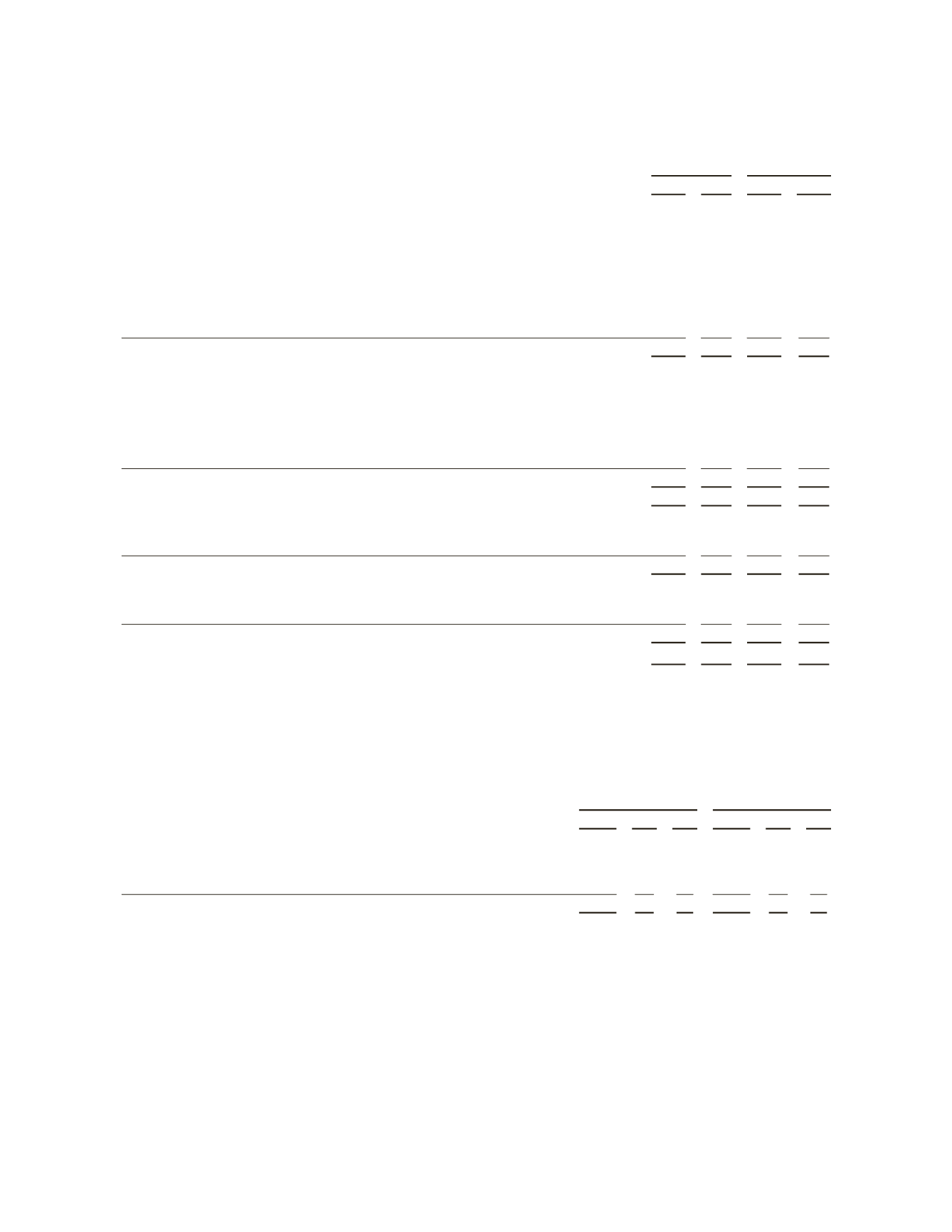

The changes in the projected benefit obligation, plan assets and funded status of the plans were as follows:

(Stated in millions)

US

International

2011 2010 2011 2010

Change in Projected Benefit Obligations

Projected benefit obligation at beginning of year

$2,769

$2,439

$4,088

$3,518

Service cost

59

56

64

51

Interest cost

150

142

226

208

Contributions by plan participants

–

–

102

76

Actuarial losses

225

172

321

310

Currency effect

–

–

(8)

(28)

Benefits paid

(130)

(122)

(127)

(121)

Plan amendments

–

82

–

74

Projected benefit obligation at end of year

$3,073

$2,769

$4,666

$4,088

Change in Plan Assets

Plan assets at fair value at beginning of year

$2,635

$2,254

$3,764

$2,976

Actual return on plan assets

78

316

–

426

Currency effect

–

–

(6)

(26)

Company contributions

72

187

364

433

Contributions by plan participants

–

–

102

76

Benefits paid

(130)

(122)

(127)

(121)

Plan assets at fair value at end of year

$2,655

$2,635

$4,097

$3,764

Unfunded Liability

$ (418)

$ (134)

$ (569)

$ (324)

Amounts Recognized in Balance Sheet

Postretirement Benefits

$ (418)

$ (134)

$ (569)

$ (367)

Other Assets

–

–

–

43

$ (418)

$ (134)

$ (569)

$ (324)

Amounts Recognized in Accumulated Other Comprehensive Loss

Actuarial losses

$1,048

$ 819

$1,002

$ 447

Prior service cost

101

114

729

840

$1,149

$ 933

$1,731

$1,287

Accumulated benefit obligation

$2,861

$2,568

$4,336

$3,785

The unfunded liability represents the difference between the plan assets and the projected benefit obligation (“PBO”). The

PBO represents the actuarial present value of benefits based on employee service and compensation and includes an

assumption about future compensation levels. The accumulated benefit obligation represents the actuarial present value of

benefits based on employee service and compensation, but does not include an assumption about future compensation levels.

