The following discussion and analysis of results of operations should be read in conjunction with the

Consolidated

Financial Statements

.

Fourth Quarter 2012 Results

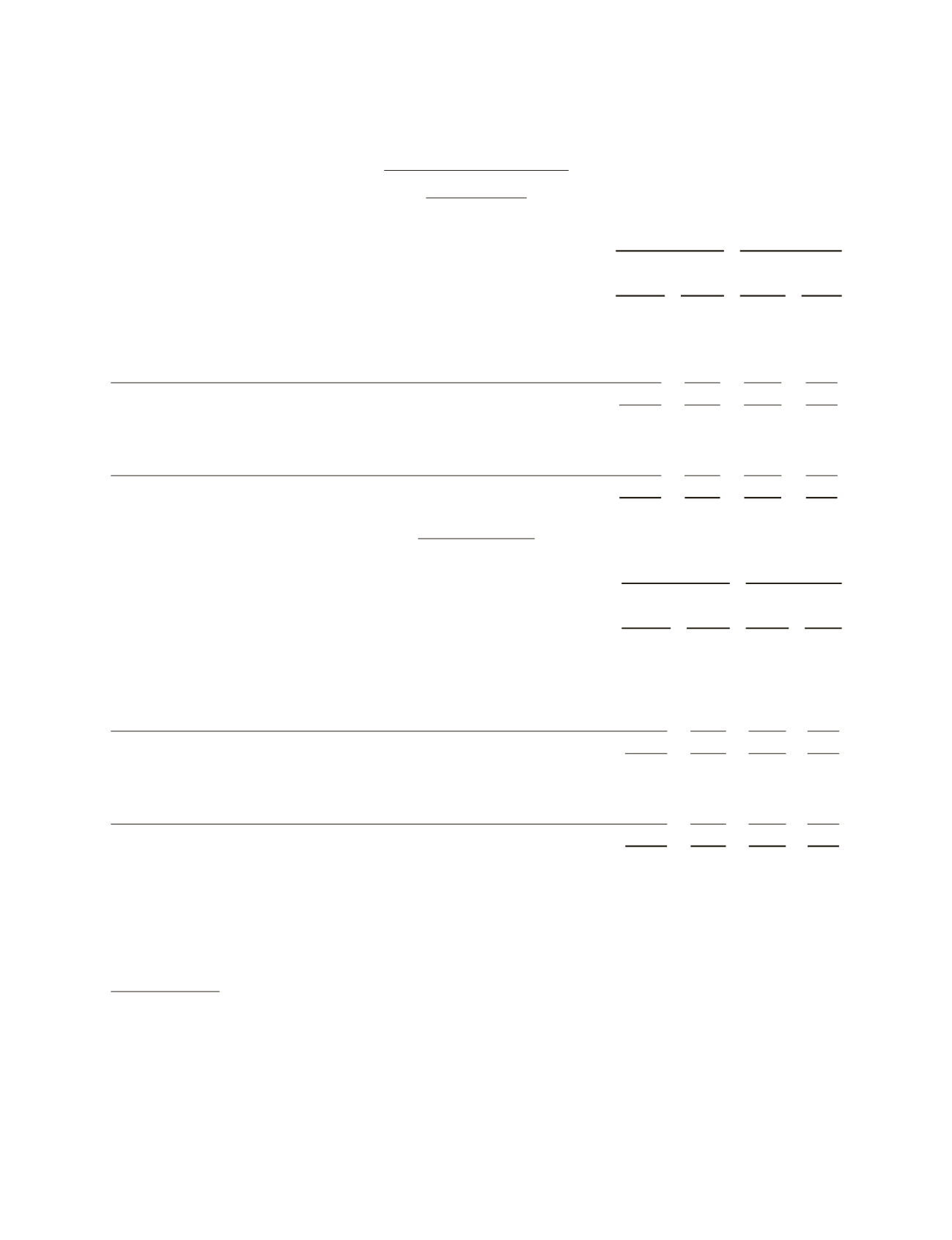

Product Groups

(Stated in millions)

Fourth Quarter 2012

Third Quarter 2012

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Oilfield Services

Reservoir Characterization

$ 3,150 $ 917

$ 2,910 $ 838

Drilling

4,137

696

4,048

733

Production

3,924

590

3,675

548

Eliminations & other

(37)

(39)

(25)

23

11,174 2,164

10,608

2,142

Corporate & other

(1)

–

(180)

–

(176)

Interest income

(2)

–

6

–

8

Interest expense

(3)

–

(90)

–

(85)

Charges & credits

(4)

–

(93)

–

(32)

