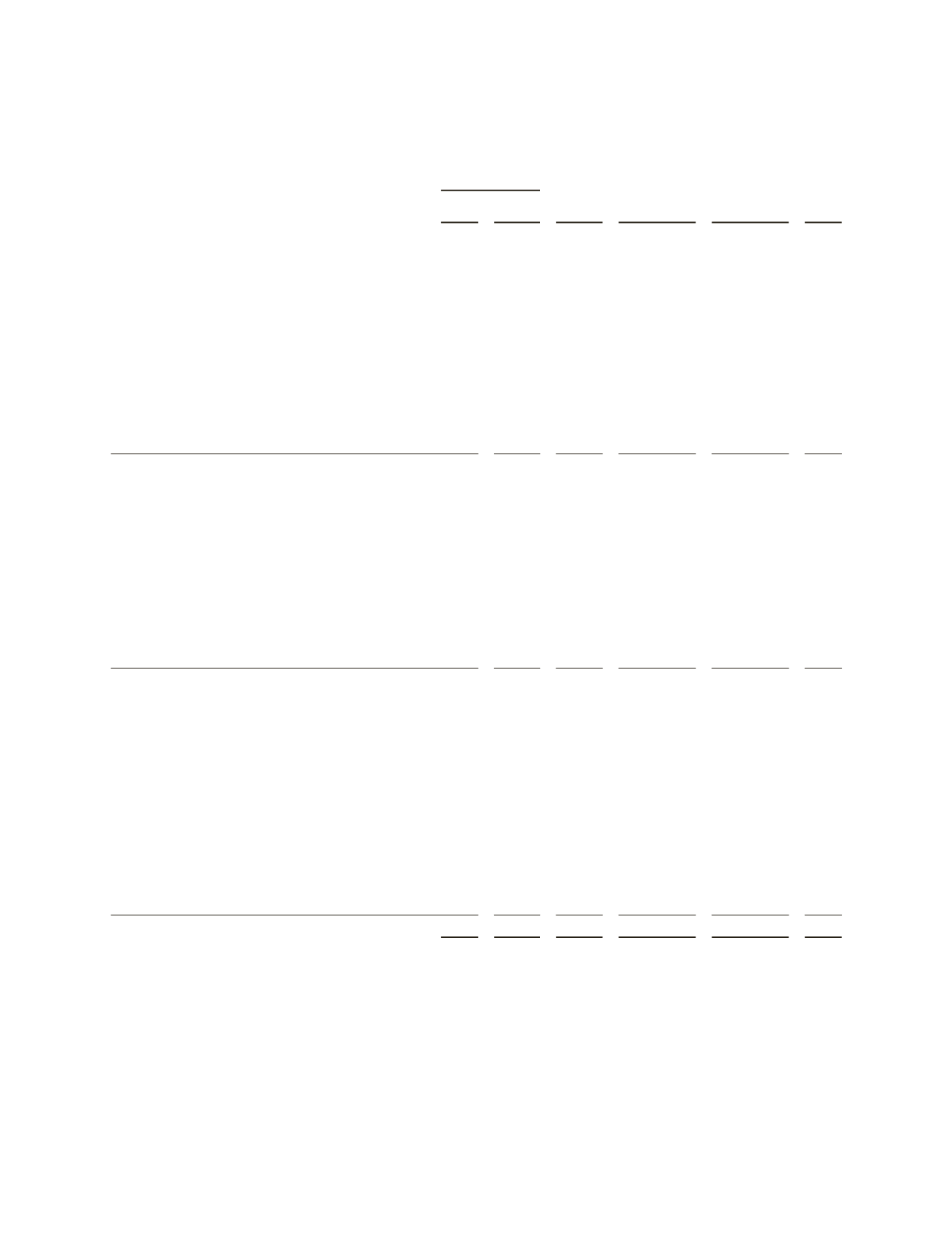

SCHLUMBERGER LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(Stated in millions)

Common Stock

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Noncontrolling

Interests

Total

Issued

In

Treasury

Balance, January 1, 2010

$ 4,777 $(5,002) $22,019

$(2,674)

$109 $19,229

Net income

4,267

(1) 4,266

Currency translation adjustments

(26)

(26)

Changes in fair value of derivatives

5

5

Pension and other postretirement benefit plans

(73)

(73)

Shares sold to optionees less shares exchanged

(8)

230

222

Vesting of restricted stock

(11)

11

–

Shares issued under employee stock purchase plan

49

130

179

Stock repurchase program

(1,717)

(1,717)

Stock-based compensation cost

198

198

Shares issued on conversions of debentures

17

303

320

Acquisition of Smith International, Inc.