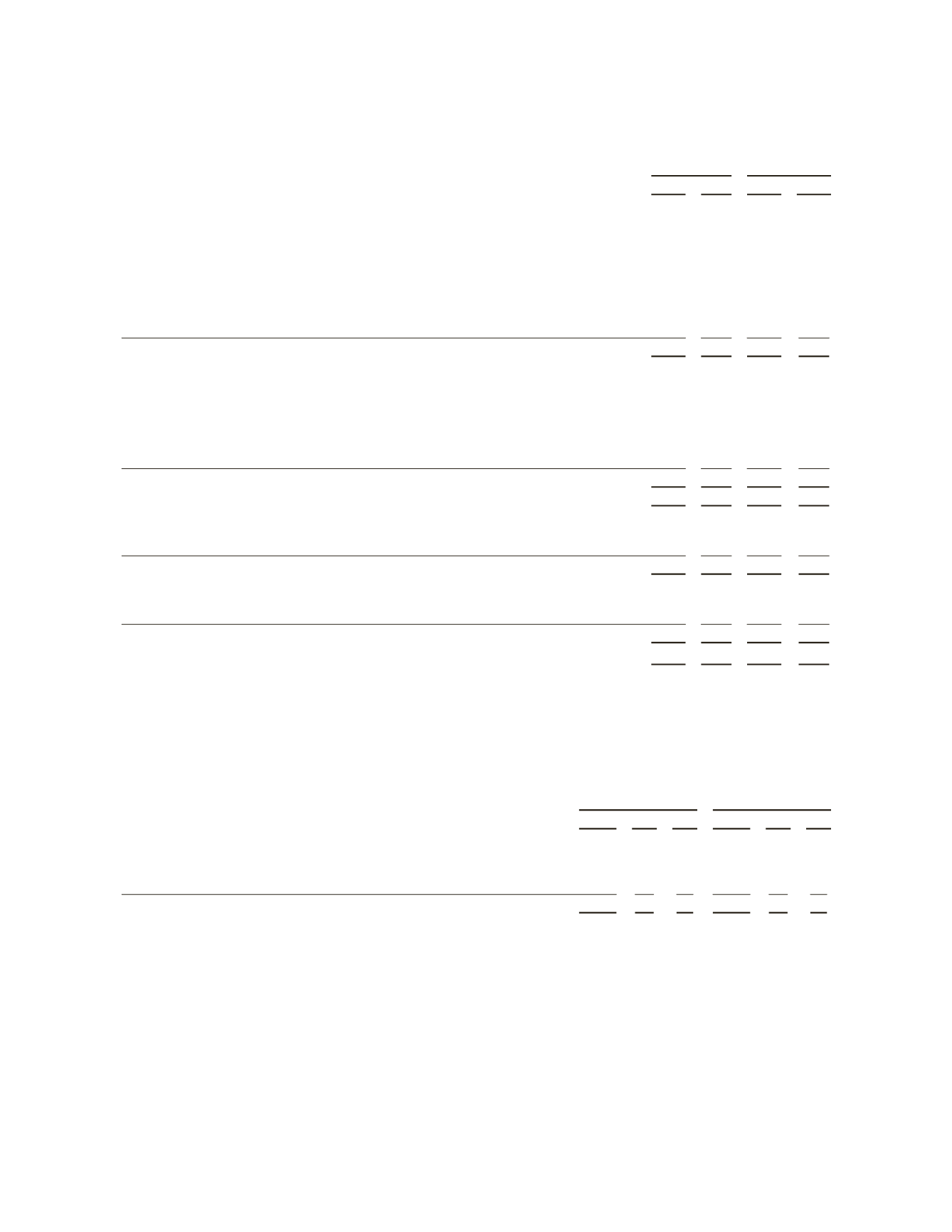

The weighted-average allocation of plan assets and the target allocation by asset category are as follows:

US

International

Target 2011 2010 Target 2011 2010

Equity securities

45 – 50% 47%

52%

50 – 70% 51%

61%

Debt securities

33 –43 39

40

25 – 35 38

31

Cash and cash equivalents

0 – 2 6

2

0 – 2 4

3

Alternative investments

0 – 10 8

6

0 – 20 7

5

100% 100%

100%

100% 100%

100%

Schlumberger’s investment policy includes various guidelines and procedures designed to ensure that assets are

prudently invested in a manner necessary to meet the future benefit obligation of the pension plans. The policy does

not permit the direct investment of plan assets in any Schlumberger security. Schlumberger’s investment horizon is

long-term and accordingly the target asset allocations encompass a strategic, long-term perspective of capital markets,

expected risk and return behavior and perceived future economic conditions. The key investment principles of

diversification, assessment of risk and targeting the optimal expected returns for given levels of risk are applied. The

target asset allocation is reviewed periodically and is determined based on a long-term projection of capital market

outcomes, inflation rates, fixed income yields, returns, volatilities and correlation relationships. The inclusion of any

given asset class in the target asset allocation is considered in relation to its impact on the overall risk/return

65