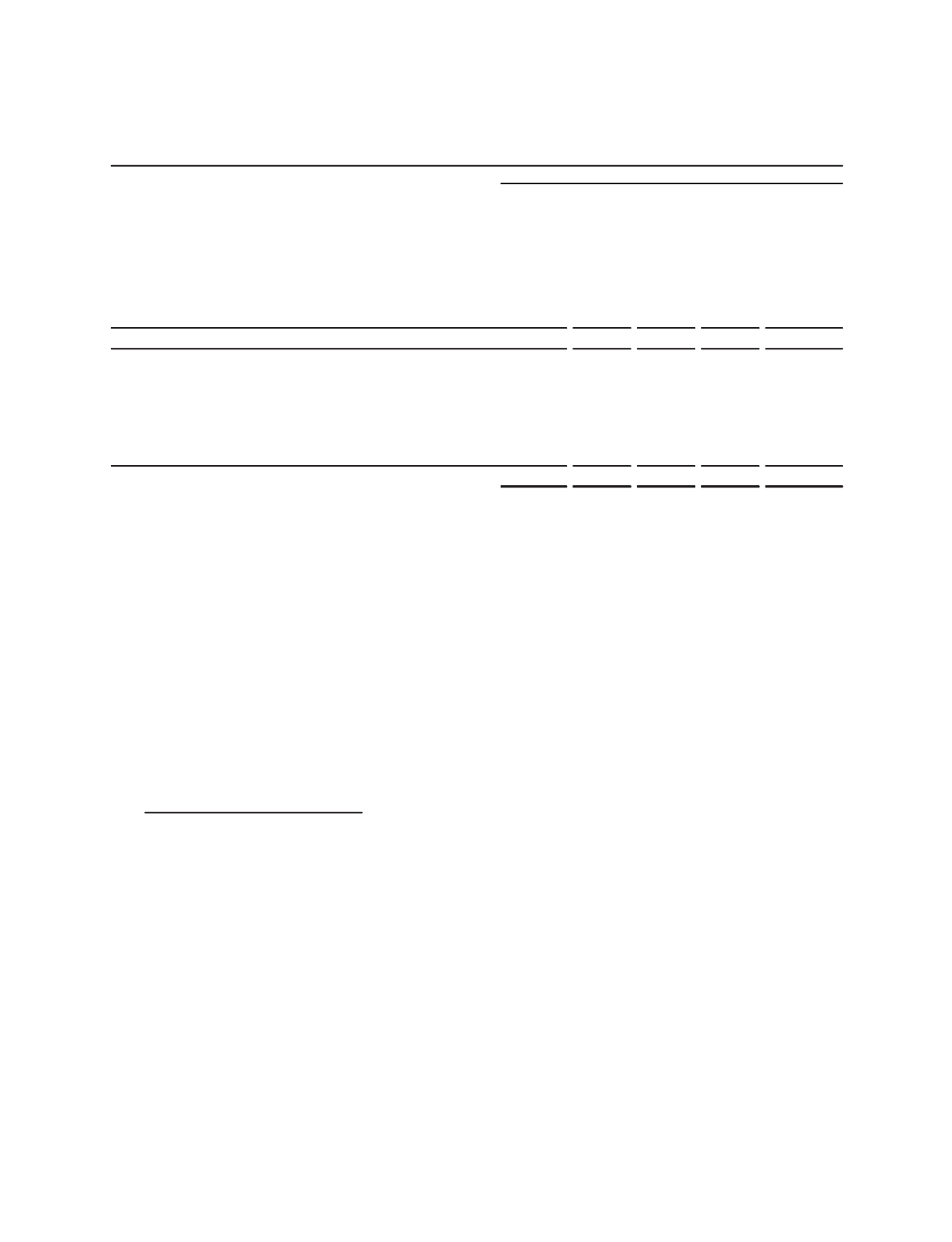

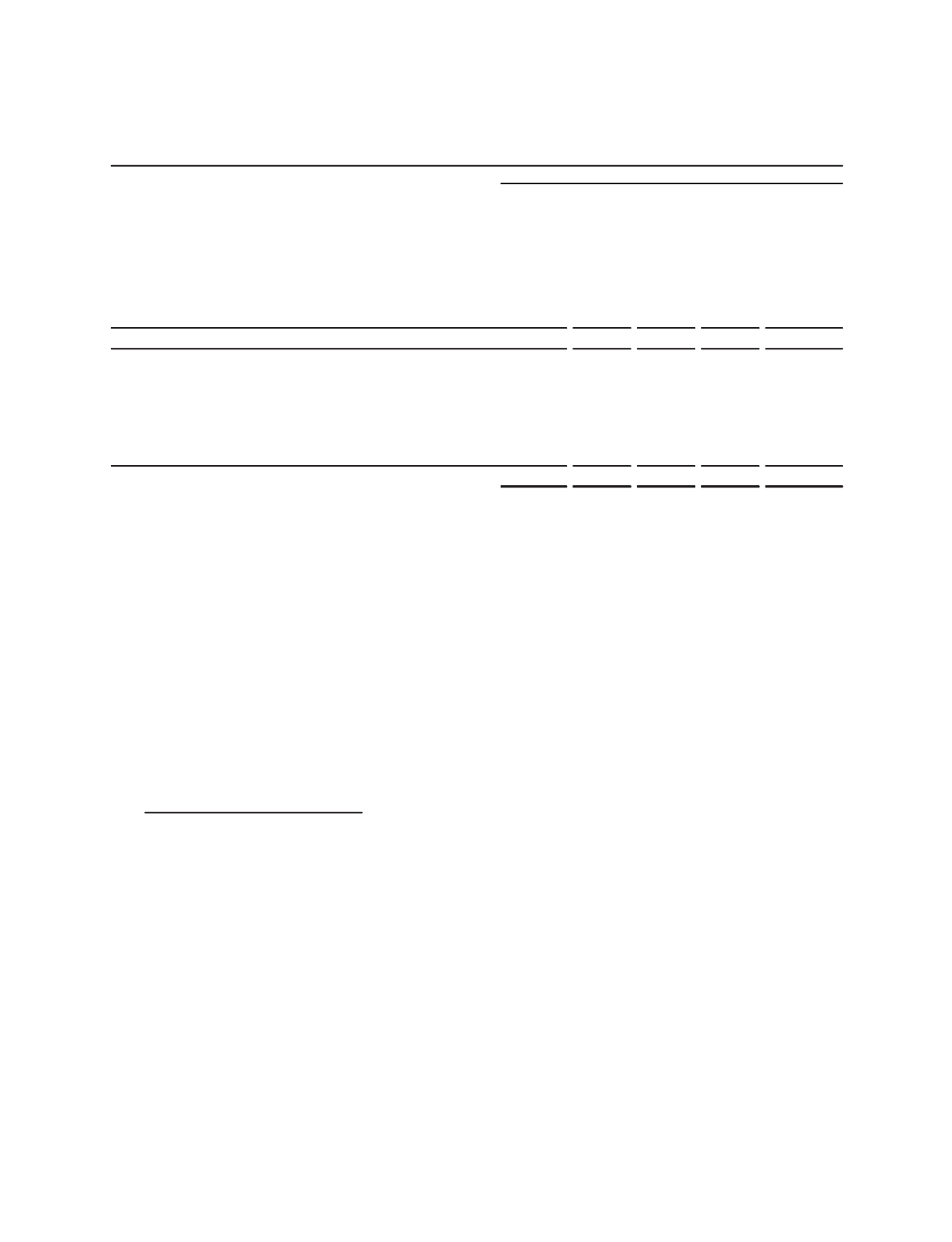

Revenue

Income

before

taxes

Assets

Depn. &

Amortn.

Capital

Expenditures

2008

(Stated in millions)

OILFIELD SERVICES

North America

$ 5,914

$1,371 $ 2,728

$ 433

$ 750

Latin America

4,230

858

2,529

223

414

Europe/CIS/Africa

8,180

2,244

4,410

600

988

Middle East & Asia

5,724

2,005

3,503

496

762

Elims/Other

(1)

234

27

2,014

(9)

128

24,282

6,505

15,184

1,743

3,042

WESTERNGECO

2,838

836

2,956

518

680

Goodwill and intangible assets

6,009

All other assets

1,914

Corporate

(2)

43

(268)

6,031

8

1

Interest income

(3)

112

Interest expense

(4)

(217)

Charges & credits

(5)

(116)

$27,163

$6,852 $32,094

$2,269

$3,723

(1) Includes certain headquarter administrative costs which are not allocated geographically, manufacturing and certain other operations, and other

cost and income items maintained at the Oilfield Services level.

(2) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based compen-

sation costs, amortization expense associated with intangible assets recorded as a result of the merger with Smith and certain other nonoperating

items. Corporate assets consist of cash, short-term investments, fixed income investments, held to maturity and investments in affiliates.

(3) Interest income excludes amounts which are included in the segments’ income (2010 - $7 million: 2009 – $10 million; 2008 – $7 million).

(4) Interest expense excludes amounts which are included in the segments’ income (2010 - $5 million; 2009 – $33 million; 2008 – $30 million).

