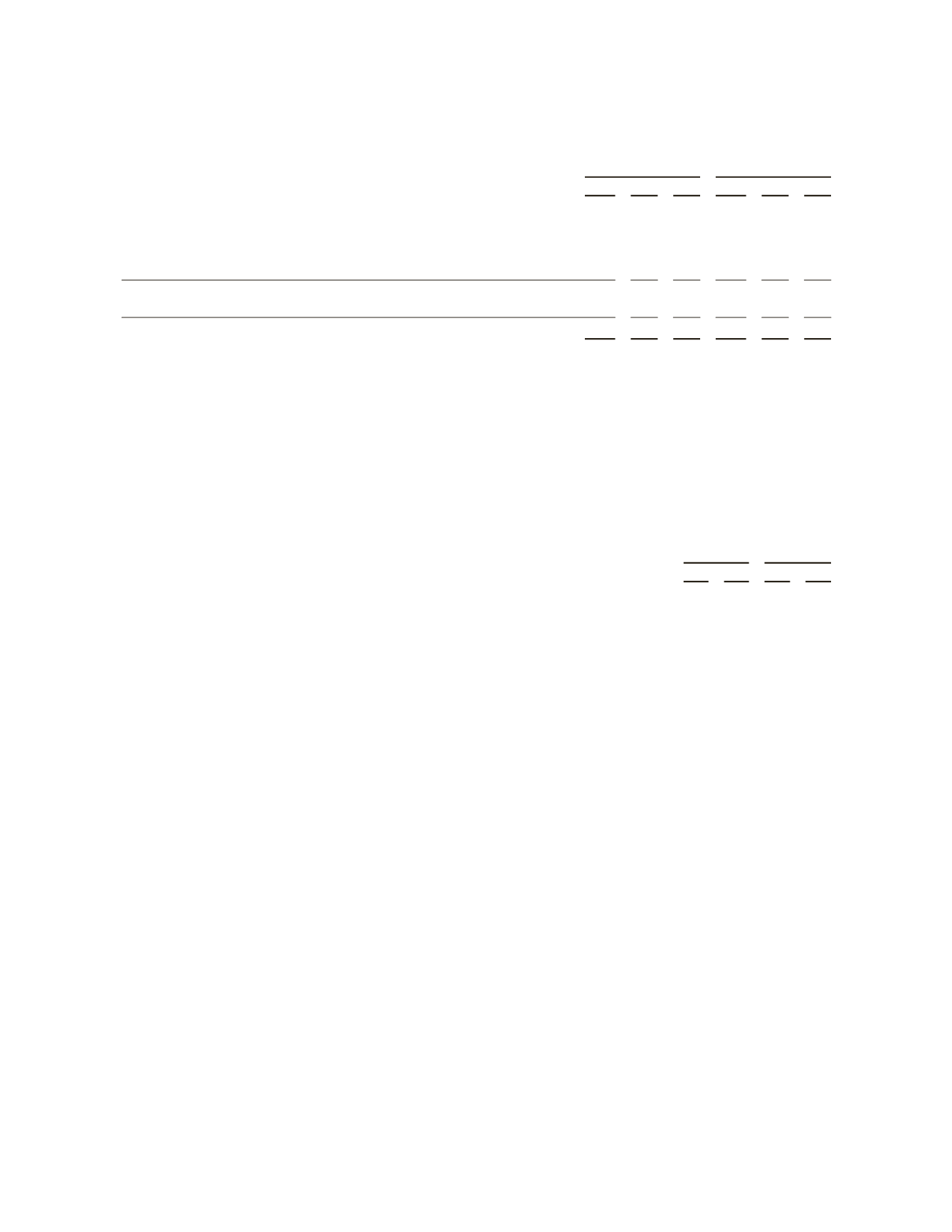

Net pension cost for 2011, 2010 and 2009 included the following components:

(Stated in millions)

US

International

2011 2010 2009 2011 2010 2009

Service cost—benefits earned during the period

$ 59

$ 56 $ 52

$ 64

$ 51 $ 67

Interest cost on projected benefit obligation

150

142 143

226

208 189

Expected return on plan assets

(170)

(191) (166)

(279)

(228) (181)

Amortization of net loss

90

60

29

31

19 —

Amortization of prior service cost

12

4

5

120

113 117

141

71

63

162

163 192

Curtailment charge

—

— 32

—

— 98

$ 141

$ 71 $ 95

$ 162

$ 163 $ 290

During 2009, due to the actions taken by Schlumberger to reduce its global workforce (See Note 3 –

Charges and

Credits

), Schlumberger experienced a significant reduction in the expected aggregate years of future service of its

employees in certain of its pension plans and its postretirement medical plan. Accordingly, Schlumberger recorded a

curtailment charge of $136 million during the second quarter of 2009 ($130 million relating to the pension plans and $6

million relating to the postretirement medical plan). The curtailment charge includes recognition of the change in

benefit obligations as well as a portion of the previously unrecognized prior service costs, reflecting the reduction in

expected future service for the impacted plans. As a result of the curtailment, Schlumberger performed a

remeasurement of the impacted plans using a discount rate of 7.25%.

