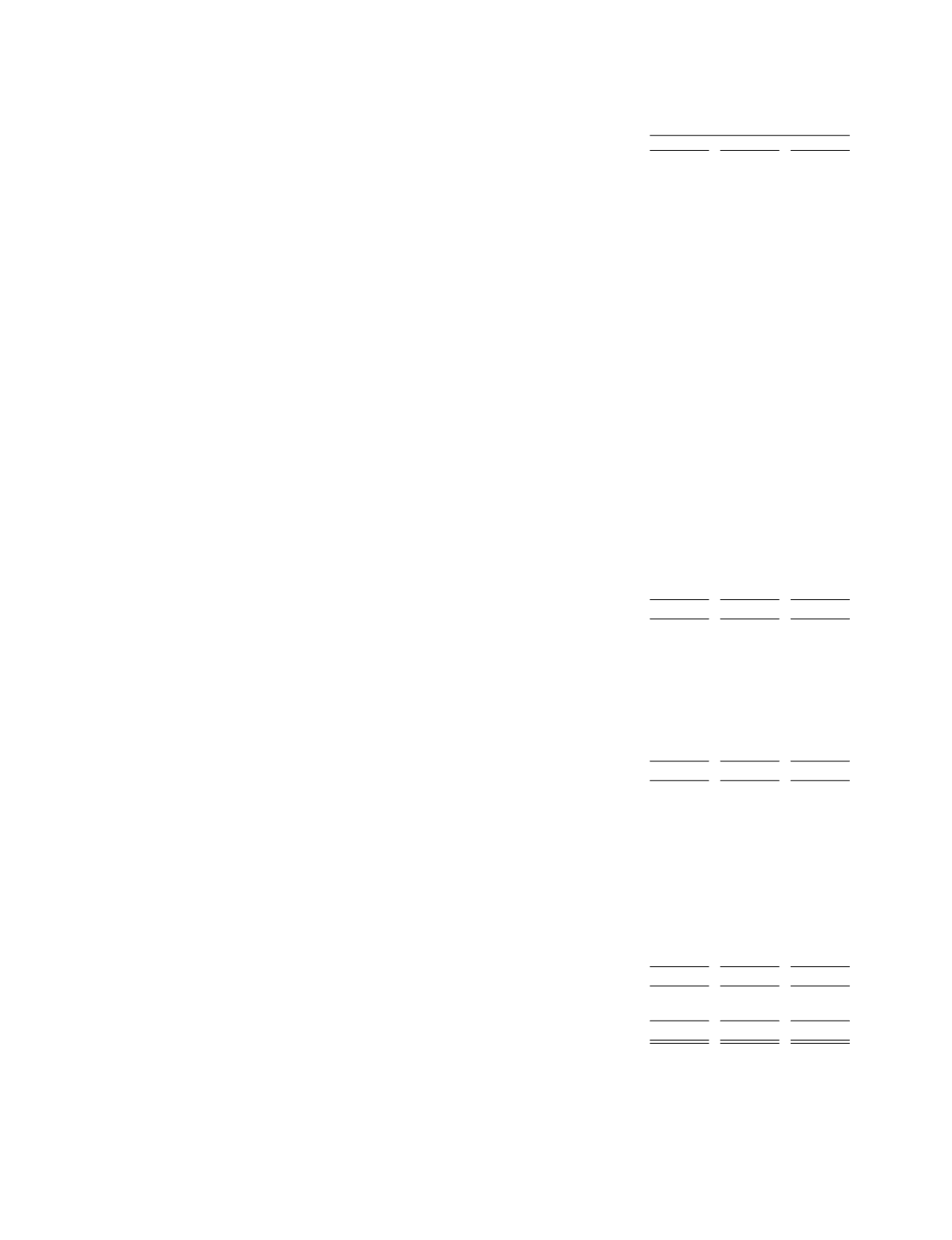

ISIS PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTSOFCASHFLOWS

(In thousands)

Years Ended December 31,

2014

2013

2012

Operating activities:

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (38,984) $ (60,644) $ (65,478)

Adjustments to reconcile net loss to net cash provided by operating activities:

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6,380

6,591

7,074

Amortization of patents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,142

1,184

1,224

Amortization of licenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,882

2,007

2,457

Amortization of premium on investments, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,470

5,572

4,193

Amortization of debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

595

415

619

Amortization of 2

⅝

percent convertible subordinated notes discount . . . . . . . . . . . . . . .

