A defining year for the Group…

Our emerging markets are performing well, although our mature European markets continue to face challenging conditions. However, we have continued to make good progress in delivering our long-term strategy, by building firm foundations for the future with our substantial investments in Vodafone Red, Project Spring and unified communications.

Review of the year

It has been a year of substantial strategic progress. The sale of our Verizon Wireless stake has rewarded shareholders for their support, and enabled the acceleration of our strategy through the acquisition of Kabel Deutschland, the pending acquisition of Ono and our Project Spring investment programme.

Our operational performance has been mixed. The Group’s emerging markets businesses have performed strongly throughout the year: we have executed our strategy well and have successfully positioned ourselves for the rapid growth in data we are now witnessing. In Europe, where we continue to face competitive, regulatory and macroeconomic pressures, we have taken steps to improve our commercial performance, particularly in Germany and Italy, and are beginning to see encouraging early signs.

Verizon Wireless transaction

The sale of our 45% interest in Verizon Wireless, the leading mobile operator in the United States, was the culmination of a highly successful 14 year investment which began when Verizon and Vodafone entered into a partnership to create Verizon Wireless in 2000.

We had been very happy to stay invested in the business over the years, despite our minority position, because of the strong growth and returns generated, and the attractiveness of the US market. However, the Board viewed the offer of US$130 billion as a very attractive price at which to exit. The completion of the transaction enabled us to return a record US$85 billion to our shareholders, while retaining ample financial flexibility to pursue our own strategy both organically and through targeted acquisitions.

Strategic progress

We have made very substantial progress on our strategy in the past year, despite the significant challenges faced in Europe.

Highlights

- Unified communications strategy: acquisition of Kabel Deutschland and proposed acquisition of Ono – two leading cable companies, ongoing fibre build in Spain and Portugal, with Italy to commence this year

- Project Spring underway, initially with increased network investment in India and Germany

- 4.7 million 4G customers in 14 markets; early 4G data usage more than double that of 3G data usage

- European smartphone penetration 45%, up 7 percentage points year-on-year

- Vodafone Red now in 20 markets; 12 million customers as at 31 March 2014

- M-Pesa now in 10 markets, 17 million customers

Project Spring

Project Spring is our organic investment programme which will allow us to accelerate and extend our strategic priorities through investment in mobile and fixed networks, products and services, and our retail platform. Announced alongside the Verizon transaction in September 2013, Project Spring will strengthen further our network and service differentiation. The transition to 4G and unified communications, coupled with an improved economic outlook for Europe, lead us to believe Vodafone has a unique opportunity to invest now. We expect total investments, including Project Spring, to be around £19 billion over the next two years. The main elements of our investment are:

- 4G in Europe: we aim to reach 91% population coverage by March 2016;

- 3G in emerging markets: with 95% population coverage in targeted urban areas in India by March 2016;

- next-generation fixed line infrastructure: laying fibre to more base stations and deep into residential areas across Europe and in selected emerging market urban areas;

- development of enterprise products and services: extending our M2M reach to 75 countries and rolling out hosting and IP-VPN services internationally;

- investment in our retail estate: modernising 8,000 of our stores to improve the customer experience.

Want to find out more?

Read more about:

How and where we do business

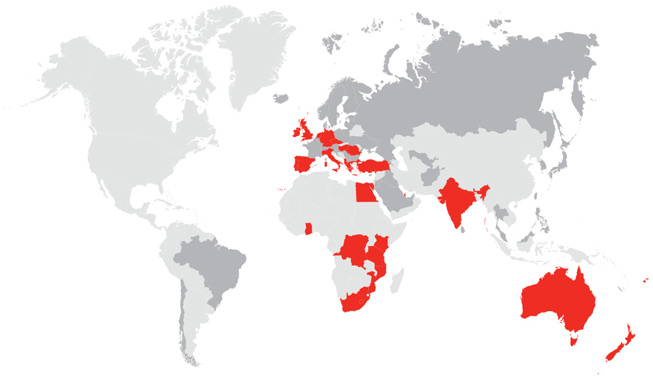

We are one of the world’s largest telecommunications companies providing a wide range of services including voice, messaging, data and fixed broadband. We have 434 million mobile customers and 9 million fixed broadband customers across the globe.

Our business is split across two geographic regions – Europe, and Africa, Middle East and Asia Pacific (‘AMAP’), which includes our emerging markets.

The services we provide

Voice

We carried 1.2 trillion minutes of calls over our network last year – that’s the equivalent of everyone around the world talking for two and a half hours.

Messaging

Our network carried 337 billion text, picture, music and video messages last year.

Data

Over 544 petabytes of data were sent across our network last year – that’s enough data for over 100 billion one minute video clips.

Fixed broadband

We have 9.3 million fixed broadband customers, mainly in Germany, Spain and Italy.

Other services

Includes revenue from mobile virtual network operators (‘MVNOs’) using our network in our markets and from operators outside our footprint using our products and services as part of our partner market network that spans 48 countries.

Where we operate

- Our markets

- Our partner markets

Europe

We are the number one or two mobile operator in most of our European markets with market shares ranging from around 25% to over 40%. We have a small but growing share in fixed line across Europe, with the acquisition of Kabel Deutschland and proposed acquisition of Ono boosting our positions in Germany and Spain.

AMAP

We are the number one or two mobile operator in most of our AMAP region. Our mobile market shares vary by market from around 20% to over 50%.

Want to find out more?

Read more about:

Key events

A look back at some of the key moments in our year.

- Expanding Vodafone Red

- M-Pesa in India

- Kabel Deutschland

- 4G

- Sale of our interest in Verizon Wireless

- Project Spring

- Vodafone Foundation Instant Network

- M-Pesa ‘Text to Treatment’Programme

- New brand strategy – Vodafone Firsts

- New spectrum in India

- The single largest return of value to shareholders

- Ono

How we’ve performed this year

Our financial performance reflects continued strong growth in our emerging markets, partly offsetting competitive, regulatory and macroeconomic pressures in Europe.

Watch the video to find out how we’ve performed.

(All financial information in this review is presented on a management basis. See page 3 in our Annual Report)

Want to find out more?

Read more about:

Our strategy

As the demand for ubiquitous data grows rapidly, we are transforming our business to become a leading unified communications company, and to strengthen further our network and service differentiation against our peers.