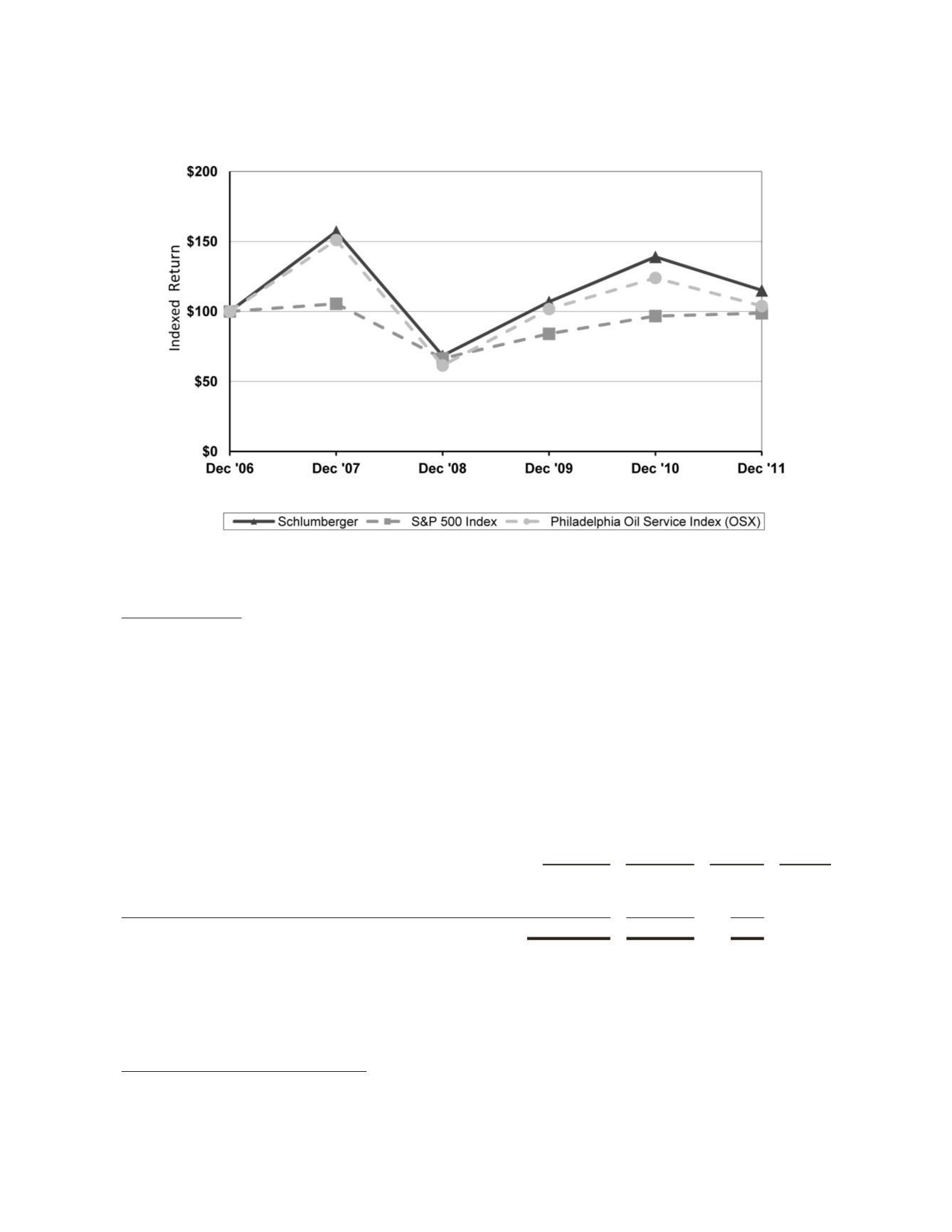

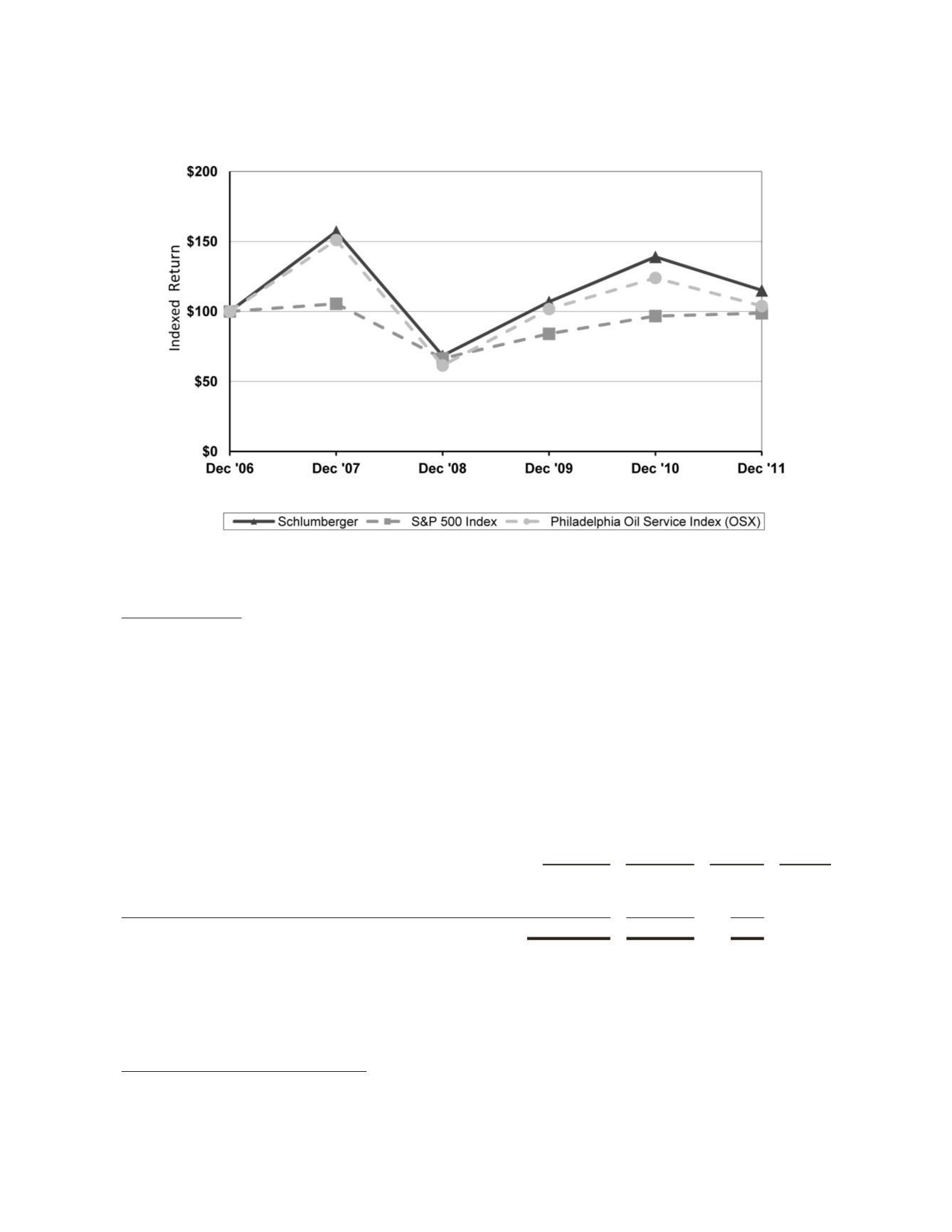

Comparison of five-year cumulative total return among

Schlumberger common stock, the S&P 500 Index and the

Philadelphia Oil Service Index (OSX)

Assumes $100 invested on December 31, 2006 in Schlumberger common stock, in the S&P 500 Index and in the

Philadelphia Oil Service Index (OSX) and reinvestment of dividends on the last day of the month of payment.

Share Repurchases

On April 17, 2008, the Schlumberger Board of Directors approved an $8 billion share repurchase program for

Schlumberger common stock, to be acquired in the open market before December 31, 2011. On July 21, 2011, the Board

approved an extension of this repurchase program to December 31, 2013.

Schlumberger’s common stock repurchase program activity for the three months ended December 31, 2011 was as

follows:

(Stated in thousands, except per share amounts)

Total number

of shares

purchased

Average price

paid per

share

Total

number of

shares

purchased

as part of

publicly

announced

program

Maximum

value

of shares

that may

yet be

purchased

under the

program

October 1 through October 31, 2011

3,286.0 $

64.91

3,286.0 $2,273,344

November 1 through November 30, 2011

2,852.3 $

73.04

2,852.3 $2,065,022

December 1 through December 31, 2011

3,015.0 $

70.90

3,015.0 $1,851,255

9,153.3 $

69.42

9,153.3

In connection with the exercise of stock options under Schlumberger’s incentive compensation plans, Schlumberger

routinely receives shares of its common stock from optionholders in consideration of the exercise price of the stock

options. Schlumberger does not view these transactions as requiring disclosure under this Item 5. as the number of

shares of Schlumberger common stock received from optionholders is not material.

Unregistered Sales of Equity Securities

None.

13