Fellow Shareholders

Allstate is a special place. We rally employees and agency teams around the theme of “Be A Force For Good” and live this by striving to do the right thing at the right time, putting people before policies and defying expectations. This is not easy, and we are not always perfect since we are an organization powered by people. Allstate is a different kind of insurance company and is on a different path — a path based on a differentiated customer-focused strategy that invests in people and takes a proactive leadership approach. As a result, our operating performance was strong and shareholders had a 38% total return in 2013. Going forward, the future looks bright given our capabilities, brands and financial strength.

Customer-focused strategy is working

Our strategy of focusing on the four unique segments of the consumer insurance market is working. As our competitors respond, we will continue to invest in improving and expanding the customer value propositions for all three underwritten brands: Allstate, Esurance and Encompass.

- Allstate agencies improved their service levels for customers who prefer local advice and want the value that comes from the Allstate-branded offering.

- Esurance continues to provide new tools and services to assist customers who prefer to tackle their own insurance needs, while expanding the breadth of its branded products.

- Encompass provides a packaged auto and homeowners policy for customers of independent agencies who want local advice but prefer a choice of insurance carriers.

ACHIEVED 2013 OPERATING PRIORITIES

Allstate delivered strong results last year on all five 2013 operating priorities.

- Grow Insurance Premiums: Total premiums grew as a result of policy growth in all three brands where we underwrite risk (Allstate, Esurance and Encompass). Our Allstate Benefits and Allstate Roadside Services businesses also grew.

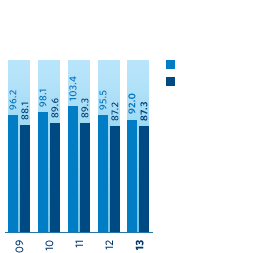

- Maintain Auto Profitability: The total Allstate Protection auto combined ratio of 96.4 continued at the attractive levels we maintained over the past decade. However, the Esurance and Encompass auto loss ratios were higher than our targets. These management teams continue to work hard to improve these results so we can maintain overall growth in policies in force.

- Raise Returns in Homeowners and Annuity Businesses: Allstate brand homeowners returns showed continued improvement as a result of our actions, positioning this business for sustainable profitability. Insurance premiums in this business have now reached levels appropriate for the dramatic increase in catastrophe losses we experienced over the last six years, having increased nearly 25% from an average premium of $861 in 2008 to $1,115 in 2013. In 2013, the homeowners business generated an underwriting profit* of $1.4 billion, a $2.7 billion improvement over 2011, reflecting a large decline in catastrophe losses. While we can’t predict the future level of catastrophe losses, Allstate is far better-positioned to maintain appropriate returns in homeowners insurance. Returns also improved in the annuity business, but more work needs to be done to achieve sustainable profitability.

- Proactively Manage Investments: Investment income exceeded our expectations, as strong results from limited partnership investments partially offset the negative impact of low interest rates. Interest rate risk was substantially reduced beginning in 2012, which was a smart decision, given that interest rates increased in 2013. The total return on the portfolio was 1.8% for the year. This return did not meet our long-term targets, as the rise in interest rates lowered the value of our fixed income portfolio. On a three-year average, the total return of 5.2% was much closer to the level of return expected given the portfolio’s risk characteristics.

- Reduce Our Cost Structure: Progress was made in reducing our future cost structure, including changes to our processes and employee benefits. Continuous improvements and simplification in our processes and technology were also initiated to deliver more value to our customers.

STRONG FINANCIAL RESULTS

As a result of excellent operating results, financial performance was strong in 2013.

- Premiums written increased by $1.1 billion or 4.2% over 2012.

- Net income was $2.3 billion, as operating profit was somewhat reduced by losses on the pending sale of Lincoln Benefit Life Company, the replacement of high-cost debt and employee benefit-related charges.

- Operating income* reached $2.7 billion.

- Return on equity was 11.0% and 14.5% on a net income and operating income* basis, respectively.

- Operating income return on equity* of 14.5% exceeded our 2014 year-end goal of 13%, even after adjusting for the relatively low level of catastrophe losses and nonrecurring charges in 2013.

Financial Highlights

STRENGTHENING CAPITAL

Proactively managing capital is a core focus. We continued to build on our legacy in 2013 by reducing capital in lower-return businesses, investing in growth and providing shareholders with good cash returns.

