Year-on-year, pretax operating margin decreased 194 bps to 13.4% as the result of the lower pricing and activity in

Marine and reduced profitability in Land and Data Processing. These decreases were partially offset by an improvement

in Multiclient margins on the increased activity.

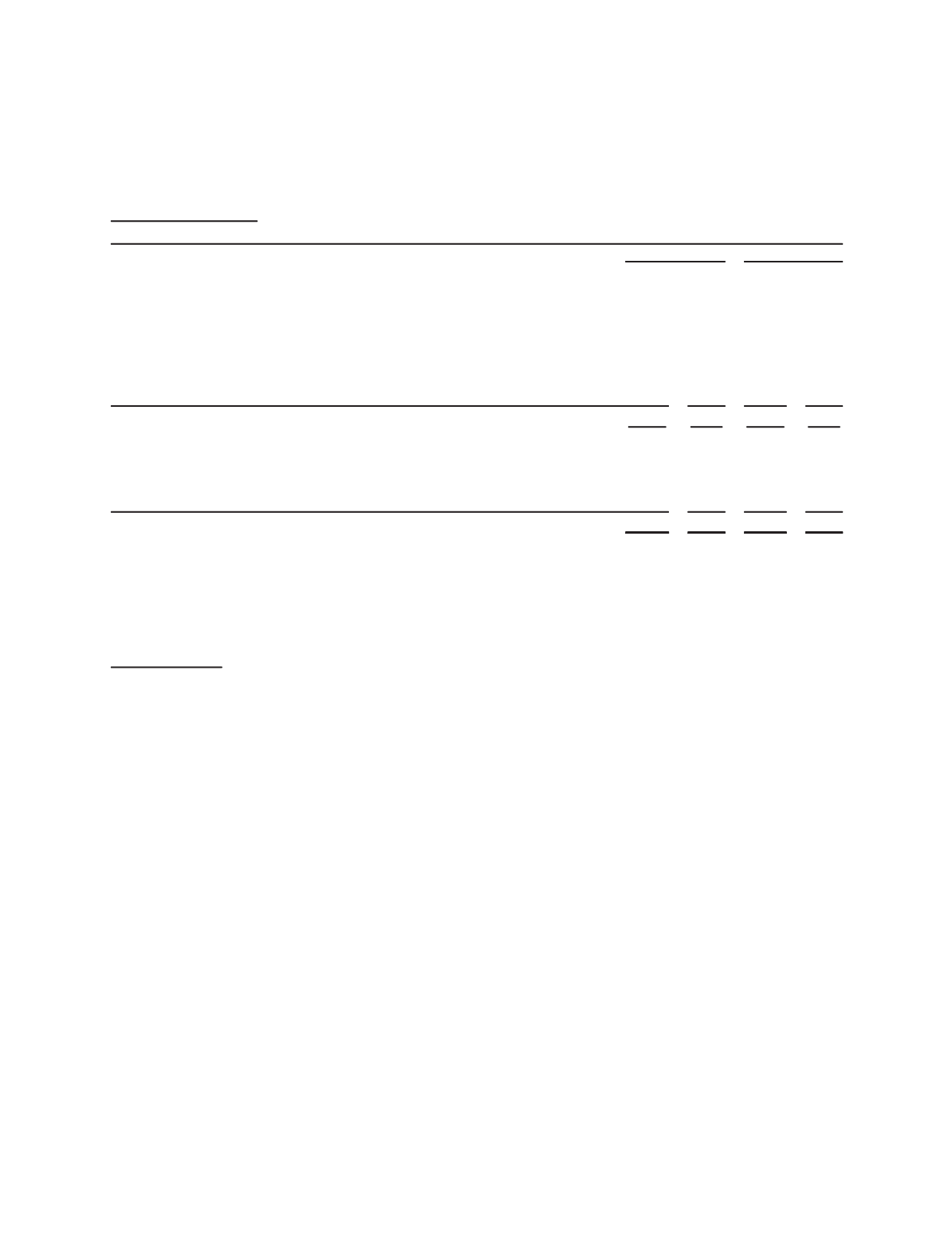

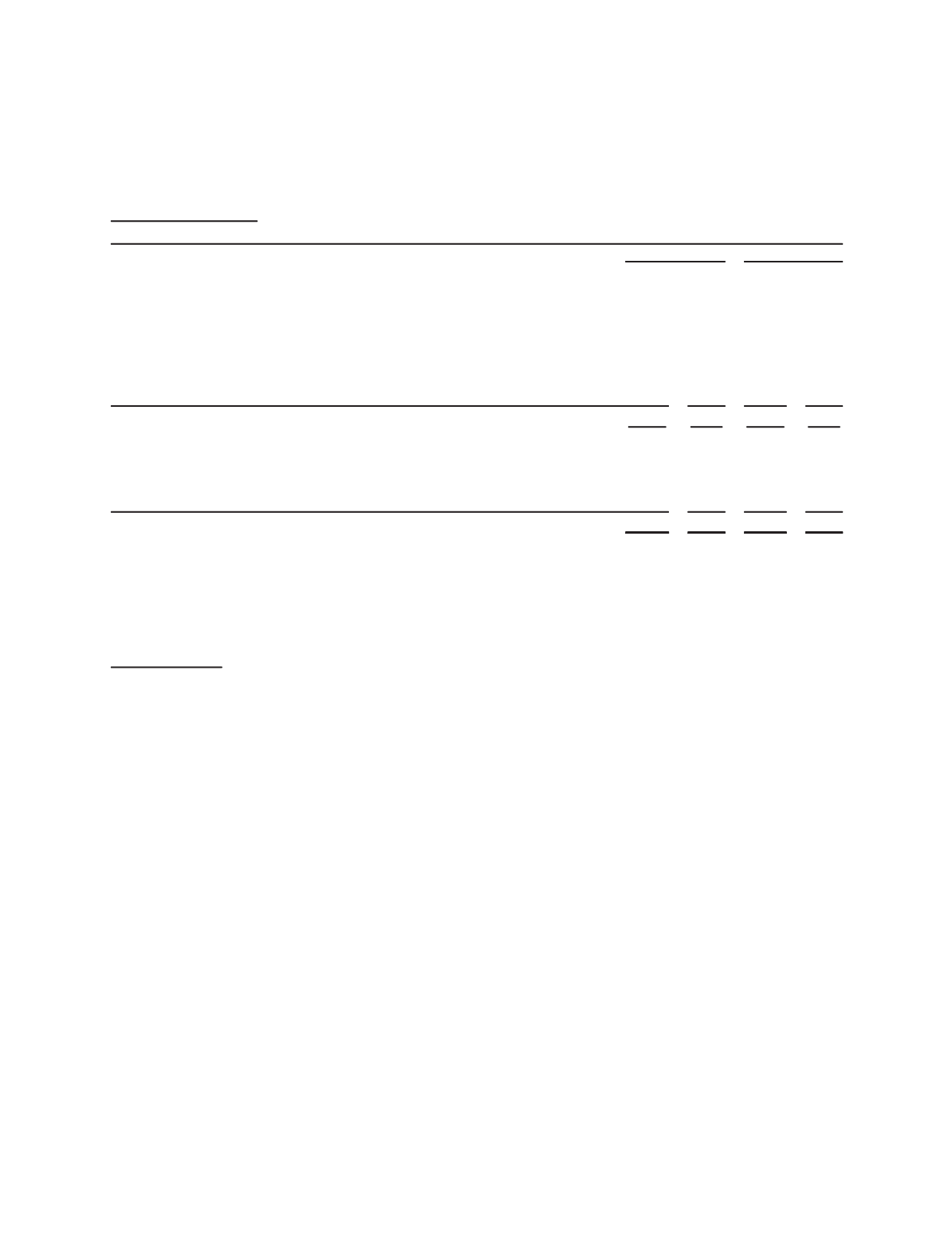

Full-Year 2009 Results

Revenue

Income

before

taxes

Revenue

Income

before

taxes

2009

2008

(Stated in millions)

OILFIELD SERVICES

North America

$ 3,707 $ 216 $ 5,914 $1,371

Latin America

4,225

753

4,230

858

Europe/CIS/Africa

7,150

1,707

8,180

2,244

Middle East & Asia

5,234

1,693

5,724

2,005

Elims/Other

202

(43)

234

27

20,518

4,326

24,282

6,505

WESTERNGECO

2,122

326

2,838

836

Corporate

(1)

62

(344)

43

(268)

Interest income

(2)

52

112

Interest expense

(3)

(188)

(217)

Charges & credits

(4)

(238)

(116)

$22,702 $3,934 $27,163 $6,852

(1) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based compen-

sation costs and certain other nonoperating items.

(2) Excludes interest income included in the segments’ income (2009 – $10 million; 2008 – $7 million).

(3) Excludes interest expense included in the segments’ income (2009 – $33 million; 2008 – $30 million).

(4) Charges and credits are described in detail in Note 3 to the

Consolidated Financial Statements.

Oilfield Services

Full-year 2009 revenue of $20.52 billion declined 16% versus 2008. Lower natural gas prices and unfavorable market

fundamentals resulted in a 37% decline in North America revenue, primarily in the US Land and Canada GeoMarkets.

Europe/CIS/Africa revenue decreased 13% mainly due to the weakening of local currencies against the US dollar and