— — 6,169

Amortization of 2¾ percent convertible senior notes discount . . . . . . . . . . . . . . . . . . . .

6,723

6,344

2,268

Amortization of 1 percent convertible senior notes discount . . . . . . . . . . . . . . . . . . . . .

2,256

— —

Amortization of long-term financing liability for leased facility. . . . . . . . . . . . . . . . . . .

6,622

6,567

6,503

Share-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31,383 11,418

8,571

Equity in net loss of Regulus Therapeutics Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — 1,406

Gain on investment in Regulus Therapeutics Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(19,902)

— (18,356)

Loss on early retirement of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8,292

— 4,770

Gain on investments, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1,256)

(2,378)

(1,465)

Non-cash losses related to patents, licensing and property, plant and equipment . . . . . . .

1,305

6,306

825

Tax benefit from other unrealized gains on securities . . . . . . . . . . . . . . . . . . . . . . . . . .

(12,835)

(5,914)

(9,111)

Changes in operating assets and liabilities:

Contracts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,199 (10,580)

6,399

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,743 (1,912)

(1,982)

Other current and long-term assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1,750)

(1,091)

279

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4,824

66

1,292

Income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4,034)

— —

Accrued compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

134

4,290 (1,305)

Deferred rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

153

217

255

Accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8,358

6,691 (3,254)

Deferred contract revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(11,415)

