Part II, Item 5, 6

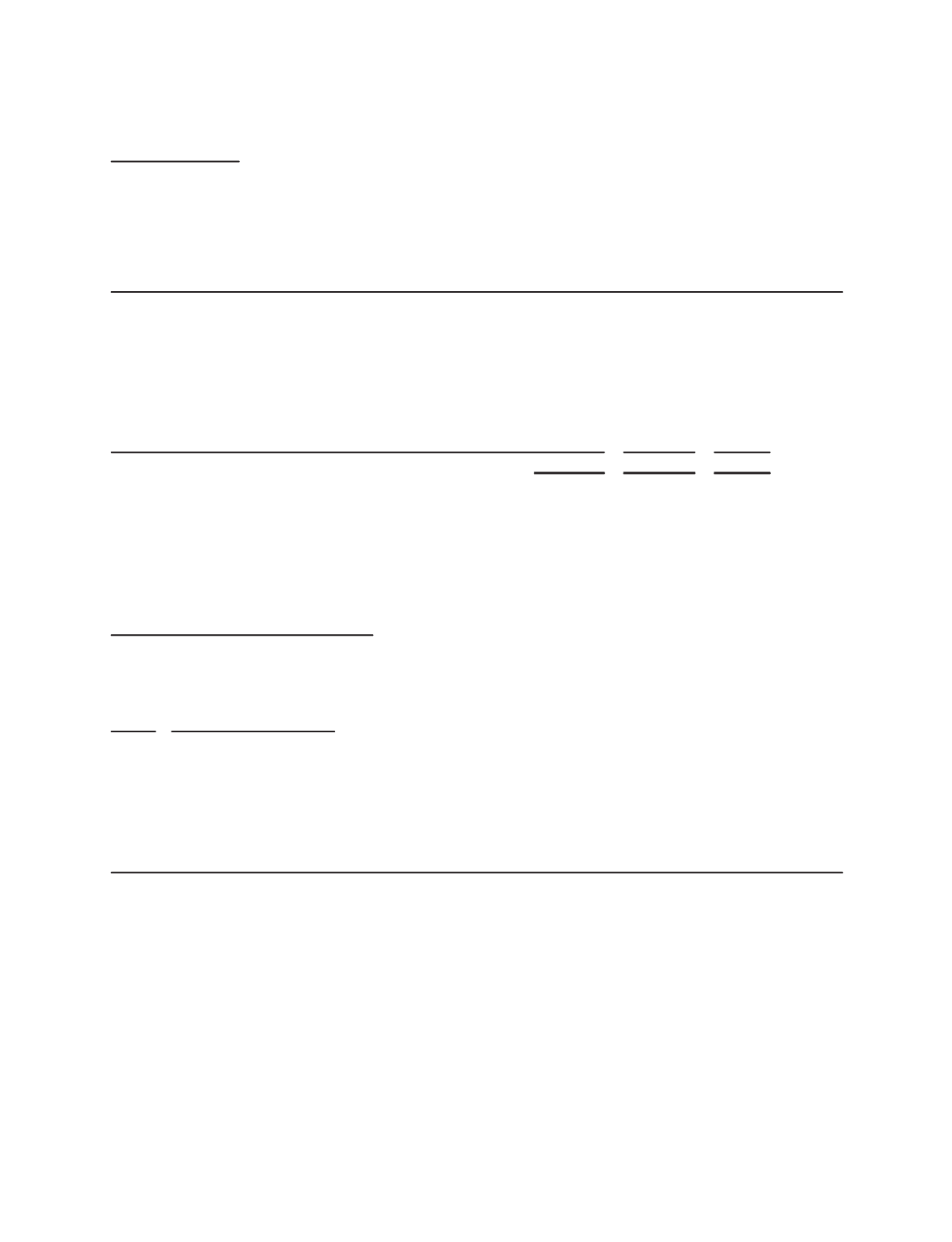

Share Repurchases

On April 17, 2008, the Schlumberger Board of Directors approved an $8 billion share repurchase program for

Schlumberger common stock, to be acquired in the open market before December 31, 2011.

Schlumberger’s common stock repurchase program activity for the three months ended December 31, 2010 was as

follows:

Total number

of shares

purchased

Average price

paid per

share

Total

number of

shares

purchased

as part of

publicly

announced

program

Maximum

value

of shares

that may

yet be

purchased

under the

program

(Stated in thousands, except per share amounts)

October 1 through October 31, 2010

1,931.0 $

63.04

1,931.0 $5,176,181

November 1 through November 30, 2010

1,050.0 $

73.46

1,050.0 $5,099,043

December 1 through December 31, 2010

3,074.3 $

81.35

3,074.3 $4,848,944

6,055.3 $

74.14

6,055.3

In connection with the exercise of stock options under Schlumberger’s incentive compensation plans, Schlumberger

routinely receives shares of its common stock from optionholders in consideration of the exercise price of the stock

options. Schlumberger does not view these transactions as requiring disclosure under this Item 5 as the number of

shares of Schlumberger common stock received from optionholders is not material.

Unregistered Sales of Equity Securities

None.

