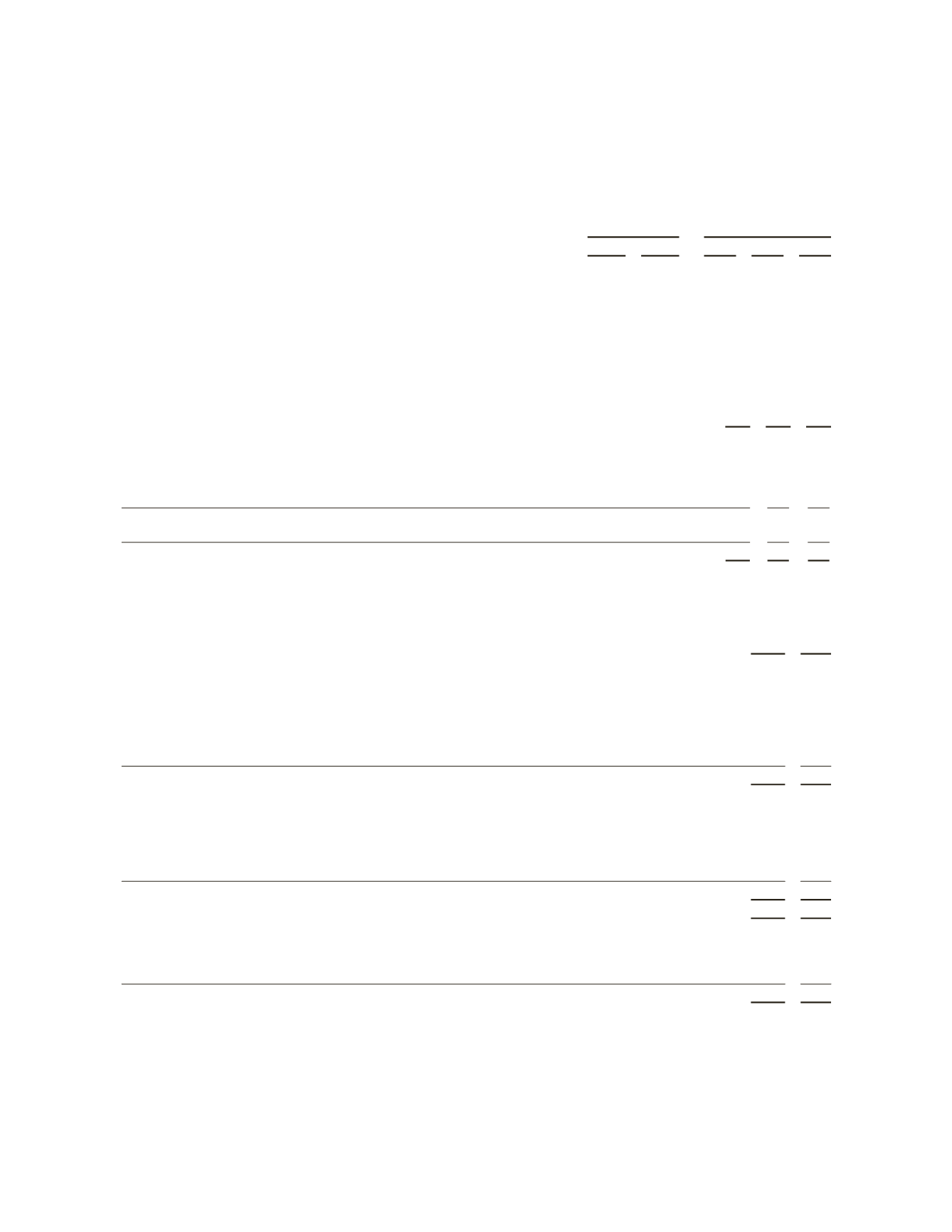

Postretirement Benefits Other than Pensions

Schlumberger provides certain health care benefits to former US employees who have retired.

The actuarial assumptions used to determine the accumulated postretirement benefit obligation and net periodic

benefit cost for the US postretirement medical plan were as follows:

