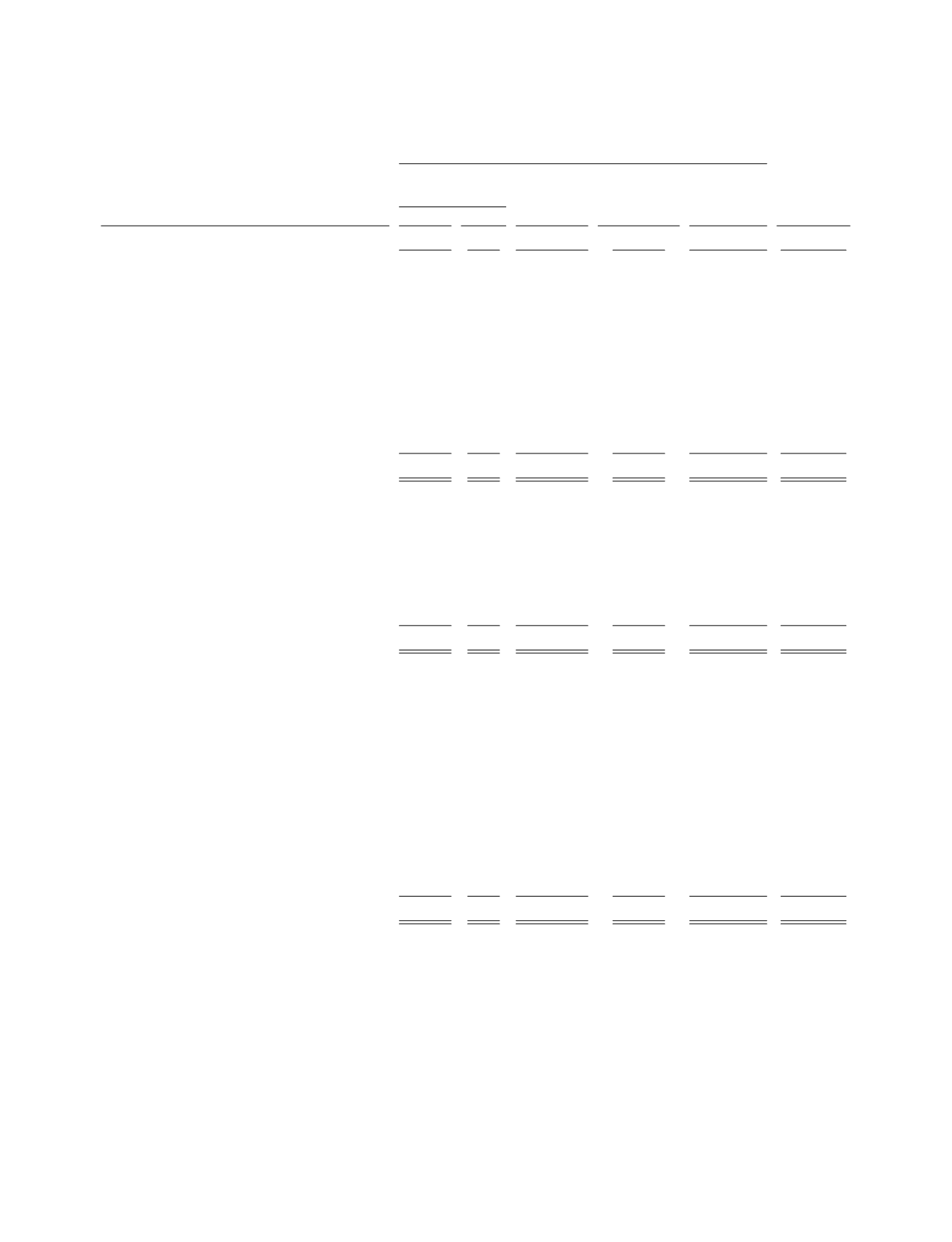

ISIS PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTSOF STOCKHOLDERS’ EQUITY

Years Ended December 31, 2014, 2013 and 2012

(In thousands)

Isis Pharmaceuticals, Inc. Stockholders’ Equity

Common stock

Additional

paid in

capital

equity

Accumulated

other

comprehensive

income (loss)

Accumulated

deficit

Total

stockholders’

Description

Shares Amount

Balance at December 31, 2011

. . . . . . . . . . 100,043 $100 $1,013,592 $ (770) $ (841,488) $ 171,434

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — — (65,478) (65,478)

Change in unrealized gains (losses),

net of tax . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — 13,250

— 13,250

Issuance of common stock in connection

with employee stock plans . . . . . . . . . . . .

1,438

2

9,468

—

— 9,470

2

⅝

percent convertible subordinated notes

redemption, equity portion . . . . . . . . . . . .

— — (12,041)

—

— (12,041)

2¾ percent convertible senior notes,

equity portion, net of issuance costs. . . . .

— — 57,560

—

— 57,560

Share-based compensation expense . . . . . . .

