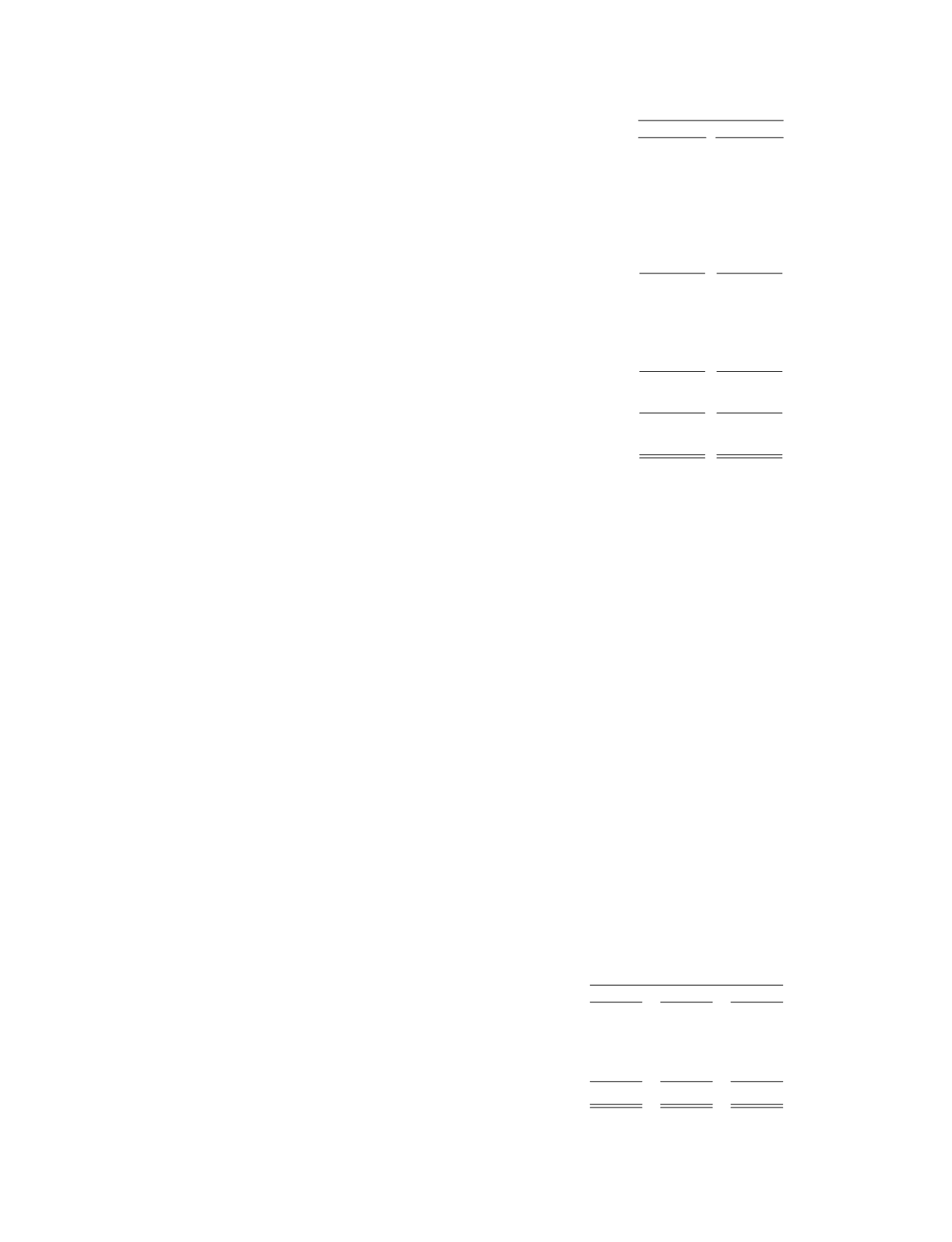

Significant components of our deferred tax assets and liabilities as of December 31, 2014 and 2013 are as

follows (in thousands):

Year Ended December 31,

2014

2013

Deferred TaxAssets:

Net operating loss carryovers. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 231,654 $ 260,462

R&D credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

93,594 65,600

Capitalized R&D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3,088

2,736

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

58,836 28,555

Accrued restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,374

3,304

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3,762

7,107

Total deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 393,308 $ 367,764

Deferred Tax Liabilities:

Convertible debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (73,733) $ (20,895)

Intangible and capital assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3,641)

(4,614)

Net deferred tax asset. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 315,934 $ 342,255

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (315,934) (342,255)

Net deferreds. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

— $

—

The deferred tax assets and liabilities shown above do not include certain deferred tax assets at

December 31, 2014 and 2013 that arose directly from (or the use of which was postponed by) tax deductions

related to equity compensation in excess of compensation recognized for financial reporting. Those deferred tax

assets include non-qualified stock options and incentive stock options we issued. We will increase stockholders’

equity by approximately $49.5 million if and when we ultimately realize such deferred tax assets. We use the

with and without approach for purposes of determining when excess tax benefits have been realized.