Benefit Obligation

at December 31,

Net Periodic Benefit Cost

for the year

2011 2010

2011 2010 2009

Discount rate

5.00%

5.50%

5.50%

6.00% 6.94%

Return on plan assets

–

–

7.00%

8.00% 8.00%

Current medical cost trend rate

8.00%

8.00%

8.00%

8.00% 8.00%

Ultimate medical cost trend rate

5.00%

5.00%

5.00%

5.00% 5.00%

Year that the rate reaches theultimate trend rate

2018

2017

2017

2016 2015

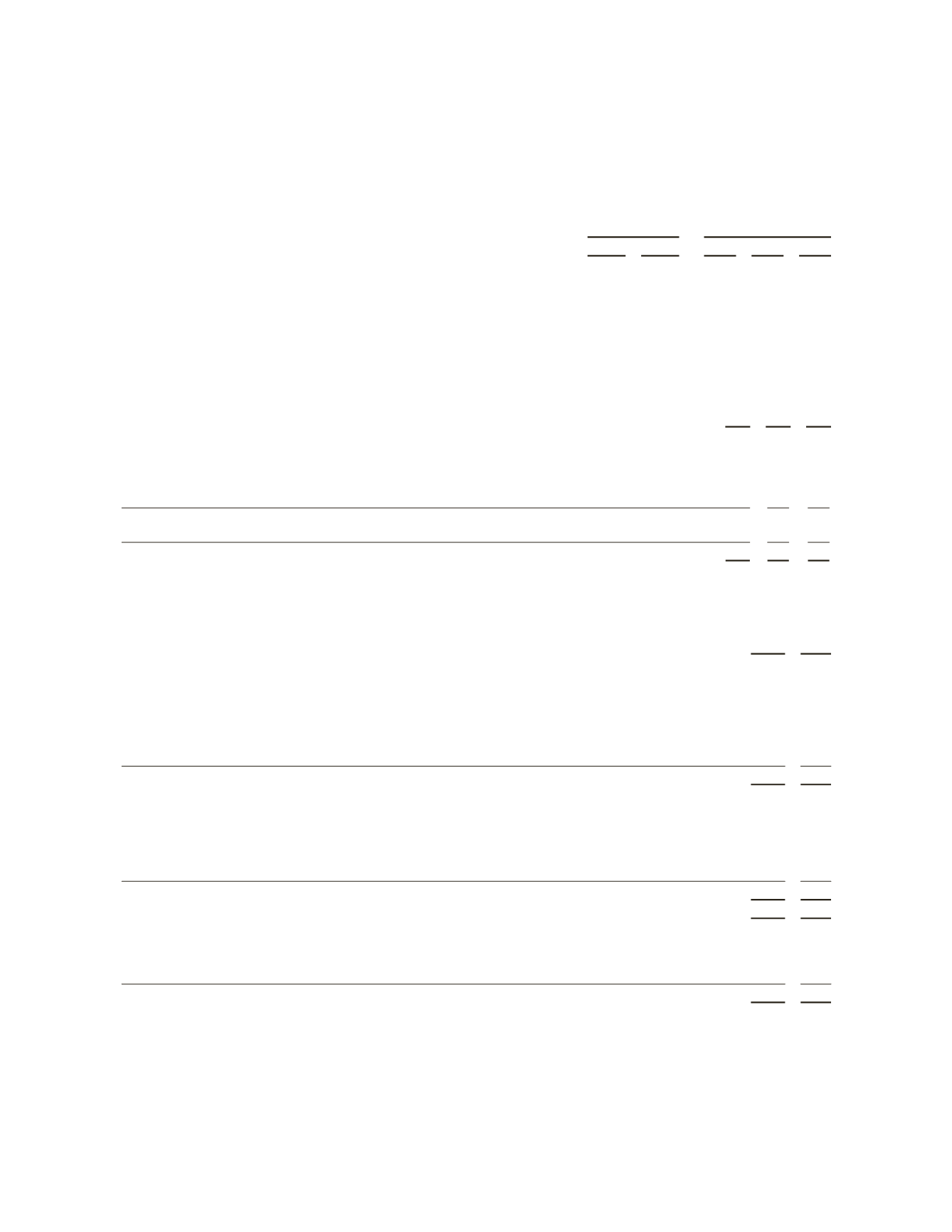

The net periodic benefit cost for the US postretirement medical plan included the following components:

(Stated in millions)

2011 2010 2009

Service cost – benefits earned during the period

$ 24

$ 23 $ 19

Interest cost on projected benefit obligation

57

58

56

Expected return on plan assets

(20)

(6)

(2)

Amortization of prior service credit

(12)

(21) (25)

Amortization of net loss

13

11

3

62

65

51

Curtailment charge

–

–

6

$ 62

$ 65 $ 57

The changes in the accumulated postretirement benefit obligation, plan assets and funded status were as follows:

(Stated in millions)

2011 2010

Change in Accumulated Postretirement Benefit Obligation

Benefit obligation at beginning of year

$1,051

$ 991

Service cost

24

23

Interest cost

57

58

Contributions by plan participants

6

4

Actuarial losses

90

8

Benefits paid

(40)

(33)

Benefit obligation at end of year

$1,188

$1,051

Change in Plan Assets

Plan assets at fair value at beginning of year

$ 290

$ 58

Company contributions

165

248

Contributions by plan participants

6

5

Benefits paid

(40)

(33)

Actual return on plan assets

22

12

Plan assets at fair value at end of year

$ 443

$ 290

Unfunded Liability

$ (745)

$ (761)

Amounts Recognized in Accumulated

Other Comprehensive Loss

Actuarial losses

$ 286

$ 212

Prior service cost

(24)

(35)

$ 262

$ 177

The unfunded liability is included in Postretirement Benefits in the Consolidated Balance Sheet.

The assets of the US postretirement medical plan are invested 60% in US equity securities and 40% in government

and government-related debt securities. The fair value of these assets were determined based on quoted prices in

active markets for identical instruments.

68