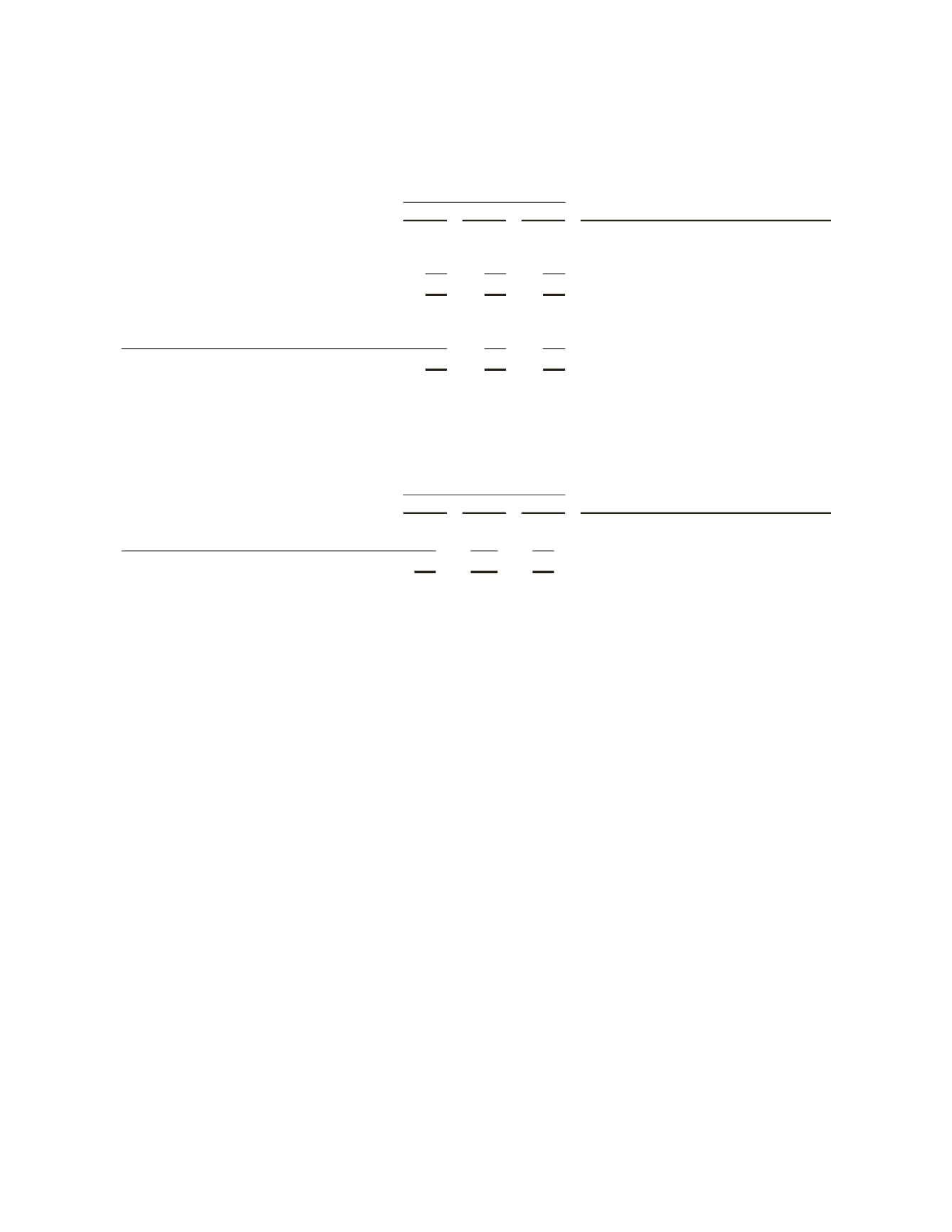

The effect of derivative instruments designated as fair value hedges and not designated as hedges on the

Consolidated Statement of Income

was as follows:

(Stated in millions)

Gain (Loss) Recognized

in Income

2011

2010

2009 Consolidated Statement of Income Classifiaction

Derivatives designated as fair value hedges:

Foreign exchange contracts

$ –

$ (8)

$105

Cost of revenue - Oilfield Services

Interest rate swaps

9

22

6

Interest expense

$ 9

$ 14

$111

Derivatives not designated as hedges:

Foreign exchange contracts

$(17)

$(13)

$ 32

Cost of revenue - Oilfield Services

Commodity contracts

(5)

