Drilling

Fourth-quarter revenue of $3.91 billion was 6% higher sequentially. Pretax operating income of $658 million

improved 7% sequentially.

Significant sequential revenue growth was recorded by M-I SWACO from higher rig count on land in the US &

Canada; sustained growth in deepwater activity in the US Gulf of Mexico; and strong contributions in Latin America.

IPM activity increased significantly, mainly from projects in Mexico and in Iraq. Drilling & Measurements revenue

increased on improved pricing and strong activity in the US Gulf of Mexico and the Nigeria & Gulf of Guinea

GeoMarket, although this was partially offset by weather-related activity reductions in the North Sea and East Asia

GeoMarkets. In addition, Geoservices and Bits & Advanced Technologies registered robust sequential increases.

Sequentially, pretax operating margins were up slightly to 16.8%. Drilling & Measurements obtained increased

margins from improved technology mix and service pricing but this was partly offset by the effects of weather-related

activity delays and reductions. Most of the other Technologies exacted margin expansion following the continued

successful integration and expansion of Smith, Geoservices and Schlumberger drilling technologies.

Reservoir Production

Fourth-quarter revenue of $3.60 billion increased 7% over the prior quarter. Pretax operating income of $768 million

was 9% higher sequentially.

Among Reservoir Production Group Technologies, Completions and Artificial Lift posted the strongest sequential

growth driven by robust product sales across all Areas. Well Services sequential growth was seen mainly in North

America Land as additional fleets deployed and continued improvements in asset utilization and crew efficiency were

achieved although these positive factors were partially muted by the impact of year-end seasonal effects. Framo and

SPM also posted strong sequential increases.

Sequentially, fourth-quarter pretax operating margins were slightly up at 21.3%. Completions, Artificial Lift and Well

Services reported improvements from strong sales.

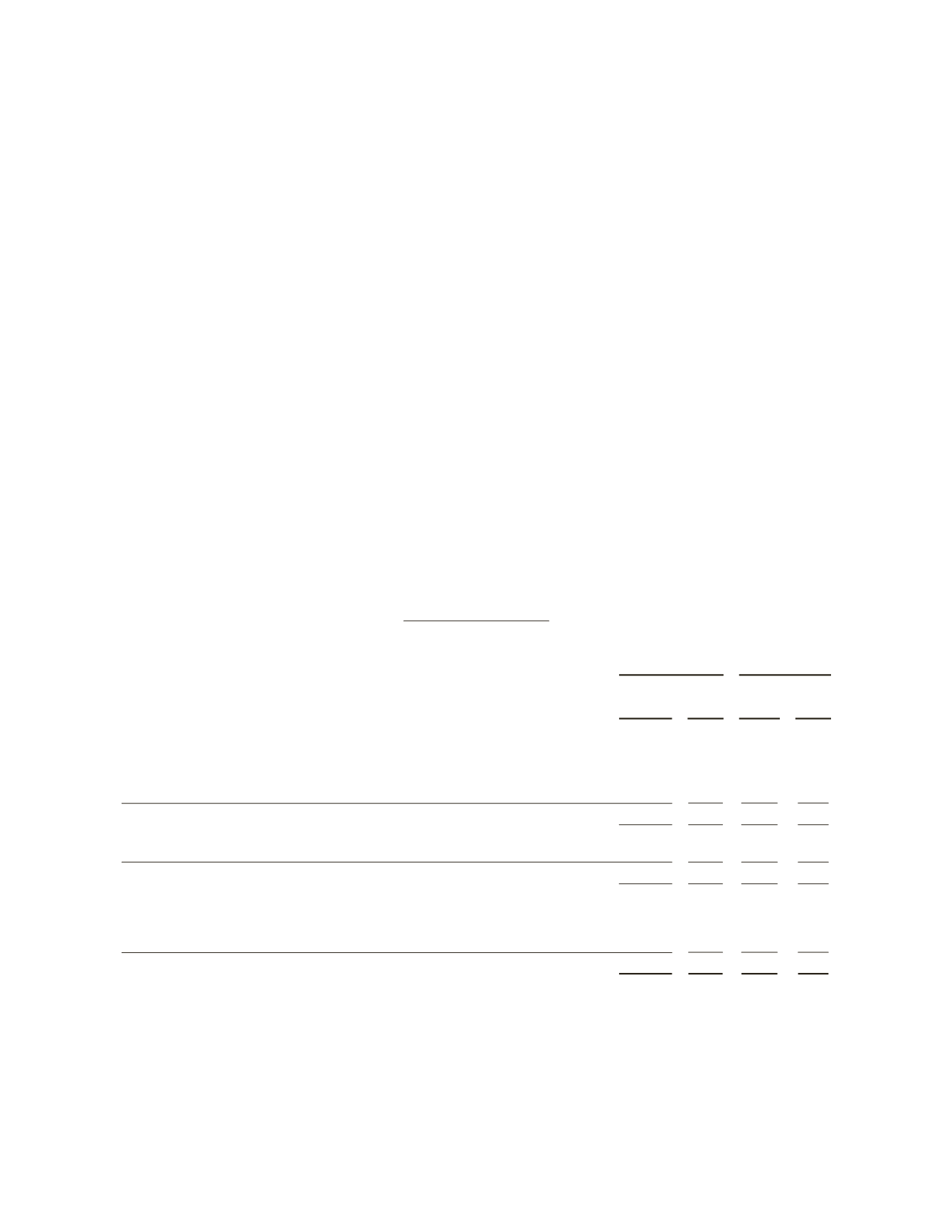

Full-Year 2011 Results

(Stated in millions)

2011

2010

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Oilfield Services

Reservoir Characterization

$ 9,929 $2,449

$ 9,321 $2,321

Drilling

14,248 2,275

8,230 1,334

Reservoir Production

12,748 2,616

9,053 1,368

Eliminations & other

34

(35)

69

48

36,959 7,305

26,673 5,071

Distribution

2,621

103

774

29

Eliminations

(40)

–

–

–

2,581

103

774

29

Corporate & other

(1)

– (592)

– (405)

Interest income

(2)

–

37

–

43

Interest expense

(3)

– (290)

– (202)

Charges & credits

(4)

–

(225)

–

620

$39,540 $6,338

$27,447 $5,156

19