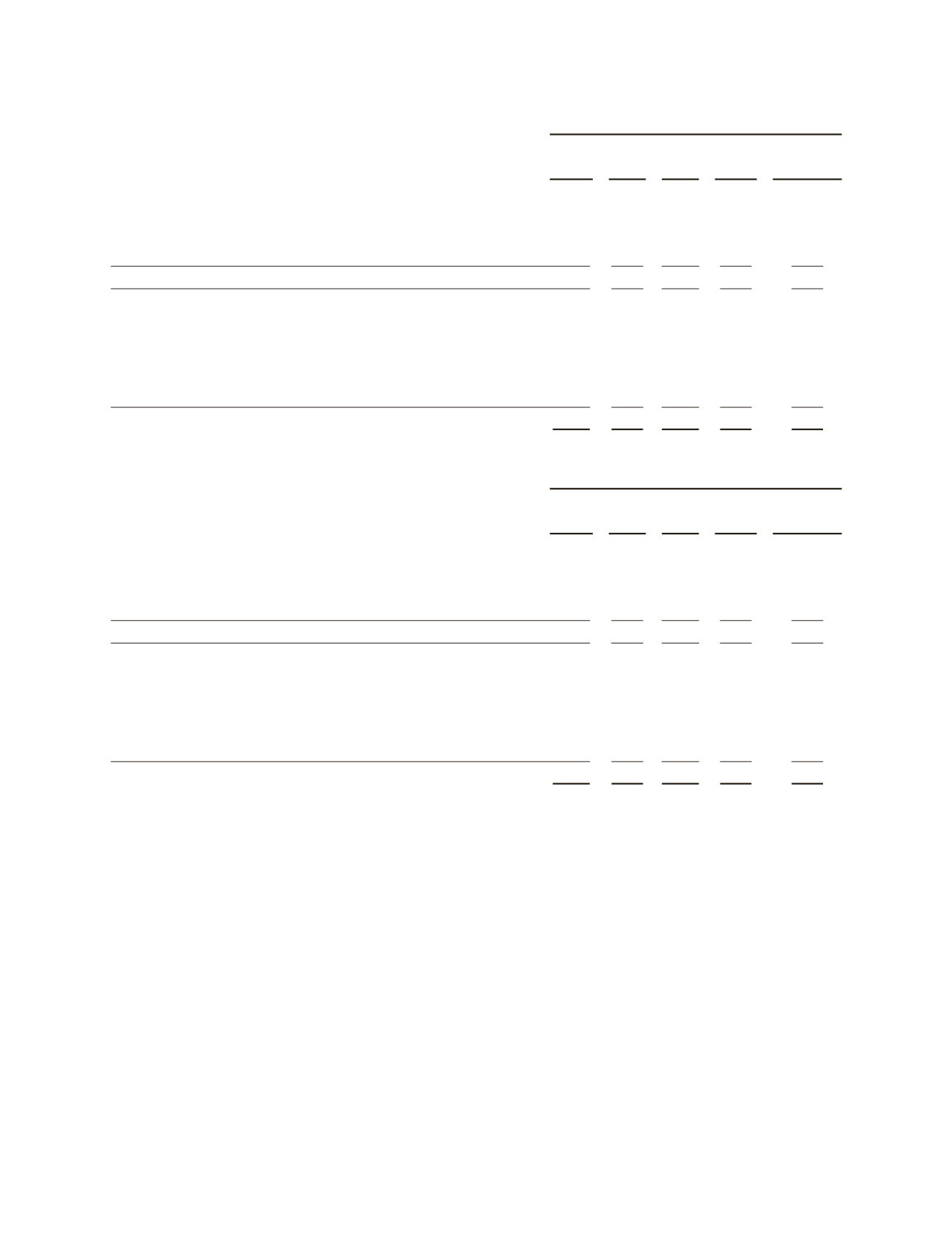

(Stated in millions)

2011

Revenue

Income

before

taxes Assets

Depn. &

Amortn.

Capital

Expenditures

OILFIELD SERVICES

Reservoir Characterization

$ 9,929 $2,449 $ 7,621 $1,285

$1,057

Drilling

(1)

13,860 2,254

9,093

982

1,420

Production

(1)

13,136 2,637

8,007

643

1,383

Eliminations & other

(2)

34

(35)

1,958

162

148

36,959 7,305 26,679 3,072

4,008

Goodwill and intangible assets

(3)

18,932

Discontinued operations assets

1,055

All other assets

2,202

Corporates

(4)

(590)

6,333

202

Interest income

(5)

37

Interest expense

(6)

(290)

Charges & credits

(7)

(223)