1

2

Cost of revenue - Oilfield Services

$(22)

$(12)

$ 34

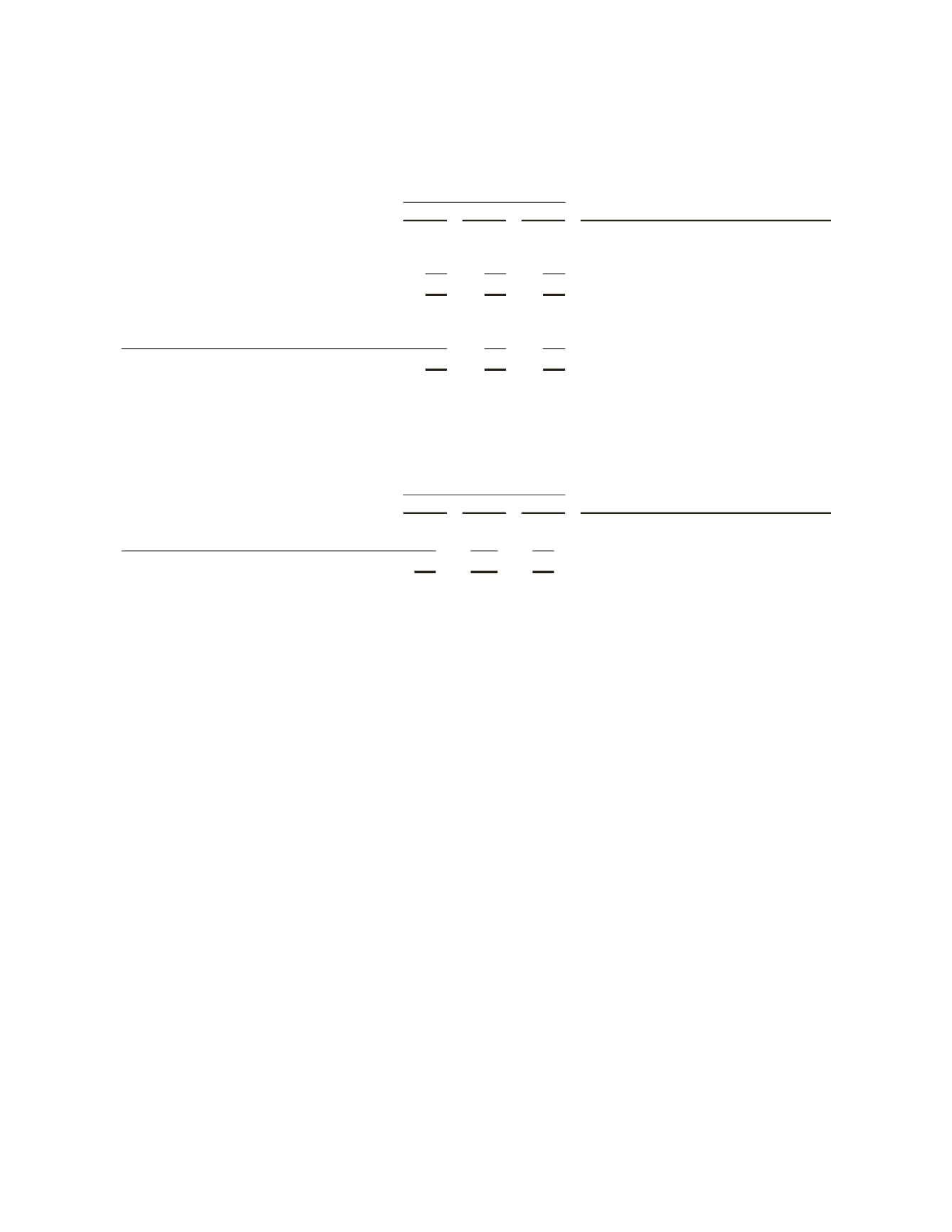

The effect of derivative instruments in cash flow hedging relationships on income and

Accumulated other

comprehensive loss

(AOCL) was as follows:

(Stated in millions)

Gain (Loss) Reclassified from

AOCL into Income

2011

2010

2009 Consolidated Statement of Income Classification

Foreign exchange contracts

$(25)

$(260)

$ 95

Cost of revenue - Oilfield Services

Foreign exchange contracts

17

(14)

(15)

Research & engineering

$ (8)

$(274)

$ 80

55