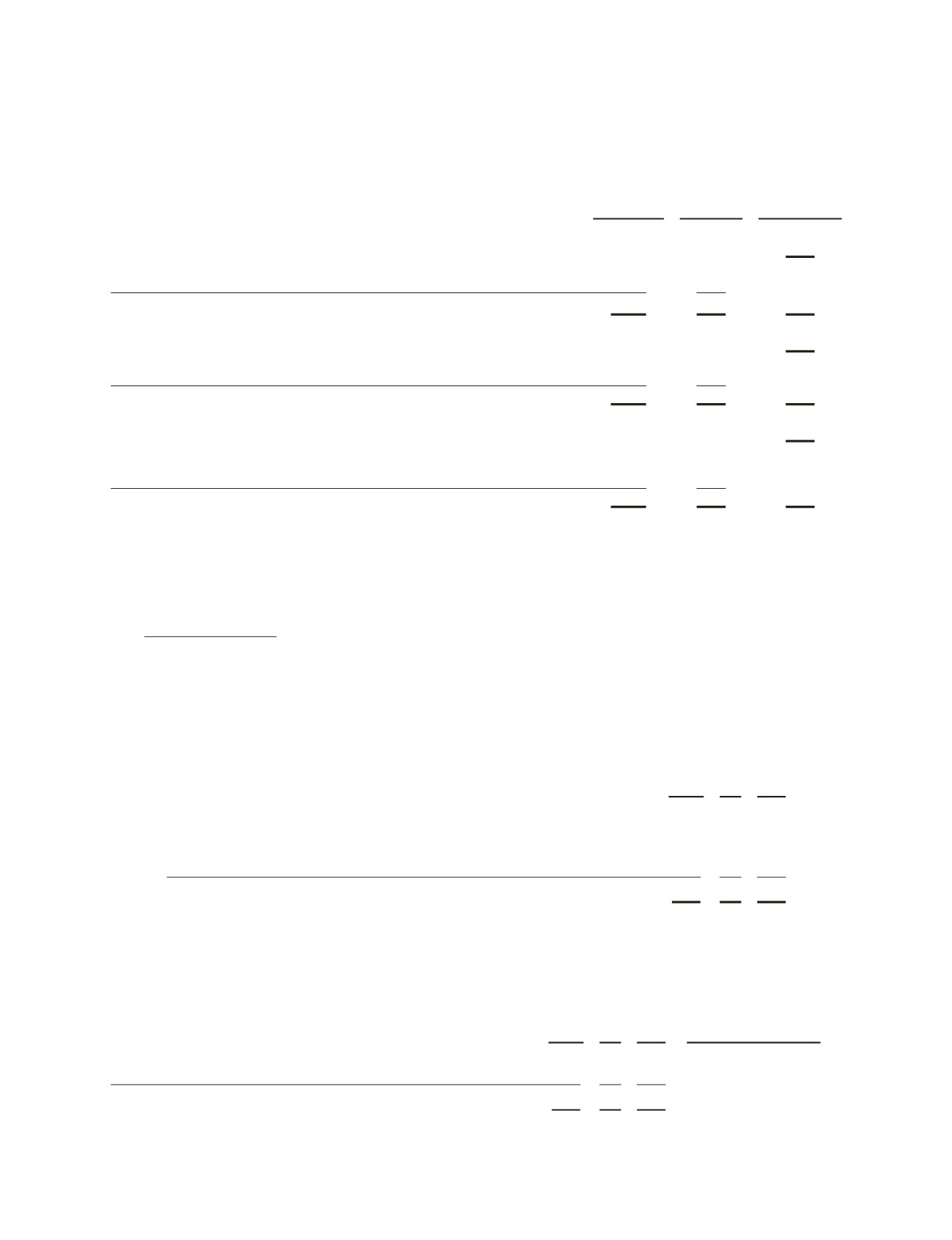

The following is a reconciliation from basic to diluted earnings per share from continuing operations of

Schlumberger for each of the last three years:

(Stated in million except per share amounts)

Schlumberger

Income from

Continuing

Operations

Weighted

Average

Shares

Outstanding

Earnings Per

Share from

from Continuing

Operations

2012:

Basic

$5,439

1,330

$4.09

Assumed exercise of stock options

–

5

Unvested restricted stock

–

4

Diluted

$5,439

1,339

$4.06

2011:

Basic

$ 4,720

1,349

$ 3.50

Assumed exercise of stock options

–

10

Unvested restricted stock

–

2

Diluted

$ 4,720

1,361

$ 3.47

2010:

Basic

$ 4,255

1,250

$ 3.40

Assumed conversion of debentures

3

2

Assumed exercise of stock options

–

9

Unvested restricted stock

–

2

Diluted

$ 4,258

1,263

$ 3.37

Employee stock options to purchase approximately 21.0 million, 14.0 million and 12.5 million shares of common

stock at December 31, 2012, 2011 and 2010, respectively, were outstanding but were not included in the computation of

diluted earnings per share because the option exercise price was greater than the average market price of the common

stock, and therefore, the effect on diluted earnings per share would have been anti-dilutive.