reduced activity in the Russia, North Sea, West & South Africa and Caspian GeoMarkets as well as in Framo, which was

partially offset by increased activity in the North Africa GeoMarket. Middle East & Asia revenue also fell by 9% primarily

due to decreases in the East Asia, East Mediterranean, Arabian and Australia/Papua New Guinea GeoMarkets. Latin

America revenue was only marginally lower than last year as the impact of the weakening of local currencies against the

US dollar and much lower activity in Venezuela/Trinidad & Tobago and Peru/Colombia/Ecuador were nearly offset by

stronger activity in Mexico/Central America and Brazil. Weakening of local currencies against the US dollar reduced

2009 revenue by approximately 4%. Across the Areas, all of the Technologies recorded revenue declines except Testing

Services. IPM recorded revenue growth compared to the same period last year.

Full-year 2009 pretax operating margin decreased 5.7 percentage points to 21.1%, on the significant drop in activity

and pricing pressure experienced across all the Areas, but most notably in North America.

North America

Revenue of $3.71 billion was 37% lower than last year with reductions across the entire Area. The decreases were

highest in US Land and Canada, where lower natural gas prices resulted in a steep drop in activity and consequent

pressure on pricing. Canada revenue was also lower as the result of the weakening of the Canadian dollar against the

US dollar. Revenue in the US Gulf of Mexico GeoMarket was severely impacted by weaker shelf drilling activity and strong

pricing pressure.

Pretax operating margin fell 17.3 percentage points to 5.8% due to the significant decline in activity levels across the

Area, combined with the severe pricing erosion.

23

Part II, Item 7