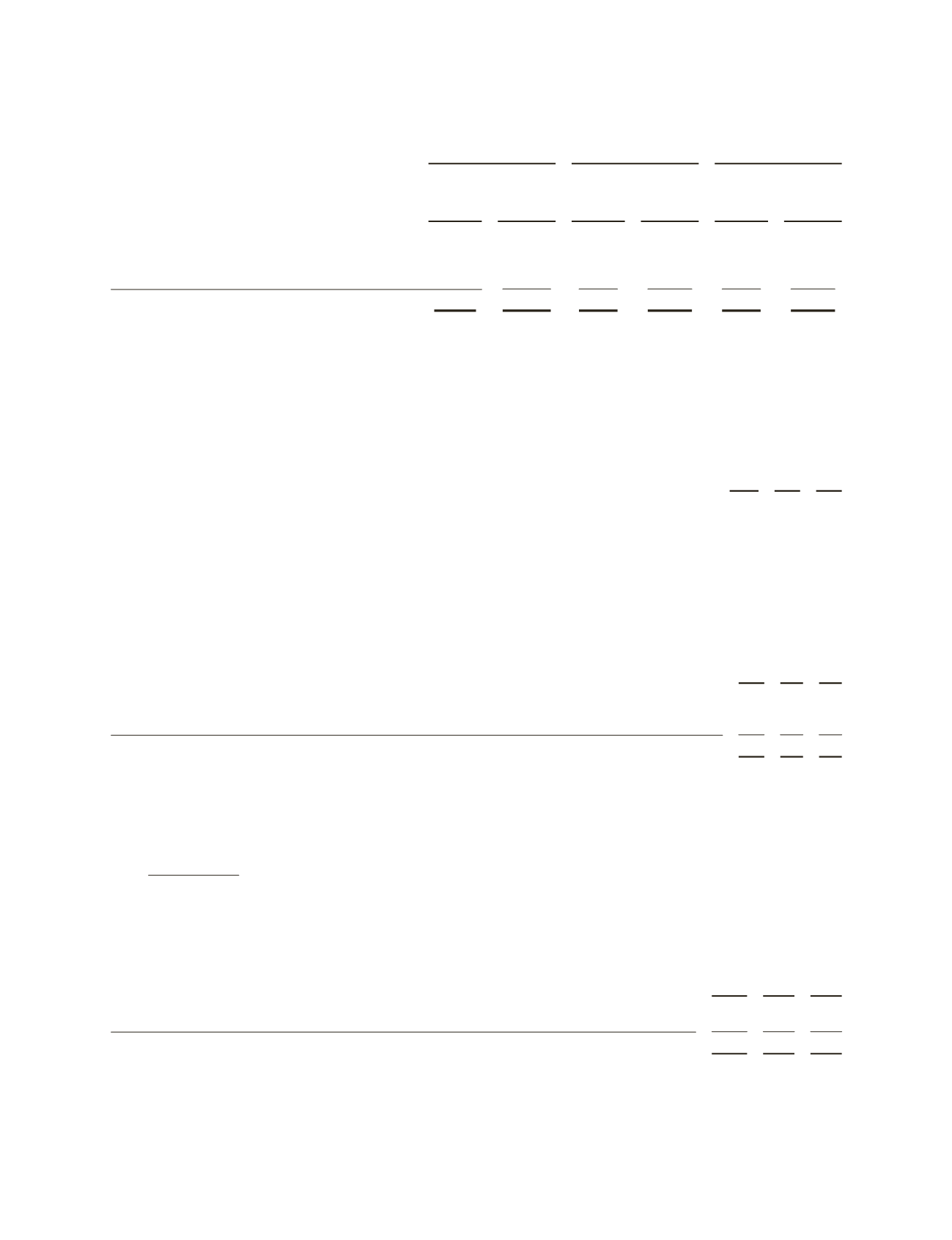

The following table summarizes information about restricted stock transactions:

(Shares stated in thousands)

2012

2011

2010

Restricted

Stock

Weighted

Average

Grant Date

Fair Value

Restricted

Stock

Weighted

Average

Grant Date

Fair Value

Restricted

Stock

Weighted

Average

Grant Date

Fair Value

Unvested at beginning of year

2,433

$72.25

2,223

$64.27

1,343

$62.75

Granted

1,668

71.09

1,136

84.61

1,261

65.79

Vested

(351)

52.26

(767)

67.36

(286)

63.92

Forfeited

(184)

73.38

(159)

72.51

(95)

