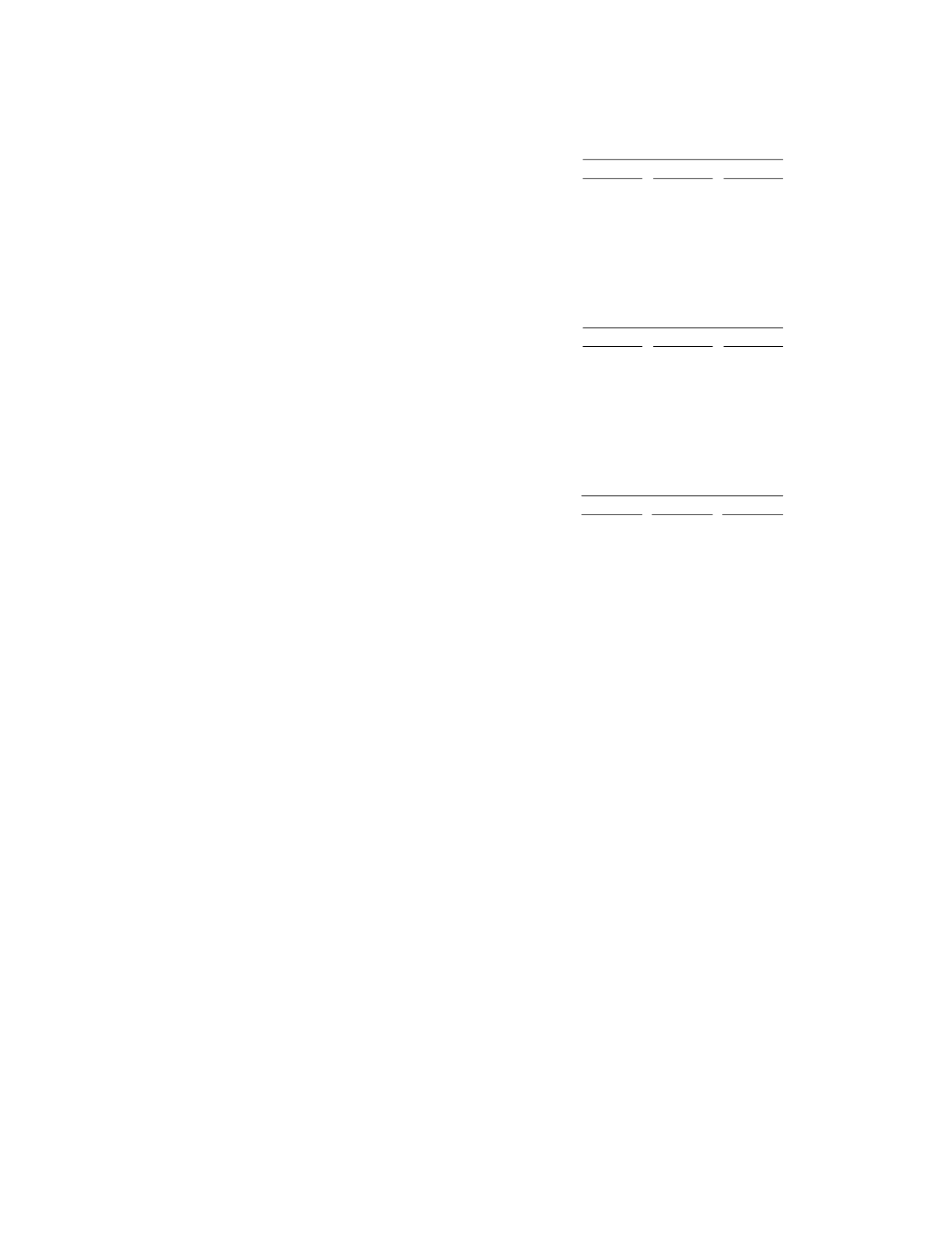

For the years ended December 31, 2014, 2013 and 2012, we used the following weighted-average

assumptions in our Black-Scholes calculations:

Employee Stock Options:

December 31,

2014

2013

2012

Risk-free interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.7% 1.1% 1.1%

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.0% 0.0% 0.0%

Volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50.1% 51.1% 50.7%

Expected life. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.7 years 5.1 years 5.1 years