$11,174 $1,807

$10,608 $1,857

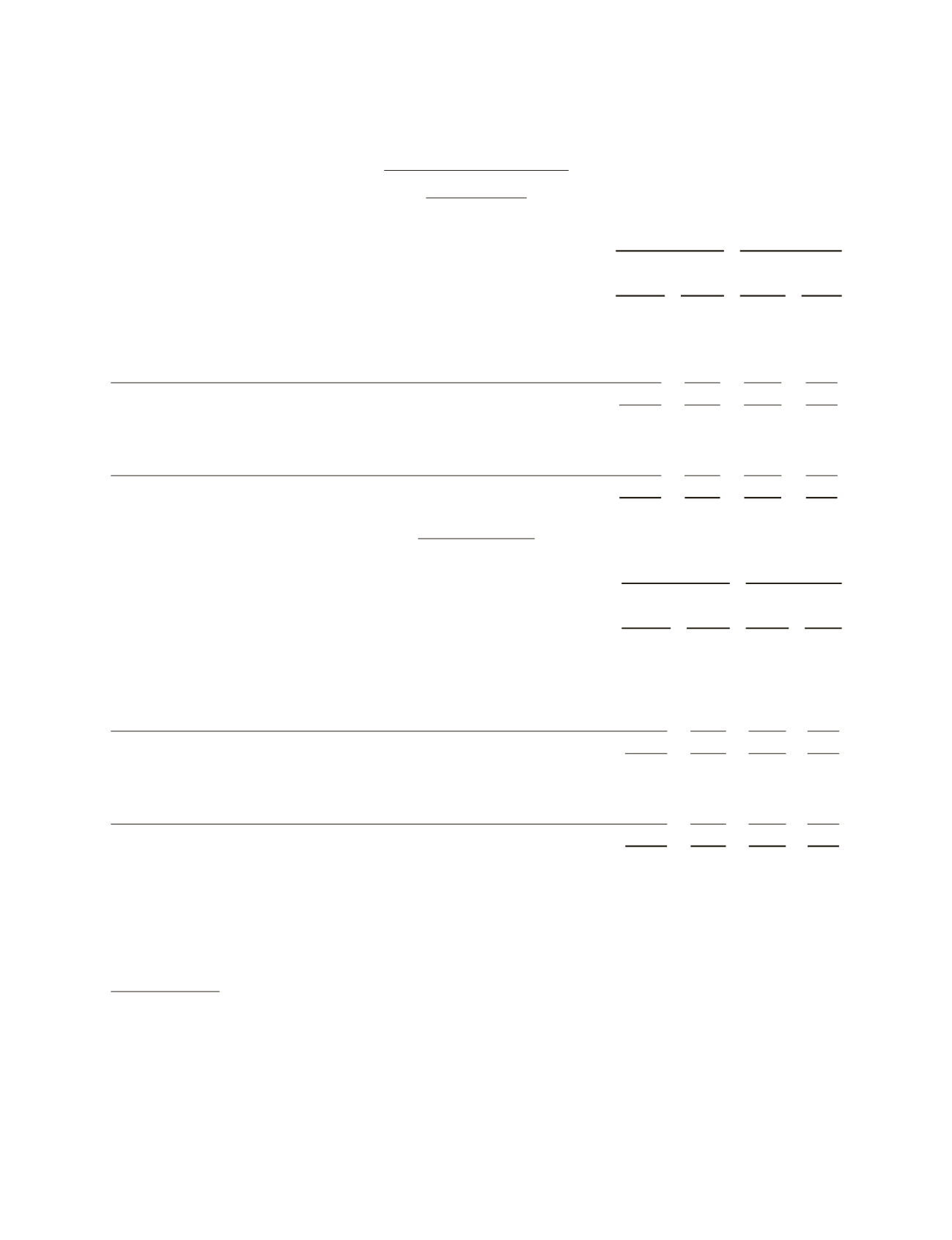

Geographic Areas

(Stated in millions)

Fourth Quarter 2012

Third Quarter 2012

Revenue

Income

before

taxes Revenue

Income

before

taxes

Oilfield Services

North America

$ 3,409 $ 655

$ 3,290 $ 610

Latin America

2,071

377

1,860

333

Europe/CIS/Africa

2,958

579

2,985

646

Middle East & Asia

2,577

601

2,352

570

Eliminations & other

159

(48)

121

(17)

11,174 2,164

10,608 2,142

Corporate & other

(1)

–

(180)

– (176)

Interest income

(2)

–

6

–

8

Interest expense

(3)

–

(90)

–

(85)

Charges & credits

(4)

–

(93)

–

(32)

$11,174 $1,807

$10,608 $1,857

(1)

Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based

compensation costs, amortization expense associated with intangible assets recorded as a result of the 2010 acquisition of Smith International,

Inc. (“Smith”) and certain other nonoperating items.

(2)

Excludes interest income included in the segments’ income (fourth quarter 2012 – $- million; third quarter 2012 – $- million).

(3)

Excludes interest expense included in the segments’ income (fourth quarter 2012–$3 million; third quarter 2012 – $3 million).

(4)

Charges and credits are described in detail in Note 3 to the

Consolidated Financial Statements

.

Oilfield Services

Fourth-quarter revenue of $11.17 billion increased $567 million or 5% sequentially, on robust international activity.

Of the revenue increase, approximately 36% came from the typical year-end surge in product and software sales, and

12% came from the increase in WesternGeco multiclient sales. Reservoir Characterization Group revenue grew 8% to

reach $3.2 billion, while Drilling Group revenue of $4.1 billion was 2% higher. Production Group revenue increased 7%

to $3.9 billion. Geographically, International revenue of $7.6 billion increased $409 million or 6% sequentially, while

North America revenue of $3.4 billion grew by $118 million or 4% sequentially.

16