The effective tax rate for 2010 was significantly impacted by the charges and credits described in Note 3 to the

Consolidated Financial Statements

. The effective tax rate for 2009 was also impacted by charges, but to a much lesser

extent. Excluding charges and credits, the effective tax rate in 2010 was approximately 20.6% compared to 19.2% in 2009.

This increase is largely attributable to the geographic mix of earnings as well as the inclusion of four months results from

the merger with Smith. Smith, which as a US company has a US tax rate applicable to its worldwide operations and as

such, will serve to increase Schlumberger’s overall effective tax rate.

The decrease in the Schlumberger effective tax rate in 2009 as compared to 2008 was primarily attributable to the

geographic mix of earnings. Schlumberger generated a lower proportion of its pretax earnings in North America in 2009

as compared to 2008. In addition, outside North America, various GeoMarkets with lower tax rates contributed a greater

percentage to pretax earnings in 2009 as compared to 2008.

Charges and Credits

Schlumberger recorded significant charges and credits in continuing operations during 2010, 2009 and 2008. These

charges and credits, which are summarized below, are more fully described in Note 3 to the

Consolidated Financial

Statements

.

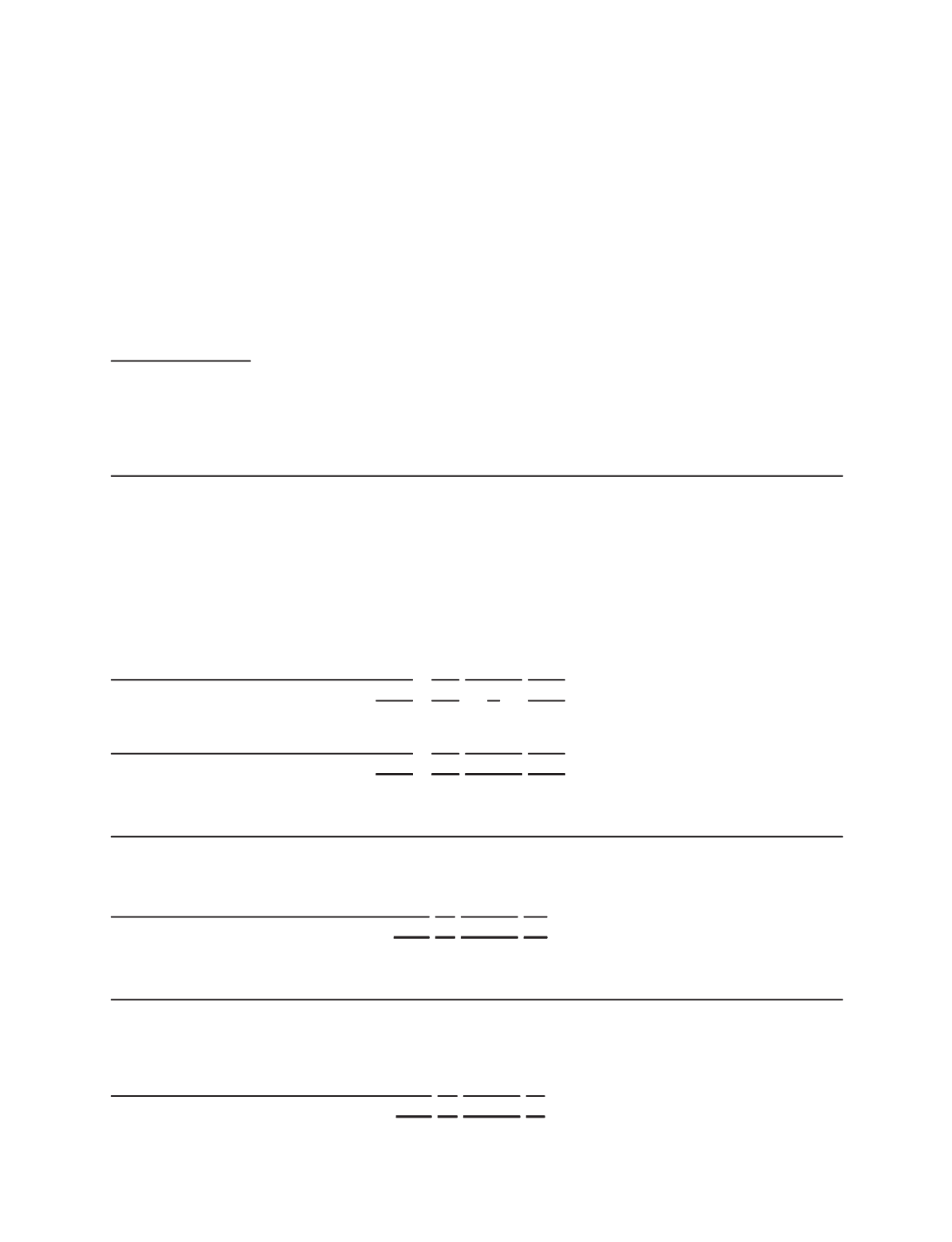

The following is a summary of the 2010 charges and credits:

Pretax Tax

Non-

controlling

Interest

Net Income Statement Classification

(Stated in millions)

Restructuring and Merger-related Charges:

