The above deferred balances at December 31, 2010 and 2009 are net of valuation allowances relating to net operating

losses in certain countries of $263 million and $251 million, respectively. The deferred tax balances at December 31,

2009 were net of a valuation allowance relating to a foreign tax credit carryforward of $30 million.

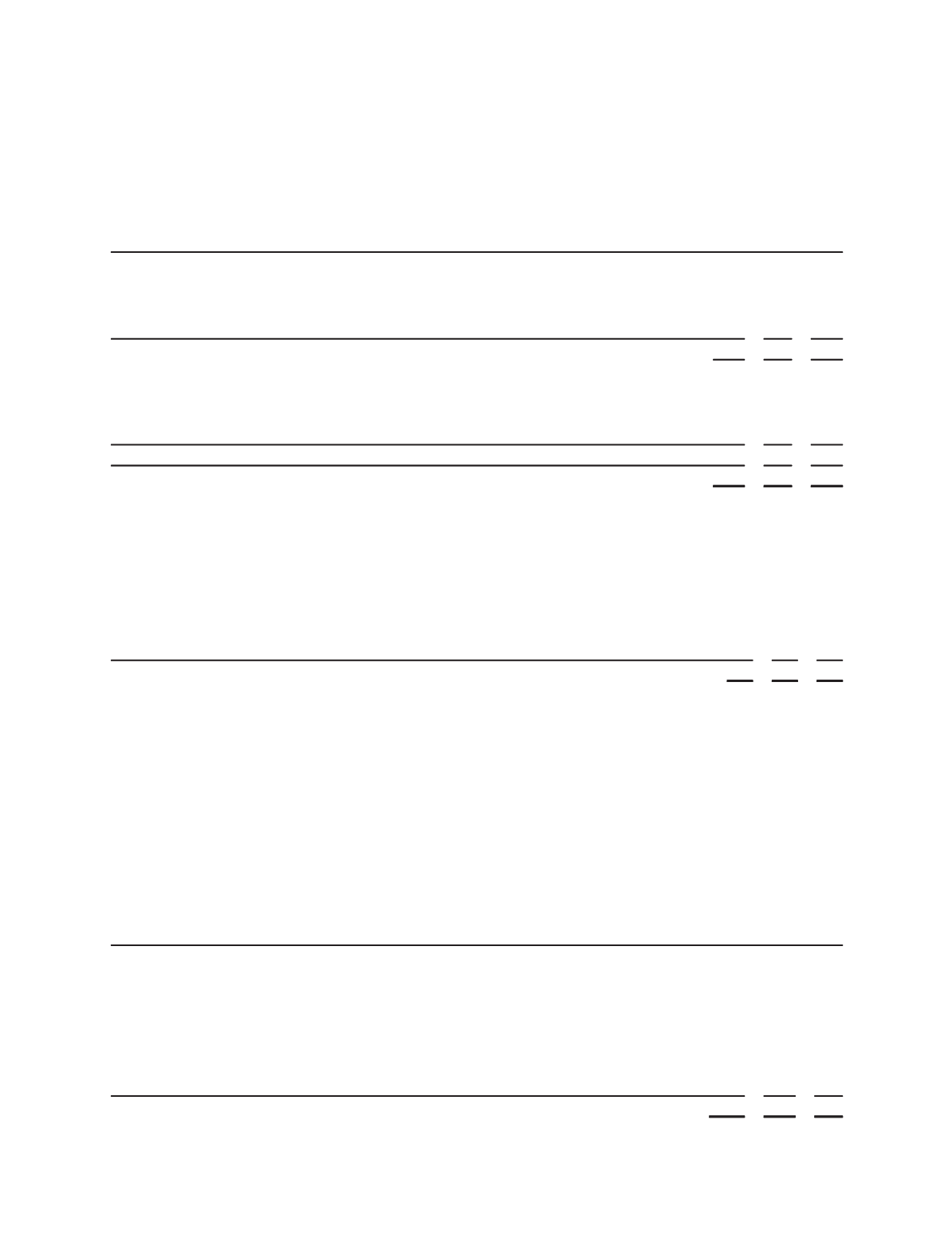

The components of

Taxes on income

were as follows:

2010 2009 2008

(Stated in millions)

Current:

United States – Federal

$ 76

$(191) $ 453

United States – State

14

(6)

34

Outside United States

909

594

949

$ 999

$ 397 $1,436

Deferred:

United States – Federal

$ 183

$ 247 $ 23

United States – State

2

13

1

Outside United States

(281)

86

(12)

Valuation allowance

(13)

27

(18)

$(109)

$ 373 $ (6)

Consolidated taxes on income

$ 890

$ 770 $1,430

A reconciliation of the United States statutory federal tax rate (35%) to the consolidated effective tax rate is:

2010 2009 2008

US statutory federal rate

35%

35% 35%

US state income taxes

–

–

1

Non-US income taxed at different rates

(14)

(16) (13)

Effect of equity method investment

–

–

(1)

Charges and Credits (See Note 3)

(3)

1

–

Other

(1)

–

(1)

Effective income tax rate

17%

20% 21%

Schlumberger conducts business in more than 100 jurisdictions, a number of which have tax laws that are not fully

defined and are evolving. Due to the geographic breadth of the Schlumberger operations, numerous tax audits may be

ongoing throughout the world at any point in time. Tax liabilities are recorded based on estimates of additional taxes

which will be due upon the conclusion of these audits. Estimates of these tax liabilities are made based upon prior

experience and are updated in light of changes in facts and circumstances. However, due to the uncertain and complex

application of tax regulations, it is possible that the ultimate resolution of audits may result in liabilities which could be

materially different from these estimates. In such an event, Schlumberger will record additional tax expense or tax

benefit in the period in which such resolution occurs.

