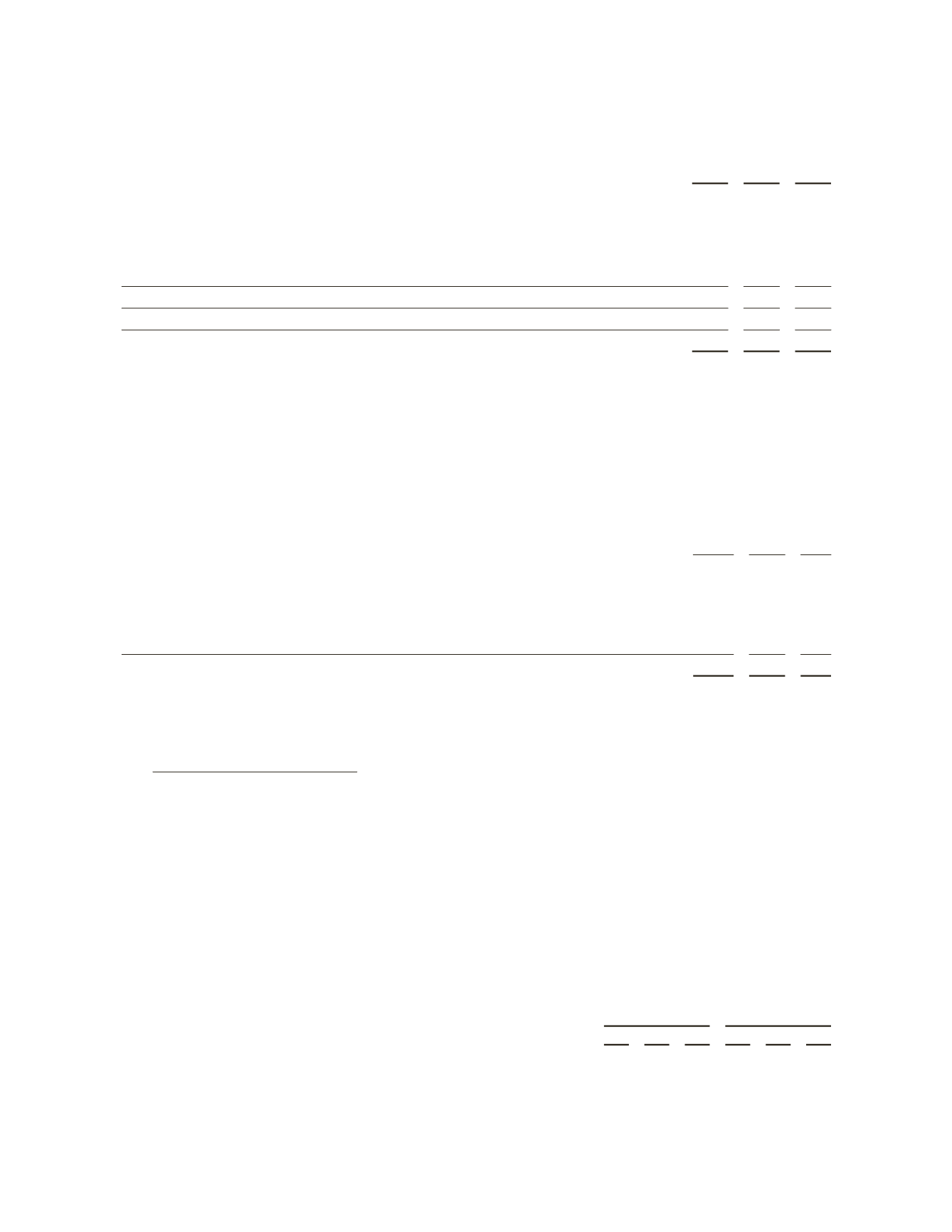

Revenue

for the years ended December 31, 2011, 2010 and 2009, by geographic area is as follows:

(Stated in millions)

2011 2010 2009

OILFIELD SERVICES

North America

$12,273 $ 6,729 $ 4,217

Latin America

6,453 4,985 4,552

Europe/CIS/Africa

9,761 8,024 7,737

Middle East & Asia

8,065 6,650 5,961

Eliminations & other

407

285

235

36,959 26,673 22,702

DISTRIBUTION

2,581

774

—

$39,540 $27,447 $22,702

Revenue is based on the location of where services are provided. Approximately 99% and 97% of Distribution’s

revenue in 2011 and 2010, respectively, was generated in North America.

During each of the three years ended December 31, 2011, 2010 and 2009, no single customer exceeded 10% of

consolidated revenue.

Schlumberger did not have revenue from third-party customers in its country of domicile during the last three years.

Revenue in the United States in 2011, 2010 and 2009 was $12.7 billion, $6.5 billion and $3.7 billion, respectively.

