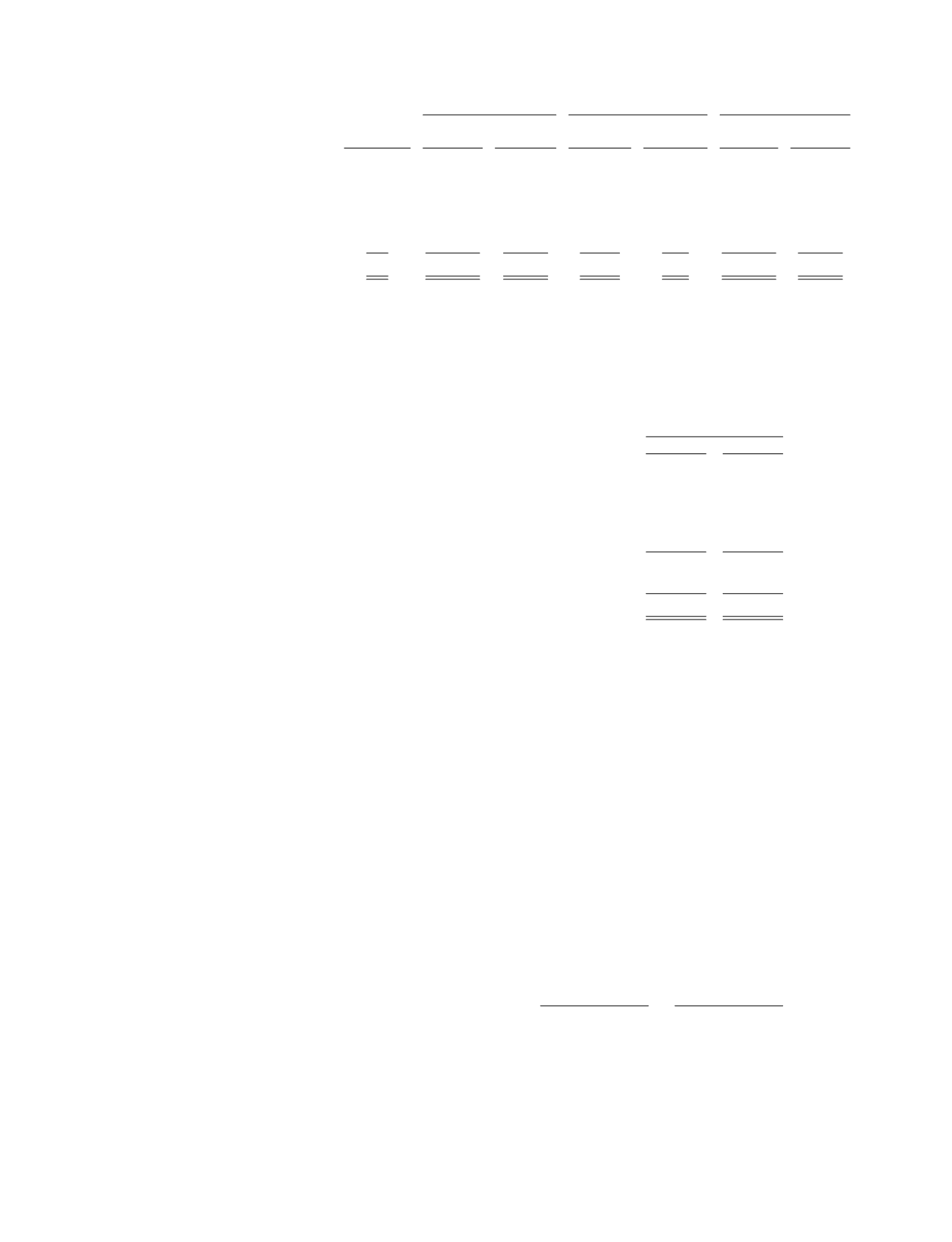

Investments we consider to be temporarily impaired at December 31, 2014 are as follows (in thousands):

Less than 12months of

temporary impairment

More than 12months of

temporary impairment

Total temporary

impairment

Number of

Investments

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

Corporate debt securities. . . . . . . . . . .

239

$242,124 $ (681)

$3,503

$ (8)

$245,627 $ (689)

Debt securities issued by U.S.

government agencies. . . . . . . . . . . .

16

98,342

(178)

— — 98,342

(178)

Debt securities issued by states of the

United States and political

subdivisions of the states. . . . . . . . .

46

54,292

(237)

225

(50)

54,517

(287)

Total temporarily impaired securities . .

301

$394,758 $(1,096)

$3,728

$(58)

$398,486 $(1,154)

We believe that the decline in value of these securities is temporary and primarily related to the change in

market interest rates since purchase. We believe it is more likely than not that we will be able to hold these

securities to maturity. Therefore, we anticipate full recovery of their amortized cost basis at maturity.