— — 8,571

—

— 8,571

Balance at December 31, 2012

. . . . . . . . . . 101,481 $102 $1,077,150 $12,480 $ (906,966) $ 182,766

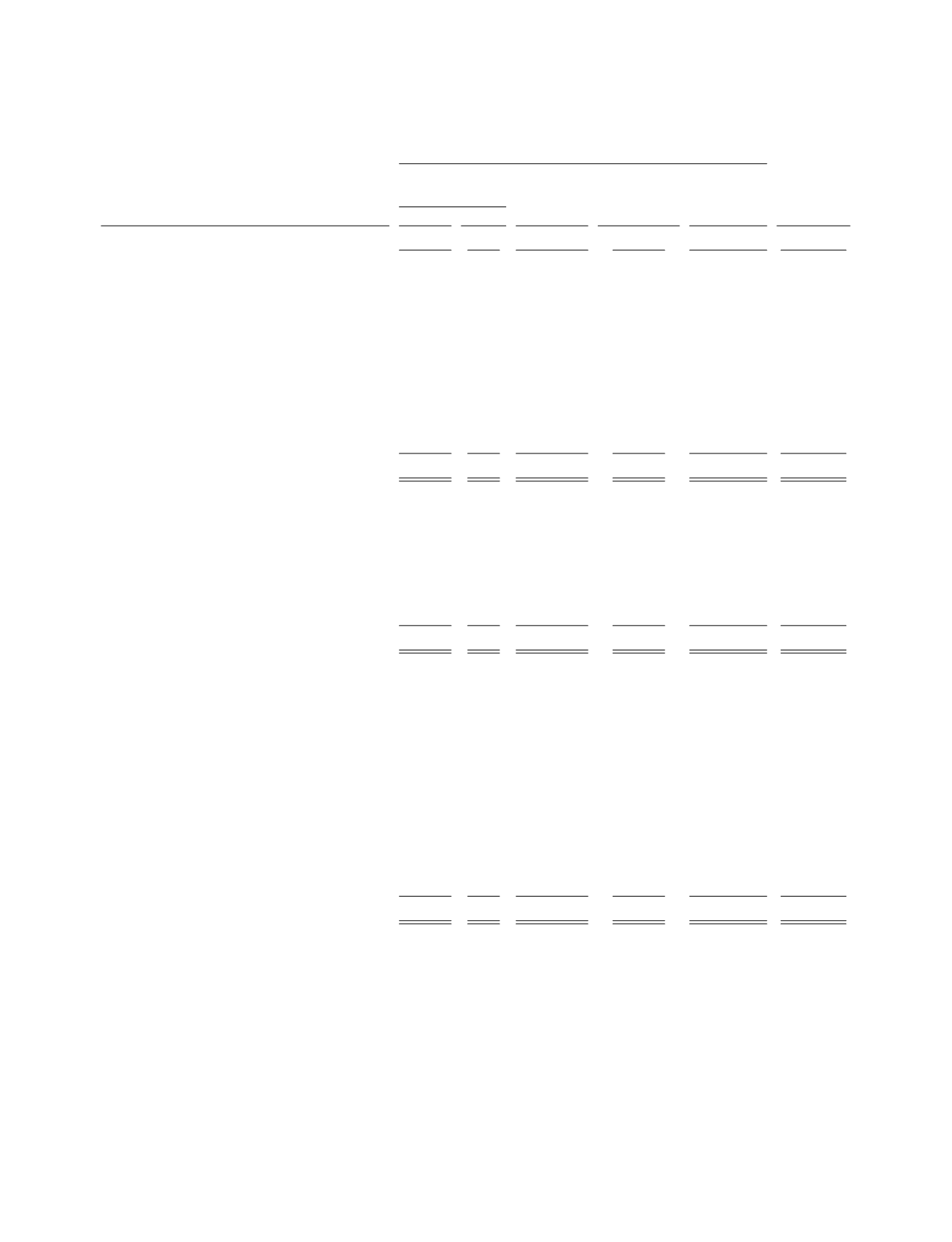

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — — (60,644) (60,644)

Change in unrealized gains (losses),

net of tax . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — 8,600

— 8,600

Issuance of common stock in connection

with employee stock plans . . . . . . . . . . . .

5,372

5

62,953

—

— 62,958

Issuance of public common stock. . . . . . . . .

9,618

9 173,283

—

— 173,292

Share-based compensation expense . . . . . . .

— — 11,418

—

— 11,418

Balance at December 31, 2013

. . . . . . . . . . 116,471 $116 $1,324,804 $21,080 $ (967,610) $ 378,390

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — — (38,984) (38,984)

Change in unrealized gains (losses),

net of tax . . . . . . . . . . . . . . . . . . . . . . . . . .

— — — 18,667

— 18,667

Issuance of common stock in connection

with employee stock plans . . . . . . . . . . . .

1,972

2

23,071

—

— 23,073

2¾ percent convertible senior notes

repurchase, equity portion. . . . . . . . . . . . .

— — (326,444)

—

— (326,444)

1 percent convertible senior notes,

equity portion, net of issuance costs. . . . .

— — 170,232

—

— 170,232

Share-based compensation expense . . . . . . .

— — 31,383

—

— 31,383

Excess tax benefits from share-based

compensation awards. . . . . . . . . . . . . . . . .

— — 1,463

—

— 1,463

Balance at December 31, 2014

. . . . . . . . . . 118,443 $118 $1,224,509 $39,747 $(1,006,594) $ 257,780

See accompanying notes.

F-6