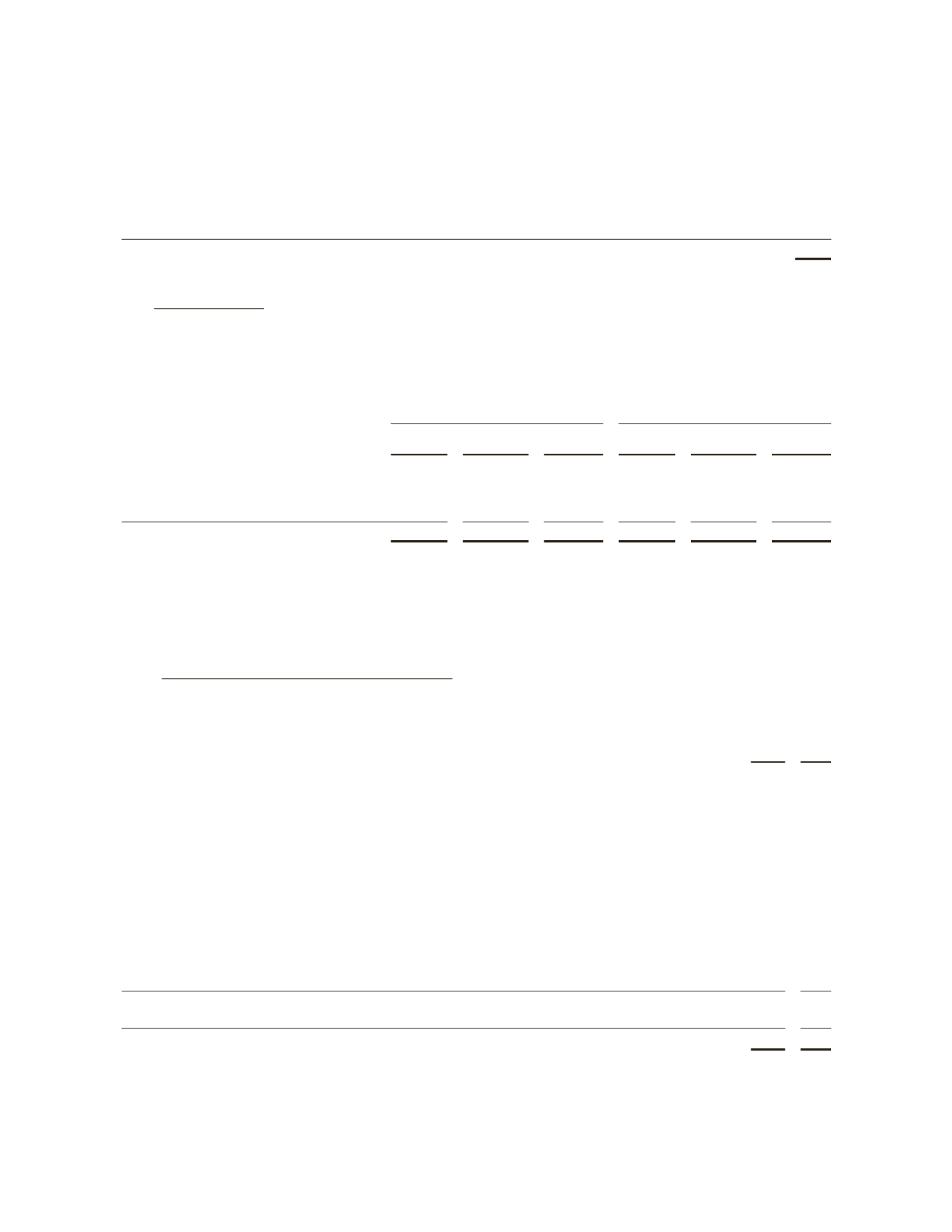

The change in the carrying amount of goodwill during 2010 was as follows:

(Stated in millions)

Balance, January 1, 2010

$ 5,305

Acquisition of Smith

7,892

Other additions

761

Impact of change in exchange rates

(6)

