3. Investments

As of December 31, 2014, we have primarily invested our excess cash in debt instruments of the

U.S. Treasury, financial institutions, corporations, and U.S. government agencies with strong credit ratings and an

investment grade rating at or aboveA-1, P-1 or F-1 byMoody’s, S&P or Fitch, respectively. We have established

guidelines relative to diversification and maturities that maintain safety and liquidity. We periodically review and

modify these guidelines to maximize trends in yields and interest rates without compromising safety and

liquidity.

The following table summarizes the contract maturity of the available-for-sale securities we held as of

December 31, 2014:

One year or less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55%

After one year but within two years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31%

After two years but within three years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14%

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

100%

As illustrated above, at December 31, 2014, 86 percent of our available-for-sale securities had a maturity of

less than two years.

All of our available-for-sale securities are available to us for use in our current operations. As a result, we

categorize all of these securities as current assets even though the stated maturity of some individual securities

may be one year or more beyond the balance sheet date.

At December 31, 2014, we had an ownership interest of less than 20 percent in one private company and

two public companies with which we conduct business. The privately-held company is Atlantic Pharmaceuticals

Limited and the publicly-traded companies areAntisense Therapeutics Limited and Regulus. We account for

equity investments in the privately-held company under the cost method of accounting and we account for equity

investments in the publicly-traded companies at fair value. We record unrealized gains and losses as a separate

component of comprehensive income (loss) and include net realized gains and losses in gain (loss) on

investments.

During 2014, we realized a gain on investments we sold of $21.2 million, consisting primarily of the

$19.9 million gain we realized when we sold a portion of the stock we own in Regulus. During 2013, we

recognized a $2.4 million net gain on investments related to the sale of stock in several satellite companies.

During 2012, we recognized an $18.4 million gain because of the increase in Regulus’ valuation resulting from

its IPO. Our gain fromRegulus in 2012 and 2014 is reflected in a separate line on our Consolidated Statements

of Operations called ‘‘Gain on investment in Regulus Therapeutics Inc.’’

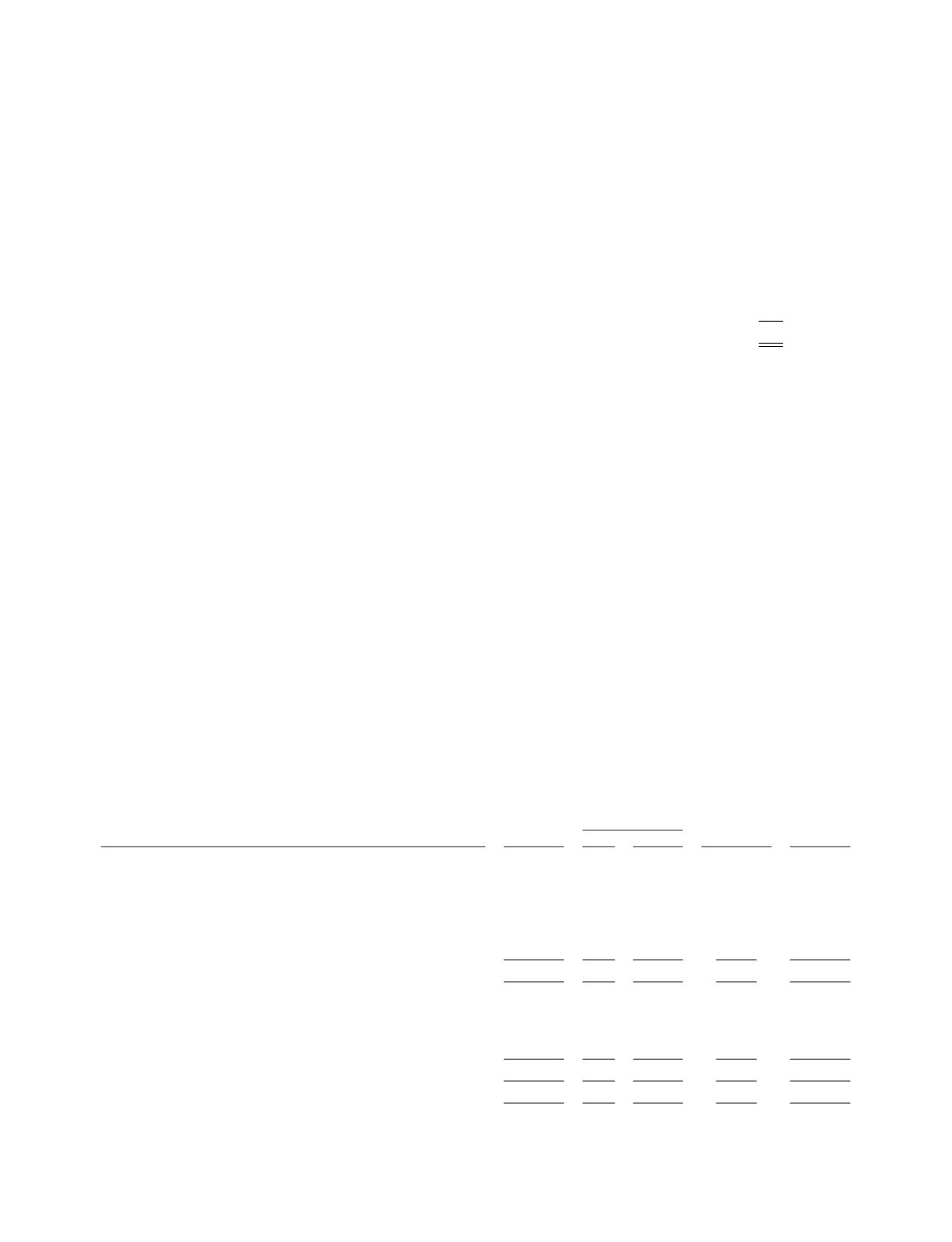

The following is a summary of our investments (in thousands):

Amortized

Cost

Unrealized

Other-Than-

Temporary

Impairment

Loss

Estimated

Fair Value

December 31, 2014

Gains

Losses

Available-for-sale securities:

Corporate debt securities(1) . . . . . . . . . . . . . . . . . . . . . . . $219,856 $ 89 $ (89)

$ — $219,856

Debt securities issued by U.S. government agencies. . . .

47,496

7

(27)

— 47,476

Debt securities issued by the U.S. Treasury (1). . . . . . . .

19,008

9

— — 19,017

Debt securities issued by states of the United States

and political subdivisions of the states (1). . . . . . . . . .

45,196 19

(53)

— 45,162

Total securities with a maturity of one year or less . .

331,556 124 (169)

— 331,511

Corporate debt securities. . . . . . . . . . . . . . . . . . . . . . . . . .

152,730 16 (600)

— 152,146

Debt securities issued by U.S. government agencies. . . .

62,530 — (151)

— 62,379

Debt securities issued by states of the United States

and political subdivisions of the states. . . . . . . . . . . . .

60,073 32 (234)

— 59,871

Total securities with a maturity of more than one year. .

275,333 48 (985)

— 274,396

Total available-for-sale securities . . . . . . . . . . . . . . . . . $606,889 $172 $(1,154)

$ — $605,907

F-21