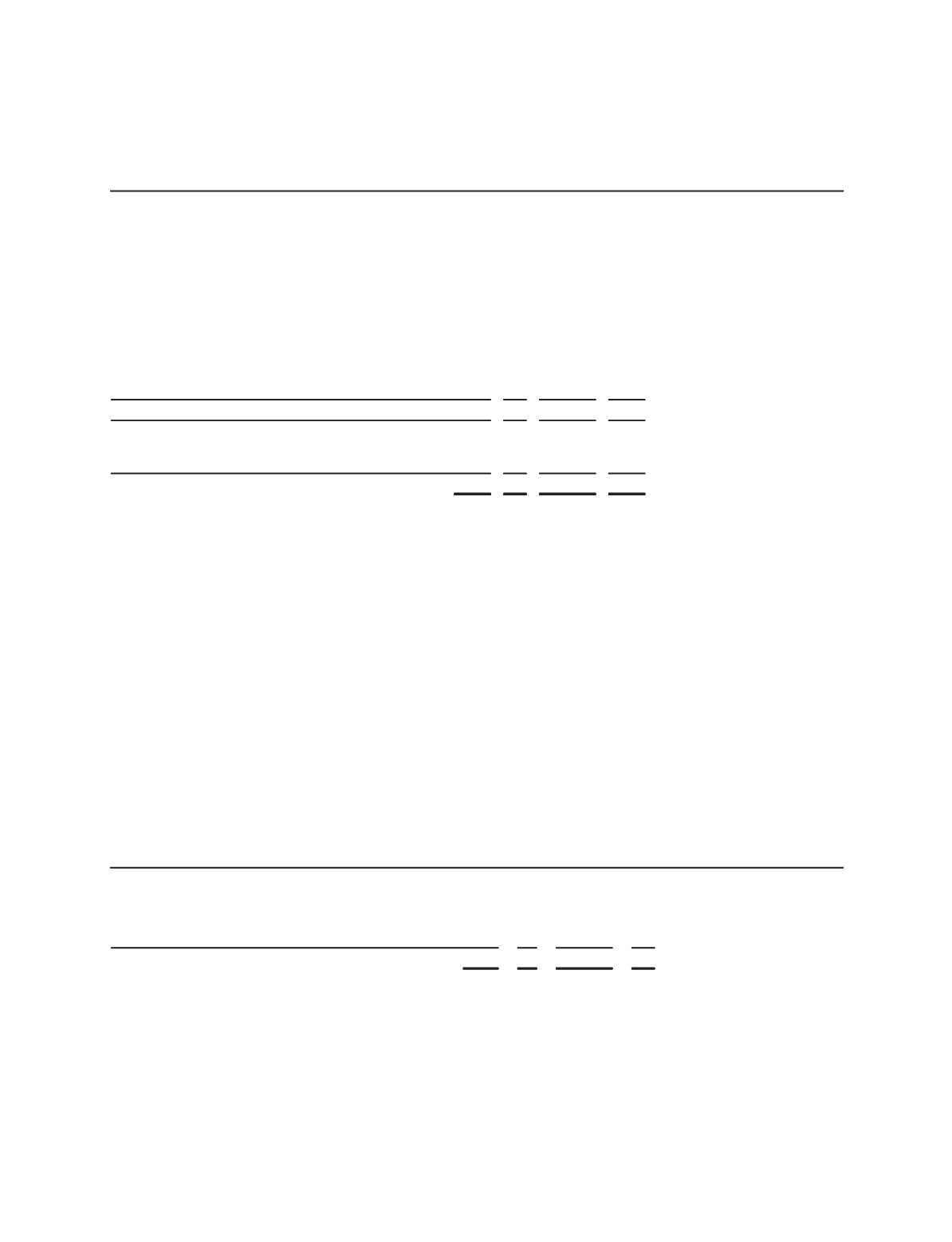

The following is a summary of 2010 Charges and Credits:

Pretax Tax

Non-

controlling

Interests

Net Income Statement Classification

(Stated in millions)

Restructuring and Merger-related Charges:

Severance and other

$ 90 $ 13

$– $ 77

Restructuring & other

Impairment relating to WesternGeco’s first generation

Q-Land acquisition system

78

7

–

71

Restructuring & other

Other WesternGeco-related charges

63

–

–

63

Restructuring & other

Professional fees and other

107

1

– 106

Merger & integration

Merger-related employee benefits

58 10

–

48

Merger & integration

Inventory fair value adjustments

153 56

–

97

Cost of revenue

Mexico restructuring

40

4

–

36

Restructuring & other

Repurchase of bonds

60 23

37

Restructuring & other

Total restructuring and merger-related charges

649 114

– 535

Gain on investment in M-I SWACO

(1,270) (32)

– (1,238)

Gain on Investment in M-I SWACO

Impact of elimination of tax deduction related to Medicare

Part D subsidy

– (40)

–

40

Taxes on income

$ (621) $ 42

$– $ (663)

Approximately $165 million of the $649 million of pretax restructuring and merger-related charges described above

represent non-cash charges. The vast majority of the balance of the charges have either been paid or are expected to be

paid within the next three months.