$36,959 $6,239 $55,201 $3,274

$4,008

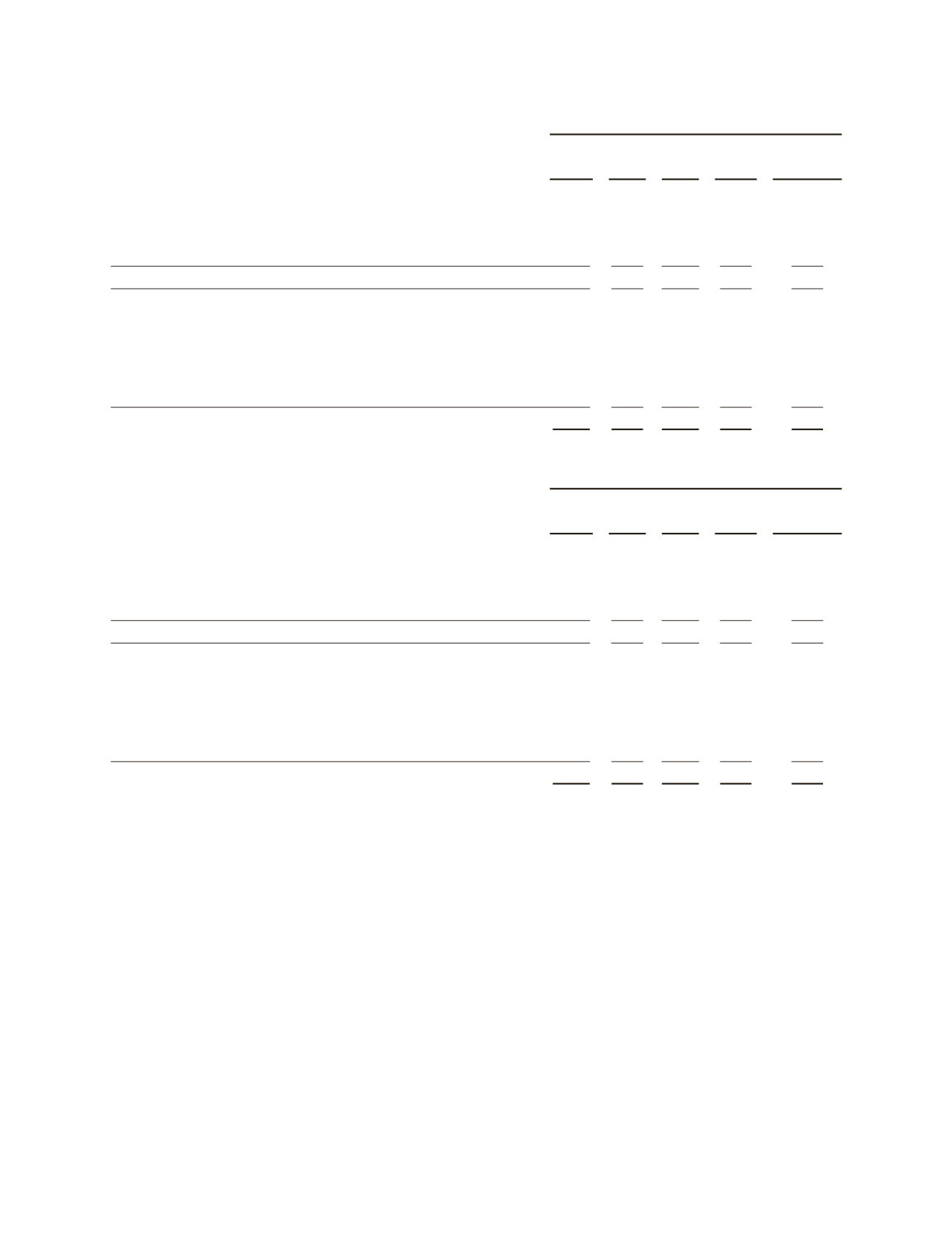

(Stated in millions)

2010

Revenue

Income

before

taxes Assets

Depn. &

Amortn.

Capital

Expenditures

OILFIELD SERVICES

Reservoir Characterization

$ 9,321 $2,321 $ 7,338 $1,246

$ 885

Drilling

(1)

7,917 1,313

8,355

721

942

Production

(1)

9,366 1,389

6,254

571

850

Eliminations & other

(2)

68

48

1,801

142

234

26,672 5,071 23,748 2,680

2,911

Goodwill and intangible assets

(3)

19,014

Discontinued operations assets

862

All other assets

1,599

Corporate

(4)

(405)

6,544

77

1

Interest income

(5)

43

Interest expense

(6)

(202)

Charges & credits

(7)

625

$26,672 $5,132 $51,767 $2,757

$2,912

(1) Effective January 1, 2012, a component of the Drilling Group was reallocated to the Production Group. Historical

information has been reclassified to conform to this presentation.

(2) Includes certain headquarter administrative costs which are not allocated to the segments, and certain other

operations and other cost and income items maintained at the Oilfield Services level.

(3) Excludes goodwill and intangible assets relating to discontinued operations.

(4) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical

benefits, stock-based compensation costs, amortization expense associated with intangible assets recorded as a

result of the acquisition of Smith and certain other nonoperating items. Corporate assets consist of cash, short-

term investments, fixed income investments, held to maturity and investments in affiliates.

(5) Interest income excludes amounts which are included in the segments’ income (2012 – $- million: 2011 – $3

million; 2010 – $7 million).

(6) Interest expense excludes amounts which are included in the segments’ income (2012 – $8 million; 2011 – $8

million; 2010 – $5 million).

(7) See Note 3 –

Charges and Credits

.

57