Reservoir Production

Revenue of $12.75 billion was 41% higher than the same period last year while pretax operating margin increased

541 bps to 20.5%. Well Services revenue and margins expanded strongly in North America on higher pricing, capacity

additions and improved asset utilization and efficiency as the market transitioned to liquid-rich plays. Internationally,

Well Services also posted growth on the strength of higher activity, despite the exceptional geopolitical events which

prevailed during the first quarter of 2011.

Distribution

Revenue of $2.62 billion increased $1.85 billion, while pretax operating income of $103 million increased $74 million

compared to last year. These increases are attributable to the fact that 2010 reflected only four months of activity

following the Smith acquisition.

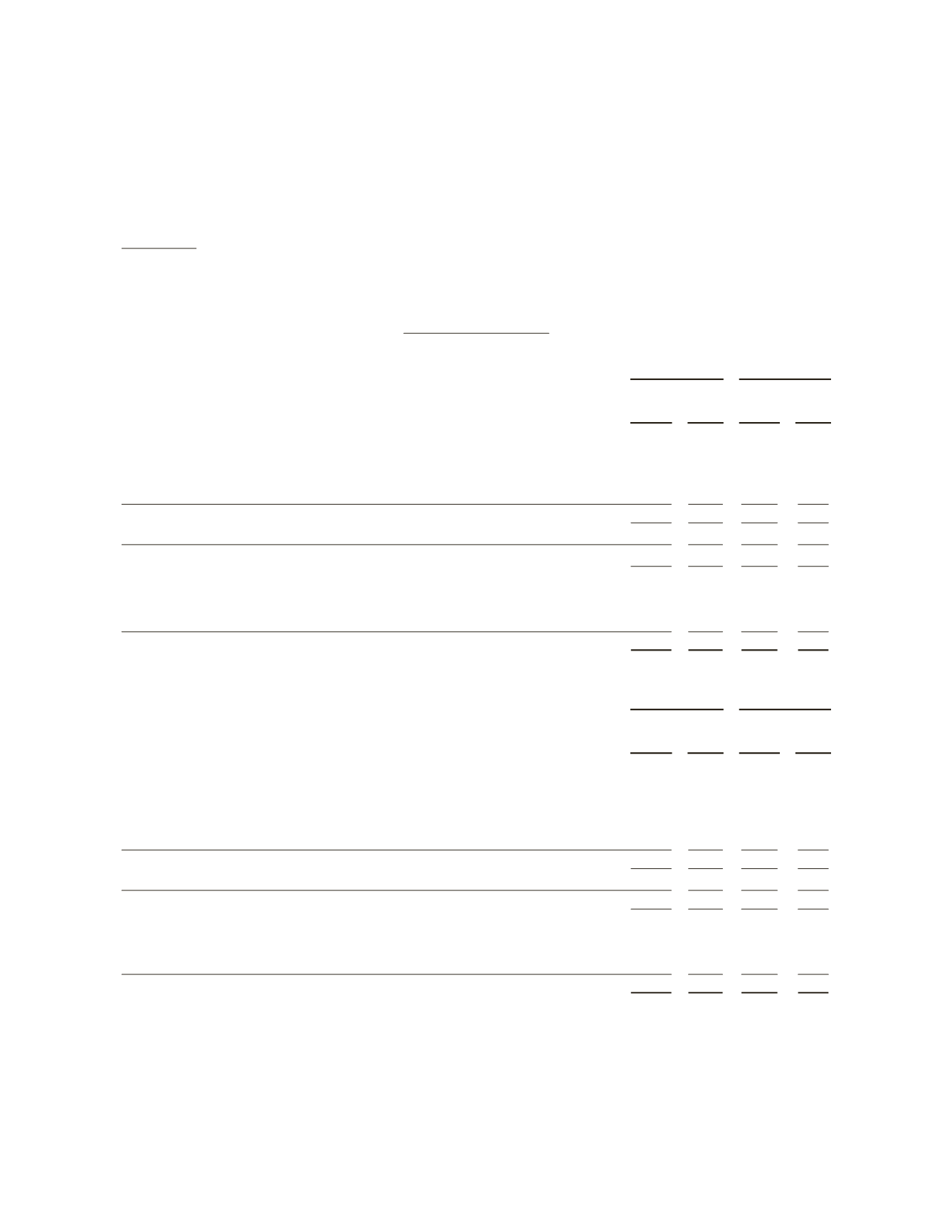

Full-Year 2010 Results

(Stated in millions)

2010

2009

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Oilfield Services

Reservoir Characterization

$ 9,321 $2,321

$ 9,502 $2,559

Drilling

8,230 1,334

5,881 1,245

Reservoir Production

9,053 1,368

7,282

780

Eliminations & other

69

48

37

51

26,673 5,071

22,702 4,635

Distribution

774

29

–

–

774

29

–

–

Corporate & other

(1)

– (406)

– (327)

Interest income

(2)

–

43

–

52

Interest expense

(3)

– (202)

– (188)

