The combination of our substantial company-owned rock reserves, our granulation capacity, geographic locations, and a worldwide supply chain and distribution network differentiates Mosaic.

As a best-in-class company, Mosaic builds on its leadership position by enhancing our product lines and building efficiencies across our global network. Mosaic maintains an enviable position in phosphates, and our substantial asset base and geographic reach are unmatched in the industry. In fiscal 2010, we took further steps to ensure our leadership position and solidify our future success.

Integrated production on an unparalleled scale — combining substantial company-owned rock reserves, our granulation capacity, geographic location, and our global supply chain and distribution network — differentiates Mosaic's Phosphates segment. Port access from our Tampa and Louisiana operations on the Gulf Coast makes distribution of our products efficient and advantaged. As one of the industry's lowest-cost producers, and combined with our preferential geographic access to sulfur and ammonia, we ensure timely delivery of our products to our customers on a global basis. Our U.S. production capacity represents about 13 percent global market share and 56 percent of U.S. production capacity.

From an overall perspective, phosphate fundamentals continue to be firm and we expect the market to remain tight as pipeline inventories have been drawn down. Recent strong phosphate demand has significantly driven down North American producer stocks, despite more normal operating rates. We anticipate that over the next decade phosphate demand will grow at a compound annual growth rate of approximately 2 to 2.5 percent. While the growth rate may fluctuate from year to year, on average it's about 1.5 million tonnes of diammonium phosphate (DAP) annually.

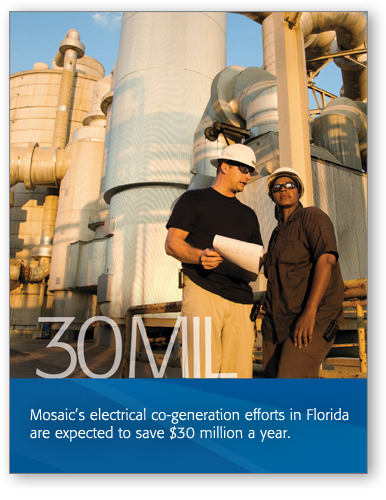

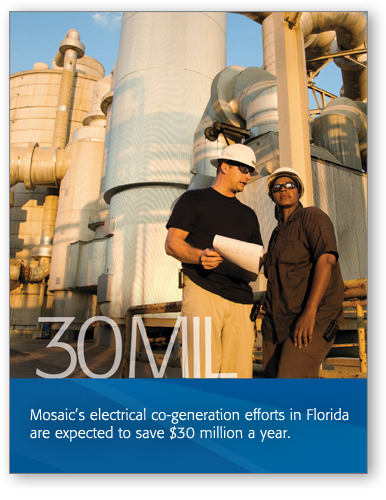

In addition to these significant achievements, we are implementing improved processes for maintenance, capital deployment, energy use, co-generation capacity and vendor rationalization. We also continue to focus on initiatives that will leverage our scale and geographic location.

In order to ensure Mosaic's competitive positioning, in 2010 we took a significant and bold step to augment our 35-year phosphate rock reserves in Florida. Mosaic obtained advantaged access to additional rock reserves through our investment in the Miski Mayo joint venture in Peru. This investment advances our commitment to secure additional phosphate rock reserves, but more importantly, it provides Mosaic with additional flexibility and extends our reserve base. Meanwhile, we continue work to obtain permits for our phosphate reserves in Florida.

†

Additionally, earlier this year, Phosphate Chemicals Export Association, Inc. (PhosChem) reached a three-year agreement to supply six million tonnes of DAP to two large Indian customers. This three-year contract underscores Mosaic's long-term commitment to India's expanding crop nutrient industry. The baseload contract also gives us the flexibility to optimize production rates and improve operating margins.

We believe that the combination of our bold moves to grow the value of our Phosphates business uniquely positions Mosaic to maintain its leadership into the future.