- The pending sale of Lincoln Benefit Life further reduces the capital deployed in lower-margin spread businesses, allowing us to narrow our life and retirement focus to those customers served by Allstate agencies. This transaction will free up capital, which can be deployed into higher-returning businesses.

- We acquired Northeast Agencies, Inc. to enhance our capabilities to provide non-proprietary products to customers through the Allstate agencies.

- Shareholders received $2.2 billion in cash through common stock dividends and share repurchases in 2013. This represents a cash return of 9.4% when compared to Allstate’s average market capitalization.

The company also further strengthened its financial position by taking advantage of record low interest rates to utilize perpetual preferred stock and subordinated debt to refinance higher-cost senior debt. While this resulted in an after-tax loss of $319 million on extinguishment of debt, it created additional strategic flexibility.

CORPORATE STEWARDSHIP

Supporting local communities and proactive corporate governance are also key elements of Allstate’s success. Allstate, The Allstate Foundation, our employees and agency teams bring the “Good Hands” to life for less-advantaged people in virtually every city in the country by contributing over $29 million in 2013. An impressive 65% of agency owners and employees were involved in corporate responsibility programs during the year. The Board also continued to enhance its oversight and added a new Board member, as discussed in the Board’s letter to shareholders in the proxy statement. We have benefited greatly from the experience and insights of Ron LeMay and lead director John Riley and will miss their expertise and commitment to Allstate.

A BRIGHT FUTURE

Allstaters are proud to do good for customers and communities. Our stakeholders deserve the best from us, and we will continually strive to exceed their expectations. Allstate’s purpose is to protect people from life’s uncertainties and help them prepare for the future. Purpose-driven commitment to Our Shared Vision and a belief that Allstate brings out the good in life will enable us to build on our fabulous legacy and create an even brighter future!

Thomas J. Wilson

Chairman, President and

Chief Executive Officer

April 7, 2014

Profitable Growth

Profitable Growth

- Our strategy of serving unique consumer segments with differentiated offerings fueled our growth in 2013.

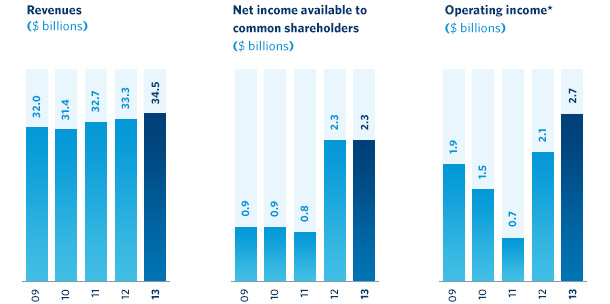

- Revenues increased 3.6% to $34.5 billion, net income available to common shareholders (“net income”) was $2.3 billion, and operating income* rose 24.3% to $2.7 billion, or $5.68 per diluted common share, due in part to lower catastrophe losses than in 2012.

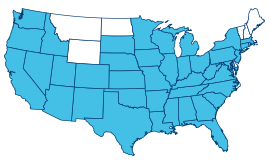

- The Allstate brand, which is delivered through 9,300 Allstate agency locations, remains the company’s largest core business. It grew both policies and premiums in 2013.

Financial Strength

Financial Strength

- The Allstate Corporation and its major subsidiaries are well capitalized, have a strong portfolio of businesses and significant liquidity.

- We had $2.6 billion of deployable assets at the holding company level as of year-end 2013.

- We continue to improve our financial strength and strategic flexibility by repurchasing outstanding debt and issuing new lower-cost senior debt, hybrid debt and preferred stock.

- Our investment portfolio is largely comprised of high-quality fixed income investments, which provide significant cash flow and liquidity. Equity and limited partnership investments provide higher returns.

Shareholder Returns

Shareholder Returns

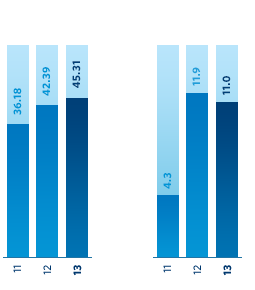

- Book value per diluted common share increased 6.9% in 2013, to $45.31 at year-end.

- Allstate returned $32 billion in capital to shareholders since its spin-off from Sears in 1995.

- In 2013, we returned $2.2 billion to shareholders by repurchasing 7.8% of our outstanding common shares and paying a quarterly dividend of 25 cents per common share.

- Allstate continues to return capital to shareholders through share repurchases. In February 2014, a $2.5 billion common share repurchase program was authorized and is expected to be completed by August 2015.