Commodity Price Risk

Schlumberger is exposed to the impact of market fluctuations in the price of certain commodities, such as metals

and fuel. Schlumberger utilizes forward contracts to manage a small percentage of the price risk associated with

forecasted metal purchases. The objective of these contracts is to reduce the variability of cash flows associated with

the forecasted purchase of those commodities. These contracts do not qualify for hedge accounting treatment and

therefore, changes in the fair value of the forward contracts are recorded directly to earnings.

The notional amount of outstanding commodity forward contracts was $43 million at December 31, 2012.

Interest Rate Risk

Schlumberger is subject to interest rate risk on its debt and its investment portfolio. Schlumberger maintains an

interest rate risk management strategy that uses a mix of variable and fixed rate debt combined with its investment

portfolio and, from time to time, interest rate swaps to mitigate the exposure to changes in interest rates.

During 2009, Schlumberger entered into an interest rate swap for a notional amount of $450 million in order to

hedge changes in the fair value of Schlumberger’s $450 million 3.00% Notes due 2013. Under the terms of this swap,

Schlumberger receives interest at a fixed rate of 3.0% annually and will pay interest quarterly at a floating rate of

three-month LIBOR plus a spread of 0.765%. This interest rate swap is designated as a fair value hedge of the

underlying debt. This derivative instrument is marked to market with gains and losses recognized currently in income

to offset the respective losses and gains recognized on changes in the fair value of the hedged debt. This results in no

net gain or loss being recognized in the

Consolidated Statement of Income

.

At December 31, 2012, Schlumberger had fixed rate debt aggregating approximately $9.6 billion and variable rate

debt aggregating approximately $2.0 billion, after taking into account the effect of the interest rate swap.

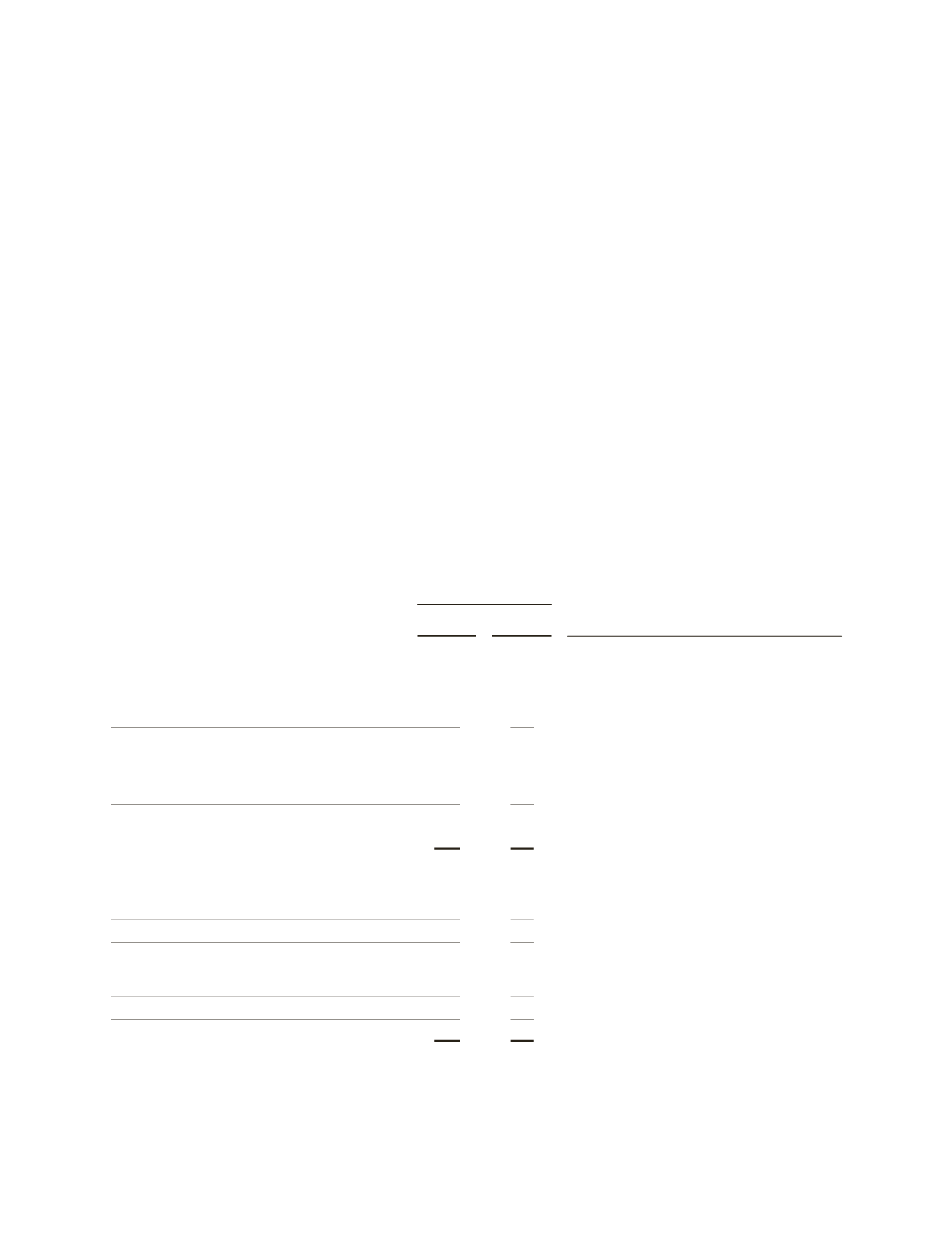

The fair values of outstanding derivative instruments are summarized as follows:

(Stated in millions)

Fair Value of

Derivatives

Consolidated Balance Sheet Classification

Derivative assets

Dec. 31,

2012

Dec. 31,

2011

Derivative designated as hedges:

Foreign exchange contracts

$ 26

$ 2

Other current assets

Foreign exchange contracts

22

4

Other Assets

Interest rate swaps

–

9

Other Assets

Interest rate swaps

2

–

Other current assets

50

15

Derivative not designated as hedges:

Foreign exchange contracts

10

8

Other current assets

Foreign exchange contracts

6

9

Other Assets

16

17

$ 66

$ 32

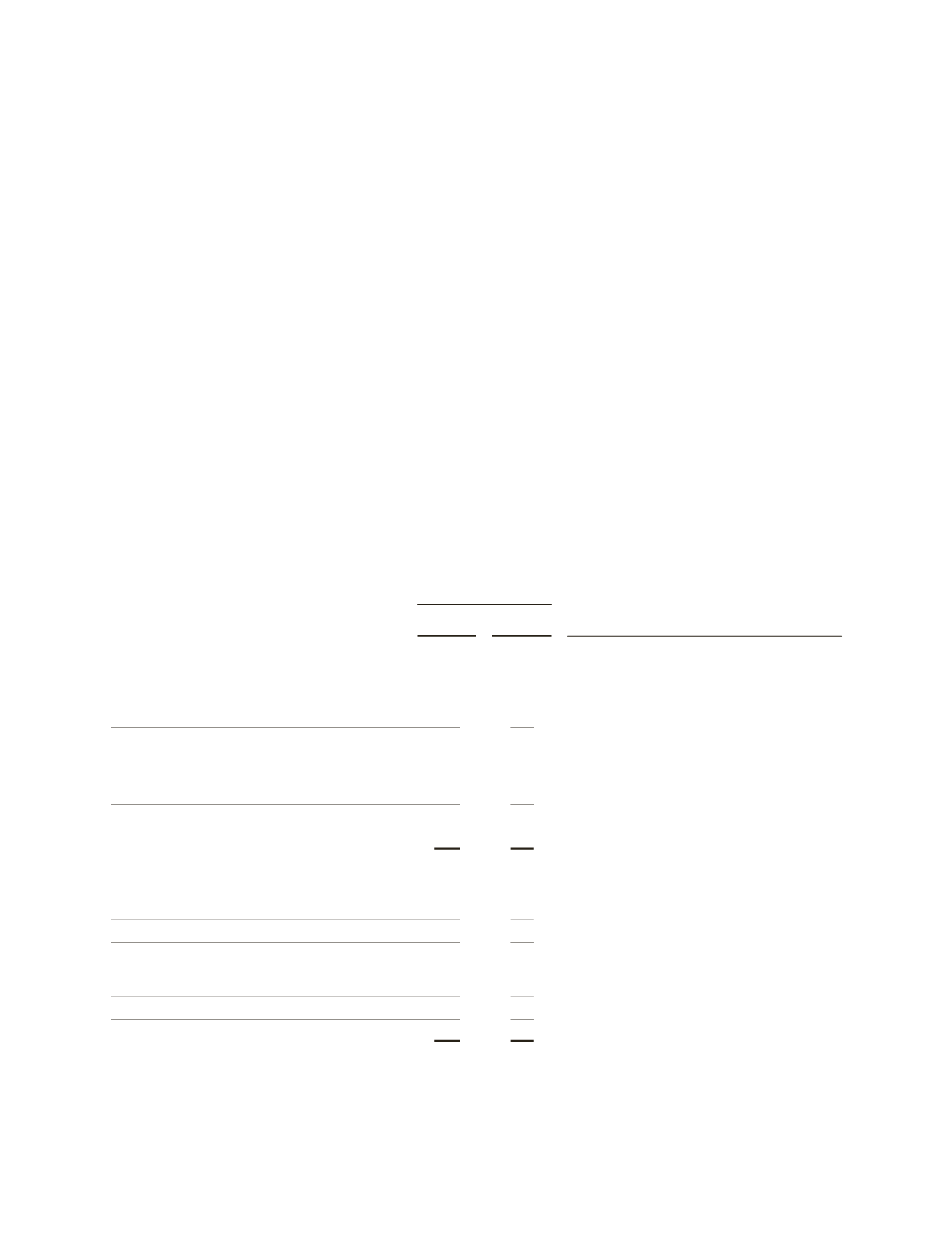

Derivative Liabilities

Derivative designated as hedges:

Foreign exchange contracts

$ 80

$ 47

Accounts payable and accrued liabilities

Foreign exchange contracts

19

130

Other Liabilities

99

177

Derivative not designated as hedges:

Commodity contracts

–

3

Accounts payable and accrued liabilities

Foreign exchange contracts

3

9

Accounts payable and accrued liabilities

3

12

$102

$189

The fair value of all outstanding derivatives is determined using a model with inputs that are observable in the

market or can be derived from or corroborated by observable data.

50