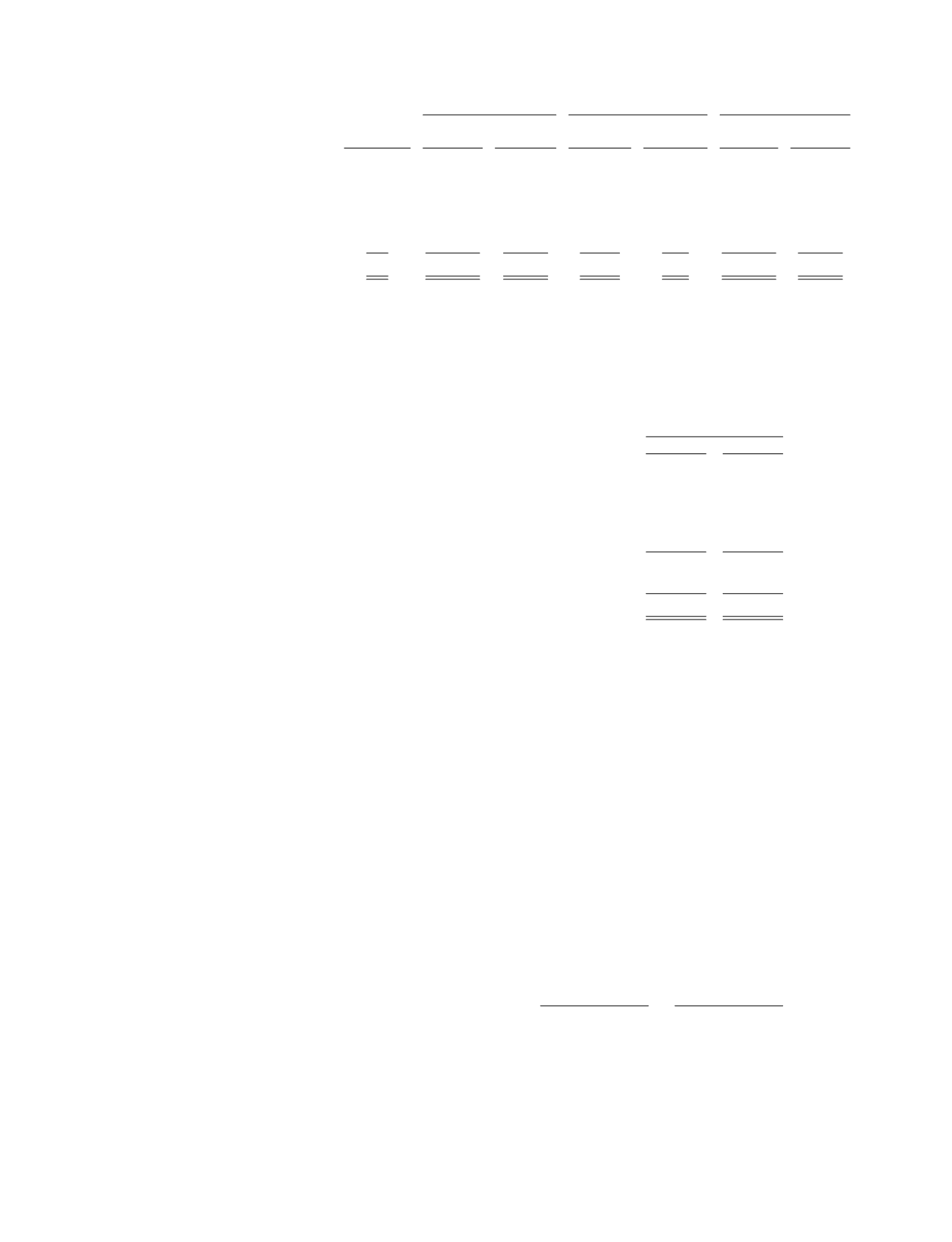

4. Long-TermObligations and Commitments

The carrying value of our long-term obligations was as follows (in thousands):

December 31,

2014

2013

1 percent convertible senior notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $327,486 $ —

2¾ percent convertible senior notes . . . . . . . . . . . . . . . . . . . . . . . . . . . .

48,014 150,334

Long-term financing liability for leased facility . . . . . . . . . . . . . . . . . . .

71,731 71,288

Equipment financing arrangement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3,226

7,461

Leases and other obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7,325

3,489

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $457,782 $232,572

Less: current portion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2,882)

(4,408)

Total Long-TermObligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $454,900 $228,164

Convertible Notes

In November 2014, we completed a $500 million offering of convertible senior notes, which mature in 2021

and bear interest at 1 percent. We raised $487 million, of proceeds, net of issuance costs. We used a substantial

portion of the net proceeds from the issuance of the 1 percent convertible senior notes to repurchase

$140 million in principal of our 2¾ percent convertible senior notes at a price of $441.9 million, including

accrued interest. As a result, the new principal balance of the 2¾ percent notes is $61.2 million. We recognized a

$8.3 million non-cash loss as a result of the early retirement of a portion of the 2¾ percent notes.

In September 2012, we used a substantial portion of the net proceeds of $194.7 from the issuance of

$201.3 million of 2¾ percent notes to redeem the entire $162.5 million in principal of our 2

⅝

percent notes at a

price of $164.0 million including accrued interest. We recognized a $4.8 million loss as a result of the

redemption of the 2

⅝

percent notes. A significant portion of the loss, or $3.6 million, was non-cash and related

to the unamortized debt discount and debt issuance costs and the remainder was related to a $1.2 million early

redemption premiumwe paid to the holders of the 2

⅝

percent notes.

At December 31, 2014 we had the following convertible debt outstanding (amounts in millions unless

otherwise noted):

1 Percent

Convertible

Senior Notes

2¾Percent

Convertible

Senior Notes

Outstanding balance. . . . . . . . . . . . . . . . . . . . . . . . . . .

$

500 $

61.2

Issue date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

November 2014

August 2012

Maturity date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

November 2021

October 2019

Interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 percent

2¾ percent

Conversion price per share . . . . . . . . . . . . . . . . . . . . .

$

66.81 $

16.63

Total shares of common stock subject to conversion.

7.5

3.7

F-23