Severance and other

$ 90 $ 13

$– $ 77

Restructuring & other

Impairment relating to WesternGeco’s first

generation Q-Land acquisition system

78

7

–

71

Restructuring & other

Other WesternGeco-related charges

63

–

–

63

Restructuring & other

Professional fees and other

107

1

–

106

Merger & integration

Merger-related employee benefits

58

10

–

48

Merger & integration

Inventory fair value adjustments

153

56

–

97

Cost of revenue

Mexico restructuring

40

4

–

36

Restructuring & other

Repurchase of bonds

60

23

37

Restructuring & other

Total restructuring and merger-related charges

649

114

–

535

Gain on investment in M-I SWACO

(1,270) (32)

–

(1,238)

Gain on Investment in M-I SWACO

Impact of elimination of tax deduction related to

Medicare Part D subsidy

– (40)

–

40

Taxes on income

$ (621) $ 42

$– $ (663)

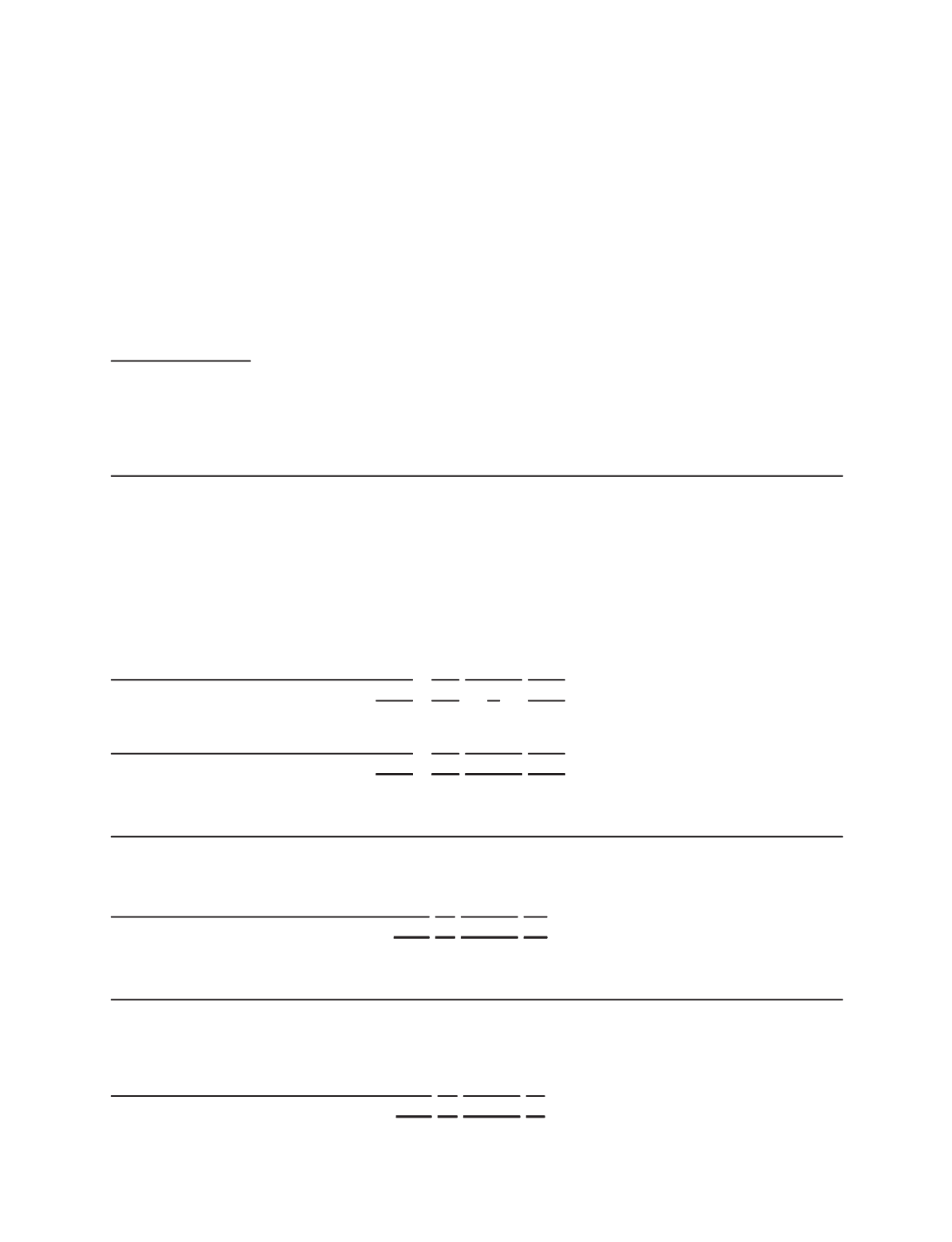

The following is a summary of the 2009 charges:

Pretax Tax

Non-

controlling

Interest Net Income Statement Classification

(Stated in millions)

Workforce reductions

$102 $17

$– $ 85

Restructuring & other

Postretirement benefits curtailment

136 14

–

122

Restructuring & other

$238 $31

$– $207

The following is a summary of the 2008 charges:

Pretax Tax

Non-

controlling

Interest Net Income Statement Classification

(Stated in millions)

Workforce reductions

$ 74 $ 9

$– $65

Restructuring & other

Provision for doubtful accounts

32 8

6

18

Restructuring & other

Other

10 –

–

10

Interest and other income, net

$116 $17

$6

$93

26

Part II, Item 7