Stock Options

Key employees are granted stock options under Schlumberger stock option plans. For all of the stock options

granted, the exercise price equals the average of the high and low sales prices of Schlumberger stock on the date of

grant; an option’s maximum term is ten years, and options generally vest in increments over four or five years.

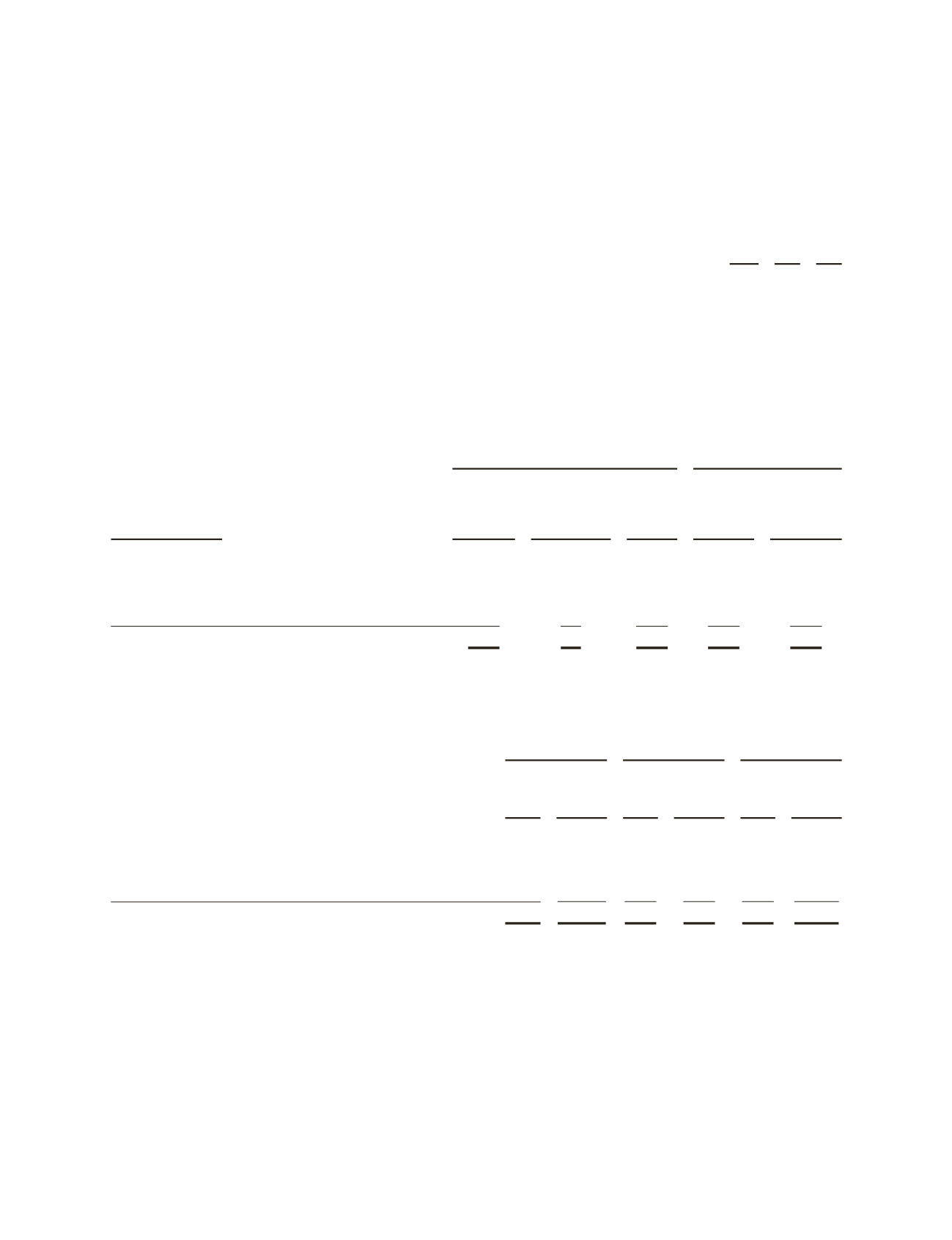

The fair value of each stock option grant was estimated on the date of grant using the Black-Scholes option-pricing

model with the following weighted-average assumptions and resulting weighted-average fair value per share:

2012 2011 2010

Dividend yield

1.5%

1.2% 1.3%

Expected volatility

39%

37% 35%

Risk free interest rate

1.5%

2.8% 2.9%

Expected option life in years

6.9

6.9 6.9

Weighted-average fair value per share

$25.26

$31.38 $24.13

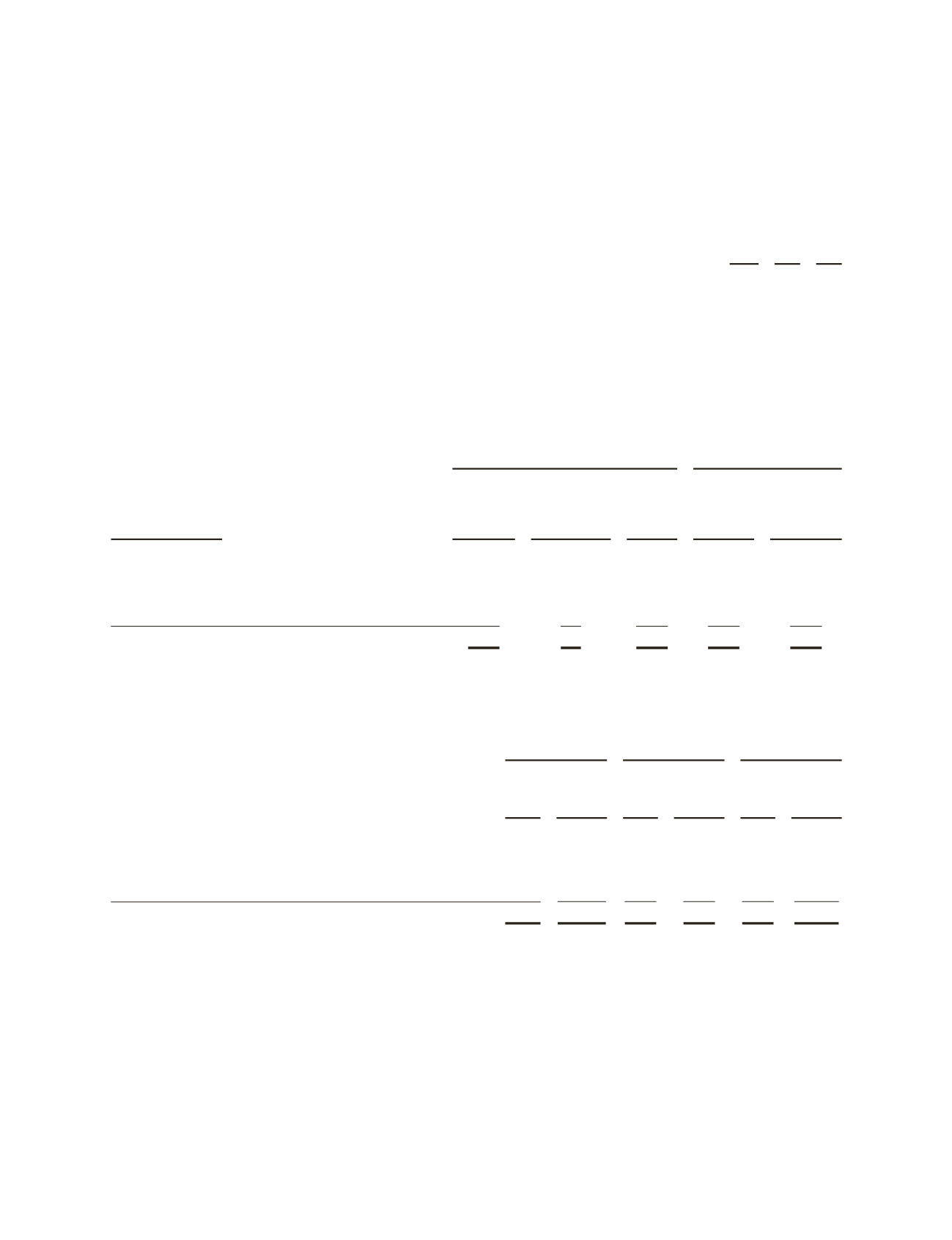

The following table summarizes information concerning options outstanding and options exercisable by five ranges

of exercise prices as of December 31, 2012:

(Shares stated in thousands)

Options Outstanding

Options Exercisable

Exercise prices range

Options

Outstanding

Weighted-

average

remaining

contractual life

(in years)

Weighted-

average

exercise

price

Options

Exercisable

Weighted-

average

exercise price

$20.65 - $32.46

631

1.31

$28.19

631

$28.19

$32.62 - $37.85

4,988

5.68

$37.45

2,670

$37.11

$39.08 - $55.69

4,779

4.09

$52.55

4,003

$53.24

$56.61 - $74.57

18,519

7.49

$68.22

5,645

$63.42

$83.89 - $110.78

13,142

7.02

$86.10

5,913

$87.58

42,059

6.65

$67.77

18,862

$63.93

The weighted average remaining contractual life of stock options exercisable as of December 31, 2012 was 5.1 years.

The following table summarizes stock option activity during the years ended December 31, 2012, 2011 and 2010:

(Shares stated in thousands)

2012

2011

2010

Shares

Weighted-

average

exercise

price Shares

Weighted-

average

exercise

price Shares

Weighted-

average

exercise

price

Outstanding at beginning of year

40,027 $63.84

37,499 $55.33 35,500

$50.30

Granted

8,664 $72.04

9,528 $84.29

8,283

$66.67

Assumed in Smith transaction

– $ –

– $ –

581

$28.77

Exercised

(4,171) $39.07

(5,470) $42.36 (5,962)

$37.60

Forfeited

(2,461) $67.50

(1,530) $58.82

(903)

$61.28

Outstanding at year-end

42,059 $67.77

40,027 $63.84 37,499

$55.33

The aggregate intrinsic value of stock options outstanding as of December 31, 2012 was approximately $308 million.

The aggregate intrinsic value of stock options exercisable as of December 31, 2012 was approximately $209 million.

The total intrinsic value of options exercised during the years ended December 31, 2012, 2011 and 2010, was $142

million, $246 million and $188 million, respectively.

Restricted Stock

Restricted stock awards generally vest at the end of three years. As of December 31, 2012, there have not been any

grants to date that are subject to performance-based vesting.

52