88,344 48,523

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6,285 63,493

1,876

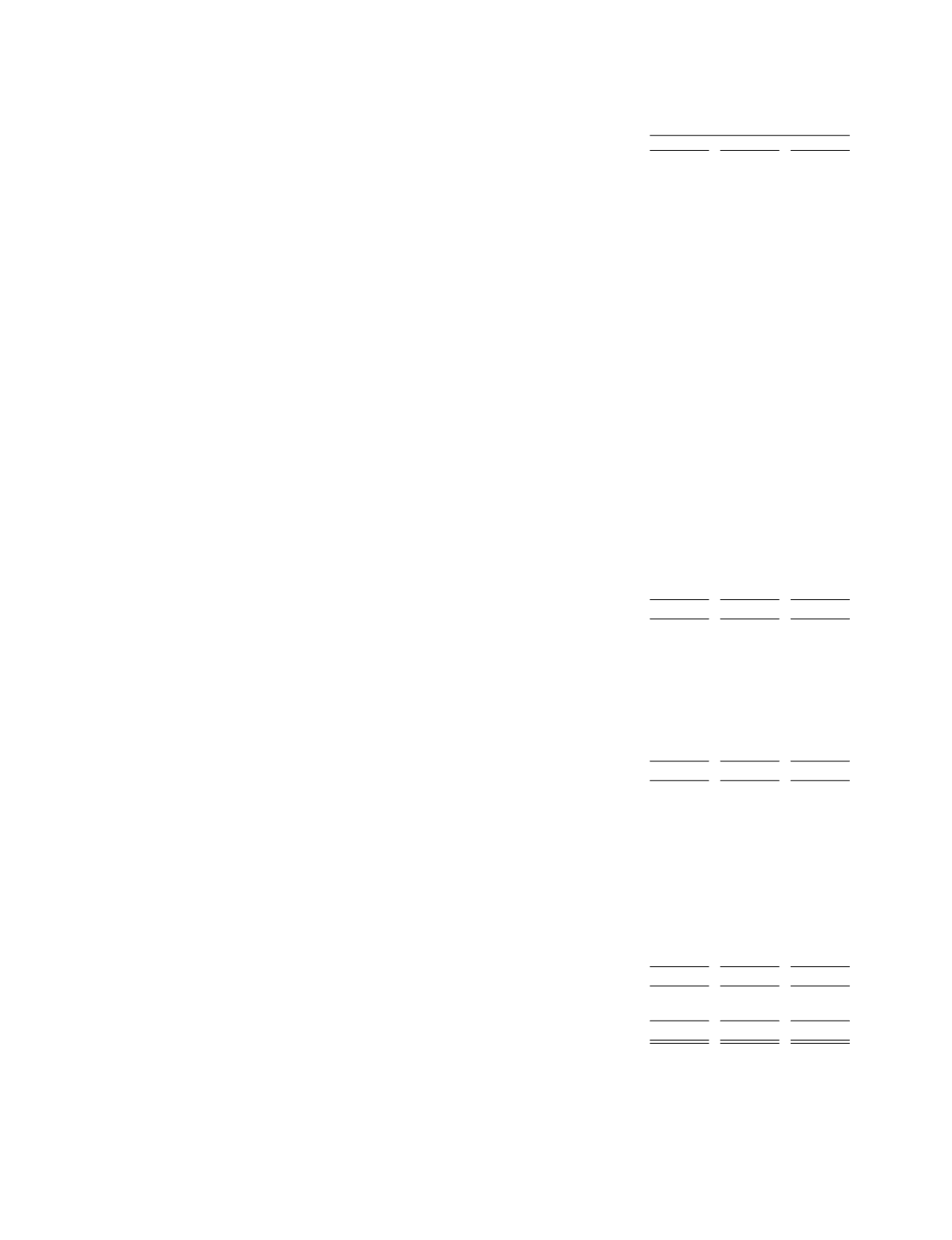

Investing activities:

Purchases of short-term investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(391,883) (425,554) (217,877)

Proceeds from the sale of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . .

294,727 172,762 242,659

Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(7,518)

(1,552)

(1,479)

Acquisition of licenses and other assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3,586)

(3,810)

(3,691)

Investment in Regulus Therapeutics Inc.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — (3,000)

Purchases of strategic investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — (790)

Proceeds from the sale of Regulus Therapeutics, Inc. . . . . . . . . . . . . . . . . . . . . . . . .

22,949

— —

Proceeds from the sale of strategic investments . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,463

2,428

2,177

Net cash (used in) provided by investing activities . . . . . . . . . . . . . . . . . . . . . . . .

(82,848) (255,726)

17,999

Financing activities:

Proceeds from equity awards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23,071 62,958

9,470

Proceeds from issuance of 2¾ percent convertible senior notes, net of issuance costs .

— — 194,697

Proceeds from issuance of 1 percent convertible senior notes, net of issuance costs . .

487,035

— —

Principal and premium payment on redemption of the 2

⅝

percent convertible

subordinated notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — (163,718)

Repurchase of $140 million principal amount of the 2¾ percent convertible senior

notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(441,394)

— —

Proceeds from public common stock offering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— 173,292

—

Proceeds from equipment financing arrangement . . . . . . . . . . . . . . . . . . . . . . . . . . .

— 2,513

9,100

Excess tax benefits from share-based compensation awards. . . . . . . . . . . . . . . . . . . .

1,463

— —

Principal payments on debt and capital lease obligations. . . . . . . . . . . . . . . . . . . . . .

(10,587) (11,039) (10,419)

Net cash provided by financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

59,588 227,724 39,130

Net (decrease) increase in cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(16,975)

35,491 59,005

Cash and cash equivalents at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . .

159,973 124,482 65,477

Cash and cash equivalents at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 142,998 $ 159,973 $ 124,482

Supplemental disclosures of cash flow information:

Interest paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,353 $ 6,000 $ 5,770

Supplemental disclosures of non-cash investing and financing activities:

Amounts accrued for capital and patent expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,151 $ 704 $ 647

F-7

See accompanying notes.