64.16

Unvested at end of year

3,566

$73.62

2,433

$72.25

2,223

$64.27

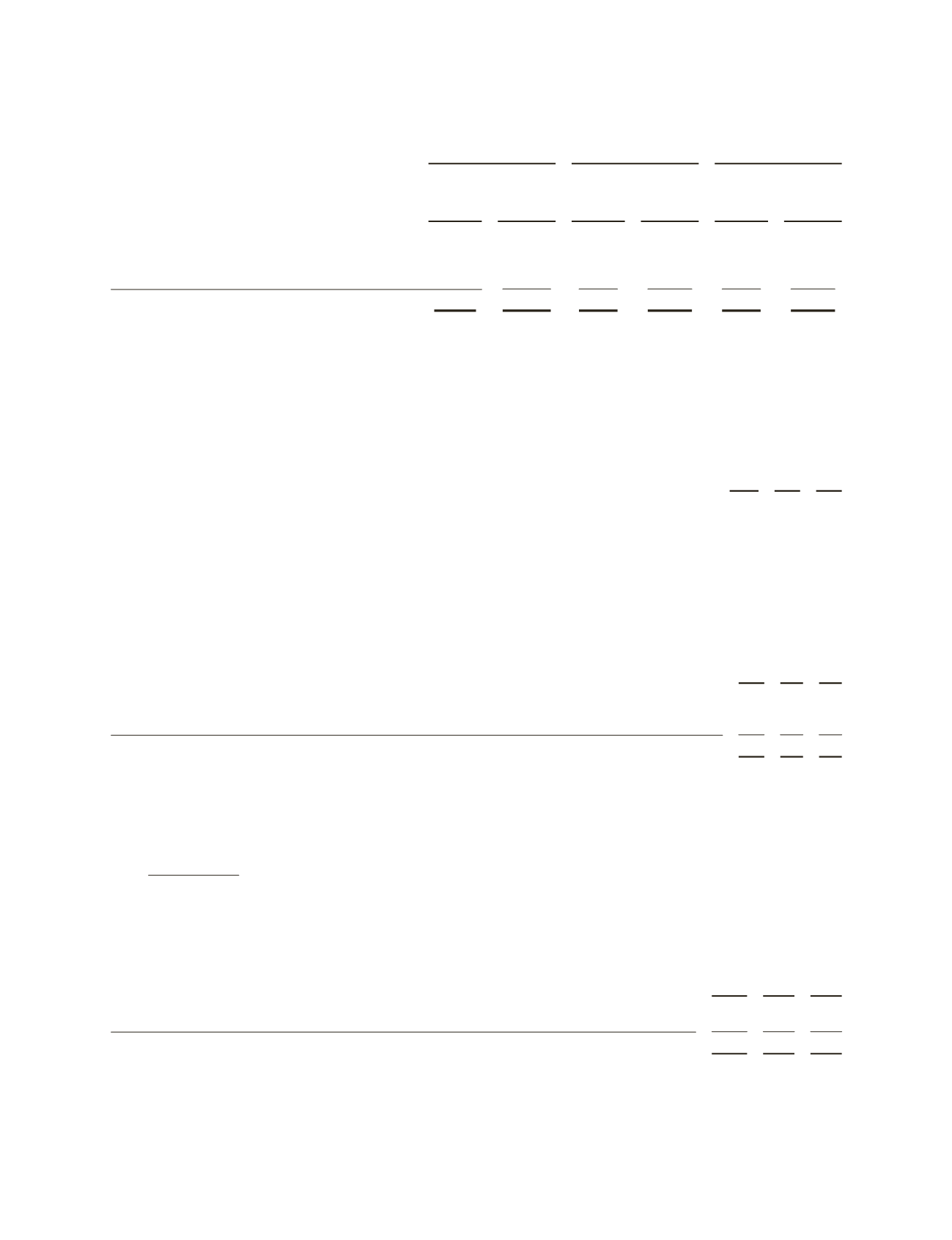

Discounted Stock Purchase Plan

Under the terms of the DSPP, employees can choose to have a portion of their earnings withheld, subject to certain

restrictions, to purchase Schlumberger common stock. The purchase price of the stock is 92.5% of the lower of the

stock price at the beginning or end of the plan period at six-month intervals.

The fair value of the employees’ purchase rights under the DSPP was estimated using the Black-Scholes model with

the following assumptions and resulting weighted average fair value per share:

2012

2011 2010

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.6%

1.2% 1.6%

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41%

28% 36%

Risk free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0.2%

0.2% 0.3%

Weighted average fair value per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$12.71

$12.83 $10.30

Total Stock-based Compensation Expense

The following summarizes stock-based compensation expense recognized in income:

(Stated in millions)

2012

2011 2010

Stock options

$203

$176 $121

Restricted stock

82

60 44

DSPP

50

36 33

$335

$272 $198

At December 31, 2012, there was $565 million of total unrecognized compensation cost related to nonvested stock-

based compensation arrangements of which $234 million is expected to be recognized in 2013, $180 million in 2014,

$108 million in 2015, $42 million in 2016 and $1 million in 2017.

14. Income Taxes

Schlumberger operates in more than 100 tax jurisdictions, where statutory tax rates generally vary from 0% to 40%.

Income from continuing operations before taxes

which were subject to United States and non-United States income

taxes for each of the three years ended December 31, was as follows:

(Stated in millions)

2012

2011 2010

United States

$1,980

$2,246 $ 617

Outside United States

5,211

3,993 4,515

$7,191

$6,239 $5,132

Schlumberger recorded $161 million of pretax charges in 2012 ($52 million in the US and $109 million outside the

US). Schlumberger recorded $223 million of net pretax charges in 2011 ($104 million in the US and $119 million

53