Charges & credits

(4)

–

621

– (238)

$27,447 $5,156

$22,702 $3,934

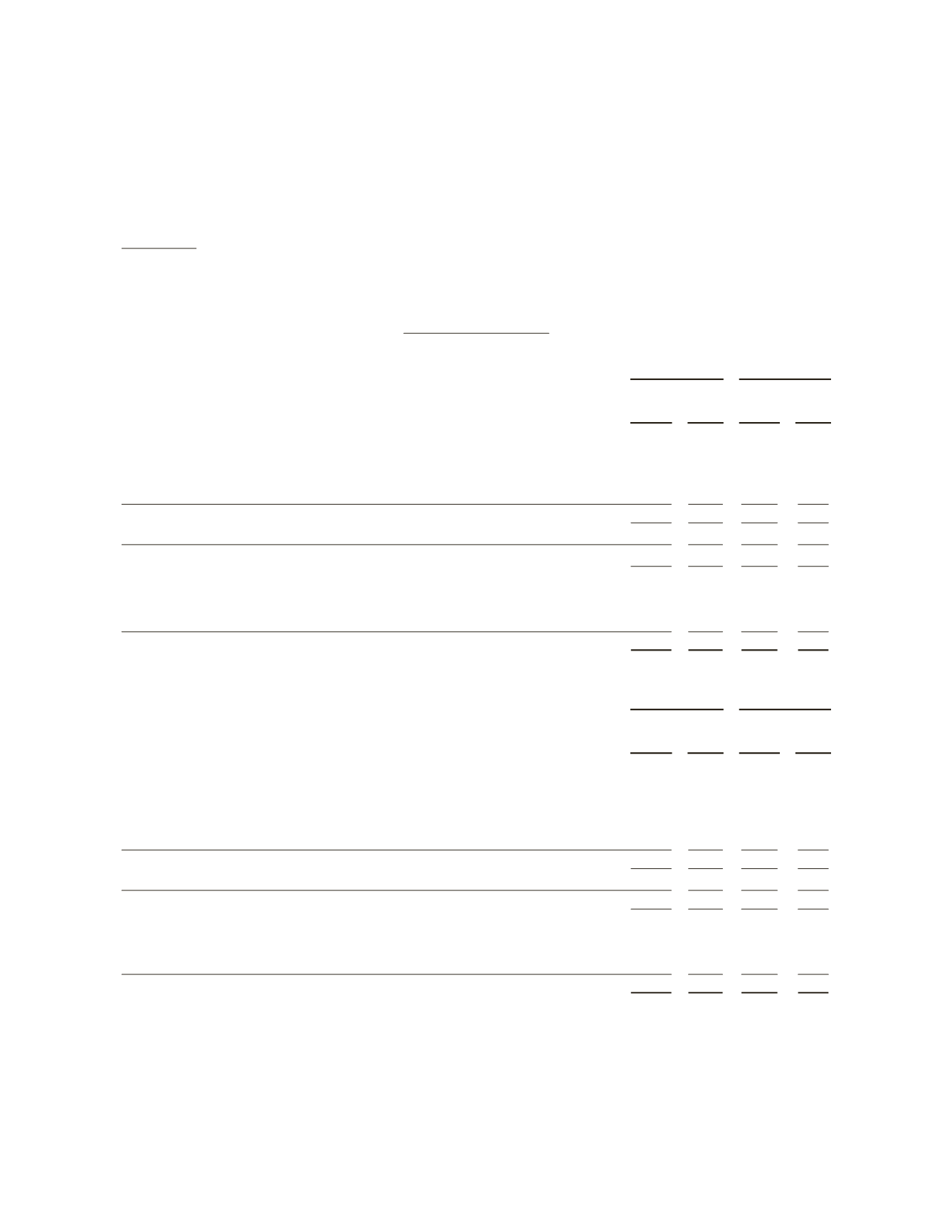

(Stated in millions)

2010

2009

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Oilfield Services

North America

$ 6,729 $1,145

$ 4,217 $ 387

Latin America

4,985

808

4,552

864

Europe/CIS/Africa

8,024 1,457

7,737 1,821

Middle East & Asia

6,650 1,764

5,961 1,817

Eliminations & other

285 (103)

235

(254)

26,673 5,071

22,702 4,635

Distribution

774

29

–

–

774

29

–

–

Corporate & other

(1)

– (406)

– (327)

Interest income

(2)

–

43

–

52

Interest expense

(3)

– (202)

– (188)

Charges & credits

(4)

–

621

– (238)

$27,447 $5,156

$22,702 $3,934

(1) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based

compensation costs, amortization expense associated with intangible assets recorded as a result of the acquisition of Smith and certain other

nonoperating items.

(2) Excludes interest income included in the segments’ income (2010 – $7 million; 2009 – $10 million).

(3) Excludes interest expense included in the segments’ income (2010 – $5 million; 2009 – $33 million).

(4) Charges and credits are described in detail in Note 3 to the Consolidated Financial Statements.

21