(5) See Note 3 –

Charges and Credits

.

Segment assets consist of receivables, inventories, fixed assets and multiclient seismic data.

Depreciation & Amortization includes multiclient seismic data costs.

During each of the three years ended December 31, 2010, 2009 and 2008, no single customer exceeded 10% of

consolidated revenue.

Schlumberger did not have revenue from third-party customers in its country of domicile during the last three years.

Revenue in the United States in 2010, 2009 and 2008 was $6.5 billion, $3.7 billion and $5.9 billion, respectively.

18. Pension and Other Benefit Plans

Pension Plans

Schlumberger sponsors several defined benefit pension plans that cover substantially all US employees hired prior to

October 1, 2004. The benefits are based on years of service and compensation, on a career-average pay basis.

In addition to the United States defined benefit pension plans, Schlumberger sponsors several other international

defined benefit pension plans. The most significant of these international plans are the International Staff Pension Plan,

which was converted from a defined contribution plan to a defined benefit pension plan during the fourth quarter of

2008, and the UK pension plan (collectively, the “International plans”). The International Staff Pension Plan covers

certain international employees and is based on years of service and compensation on a career-average pay basis. The

UK plan covers employees hired prior to April 1, 1999, and is based on years of service and compensation, on a final

salary basis.

65

Part II, Item 8