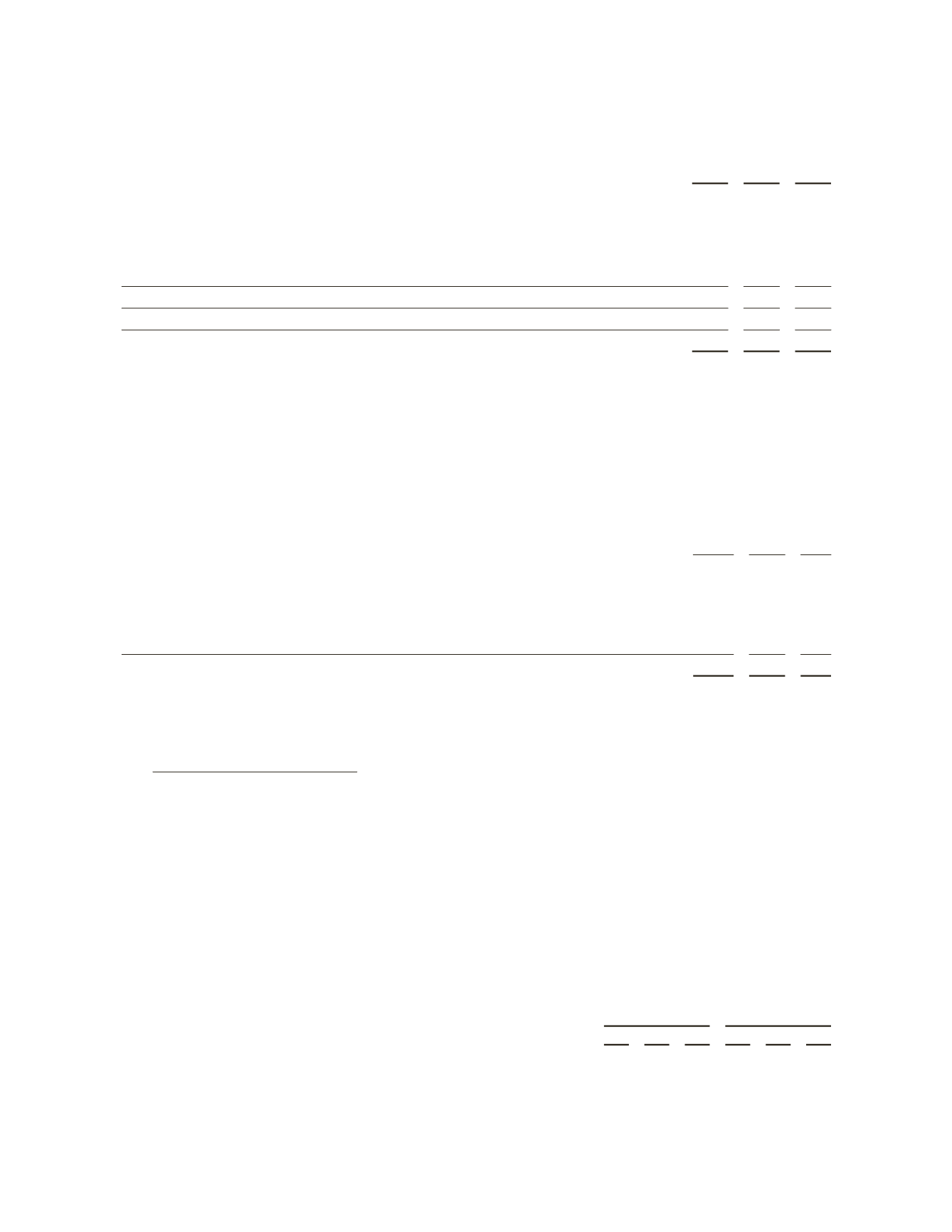

Fixed Assets less accumulated depreciation

by geographic area are as follows:

(Stated in millions)

2011 2010 2009

OILFIELD SERVICES

North America

$ 4,220

$ 3,624 $2,229

Latin America

1,472

1,274

995

Europe/CIS/Africa

3,324

3,310 2,763

Middle East & Asia

2,233

2,004 1,797

Unallocated

(1)

1,744

1,859 1,876

$12,993

$12,071 $9,660

(1)

Represents seismic vessels, including the related on-board equipment, which frequently transition between

geographic areas.

18. Pension and Other Benefit Plans

Pension Plans

Schlumberger sponsors several defined benefit pension plans that cover substantially all US employees hired prior to

October 1, 2004. The benefits are based on years of service and compensation, on a career-average pay basis.

In addition to the United States defined benefit pension plans, Schlumberger sponsors several other international

defined benefit pension plans. The most significant of these international plans are the International Staff Pension

Plan and the UK pension plan (collectively, the “International plans”). The International Staff Pension Plan covers

certain international employees and is based on years of service and compensation on a career-average pay basis. The

UK plan covers employees hired prior to April 1, 1999, and is based on years of service and compensation, on a final

salary basis.

The weighted-average assumed discount rate, compensation increases and the expected long-term rate of return

on plan assets used to determine the net pension cost for the US and International plans were as follows:

US

International

2011 2010 2009 2011 2010 2009

Discount rate

5.50%

6.00% 6.94%

5.47%

5.89% 6.81%

Compensation increases

4.00%

4.00% 4.00%

4.91%

4.93% 4.93%

Return on plan assets

7.50%

8.50% 8.50%

7.50%

8.00% 8.00%

63