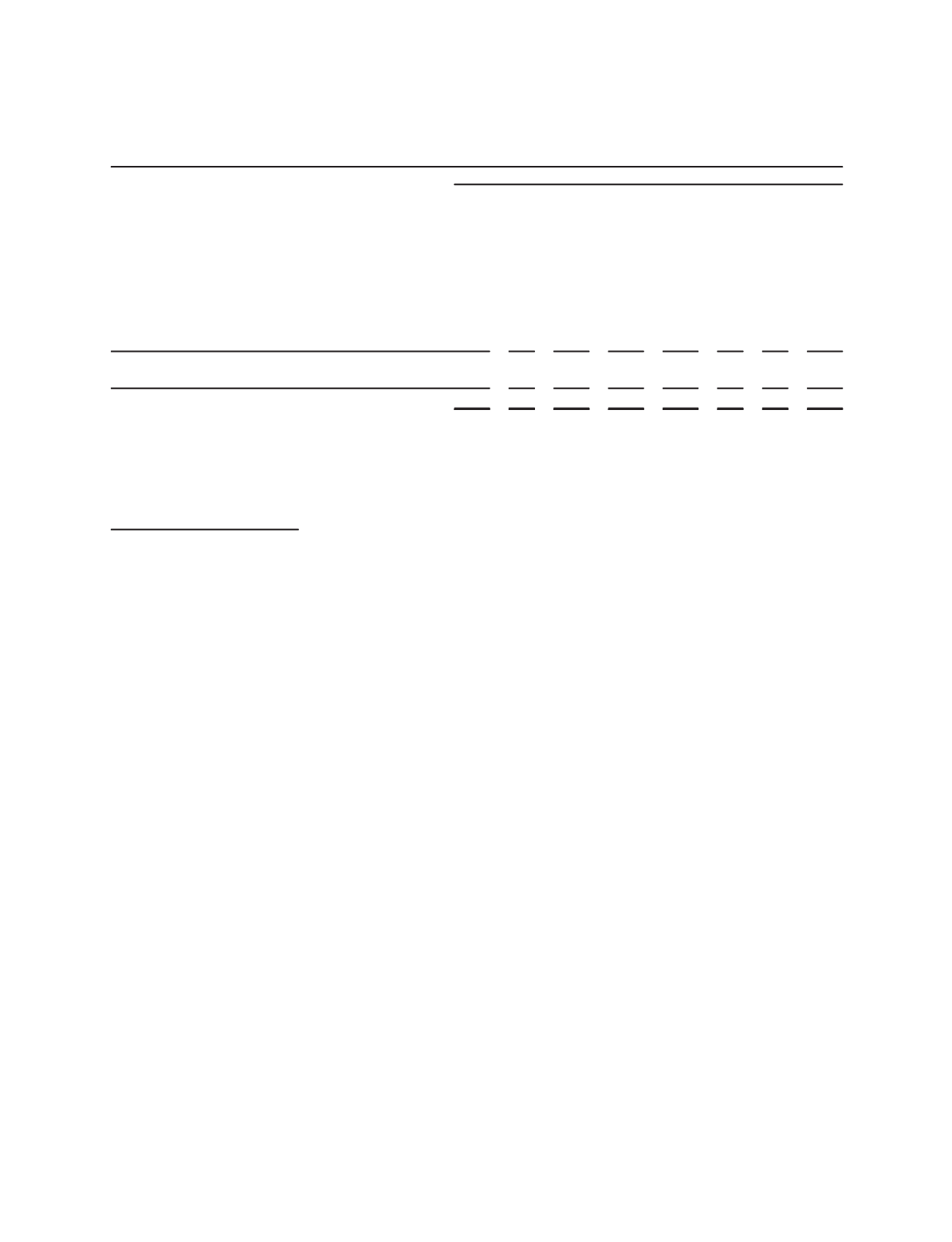

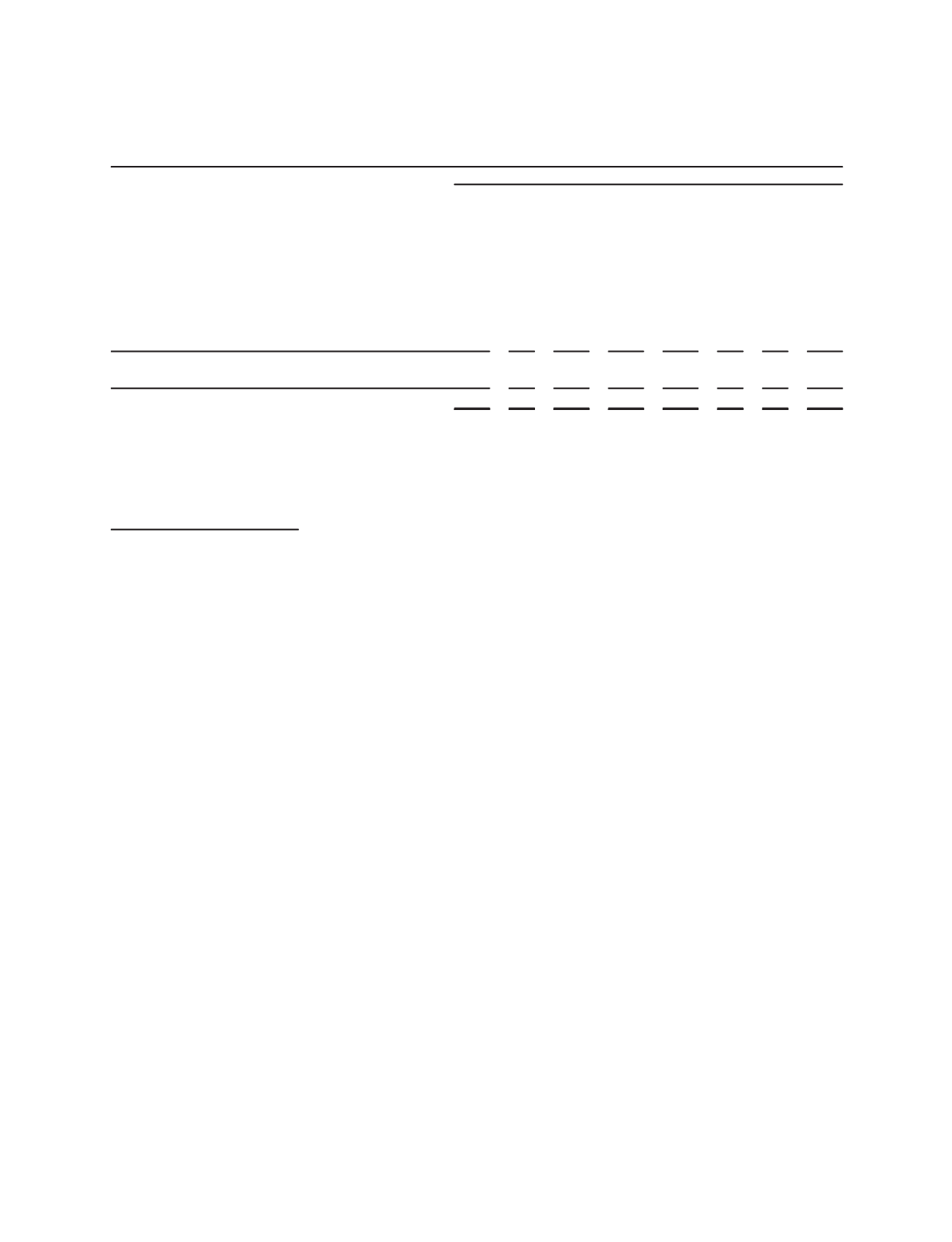

The following table represents carrying amounts of Schlumberger’s debt at December 31, 2010 by year of maturity:

2011 2012 2013 2014 2015 2016 2019 Total

Expected Maturity Dates

(Stated in millions)

Fixed rate debt

5.875% Guaranteed Bonds

$ 334

$ 334

5.25% Guaranteed Notes

$ 659

659

3.00% Guaranteed Notes

463

463

4.50% Guaranteed Notes

$ 1,319

1,319

8.625% Senior Notes

272

272

2.75% Guaranteed Notes

$ 1,310

1,310

6.00% Senior Notes

$ 218

218

9.75% Senior Notes

$ 776

776

Total fixed rate debt

$ 334

$ –

$1,122 $1,591 $1,310 $218 $776 $5,351

Variable rate debt

2,261 445

41

14

–

–

–

2,761

Total

$2,595 $445 $1,163 $1,605 $1,310 $218 $776 $8,112

The fair market value of the outstanding fixed rate debt was approximately $5.5 billion as of December 31, 2010. The

weighted average interest rate on the variable rate debt as of December 31, 2010 was approximately 1.0%.

Schlumberger does not enter into derivatives for speculative purposes.

Forward-looking Statements

This Form 10-K and other statements we make contain “forward-looking statements” within the meaning of the

federal securities laws, which include any statements that are not historical facts, such as our forecasts or expectations

regarding business outlook; growth for Schlumberger as a whole and for each of Oilfield Services and WesternGeco (and

for specified products or geographic areas within each segment); the integration of both Smith and Geoservices into our

business; the anticipated benefits of those transactions; oil and natural gas demand and production growth; oil and

