Our contractual obligations consist primarily of our convertible debt. In addition, we also have facility

leases, equipment financing arrangements and other obligations.

Convertible Debt Summary

In November 2014, we completed a $500 million offering of convertible senior notes, which mature in 2021

and bear interest at 1 percent. We used a substantial portion of the net proceeds from the issuance of the

1 percent notes convertible senior notes to repurchase $140 million in principal of our 2¾ percent convertible

senior notes. As a result, the new principal balance of the 2¾ percent notes is $61.2 million.

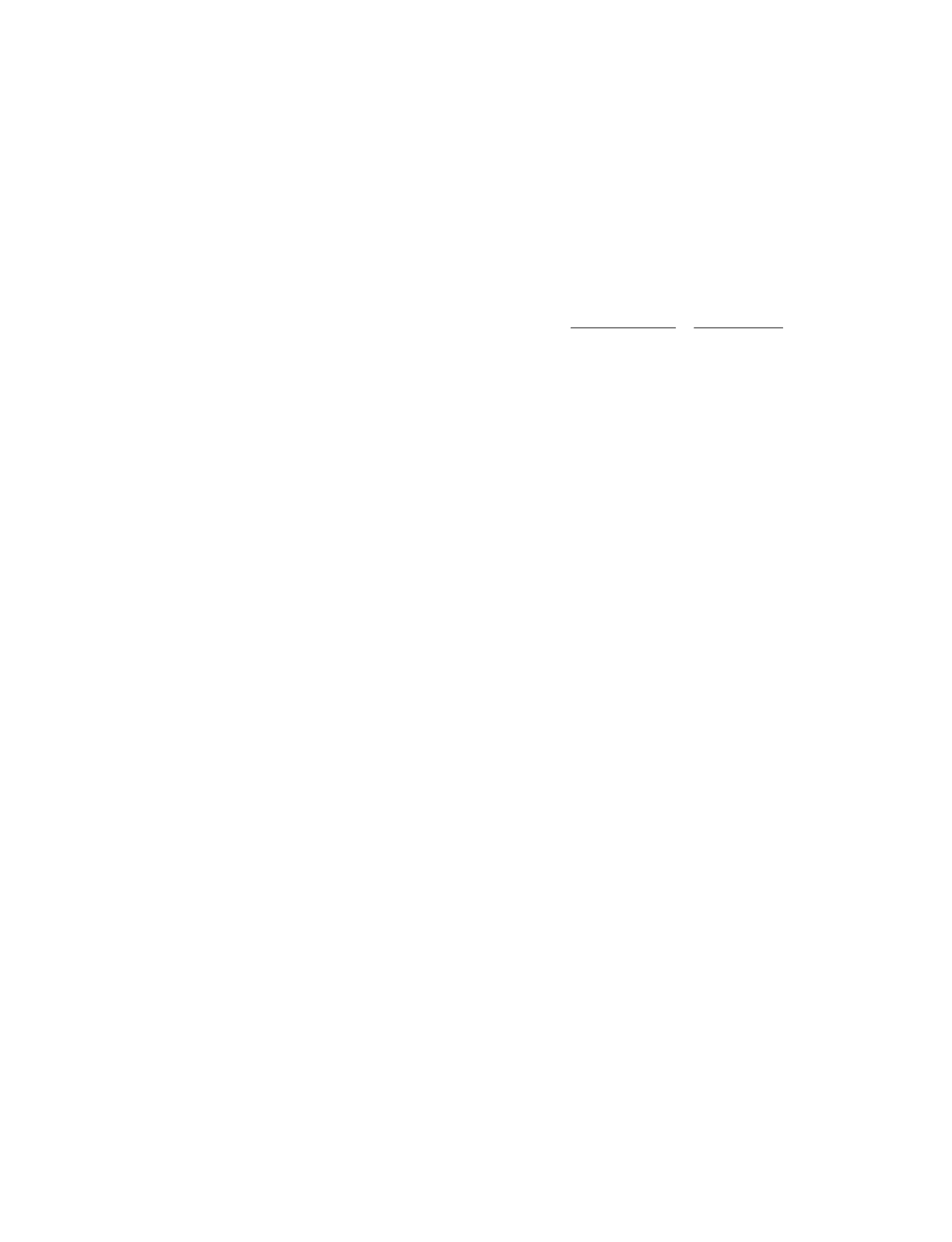

At December 31, 2014 our outstanding convertible debt was as follows (amounts in millions unless

otherwise noted):

1 Percent

Convertible

Senior Notes

2¾Percent

Convertible

Senior Notes

Outstanding principal balance. . . . . . . . . . . . . . . . . . . . . . . .

$500.0

$61.2

Issue date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . November 2014 August 2012

Maturity date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . November 2021 October 2019

Interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 percent

2¾ percent

Conversion price per share . . . . . . . . . . . . . . . . . . . . . . . . . .

$66.81

$16.63

Total shares of common stock subject to conversion . . . . .

7.5

3.7

Interest is payable semi-annually for both the 1 percent and 2¾ percent notes. The convertible notes are

convertible under certain conditions, at the option of the note holders. We will settle conversions of the notes, at

our election, in cash, shares of our common stock or a combination of both.

1 Percent Convertible Senior Notes

We may not redeem the 1 percent notes prior to maturity, and no sinking fund is provided for them. Holders

of the 1 percent notes may require us to purchase some or all of their notes upon the occurrence of certain

fundamental changes, as set forth in the indenture governing the 1 percent notes, at a purchase price equal to

100 percent of the principal amount of the notes to be purchased, plus accrued and unpaid interest.

2¾Percent Convertible Senior Notes

We may redeem the 2¾ percent notes at our option, in whole or in part, on or after October 5, 2016 if the

last reported sale price of our common stock for at least 20 trading days (whether or not consecutive) during the

period of 30 consecutive trading days ending on the trading day immediately preceding the date we provide the

redemption notice exceeds 130 percent of the applicable conversion price for the 2¾ percent notes on each such

day. The redemption price for the 2¾ percent notes will equal 100 percent of the principal amount being

redeemed, plus accrued and unpaid interest, plus $90 per each $1,000 principal amount being redeemed. Holders

of the 2¾ percent notes may require us to purchase some or all of their notes upon the occurrence of certain

fundamental changes, as set forth in the indenture governing the 2¾ percent notes, at a purchase price equal to

100 percent of the principal amount of the notes to be purchased, plus accrued and unpaid interest.

Equipment Financing Arrangement

In October 2008, we entered into an equipment financing loan agreement, and in September 2009 and June

2012, we amended the loan agreement to increase the aggregate maximum amount of principal we could draw

under the agreement. Each draw down under the loan agreement has a term of three years, with principal and

interest payable monthly. Interest on amounts we borrow under the loan agreement is based upon the three year

interest rate swap at the time we make each draw down plus 3.5 or four percent, depending on the date of the

draw. We are using the equipment purchased under the loan agreement as collateral. In June 2012, we drew

down $9.1 million in principal under the loan agreement at an interest rate of 4.12 percent and in June 2013 we

drew down $2.5 million in principal at an interest rate of 4.39 percent. As of December 31, 2014, our

outstanding borrowings under this loan agreement were at a weighted average interest rate of 4.18 percent. The

carrying balance under this loan agreement at December 31, 2014 and 2013 was $3.2 million and $7.5 million,

respectively. We will continue to use equipment lease financing as long as the terms remain commercially

attractive.

87