outside the US) and $625 million of pretax credits in 2010 ($222 million of net charges in the US and $847 million of

net credits outside the US). These charges and credits are included in the table above and are more fully described in

Note 3 –

Charges and Credits

.

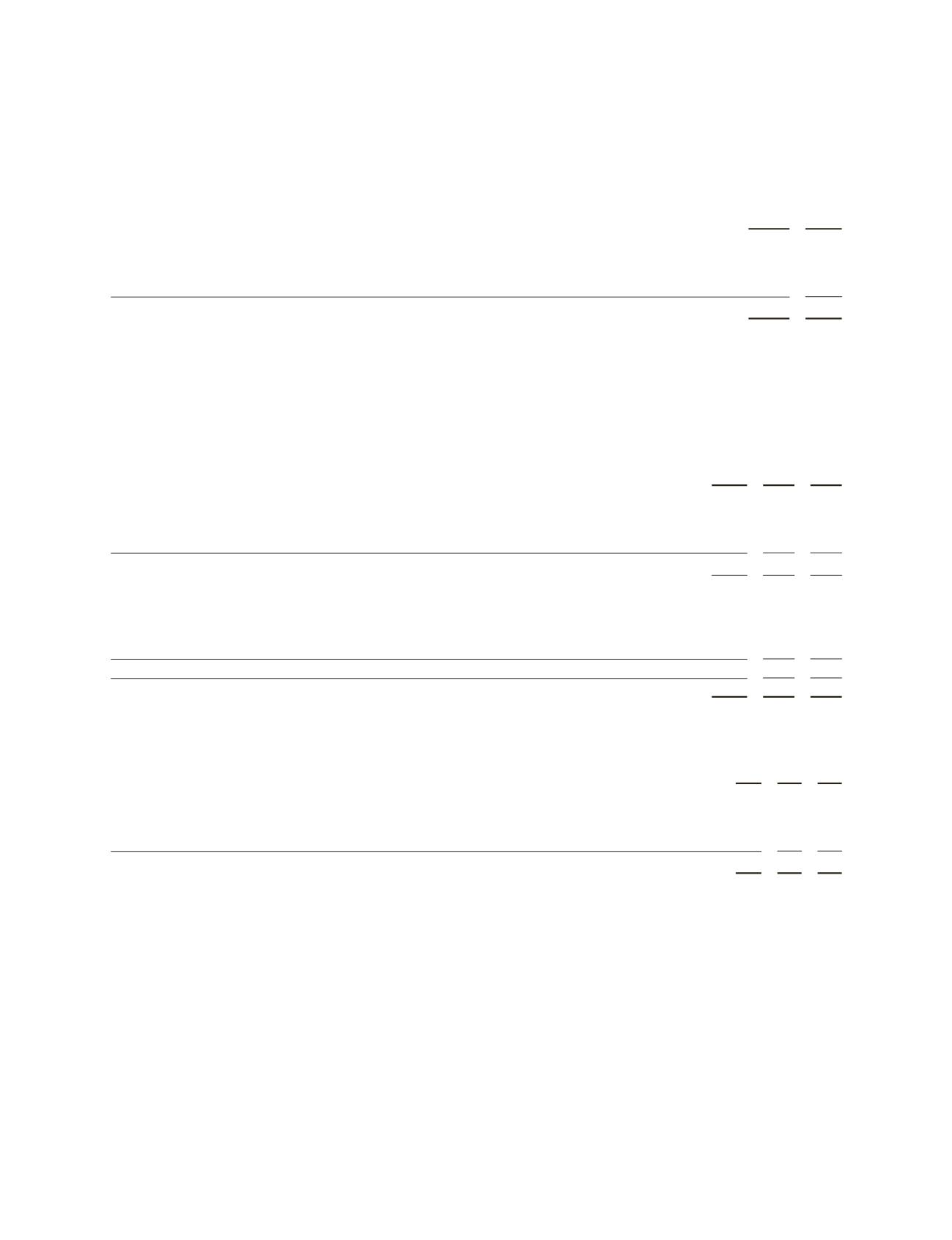

The components of net deferred tax assets (liabilities) were as follows:

(Stated in millions)

2012

2011

Postretirement benefits

$ 543

$ 440

Intangible assets

(1,490)

(1,498)

Investments in non-US subsidiaries

(317)

(349)

Other, net

114

132

$(1,150)

$(1,275)

The above deferred tax balances at December 31, 2012 and 2011 were net of valuation allowances relating to net

operating losses in certain countries of $256 million and $239 million, respectively.