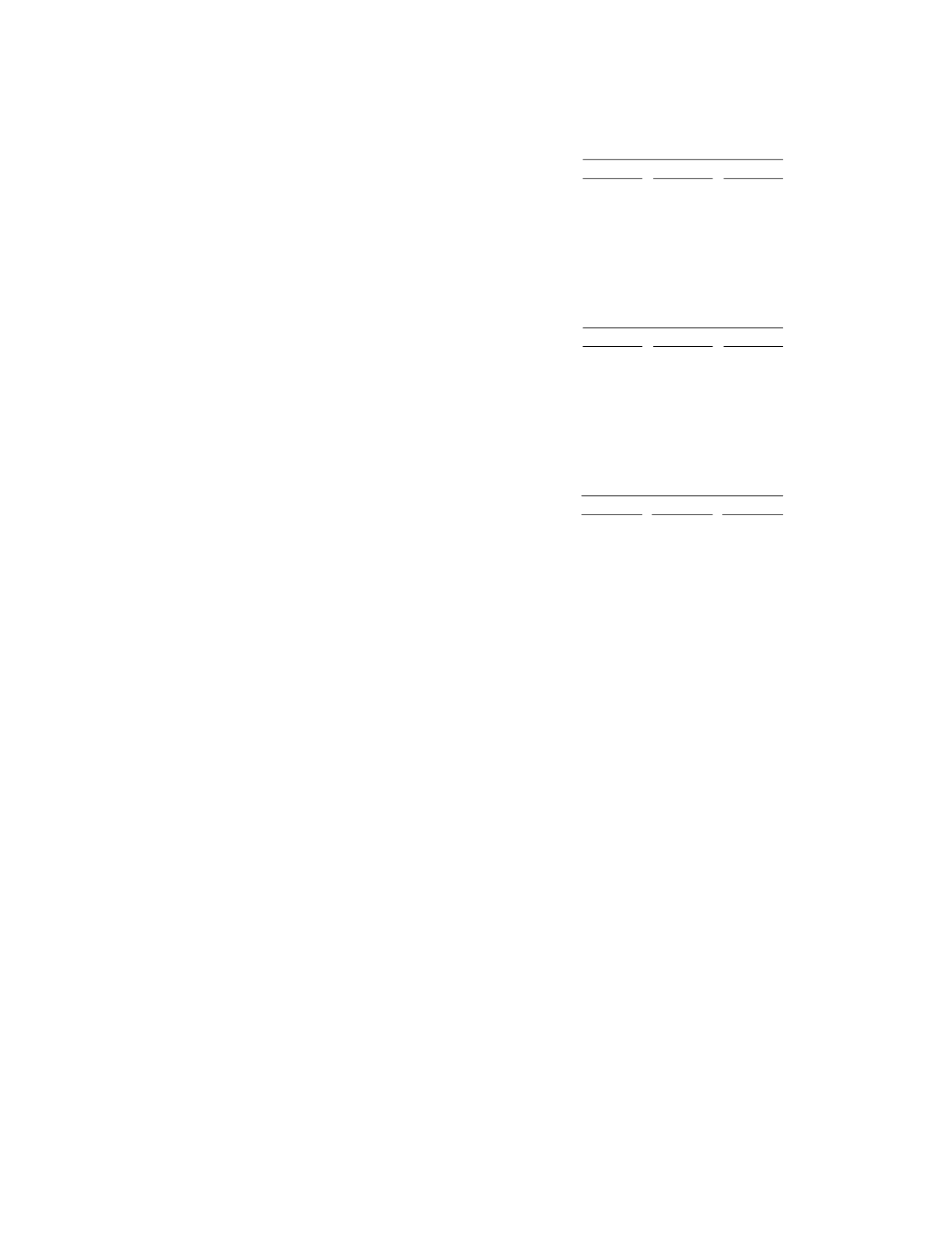

Board of Director Stock Options:

December 31,

2014

2013

2012

Risk-free interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2% 2.2% 1.3%

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.0% 0.0% 0.0%

Volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54.2% 52.7% 51.3%

Expected life. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.9 years 7.2 years 7.6 years

ESPP:

December 31,

2014

2013

2012

Risk-free interest rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.1% 0.1% 0.1%

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.0% 0.0% 0.0%

Volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

60.1% 62.9% 44.5%

Expected life. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 months 6 months 6 months

Risk-Free Interest Rate.

We base the risk-free interest rate assumption on observed interest rates appropriate

for the term of our stock option plans or ESPP.

Dividend Yield.

We base the dividend yield assumption on our history and expectation of dividend payouts.

We have not paid dividends in the past and do not expect to in the future.

Volatility.

We use an average of the historical stock price volatility of our stock for the Black-Scholes

model. We computed the historical stock volatility based on the expected term of the awards.

Expected Life.

The expected term of stock options we have granted represents the period of time that we

expect them to be outstanding. We estimated the expected term of options we have granted based on actual and

projected exercise patterns.

Forfeitures.

We reduce stock-based compensation expense for estimated forfeitures. We estimate forfeitures

at the time of grant and revise, if necessary, in subsequent periods if actual forfeitures differ from those

estimates. We estimate forfeitures based on historical experience. Our historical forfeiture estimates have not

been materially different from our actual forfeitures.

6. Income Taxes

We have net deferred tax assets relating primarily to net operating loss carryforwards, or NOL’s, and

research and development tax credit carryforwards. Subject to certain limitations, we may use these deferred tax

assets to offset taxable income in future periods. Since we have a history of losses and the likelihood of future

profitability is not assured, we have provided a full valuation allowance for the deferred tax assets in our balance

sheet as of December 31, 2014. If we determine that we are able to realize a portion or all of these deferred tax

assets in the future, we will record an adjustment to increase their recorded value and a corresponding adjustment

to increase income or additional paid in capital, as appropriate, in that same period.

Intraperiod tax allocation rules require us to allocate our provision for income taxes between continuing

operations and other categories of earnings, such as other comprehensive income. In periods in which we have a

F-31