Inventory valuation

We capitalize the costs of rawmaterials that we purchase for use in producing our drugs because until we

use these rawmaterials they have alternative future uses. We include in inventory rawmaterial costs for drugs

that we manufacture for our partners under contractual terms and that we use primarily in our clinical

development activities and drug products. We can use each of our rawmaterials in multiple products and, as a

result, each rawmaterial has future economic value independent of the development status of any single drug.

For example, if one of our drugs failed, we could use the rawmaterials for that drug to manufacture our other

drugs. We expense these costs when we deliver the drugs to our partners, or as we provide these drugs for our

own clinical trials. We reflect our inventory on the balance sheet at the lower of cost or market value under the

first-in, first-out method. We review inventory periodically and reduce the carrying value of items we consider to

be slowmoving or obsolete to their estimated net realizable value. We consider several factors in estimating the

net realizable value, including shelf life of rawmaterials, alternative uses for our drugs and clinical trial

materials, and historical write-offs. We did not record any inventory write-offs for the years ended December 31,

2014, 2013 or 2012. Total inventory was $6.3 million and $8.0 million as of December 31, 2014 and 2013,

respectively.

Property, plant and equipment

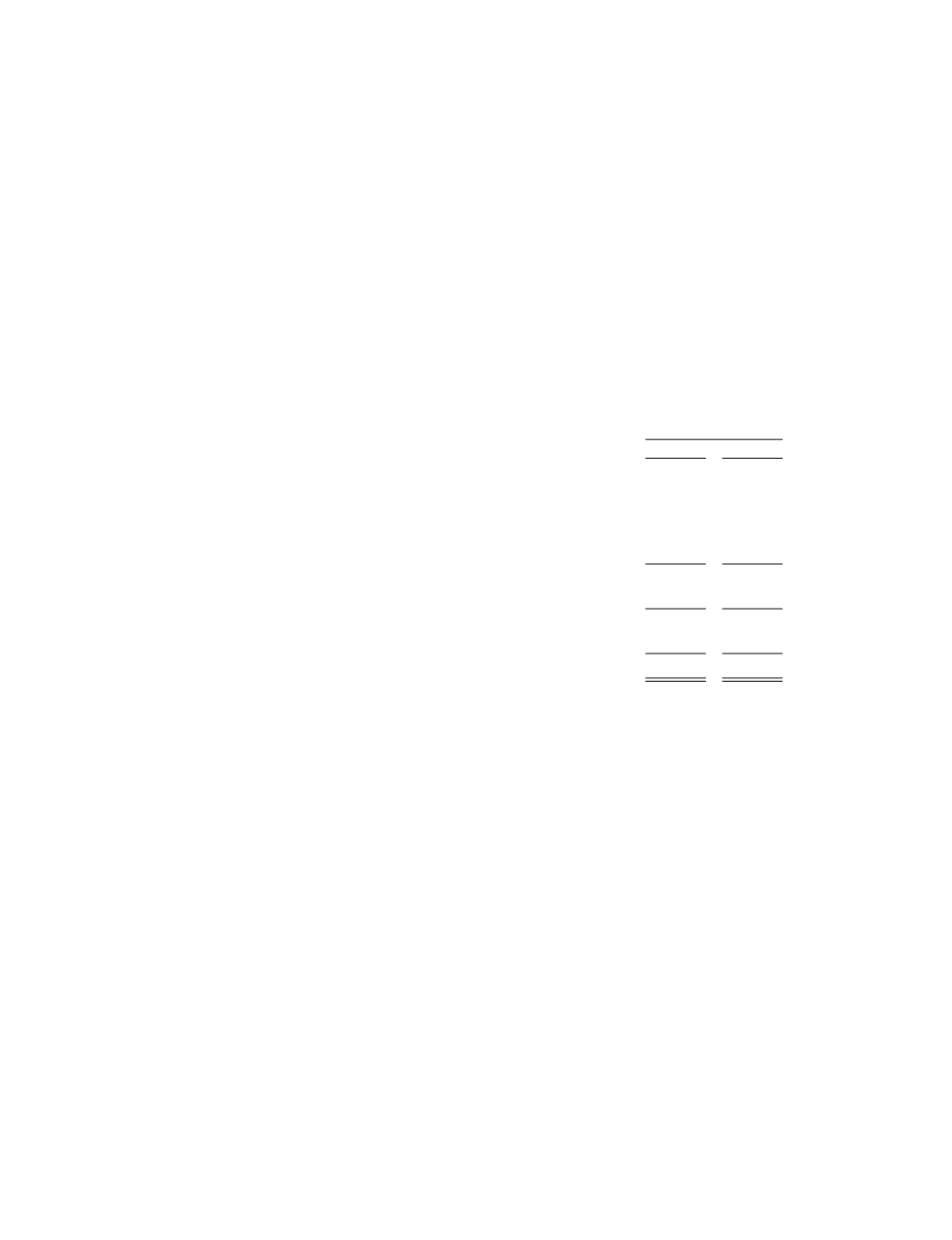

We carry our property, plant and equipment at cost, which consists of the following (in thousands):

