Operating Leases

We lease office and laboratory space under non-cancelable operating leases with terms through December

2031. We are located in three buildings in Carlsbad, California, which consists of laboratory and office space.

Our facilities include a primary research and development facility, a manufacturing facility and a building

adjacent to our manufacturing facility. Our manufacturing facility is used for our drug development business and

was built to meet current GoodManufacturing Practices and the facility adjacent to our manufacturing facility

has laboratory and office space that we use to support our manufacturing activities. The lease for our

manufacturing facility expires in 2031 and has four five-year options to extend. Under the lease agreement, we

have the option to purchase the facility at the end of each year from 2016 through 2020, and at the end of 2026

and 2031. The lease for the facility adjacent to our manufacturing facility has an initial term ending in June 2021

with an option to extend the lease for up to two five-year periods. We account for the lease of our primary

research and development facility as a financing obligation as discussed below. We also lease office equipment

under non-cancelable operating leases with terms through June 2017.

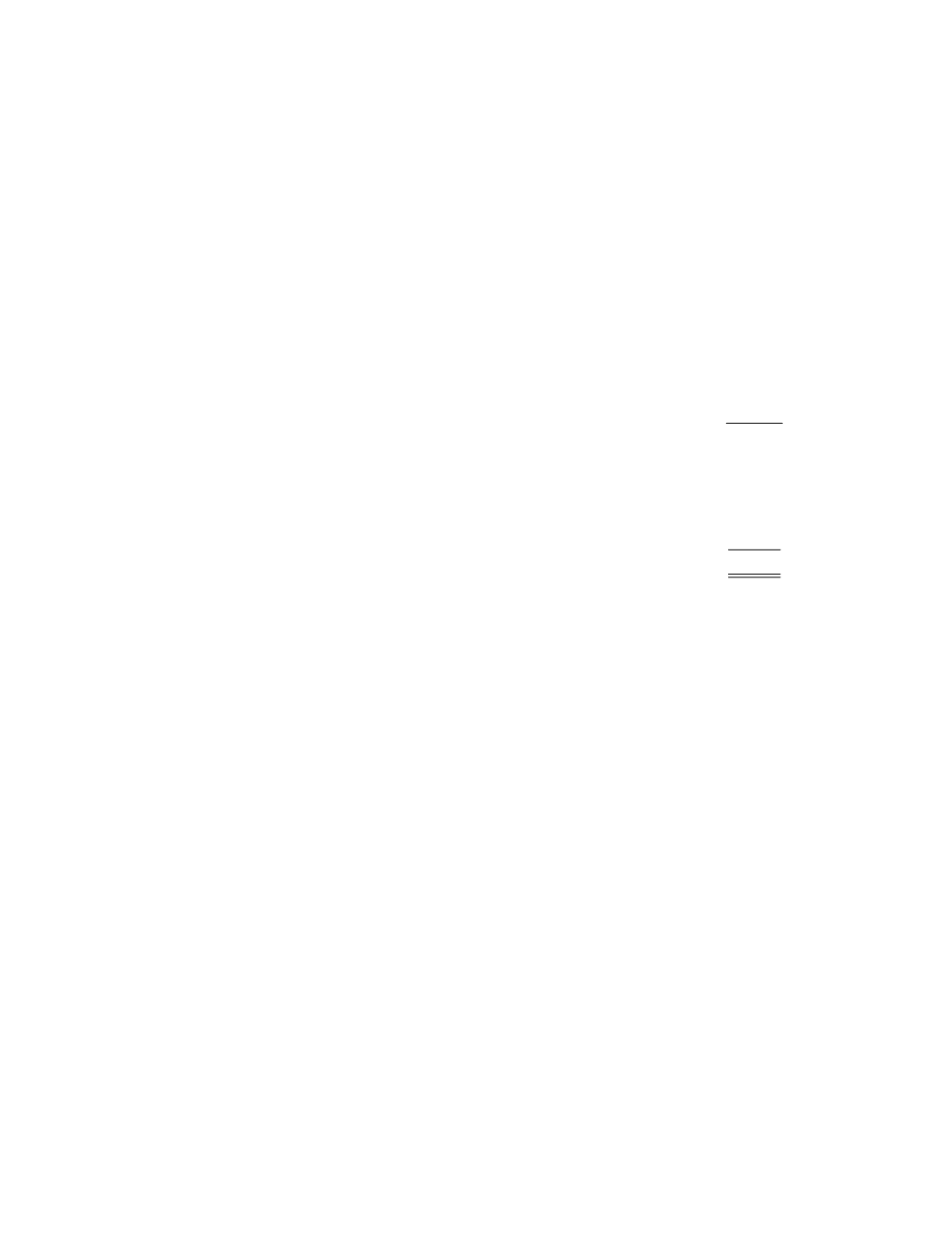

Annual future minimum payments under operating leases as of December 31, 2014 are as follows (in

thousands):

Operating

Leases

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 1,527

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,538

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,481

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,451

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,474

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17,517

Total minimum payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$24,988

Rent expense for the years ended December 31, 2014 and 2013 was $1.8 million for each year and for 2012

rent expense was $1.9 million. We recognize rent expense on a straight line basis over the lease term for the

lease on our manufacturing facility and the lease on our building adjacent to our manufacturing facility, which

resulted in a deferred rent balance of $1.8 million and $1.6 million at December 31, 2014 and 2013, respectively.

Research and Development Facility Lease Obligation

InMarch 2010, we entered into a lease agreement with an affiliate of BioMed Realty, L.P., or BioMed.

Under the lease, BioMed constructed primary research and development facility in Carlsbad, California. The

lease expires in 2031 and has four five-year options to extend. Under the lease agreement, we have the option to

purchase the facility and land at the end of each year from 2016 through 2020, and at the end of 2026 and 2031.

To gain early access to the facility, we agreed to modify our lease with BioMed to accept additional

responsibility. As a result, we recorded the costs for the facility as a fixed asset and we also recorded a

corresponding liability in our non-current liabilities as a long-term financing obligation. In July 2011, we took

possession of the facility and began depreciating the cost of the facility over its economic useful life. At

December 31, 2014 and 2013, the facility and associated parcel of land had a net book value of $64.4 million

and $66.7 million, respectively, which included $7.7 million and $5.5 million, respectively, of accumulated

depreciation. We are applying our rent payments, which began on January 1, 2012, against the liability over the

term of the lease.

In conjunction with the lease agreement with BioMed, we purchased a parcel of land for $10.1 million and

subsequently sold it to BioMed. Since we have the option to purchase the facility, including the land, we have

continuing involvement in the land, which requires us to account for the purchase and sale of the land as a

financing transaction. As such, our property, plant and equipment at December 31, 2014 and 2013 included the

value of the land. Additionally, we have recorded a corresponding amount in our non-current liabilities as a

long-term financing obligation. Since land is not a depreciable asset, the value of the land and financing

obligation we recorded will not change until we exercise our purchase option or the lease terminates.

F-26