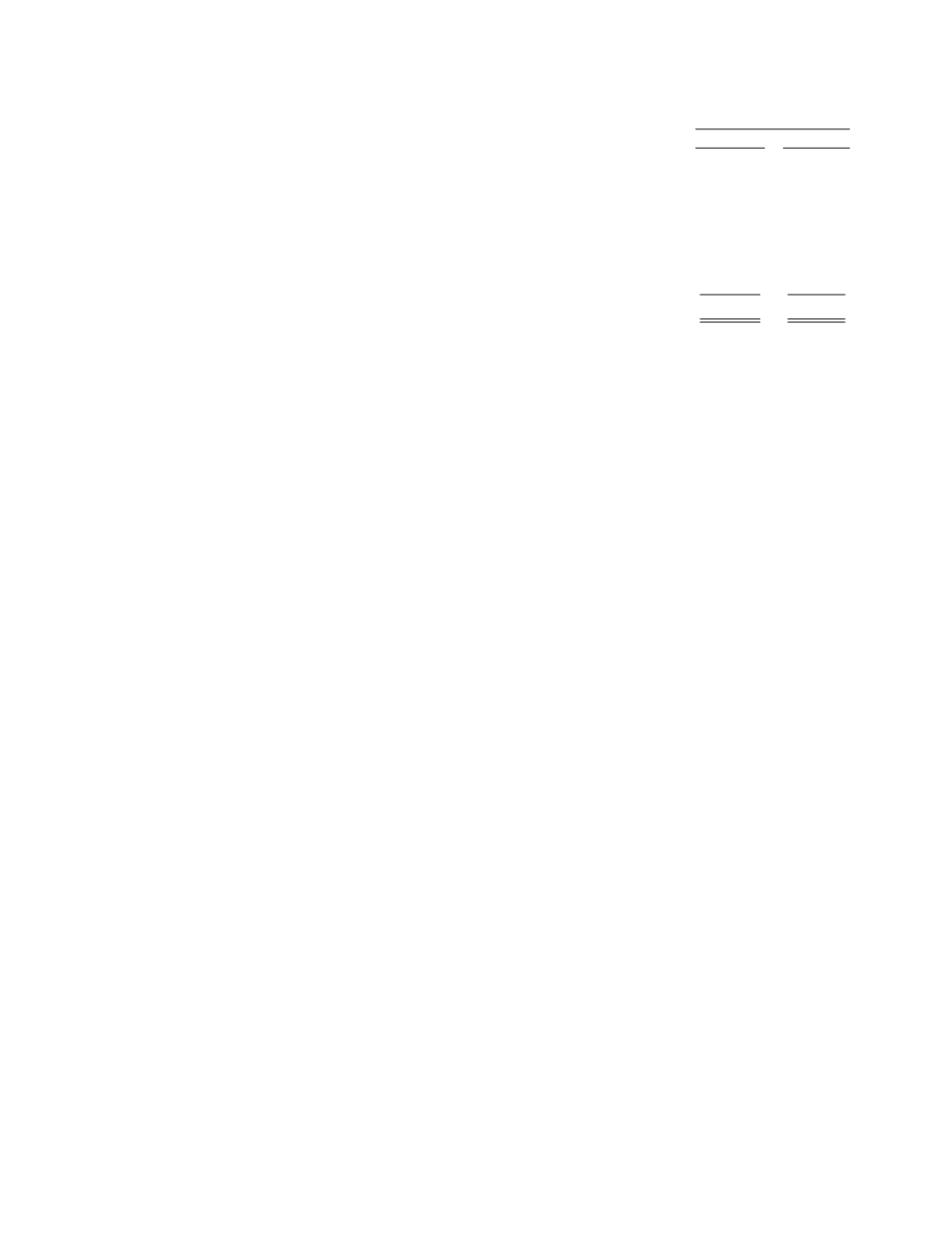

The following is a summary of our investments measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) for the years ended December 31, 2014 and 2013 (in thousands):

Year Ended December 31,

2014

2013

Beginning balance of Level 3 investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ — $ 34,350

Transfers into Level 3 investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

108,009

—

Total realized and unrealized gains and (losses):

Included in gain on investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— (1,163)

Included in accumulated other comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . . .

(24,897)

32,272

Transfers out of Level 3 investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1,231)

(65,419)

Cost basis of shares sold. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— (40)

Ending balance of Level 3 investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 81,881 $ —

Impact of recently issued accounting standards

InMay 2014, the FASB issued accounting guidance on the recognition of revenue from customers. Under

this guidance, an entity will recognize revenue when it transfers promised goods or services to customers in an

amount that reflects what the entity expects in exchange for the goods or services. This guidance also requires

more detailed disclosures to enable users of the financial statements to understand the nature, amount, timing and

uncertainty of revenue and cash flows arising from contracts with customers. The guidance is effective for fiscal

years, and interim periods within that year, beginning after December 15, 2016. The guidance allows us to select

one of two methods of adoption, either the full retrospective approach, meaning the guidance would be applied

to all periods presented, or modified retrospective, meaning the cumulative effect of applying the guidance would

be recognized as an adjustment to our opening retained earnings balance. We will adopt this guidance in our

fiscal year beginning January 1, 2017. We are currently in the process of determining the adoption method as

well as the effects the adoption will have on our consolidated financial statements and disclosures.

InAugust 2014, the FASB issued accounting guidance on how and when to disclose going-concern

uncertainties in the financial statements. This guidance requires us to perform interim and annual assessments to

determine our ability to continue as a going concern within one year from the date that we issue our financial

statements. The guidance is effective for fiscal years, and interim periods within that year, beginning after

December 15, 2016. We will adopt this guidance in our fiscal year beginning January 1, 2017. We do not expect

this guidance to have any effect on our financial statements.

2. Investment in Regulus Therapeutics Inc.

In September 2007, we andAlnylam established Regulus as a company focused on the discovery,

development and commercialization of microRNA-targeting therapeutics. Regulus combines our andAlnylam’s

technologies, know-how, and intellectual property relating to microRNA-targeting therapeutics. We andAlnylam

each granted Regulus exclusive licenses to our respective intellectual property for microRNA therapeutic

applications, and certain early fundamental patents in the microRNA field.

In October 2012, Regulus completed an IPO of approximately 12.7 million shares of its common stock at

$4.00 per share. As part of the offering, we purchased $3.0 million of Regulus’ common stock at the offering

price. We began accounting for our investment in Regulus at fair value in the fourth quarter of 2012 when our

ownership in Regulus dropped below 20 percent and we no longer had significant influence over Regulus’

operating and financial policies. We also recorded an $18.4 million gain in the fourth quarter of 2012 because of

the increase in Regulus’ valuation resulting from its IPO. During 2014, we sold 1.5 million shares of common

stock, resulting in a $19.9 million gain. We have reflected these gains in a separate line on our consolidated

statement of operations called ‘‘Gain on investment in Regulus Therapeutics Inc.’’As of December 31, 2014, we

owned approximately 11 percent of Regulus’ equity, with a carrying balance of $81.9 million on our consolidated

balance sheet.

F-20