year-to-date pre-tax loss from continuing operations and pre-tax income in other categories of earnings, such as

other comprehensive income, we must allocate the tax provision to the other categories of earnings. We then

record a related tax benefit in continuing operations. During 2014, 2013 and 2012, we recorded unrealized gains

on our investments in available-for-sale securities in other comprehensive income net of taxes. In

December 31, 2014, 2013 and 2012, we recorded a $12.8 million, $5.9 million and $9.1 million tax benefit,

respectively, in continuing operations and a $12.8 million, $5.9 million and $9.1 million tax expense,

respectively, in other comprehensive income.

In December, 2014, we reached an agreement with the State of California Franchise Tax Board with regard

to California franchise tax we paid for the tax year ended December 31, 2009. As part of the agreement, we will

receive a franchise tax refund of $4.3 million and our research credit carry-forward to December 31, 2010 will

increase by $4.3 million. We recognized an income tax benefit for the refund in the fourth quarter of 2014. The

increase in our research credit carry-forward will increase our deferred tax assets but will not impact our

consolidated balance sheet as we record a full valuation allowance on our deferred tax assets.

We are subject to taxation in the United States and various state jurisdictions. Our tax years for 1998 and

forward are subject to examination by the U.S. tax authorities and our tax years for 2001 and forward are subject

to examination by the California tax authorities due to the carryforward of unutilized net operating losses and

research and development credits.

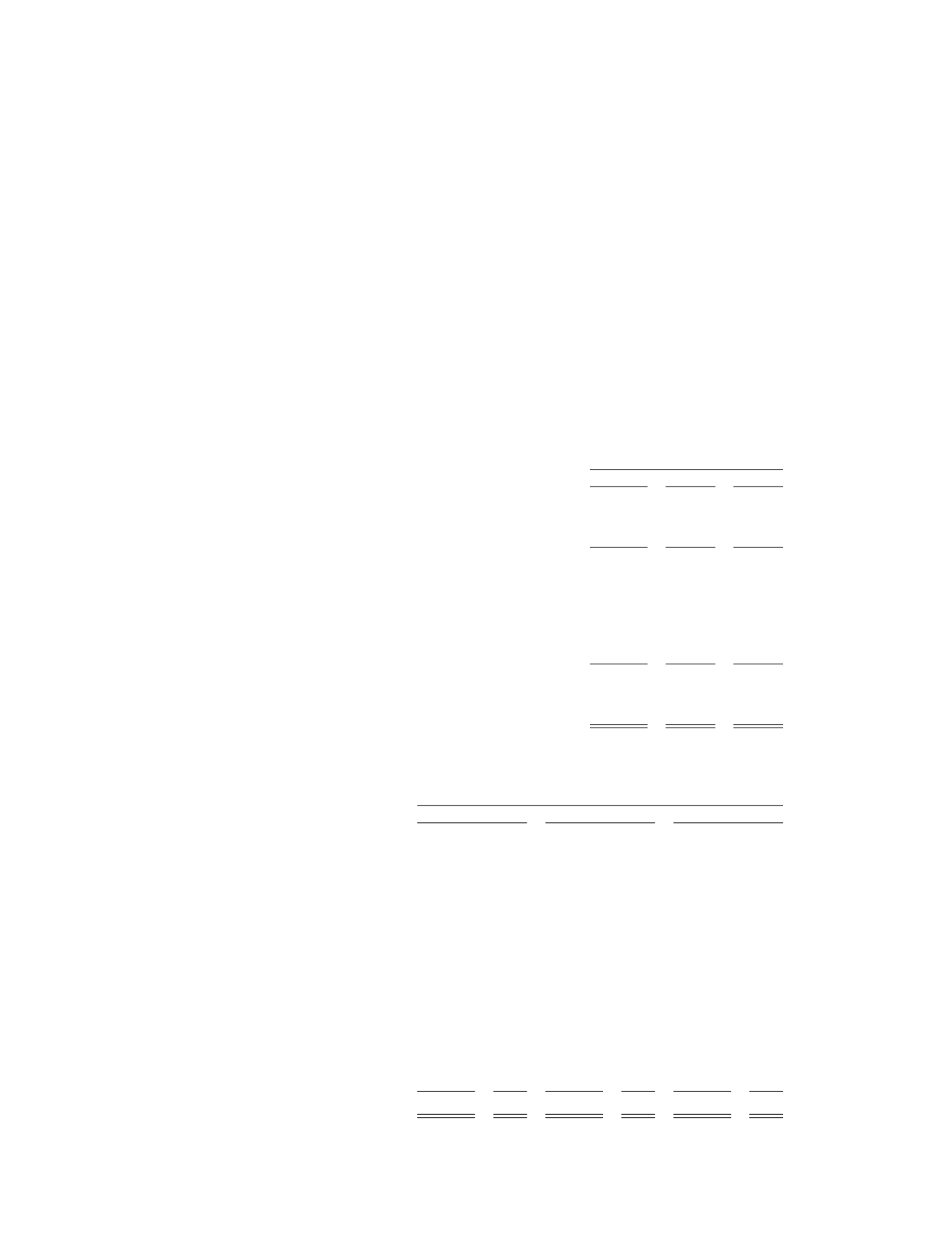

The provision for income taxes on income from continuing operations were as follows (in thousands):

Year Ended December 31,

2014

2013

2012

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 263 $ — $ —

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4,295)

2

2

Total current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4,032)

2

2

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(8,948) (5,082) (7,827)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2,427)

(834) (1,284)

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

— — —

Total deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(11,375) (5,916) (9,111)

