Sequentially, revenue growth resulted from the continued ramp up of IPM activity in Iraq and the start of new offshore

projects in East Asia. Year-end sales of Artificial Lift and Completion Systems equipment, Well Services products, and

SIS software also contributed to Area growth. These increases were partially offset by lower revenue in the Australia/

Papua New Guinea GeoMarket resulting from offshore project completions and delays in land activity due to severe

flooding, and by lower activity in the Qatar GeoMarket that reduced demand for Wireline and Drilling & Measurements

services.

Pretax operating margin decreased 119 bps sequentially to 29.1% as the positive contribution from the year-end sales

and a more favorable revenue mix in the Arabian GeoMarket were insufficient to offset the impact of the lower activity in

the Australia/Papua New Guinea GeoMarket and startup costs in Iraq.

WesternGeco

Fourth-quarter revenue of $560 million increased 17% sequentially. Pretax operating income of $113 million increased

183% sequentially.

Sequentially, revenue growth was driven by Multiclient, which recorded strong year-end sales from the US Gulf of

Mexico. This increase was partially offset by a decrease in Marine revenue due to the seasonal slow-down in activity.

Land and Data Processing revenues were flat sequentially.

Pretax operating margin increased 11.8 percentage points sequentially to 20.2% as the result of the high Multiclient

sales partially offset by the impact of the lower Marine activity.