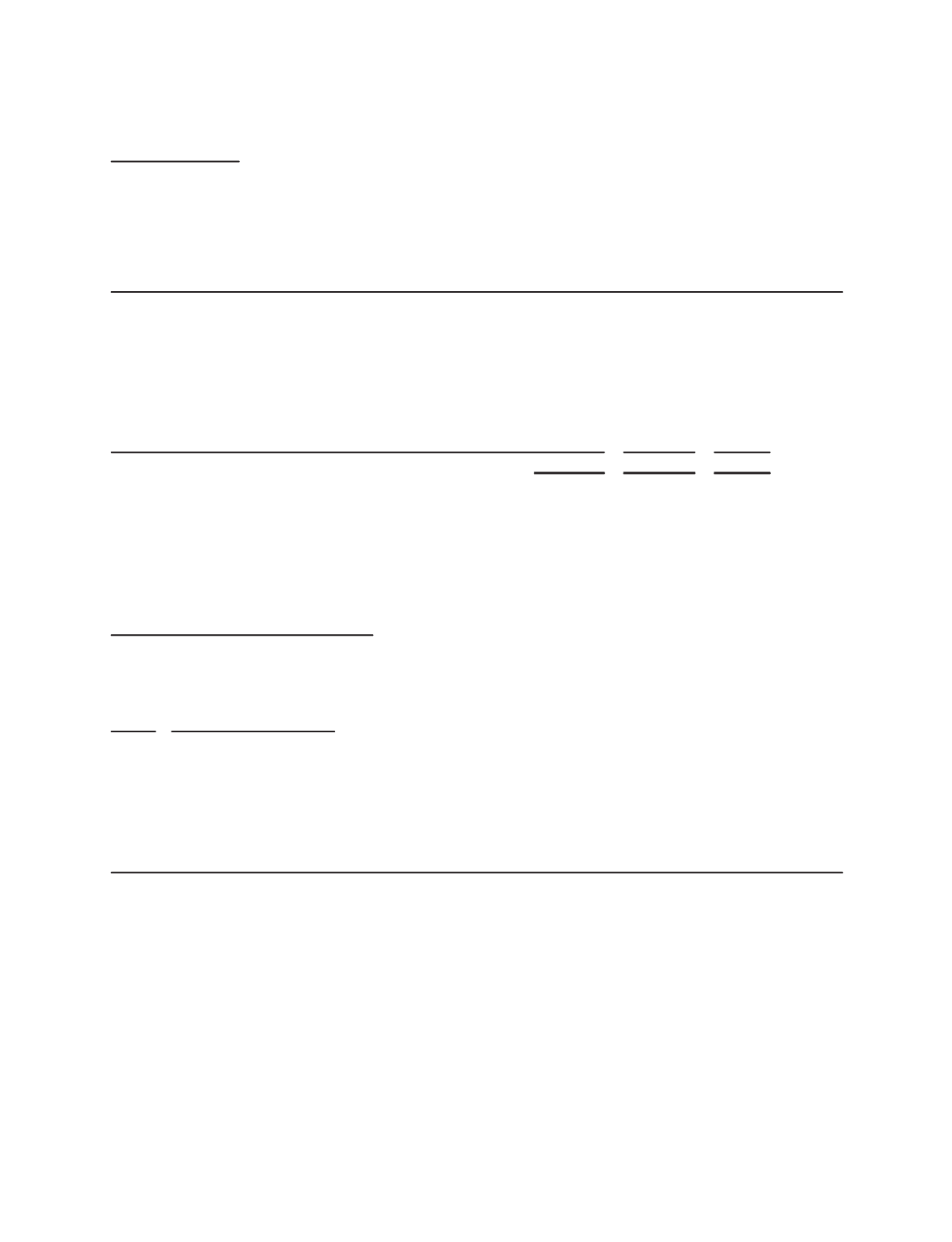

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with both “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and “Item 8. Financial Statements and

Supplementary Data” of this Form 10-K in order to understand factors, such as business combinations and charges and

credits, which may affect the comparability of the Selected Financial Data:

2010 2009 2008 2007 2006

Year Ended December 31,

(Stated in millions, except per share amounts)

Revenue

$27,447

$22,702 $27,163 $23,277 $19,230

Income from Continuing Operations

$ 4,266

$ 3,164 $ 5,422 $ 5,177 $ 3,759

Diluted earnings per share from Continuing Operations

$ 3.38

$ 2.61 $ 4.42 $ 4.20 $ 3.01

Working capital

$ 7,233

$ 6,391 $ 4,811 $ 3,551 $ 2,731

Total assets

$51,767

$33,465 $32,094 $27,853 $22,832

Net debt

(1)

$ 2,638

$ 126 $ 1,129 $ 1,857 $ 2,834

Long-term debt

$ 5,517

$ 4,355 $ 3,694 $ 3,794 $ 4,664

Schlumberger stockholders’ equity

$31,226

$19,120 $16,862 $14,876 $10,420

Cash dividends declared per share

$ 0.84

$ 0.84 $ 0.84 $ 0.70 $ 0.50

(1) “Net Debt” represents gross debt less cash, short-term investments and fixed income investments, held to maturity. Management believes that Net

Debt provides useful information regarding the level of Schlumberger indebtedness by reflecting cash and investments that could be used to repay

debt.

16