natural gas prices; improvements in operating procedures and technology; capital expenditures by Schlumberger and

the oil and gas industry; the business strategies of Schlumberger’s customers; future global economic conditions; and

future results of operations. These statements are subject to risks and uncertainties, including, but not limited to, the

current global economic downturn; changes in exploration and production spending by Schlumberger’s customers and

changes in the level of oil and natural gas exploration and development; general economic and business conditions in

key regions of the world; pricing erosion; seasonal factors; changes in government regulations and regulatory

requirements, including those related to offshore oil and gas exploration, radioactive sources, explosives, chemicals,

hydraulic fracturing services and climate-related initiatives; continuing operational delays or program reductions as of

result of the lifted drilling moratorium in the Gulf of Mexico; the inability to successfully integrate the merged Smith and

Geoservices businesses and to realize expected synergies, the inability to retain key employees; and other risks and

uncertainties detailed in the Risk Factors section of this Form 10-K and other filings that we make with the Securities

and Exchange Commission. If one or more of these or other risks or uncertainties materialize (or the consequences of

such a development changes), or should our underlying assumptions prove incorrect, actual outcomes may vary

materially from those reflected in our forward-looking statements. Schlumberger disclaims any intention or obligation to

update publicly or revise such statements, whether as a result of new information, future events or otherwise.

35

Part II, Item 7A