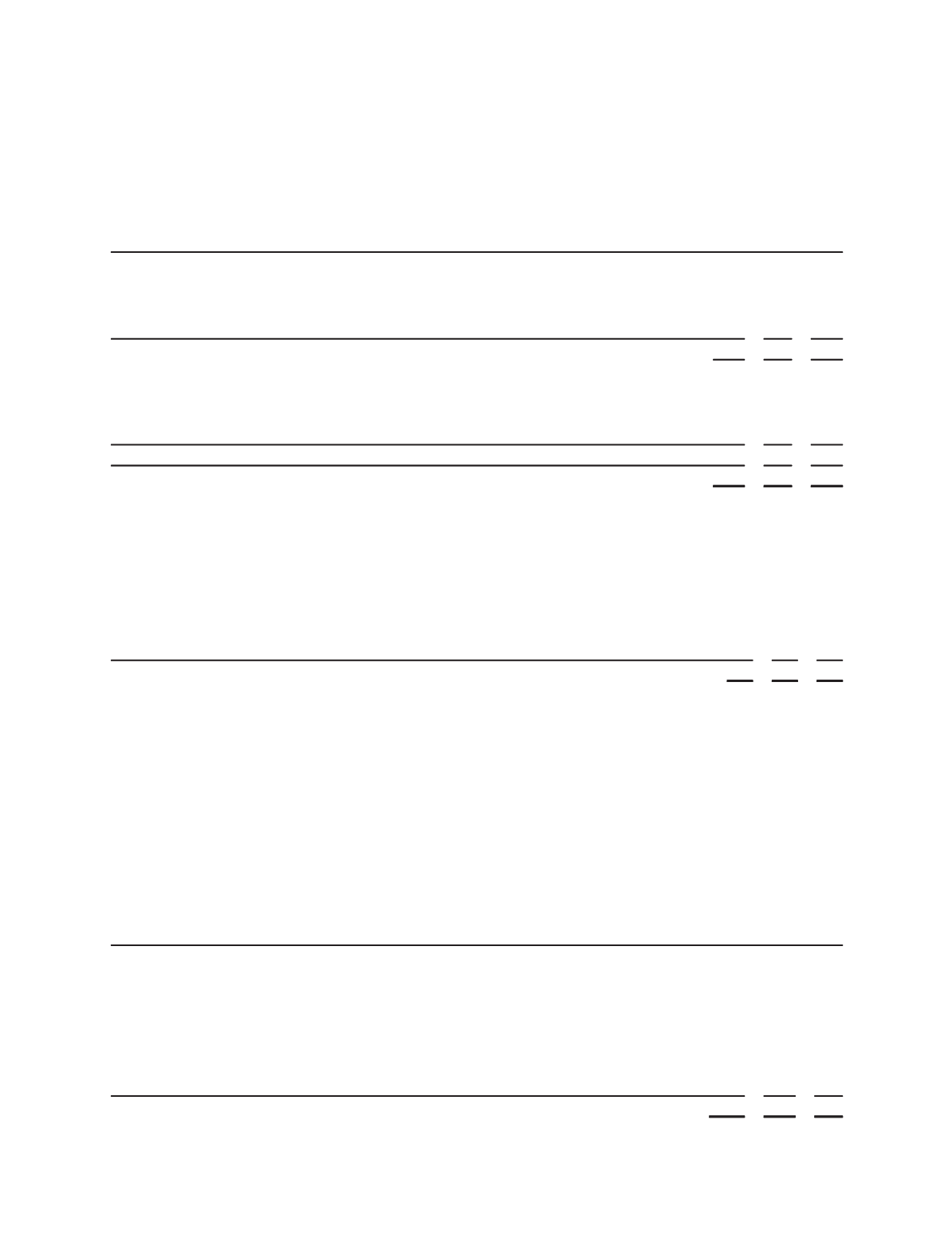

A reconciliation of the beginning and ending amount of liabilities associated with uncertain tax positions for the years

ended December 31, 2010, 2009 and 2008 is as follows:

2010 2009 2008

(Stated in millions)

Balance at beginning of year

$1,026

$ 877 $ 858

Additions based on tax positions related to the current year

190

178

217

Additions for tax positions of prior years

8

36

19

Additions related to acquisitions

115

–

6

Impact of changes in exchange rates

(3)

39

(72)

Settlements with tax authorities

(36)

(16)

(20)

Reductions for tax positions of prior years

(99)

(68) (111)

Reductions due to the lapse of the applicable statute of limitations

(36)

(20)

(20)

Balance at end of year

$1,165

$1,026 $ 877

61

Part II, Item 8