Income Tax Benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(15,407) $(5,914) $(9,109)

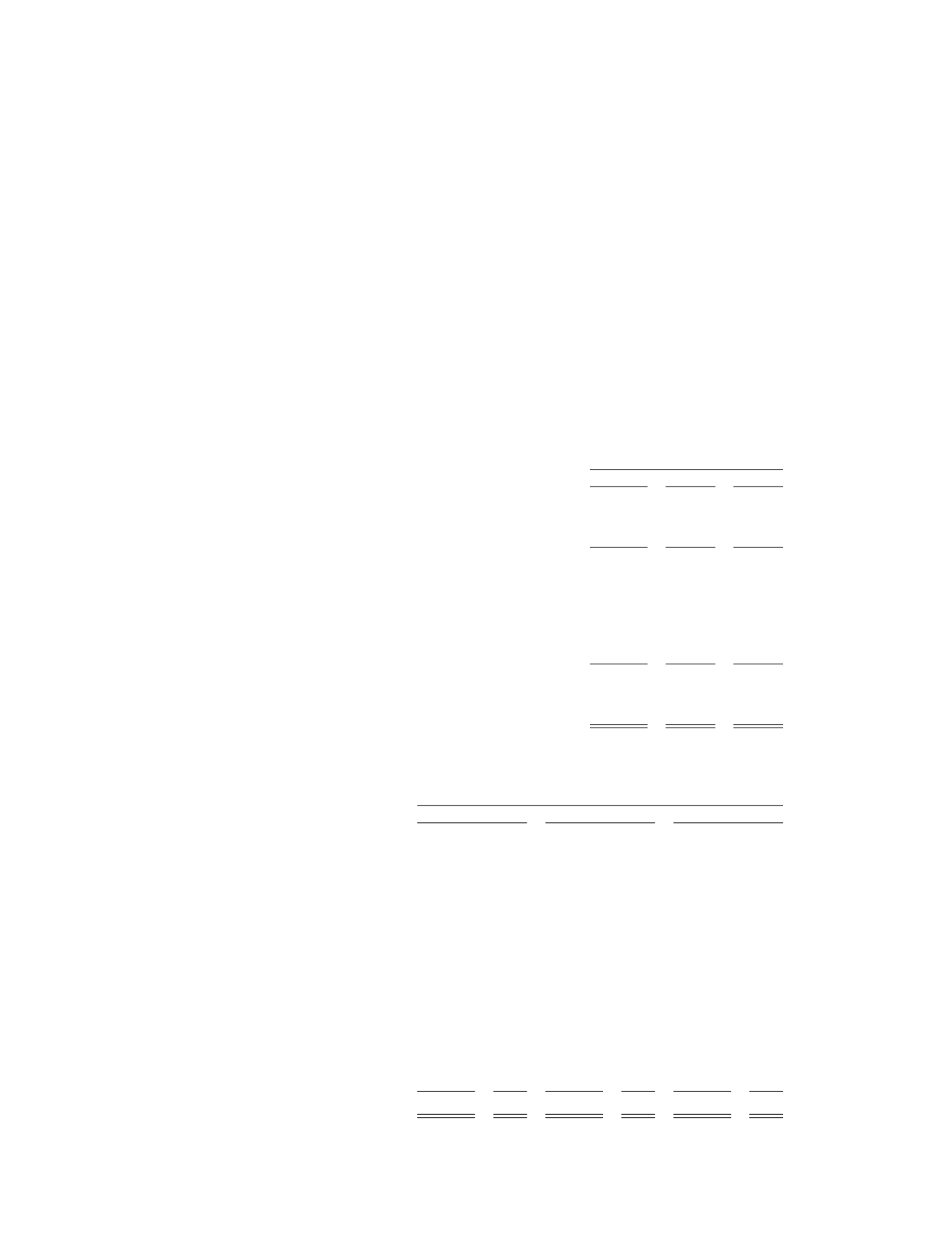

The reconciliation between the Company’s effective tax rate on income from continuing operations and the

statutory U.S. tax rate is as follows (in thousands):

Year Ended December 31,

2014

2013

2012

Pre-tax loss . . . . . . . . . . . . . . . . . . . $(54,391)

$(66,558)

$(74,587)

Statutory rate. . . . . . . . . . . . . . . . . .

(19,035) 35.0% (23,295) 35.0% (26,105) 35.0%

State income tax net of federal

benefit . . . . . . . . . . . . . . . . . . . . .

(3,125)

5.7% (3,823)

5.7% (4,284)

5.7%

Net change in valuation

allowance. . . . . . . . . . . . . . . . . . .

29,547 (54.3)% 28,850 (43.3)% 25,269 (33.9)%

Gain on Investment in Regulus

Therapeutics Inc. . . . . . . . . . . . .

— — — — (6,353)

8.5%

Loss on debt extinguishment . . . . .

2,406 (4.4%)

— — — —

Tax credits . . . . . . . . . . . . . . . . . . . .

(23,525) 43.3% (15,839) 23.8% 806 (1.1)%

California franchise tax refund. . . .

(2,795)

5.1% — — — —

Deferred tax true-up . . . . . . . . . . . .

874 (1.6)% 8,023 (12.1)% 839 (1.1)%

Other . . . . . . . . . . . . . . . . . . . . . . . .

246 (0.5)% 170 (0.2)% 719 (0.9)%

Effective rate. . . . . . . . . . . . . . . . . . $(15,407) 28.3% $ (5,914)

8.9% $ (9,109) 12.2%

F-32