2009

Second quarter of 2009:

k

Schlumberger continued to reduce its global workforce as a result of the slowdown in oil and gas exploration

and production spending and its effect on activity in the oilfield services sector. As a result of these actions,

Schlumberger recorded a pretax charge of $102 million ($85 million after-tax). These workforce reductions

were completed by the end of 2009.

k

As a consequence of these workforce reductions, Schlumberger recorded pretax non-cash pension and other

postretirement benefit curtailment charges of $136 million ($122 million after-tax). Refer to Note 18 –

Pension and Other Benefit Plans

for further details.

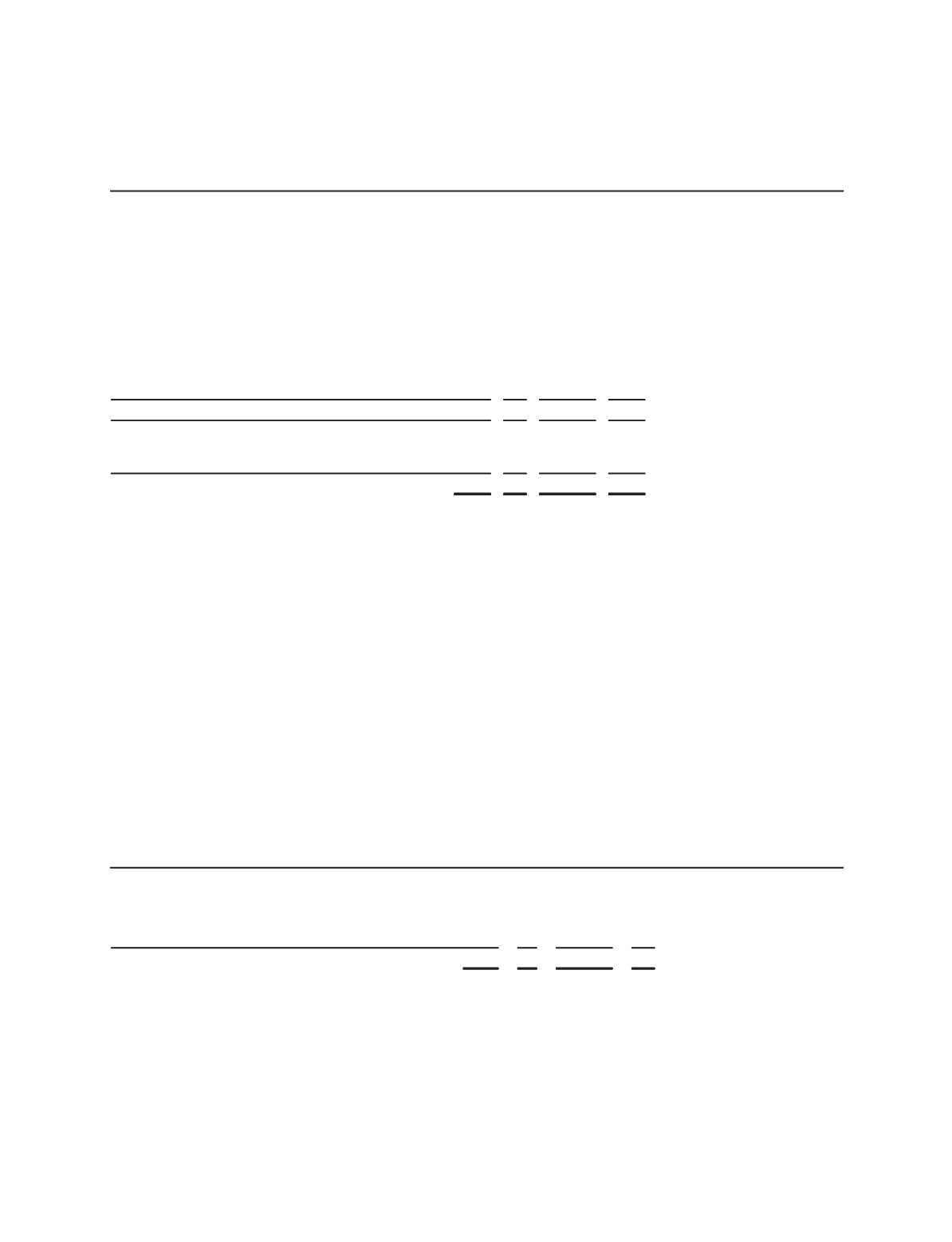

The following is a summary of these charges:

Pretax Tax

Non-

controlling

Interests Net Income Statement Classification

(Stated in millions)

Workforce reductions

$102 $17

$– $ 85

Restructuring & other

Postretirement benefits curtailment

136 14

– 122

Restructuring & other

$238 $31

$– $207

2008

Fourth quarter of 2008:

k

Due to the continuing slowdown in oil and gas exploration and production spending and its effect on activity in

the oilfield services sector, Schlumberger took actions to reduce its global workforce. As a result of these

actions, Schlumberger recorded a pretax charge of $74 million ($65 million after-tax).

47

Part II, Item 8