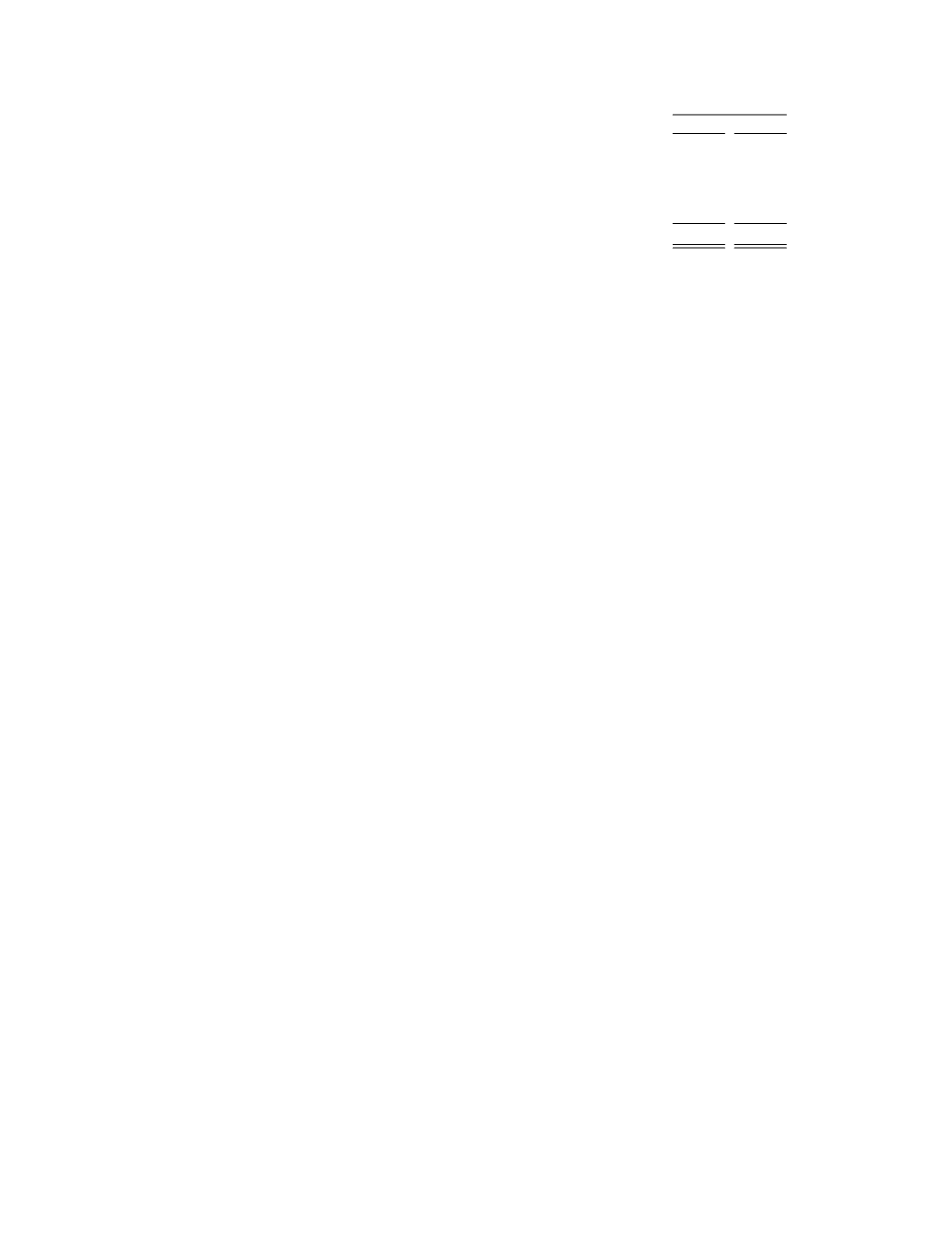

The following table sets forth information on interest expense (in thousands):

Year Ended

December 31,

2013

2012

Convertible Notes:

Non-cash amortization of the debt discount and debt issuance costs . . . $ 6,758 $ 9,846

Interest expense payable in cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,534 4,306

Non-cash interest expense for long-term financing liability . . . . . . . . . . . . . .

6,568 6,502

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

495 498

Total interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $19,355 $21,152

Interest expense for the year ended December 31, 2013 was $19.4 million compared to $21.2 million in

2012. The decrease in interest expense was primarily due to a decrease in amortization of the debt discount

related to our 2¾ percent notes. The borrowing rate for our 2¾ percent notes was less than the rate for our 2

⅝

percent notes because of market conditions at the time of each issuance. As a result, we amortized less debt

discount for the 2¾ percent notes compared to the 2

⅝

percent notes. This decrease was partially offset by an

increase in interest expense payable in cash because the interest rate was slightly higher on our 2¾ percent notes

compared to our 2

⅝

percent notes.

Gain on Investments, Net

Net gain on investments for the year ended December 31, 2013 was $2.4 million compared to $1.5 million

for 2012. The net gain on investments in 2013 was primarily due to the $1.1 million gain we realized when we

sold the stock we held in Sarepta Therapeutics, Inc., and the $0.8 million payment we received fromPfizer, Inc.

related to its acquisition of Excaliard Pharmaceuticals, Inc. During 2012 we recognized a $1.5 million net gain

on investments, which consisted primarily of the $1.3 million payment we received fromPfizer, Inc. related to its

acquisition of Excaliard.

Gain on Investment in Regulus Therapeutics Inc.