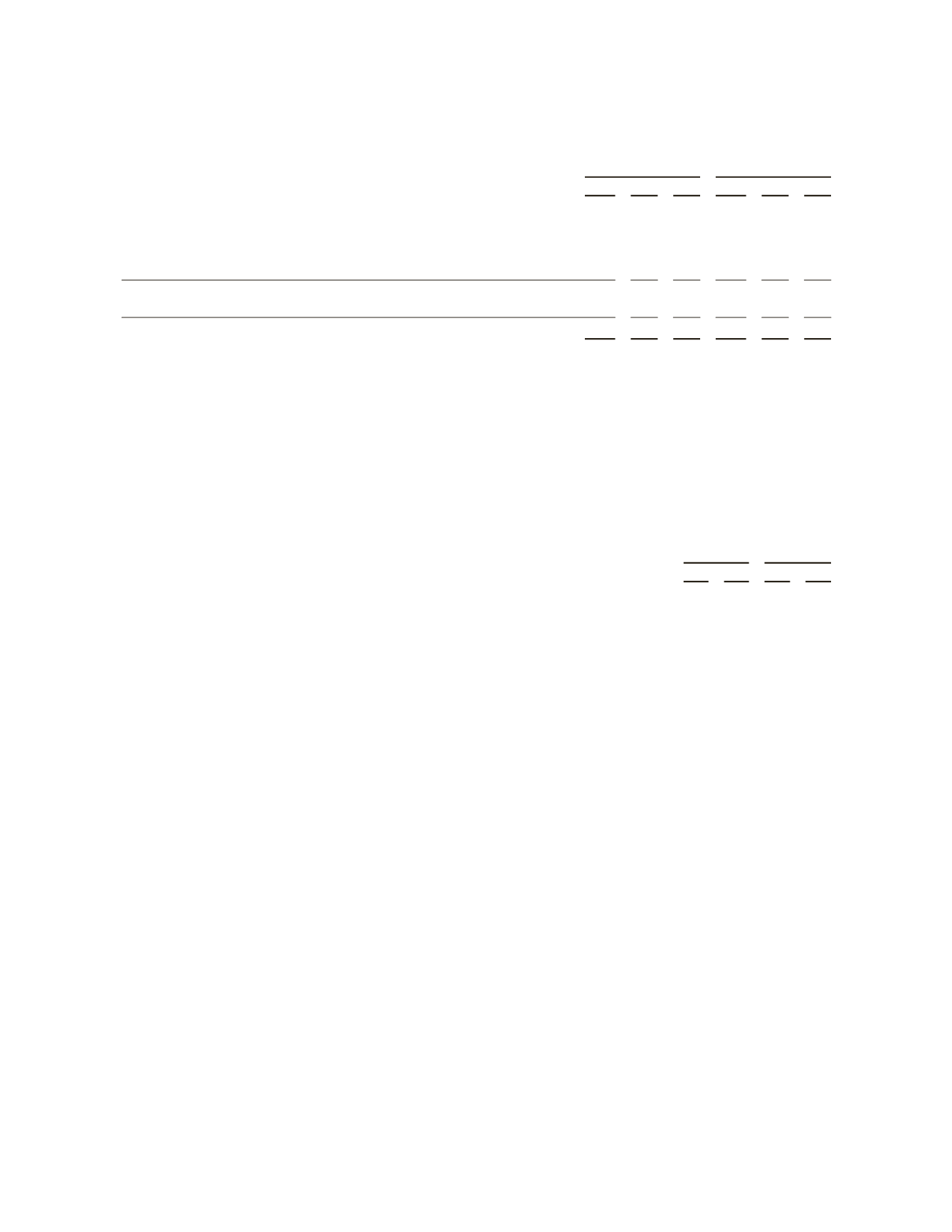

The weighted-average assumed discount rate and compensation increases used to determine the projected benefit

obligations for the US and International plans were as follows:

US

International

2011 2010 2011 2010

Discount rate

5.00%

5.50%

4.95%

5.47%

Compensation increases

4.00%

4.00%

4.91%

4.91%

64