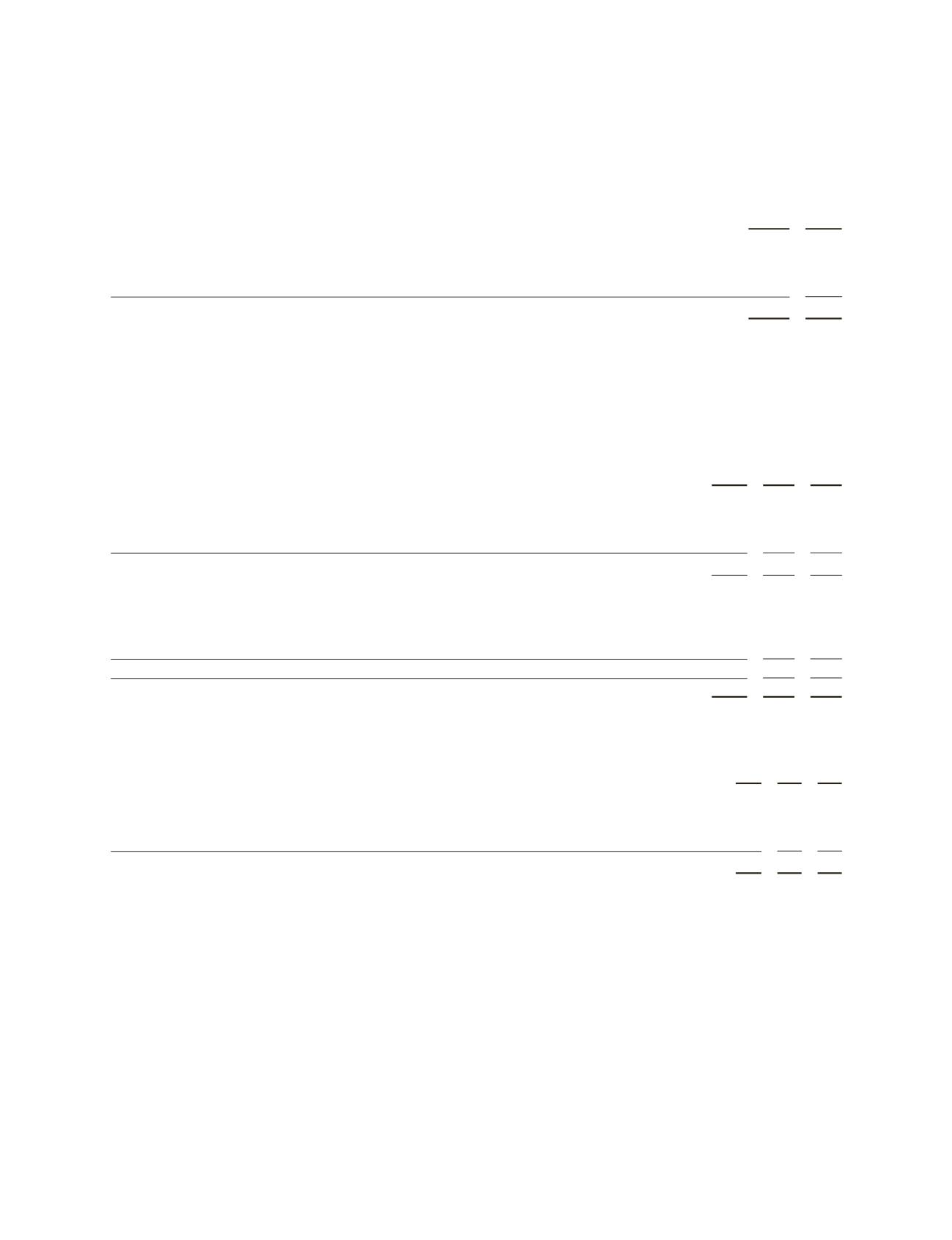

The components of

Taxes on income

were as follows:

(Stated in millions)

2012

2011 2010

Current:

United States – Federal

$ 698

$ 809 $ 89

United States – State

53

42

14

Outside United States

1,048

684

906

$1,799

$1,535 $1,009

Deferred:

United States – Federal

$ (105)

$ (73) $ 161

United States – State

(7)

(7)

2

Outside United States

22

75 (280)

Valuation allowance

14

(21)

(13)

$ (76)

$ (26) $ (130)

Consolidated taxes on income

$1,723

$1,509 $ 879

A reconciliation of the United States statutory federal tax rate (35%) to the consolidated effective tax rate is:

2012

2011 2010

US statutory federal rate

35%

35% 35%

Non-US income taxed at different rates

(10)

(10) (14)

Charges and credit (See Note 3)

–

– (3)

Other

(1)

(1) (1)

Effective income tax rate

24%

24% 17%

Schlumberger conducts business in more than 100 tax jurisdictions, a number of which have tax laws that are not

fully defined and are evolving. Schlumberger’s tax filings are subject to regular audit by the tax authorities. Tax

liabilities are recorded based on estimates of additional taxes which will be due upon the conclusion of these audits.

54