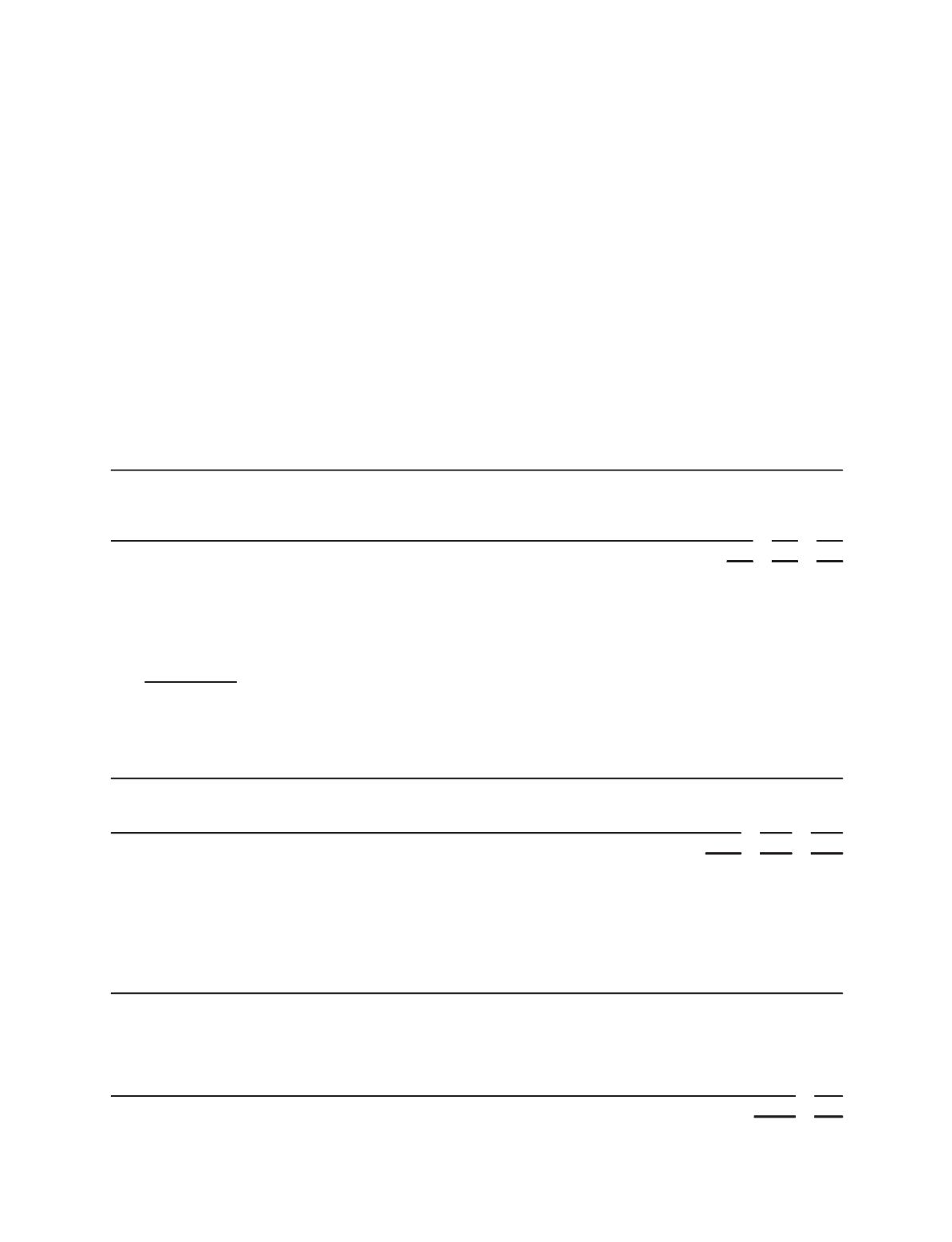

Discounted Stock Purchase Plan

Under the terms of the DSPP, employees can choose to have a portion of their earnings withheld, subject to certain

restrictions, to purchase Schlumberger common stock. The purchase price of the stock is 92.5% of the lower of the stock

price at the beginning or end of the plan period at six-month intervals.

The fair value of the employees’ purchase rights under the DSPP was estimated using the Black-Scholes model with

the following assumptions and resulting weighted average fair value per share:

2010 2009 2008

Dividend yield

1.6%

1.1% 0.9%

Expected volatility

36%

44% 34%

Risk free interest rate

0.3%

0.3% 2.7%

Weighted average fair value per share

$10.30

$9.76 $17.21

Total Stock-based Compensation Expense

The following summarizes stock-based compensation expense recognized in income:

2010 2009 2008

(Stated in millions)

Stock options

$121

$118 $111

Restricted stock

44

32

31

DSPP

33

36

30

$198

$186 $172

At December 31, 2010, there was $382 million of total unrecognized compensation cost related to nonvested stock-

based compensation arrangements. Approximately $156 million is expected to be recognized in 2011, $122 million is

expected to be recognized in 2012, $65 million in 2013, $35 million in 2014 and $4 million in 2015.