At December 31, 2014, we had federal and California tax net operating loss carryforwards of approximately

$671.9 million and $888.7 million, respectively. Our federal tax loss carryforwards begin to expire in 2023. Our

California tax loss carryforwards began to expire in 2014. At December 31, 2014, we also had federal and

California research and development tax credit carryforwards of approximately $86.0 million and $34.5 million,

respectively. Our Federal research and development tax credit carryforwards began expiring in 2004 and will

continue to expire unless we use them prior to expiration. Our California research and development tax credit

carryforwards are available indefinitely. In 2009, we had a substantial amount of taxable income and we used a

portion of our Federal NOL carryforwards to reduce our federal income taxes. We did not use any of our

California NOL carryforwards to offset our state taxes in 2009 because California suspended the use of NOL

carryforwards for 2009. As a result, our Federal NOL carryforwards are lower than our California NOL

carryforwards.

We analyze filing positions in all of the federal and state jurisdictions where we are required to file income

tax returns, and all open tax years in these jurisdictions to determine if we have any uncertain tax positions on

any of our income tax returns. We recognize the impact of an uncertain tax position on an income tax return at

the largest amount that the relevant taxing authority is more-likely-than not to sustain upon audit. We do not

recognize uncertain income tax positions if they have less than 50 percent likelihood of being sustained.

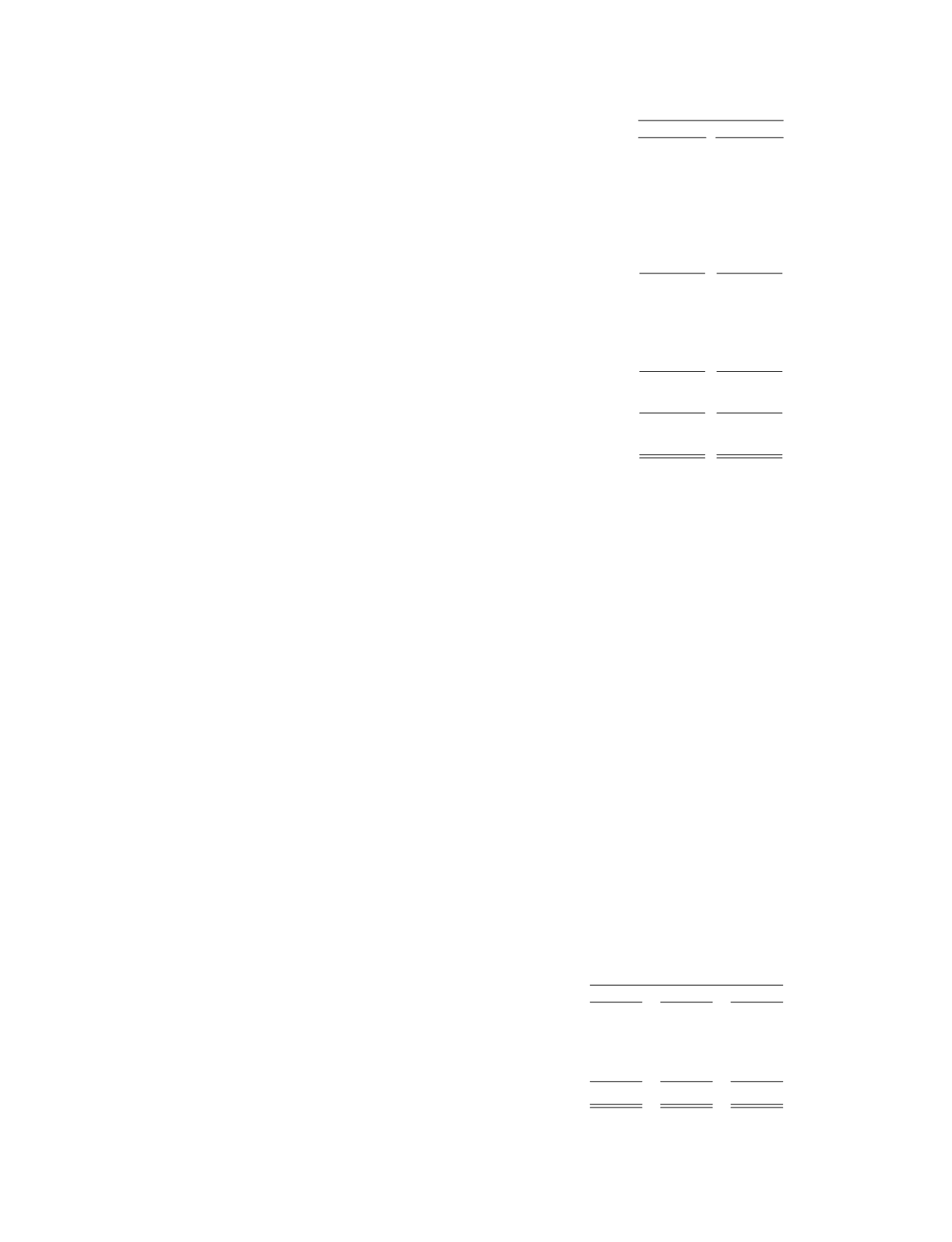

The following table summarizes our gross unrecognized tax benefits (in thousands):

Year Ended December 31,

2014

2013

2012

Beginning balance of unrecognized tax benefits . . . . . . . . . . . $23,964 $10,872 $ 9,834

Decrease for prior period tax positions. . . . . . . . . . . . . . . . . . .

(1,653)

— (174)

Increase for prior period tax positions . . . . . . . . . . . . . . . . . . .

— 9,821

791

Increase for current period tax positions. . . . . . . . . . . . . . . . . .

5,054 3,271

421

Ending balance of unrecognized tax benefits . . . . . . . . . . . . . . $27,365 $23,964 $10,872

F-33