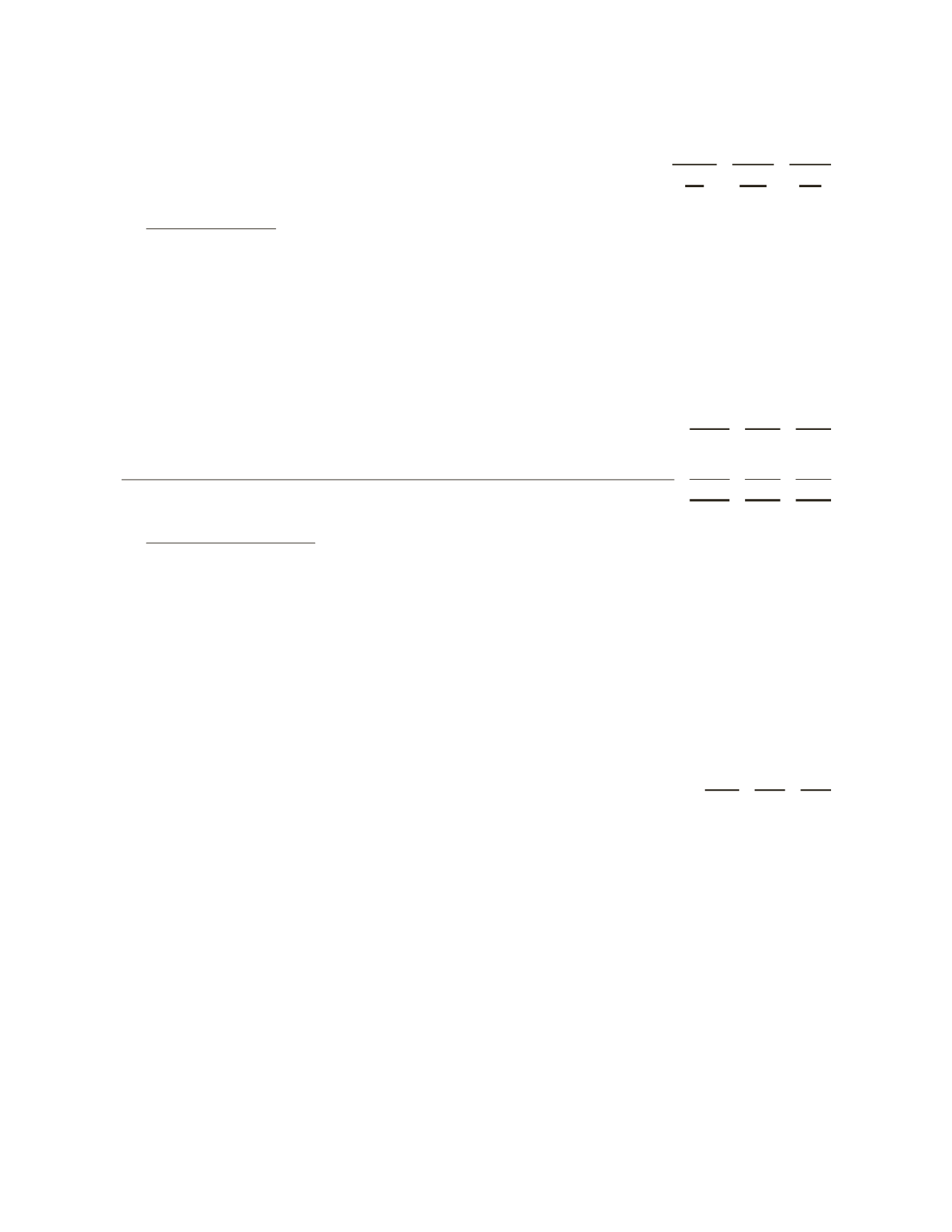

(Stated in millions)

Gain (Loss) Recognized in AOCL

2011

2010

2009

Foreign exchange contracts

$79

$(269)

$223

12. Stockholders’ Equity

Schlumberger is authorized to issue 4,500,000,000 shares of common stock, par value $0.01 per share, of which

1,333,775,406 and 1,361,171,428 shares were outstanding on December 31, 2011 and 2010, respectively. Schlumberger is

also authorized to issue 200,000,000 shares of preferred stock, par value $0.01 per share, which may be issued in series

with terms and conditions determined by the Board of Directors. No shares of preferred stock have been issued.

Holders of common stock are entitled to one vote for each share of stock held.