December 31,

2014

2013

Equipment and computer software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 49,772 $ 44,698

Building and building systems. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

48,521 48,132

Land improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,853

2,846

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37,935 35,282

Furniture and fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,732

5,473

144,813 136,431

Less accumulated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(66,053) (60,431)

78,760 76,000

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10,198 10,198

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 88,958 $ 86,198

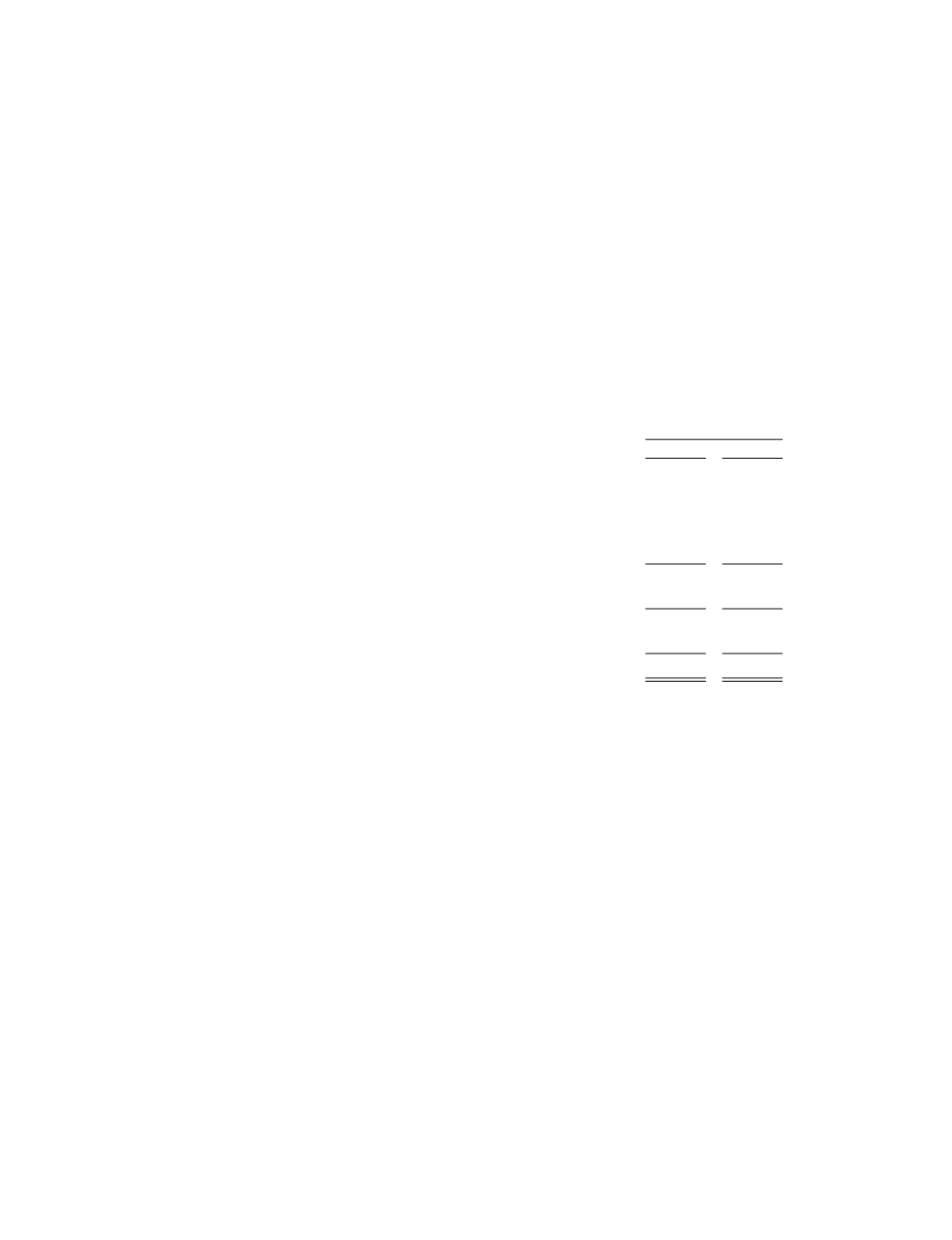

We depreciate our property, plant and equipment on the straight-line method over estimated useful lives as

follows:

Computer software and hardware . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 years

Other equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5-7 years

Furniture and fixtures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5-10 years

Manufacturing equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 years

Building systems and improvements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10-25 years

Land improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 years

Building . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40 years

We depreciate our leasehold improvements using the shorter of the estimated useful life or remaining lease

term.

F-15