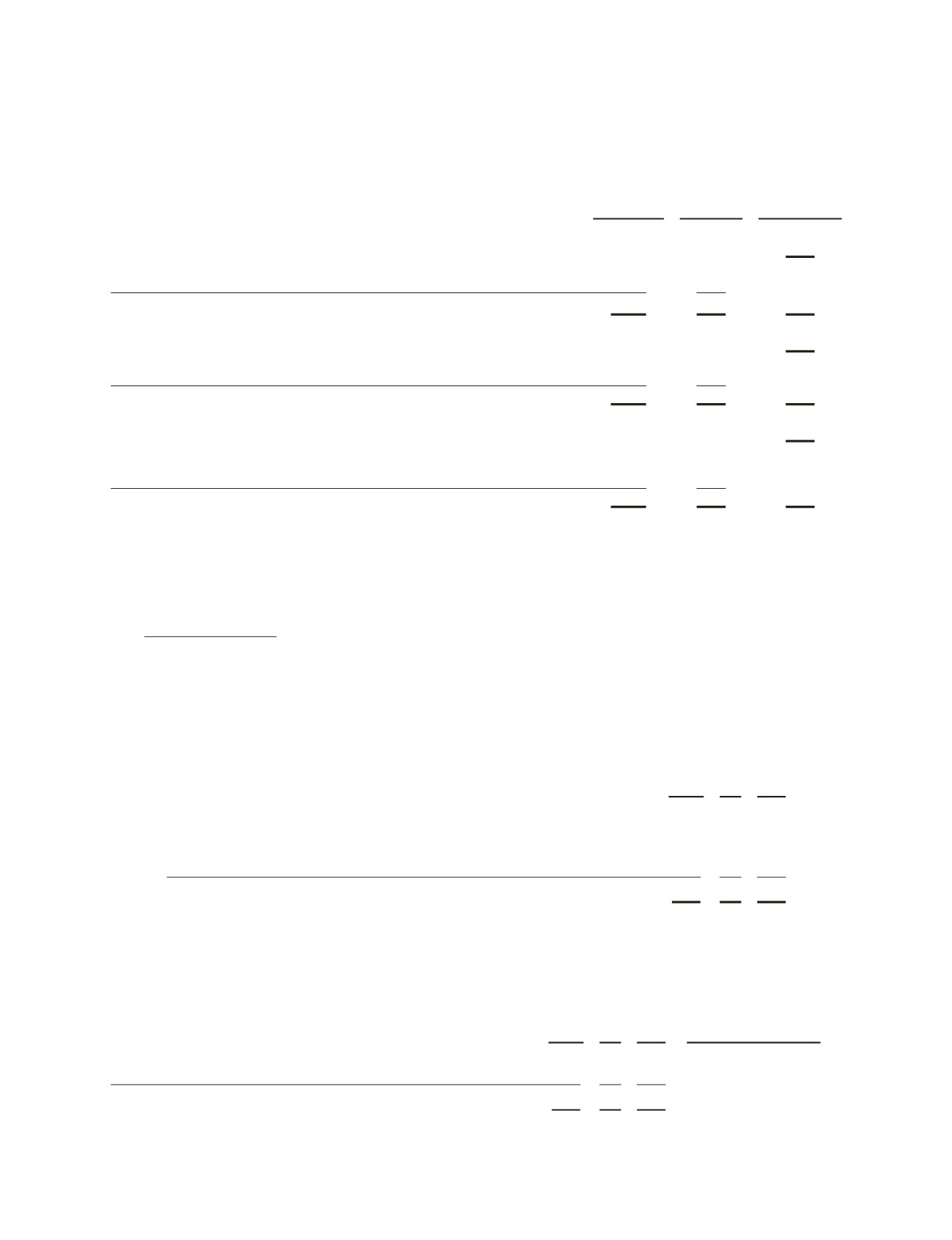

3. Charges and Credits

Schlumberger recorded the following charges and credits in continuing operations during 2012, 2011 and 2010:

2012

Š

Schlumberger recorded the following merger and integration-related charges in connection with its 2010

acquisitions of Smith International, Inc. (“Smith”) and Geoservices (see Note 4 –

Acquisitions

).

(Stated in millions)

Pretax Tax Net

First quarter

$ 14 $ 1 $ 13

Second quarter

22 1 21

Third quarter

32 4 28

Fourth quarter

60 10 50

$128 $16 $112

Š

During the fourth quarter, Schlumberger recorded a pretax charge of $33 million ($27 million after-tax)

relating to severance in connection with an initiative to rationalize global overhead costs.

The following is a summary of these charges:

(Stated in millions)

Pretax Tax Ne

t

Consolidated Statement

of Income Classification

Merger-related integration costs

$128 $16 $112

Merger & integration

Workforce reduction

33 6 27

Restructuring & other

$161 $22 $139

43