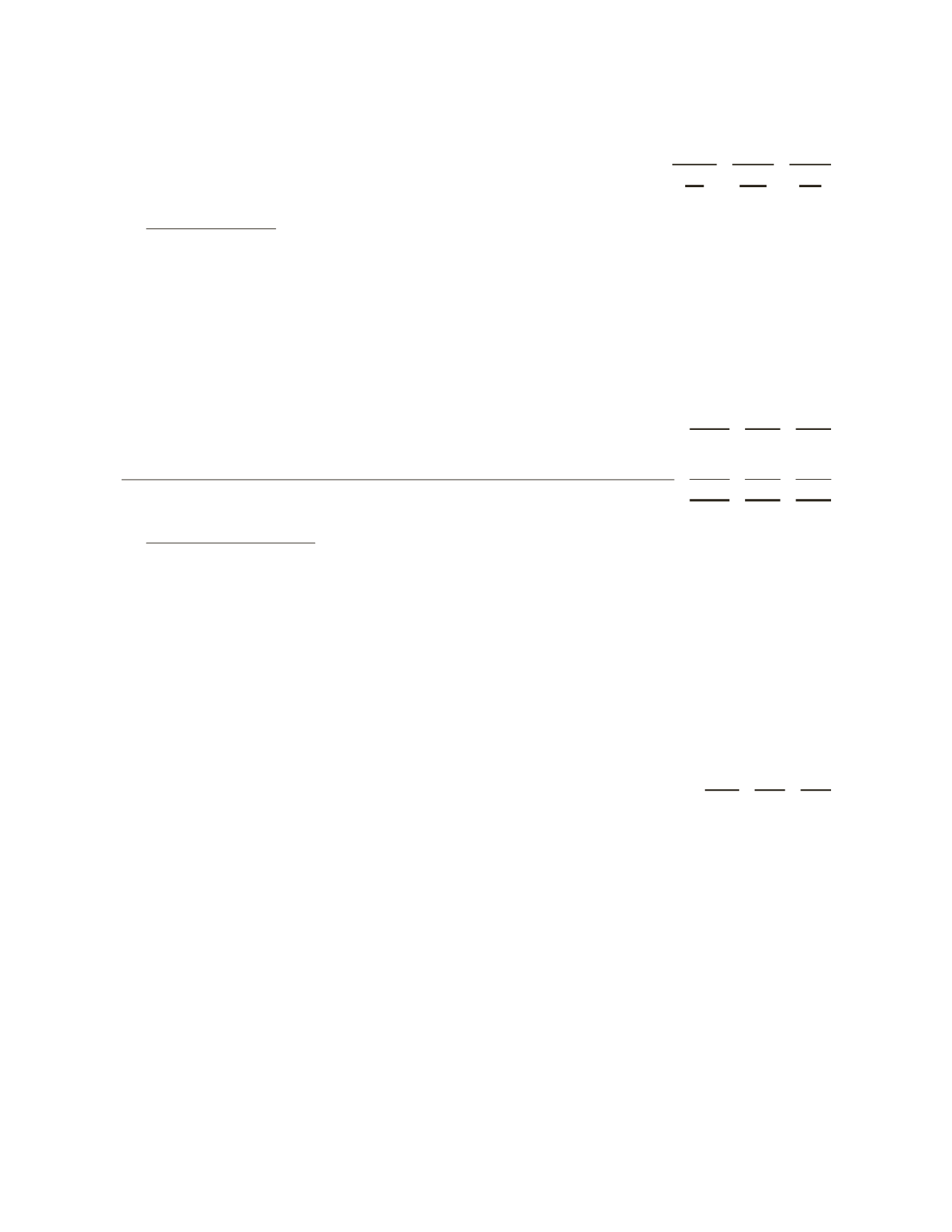

Accumulated Other Comprehensive Loss

consists of the following:

(Stated in millions)

2011 2010 2009

Currency translation adjustments

$ (993)

$ (912) $ (886)

Fair value of derivatives

(26)

45

40

Pension and other postretirement benefit plans

(2,538)

(1,901) (1,828)

$(3,557)

$(2,768) $(2,674)

13. Stock Compensation Plans

Schlumberger has three types of stock-based compensation programs: stock options, a restricted stock and

restricted stock unit program (collectively referred to as “restricted stock”) and a discounted stock purchase plan

(“DSPP”).

Stock Options

Key employees are granted stock options under Schlumberger stock option plans. For all of the stock options

granted, the exercise price equals the average of the high and low sales prices of Schlumberger stock on the date of

grant; an option’s maximum term is ten years, and options generally vest in increments over four or five years.

The fair value of each stock option grant was estimated on the date of grant using the Black-Scholes option-pricing

model with the following weighted-average assumptions and resulting weighted-average fair value per share:

2011 2010 2009

Dividend yield

1.2%

1.3% 1.2%

Expected volatility

37%

35% 34%

Risk free interest rate

2.8%

2.9% 2.2%

Expected option life in years

6.9

6.9

6.9

Weighted-average fair value per share

$31.38

$24.13 $13.92

The following table summarizes information concerning options outstanding and options exercisable by five ranges

of exercise prices as of December 31, 2011:

56