6,880

2,948

111 9,939

Dividends declared ($0.84 per share)

(1,076)

(1,076)

Other

18

(39)

(1)

(22)

Balance, December 31, 2010

11,920

(3,136)

25,210

(2,768)

218 31,444

Net income

4,997

16 5,013

Currency translation adjustments

(82)

(82)

Changes in fair value of derivatives

(71)

(71)

Pension and other postretirement benefit plans

(636)

(636)

Shares sold to optionees less shares exchanged

(29)

259

230

Vesting of restricted stock

(39)

39

–

Shares issued under employee stock purchase plan

53

155

208

Stock repurchase program

(2,998)

(2,998)

Stock-based compensation cost

272

272

Acquisition of noncontrolling interests

(553)

(80)

(633)

Dividends declared ($1.00 per share)

(1,347)

(1,347)

Other

15

2

(25)

(8)

Balance, December 31, 2011

11,639

(5,679)

28,860

(3,557)

129 31,392

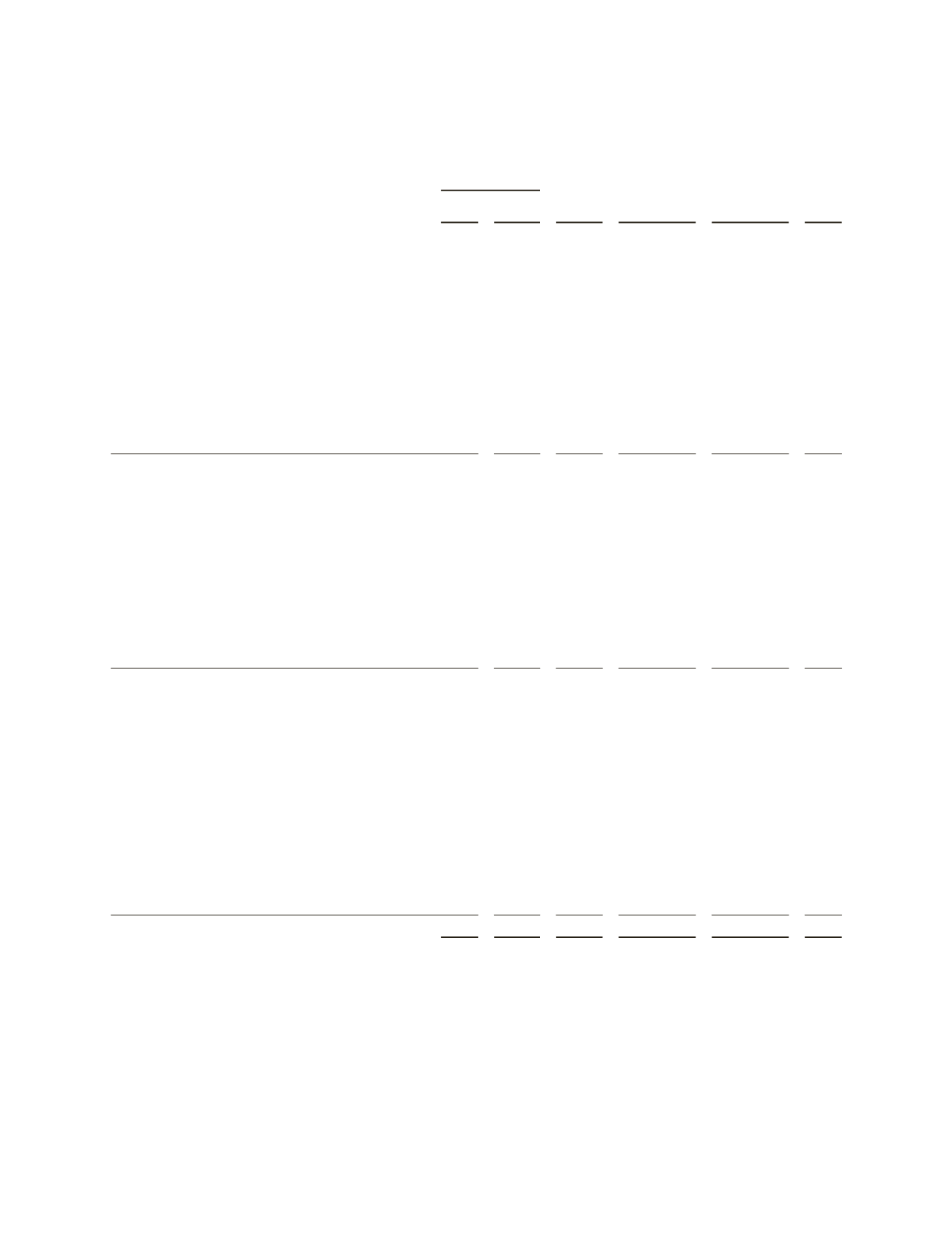

Net income

5,490

29 5,519

Currency translation adjustments

71

71

Change in unrealized gain on marketable securities

141

141

Changes in fair value of derivatives

56

56

Pension and other postretirement benefit plans

(604)

(604)

Shares sold to optionees less shares exchanged

(75)

238

163

Vesting of restricted stock

(20)

20

–

Shares issued under employee stock purchase plan

16

231

247

Stock repurchase program

(972)

(972)

Stock-based compensation cost

335

335

Sale of CE Franklin

5

(68)

(63)

Acquisition of noncontrolling interests

(3)

15

12

Dividends declared ($1.10 per share)

(1,463)

(1,463)

Other

20

2

2

24

Balance, December 31, 2012

$11,912 $(6,160) $32,887

$(3,888)

$107 $34,858

See the

Notes to Consolidated Financial Statements

37