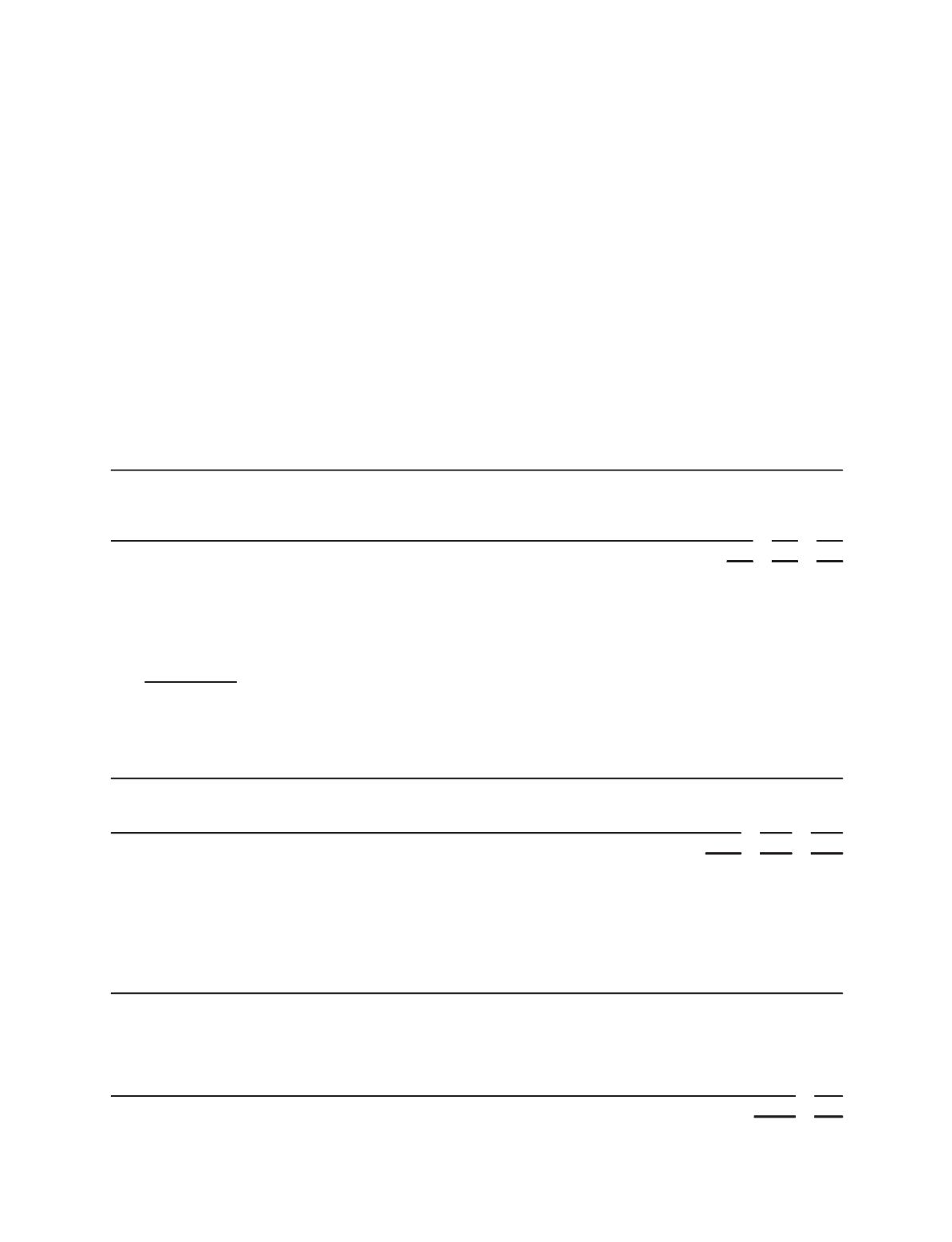

14. Income Taxes

Schlumberger operates in more than 100 jurisdictions, where statutory tax rates generally vary from 0% to 50%.

Income from Continuing Operations before taxes

which were subject to United States and non-United States income

taxes for each of the three years ended December 31, was as follows:

2010 2009 2008

(Stated in millions)

United States

$ 638

$ 86 $1,432

Outside United States

4,518

3,848 5,420

$5,156

$3,934 $6,852

Schlumberger recorded $621 million of net pretax credits in 2010 ($226 million of net charges in the US and

$847 million of net credits outside the US). Schlumberger recorded $238 million of pretax charges in 2009 ($73 million in

the US and $165 million outside the US) and $116 million in 2008 ($15 million in the US and $101 million outside the US).

These charges and credits are included in the table above and are more fully described in Note 3 –

Charges and Credits

.

The components of net deferred tax assets (liabilities) were as follows:

2010 2009

(Stated in millions)

Postretirement benefits

$ 327

$ 447

Multiclient seismic data

43

104

Intangible assets

(1,674)

(122)

Investments in non-US subsidiaries

(353)

–

Other, net

72

101

$(1,585)

$ 530

60

Part II, Item 8