Our gain on Regulus in 2012 was $18.4 million and was in the fourth quarter of 2012 because of the

increase in Regulus’ valuation resulting from its IPO. We did not sell any of our holdings of Regulus in 2013.

Early Retirement of Debt

Loss on early retirement of debt for the year ended December 31, 2012 was $4.8 million, reflecting the

early redemption of our 2

⅝

percent convertible notes in the second half of 2012. We did not recognize any loss

on early retirement of debt in 2013.

Income Tax Benefit

In 2013, we recorded a tax benefit of $5.9 million, which reflected our application of the intraperiod tax

allocation rules under which we are required to record a tax benefit in continuing operations to offset the tax

provision we recorded directly to other comprehensive income primarily related to unrealized gains on our equity

investments in our satellite companies, including Regulus. Our income tax benefit declined from $9.1 million in

2012 because the unrealized gains in 2013 were not as large as in 2012.

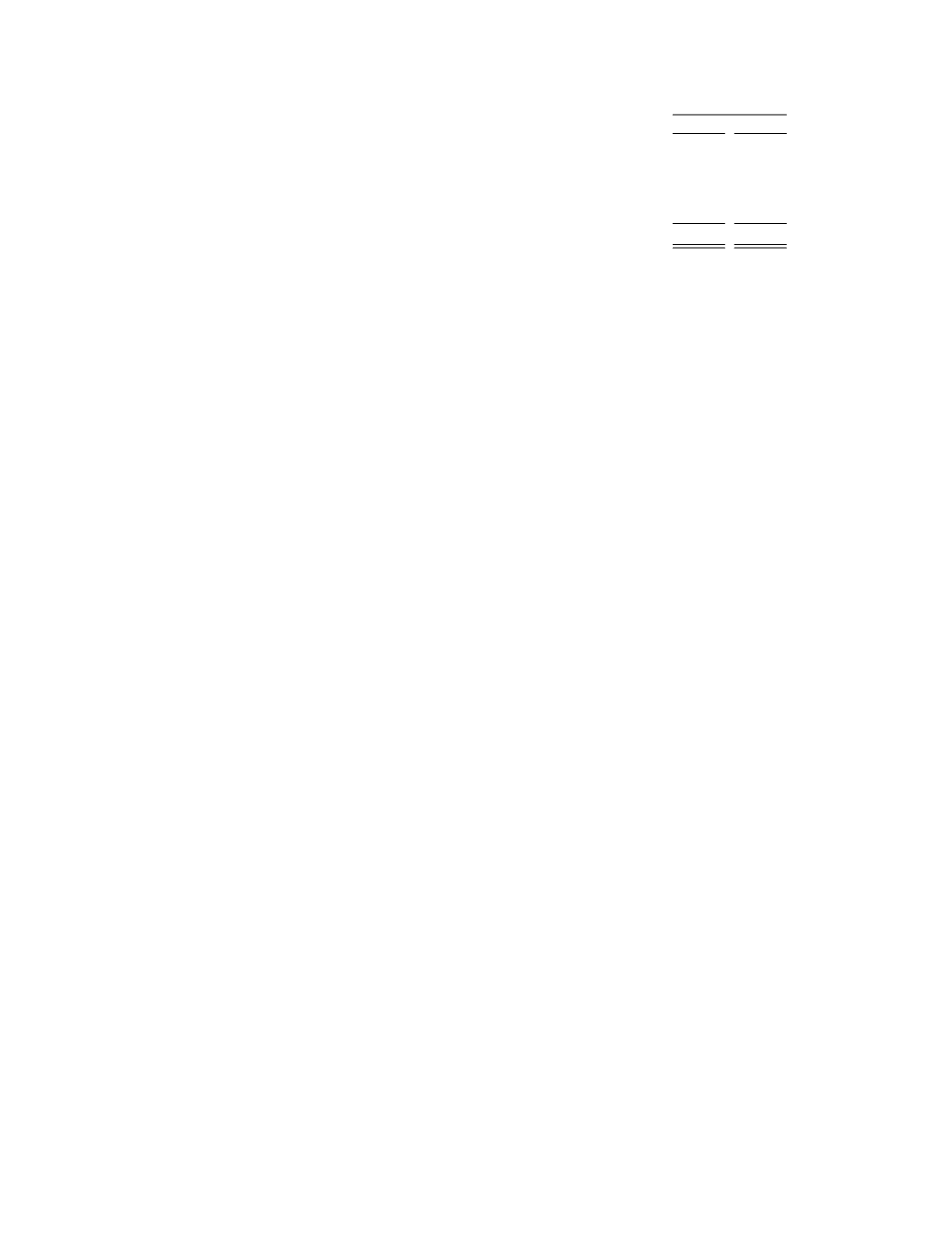

Net Loss and Net Loss Per Share

Net loss for the year ended December 31, 2013 was $60.6 million compared to $65.5 million for 2012.

Basic and diluted net loss per share for the year ended December 31, 2013 was $0.55 per share compared to

$0.65 per share for 2012. Our net loss in 2013 decreased compared to 2012 due to a decrease in our net

operating loss resulting primarily from the significant increase in revenue that we earned from our partners in

2013. The decrease in our net operating loss was partially offset by the following items that occurred in 2012

and did not reoccur in 2013:

•

$18.4 million gain we realized in 2012 because of the increase in Regulus’ valuation resulting from its

IPO; and

•

$4.8 million loss, $3.6 million of which was non-cash, we recorded in 2012 on the early retirement of

our 2

⅝

percent convertible subordinated notes.

85