Balance, December 31, 2010

$13,952

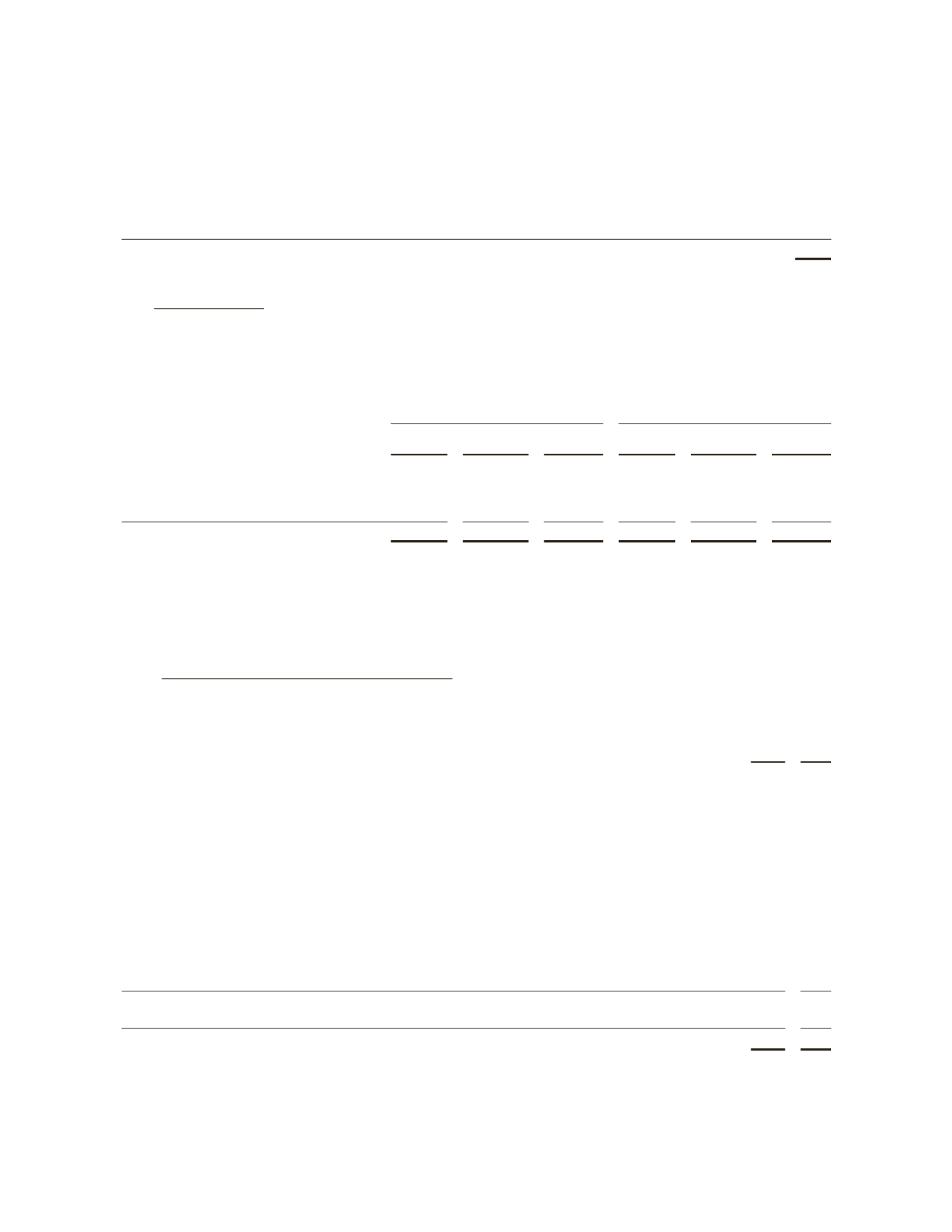

9. Intangible Assets

Intangible assets principally comprise technology/technical know-how, tradenames and customer relationships. At

December 31, the gross book value and accumulated amortization of intangible assets were as follows:

(Stated in millions)

2011

2010

Gross

Book Value

Accumulated

Amortization

Net Book

Value

Gross

Book Value

Accumulated

Amortization

Net Book

Value

Technology/Technical Know-How

$1,875

$341

$1,534

$1,846

$215

$1,631

Tradenames

1,677

131

1,546

1,678

61

1,617

Customer Relationships

1,954

209

1,745

1,963

129

1,834

Other

356

299

57

378

298

80

$5,862

$980

$4,882

$5,865

$703

$5,162

Amortization expense was $325 million in 2011, $190 million in 2010 and $114 million in 2009.

The weighted average amortization period for all intangible assets is approximately 21 years.

Amortization expense for the subsequent five years is estimated to be as follows: 2012—$323 million, 2013—

$304 million, 2014—$298 million, 2015—$287 million and 2016—$268 million.

10. Long-term Debt and Debt Facility Agreements

Long-term Debt

consists of the following:

(Stated in millions)

As at December 31,

2011 2010

3.300% Senior Notes due 2021

$1,595

$–

4.50% Guaranteed Notes due 2014

1,297

1,319

2.75% Guaranteed Notes due 2015

1,290

1,310

1.950% Senior Notes due 2016

1,099

–

4.200% Senior Notes due 2021

1,099

–

5.25% Guaranteed Notes due 2013

649

659

2.650% Senior Notes due 2016

498

–

3.00% Guaranteed Notes due 2013

450

450

Floating Rate Senior Notes due 2014

300

–

9.75% Senior Notes due 2019

–

776

8.625% Senior Notes due 2014

–

272

6.00% Senior Notes due 2016

–

218

Commercial paper borrowings

–

367

Other variable rate debt

271

133

8,548

5,504

Fair value adjustment – hedging

(1)

8

13

$8,556

$5,517

(1)

Represents changes in the fair value of the portion of Schlumberger’s fixed rate debt that is hedged through the use of interest rate swaps.

51