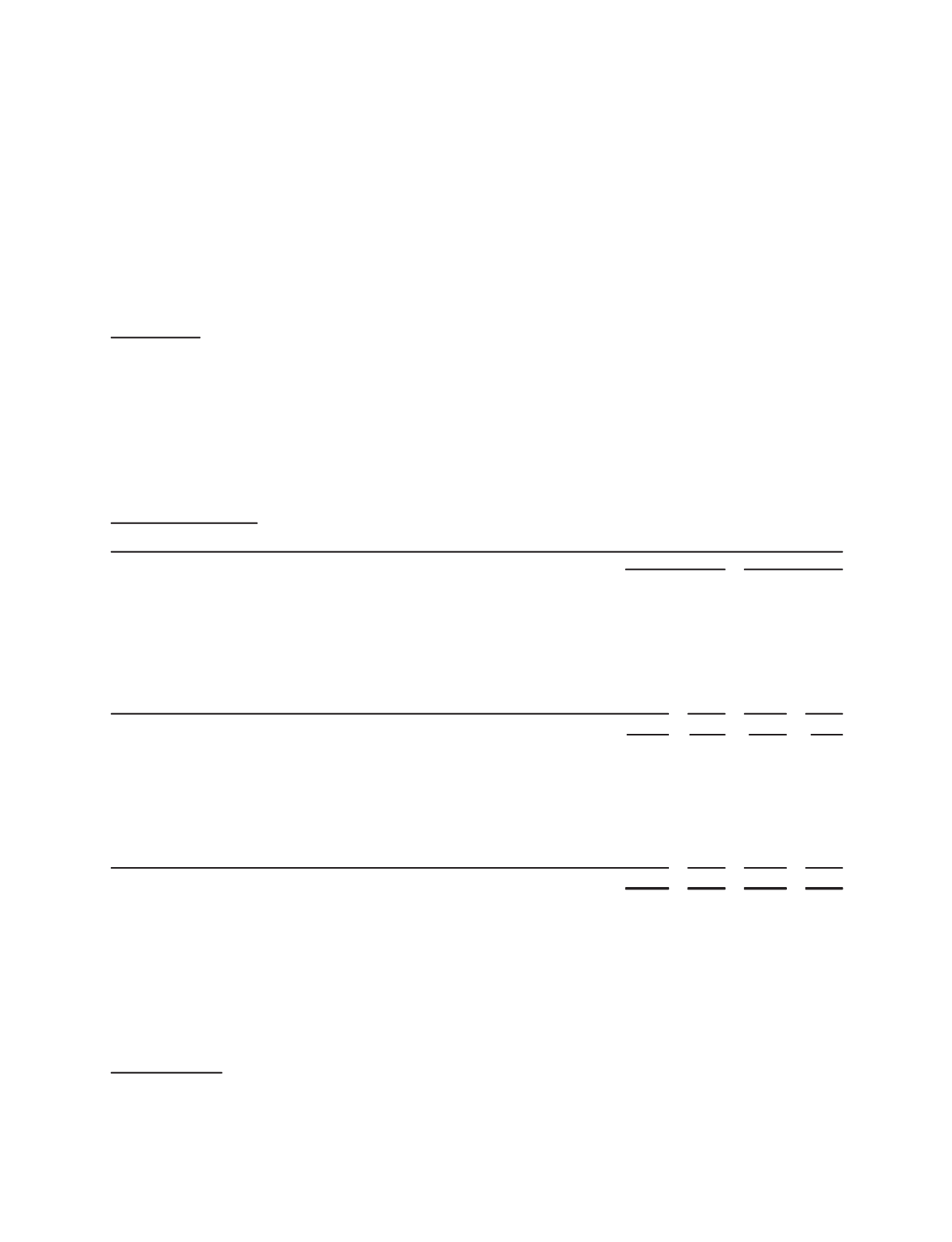

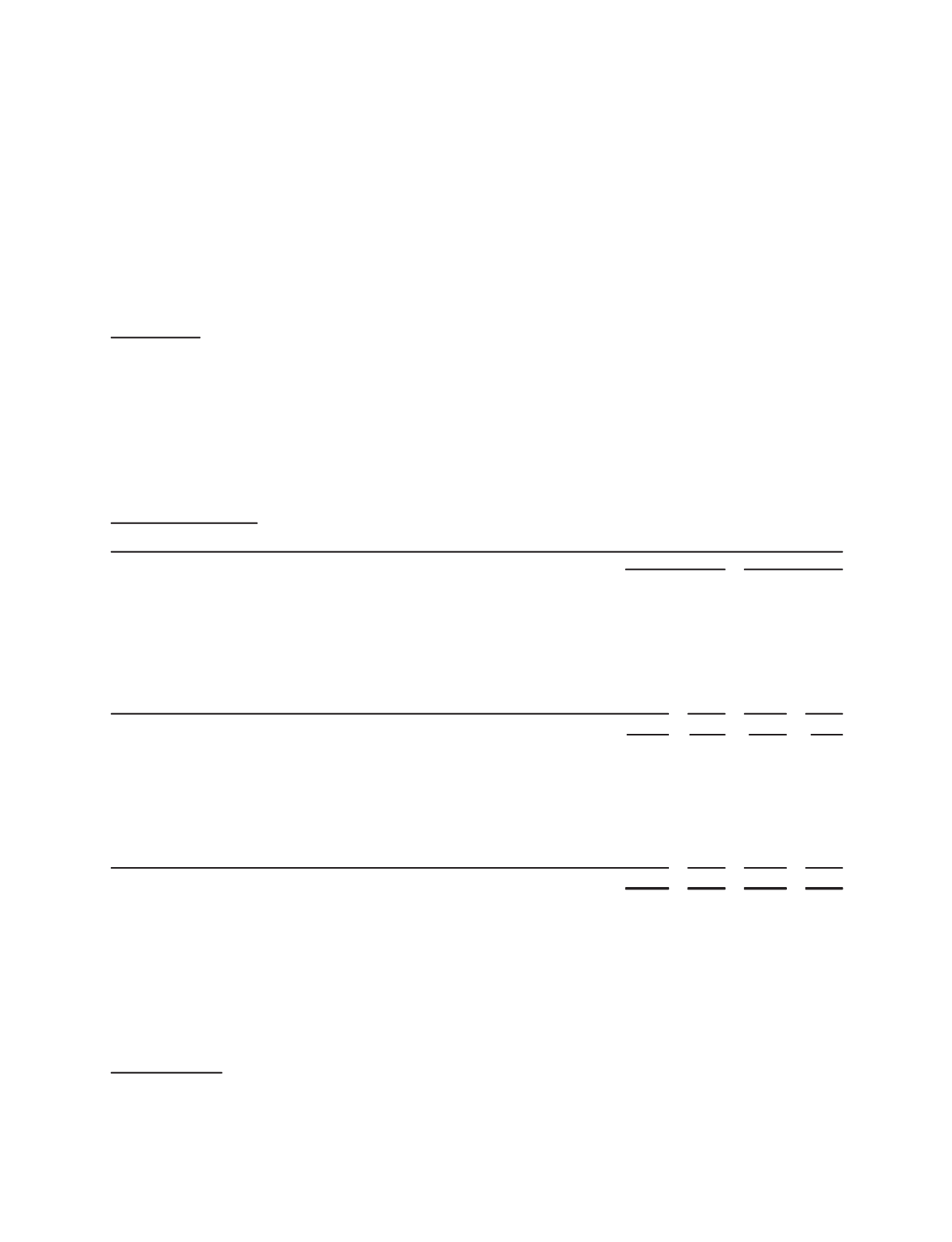

Full-Year 2010 Results

Revenue

Income

before

taxes

Revenue

Income

before

taxes

2010

2009

(Stated in millions)

OILFIELD SERVICES

North America

$ 5,010 $ 802

$ 3,707 $ 216

Latin America

4,321

723

4,225

753

Europe/CIS/Africa

6,882 1,269

7,150

1,707

Middle East & Asia

5,586 1,696

5,234

1,693

Elims/Other

280

(15)

202

(43)

22,079 4,475

20,518

4,326

WESTERNGECO

1,987

267

2,122

326

M-I SWACO

(1)

1,568

197

SMITH OILFIELD

(1)

957

132

DISTRIBUTION

(1)

774

29

Corporate

(2)

82 (405)

62

(344)

Interest income

(3)

43

52

Interest expense

(4)

(202)

(188)

Charges & credits

(5)

620

(238)

$27,447 $5,156

$22,702 $3,934

(1) 2010 includes four months of post-merger activity following the transaction with Smith on August 27, 2010. See Note 4 to the

Consolidated

Financial Statements

for further details.

(2) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based compen-

sation costs, amortization expense associated with intangible assets recorded as a result of the merger with Smith and certain other nonoperating

items.

(3) Excludes interest income included in the segments’ income (2010 – $7 million; 2009 – $10 million).

(4) Excludes interest expense included in the segments’ income (2010 – $5 million; 2009 – $33 million).

(5) Charges and credits are described in detail in Note 3 to the

Consolidated Financial Statements

.

Oilfield Services

Full-year 2010 revenue of $22.08 billion was 8% higher than 2009. Revenue growth was strongest in the North America

Area mostly as a result of higher activity and pricing for Well Services technologies in US Land but partially offset by

21

Part II, Item 7